Brilliant set of numbers from Newgen Software, OPM zooms to 24%

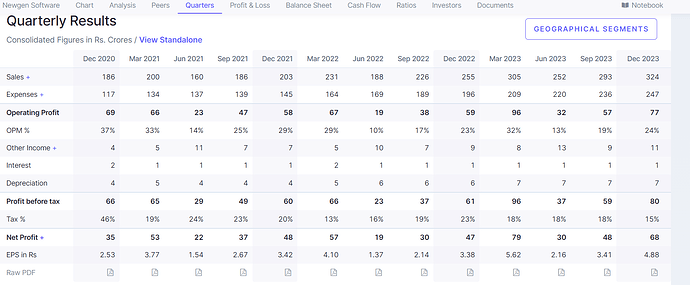

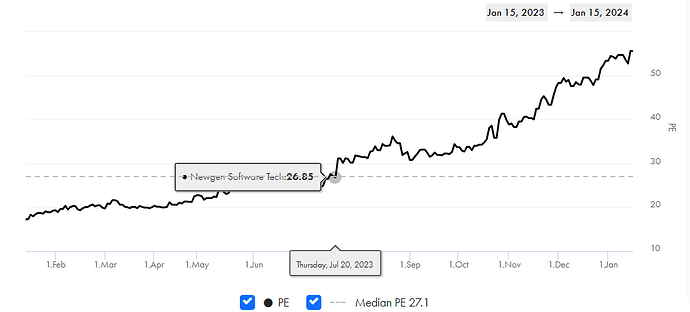

Result was again very nice . Yet there is no spectacular margin improvement , but the growth has accelerated from regular 20%, since the beginning of this year . Whole PE rerating from near 17 to 55 happened in a span of just 1 year. Can it sustain the superior growth for years to come is the question to be asked.

Disclosure: Invested

Good question on the sustainability of growth.

Edit: I am sorry I read your question as “can it sustain the re-rated PE?” and my comments below are to be read in that context. I am not deleting the post with the hope that some members may still find my post useful, even if not entirely relevant to your question.

One of the ways to look at Newgen is to look at how a private software product companies (a.k.a. a “product startup”) are valued, even when they are not making profits. I believe this comparison is valid because Newgen is still barely a ~$1.5 B value company, despite the run up - that is, it’s still a small company, with lot of growth potential.

A typical software product startup is valued ~20x their revenue - at least during good times. Based on the Q3’24 revenue, their revenue is around INR 1248 Cr. So, if another larger company were to acquire them, they might not see a valuation of ~INR 24960 Cr as out of norm. Of course, this could be much lower during bearish times. But, all in all, I do not believe it’s overvalued at the moment. Of course, this is just one of the ways to value, and also the value changes based on the economic cycle and desperation of the acquirer. Also, non-trivial part of their revenue is from “implementation”, and in that sense they cannot be valued like a true product / SaaS company yet. But since they are profitable, have close to zero customer/geo-concentration risk, and I would like to believe that as they expand in US, their margins may improve further and they may also win even larger deals. With all of this, I would think they would be even more valuable to any large company trying to expand their product portfolio and revenues, profitably.

Note that I am not speculating/suggesting that Newgen is open for being acquired. This is just an example to illustrate one common way to value small product companies.

Disc: Invested from lower levels, it has grown into my largest holding now, and views could be heavily biased. I could change my views fast too, with new information and learnings from the fellow members here. I am also a novice investor, and Mr Market keeps teaching me new lessons all the time.

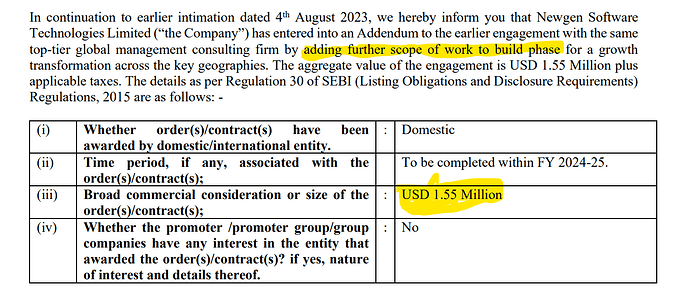

Thank you Vinay for the detailed response with rationale. ![]() .

.

I am also holding the stock from lower levels . I was trying to help with some antithesis for the newbie investors in this counter as bull markets force us making only rosy narratives about stocks we hold.I am seeing very less margin of safety in the price. I saw tweets that reads this company can give competition to salesforce in CRM space with lower price points when the vast majority of its recent growth came from emerging market (india, APAC ) and the company operates in ECM,BPM.

I havnt gone through much product startups in silicon valley but i am expecting some operational leverage kicking in and margin improvement as company grow bigger which hasnt happened yet and I can see the margin is kind of rangebound for the recent years.

Disclosure : holding and reduced exposure this week

I would like to share my thoughts on the valuation bit - since the interest rates have increased the valuations took a big hit now. There is no way a company like Newgen can be valued at 20x their revenue. The best product companies at the median level are valued at 6x revenues - have a look at this blog for more information: Clouded Judgement 1.12.24 - Hard Truths - by Jamin Ball

@Vinay_Rai → its about 10 times its revenue (TTM) not 20.

Thank you @imran-pickr for your inputs!

Thank you @aashu4uiit for the very informative article.

Thank you @Pchandrapal - You made the right call by trimming. I am hoping Q4 to be a good quarter - as per management commentary. So, I am staying put, though for the truly agile, there are many options in the current market, to grow your investment faster in short term. ![]()

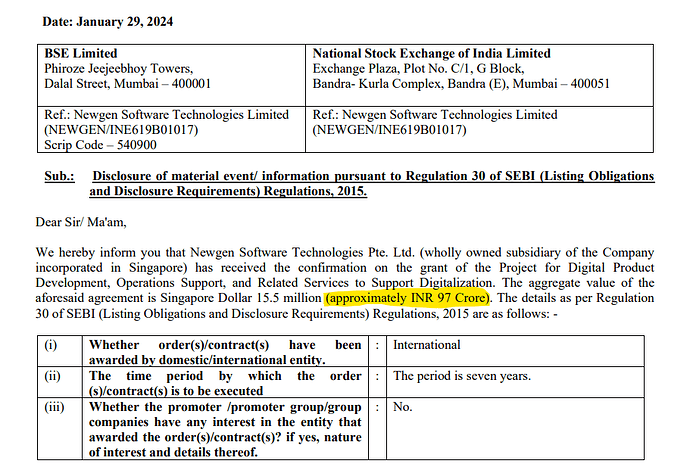

Though stock is getting expensive, new order wins are really good. 97 cr order for 7 years from Singapore.

Disclosure: Invested

Any incremental business is good - But 97 Cr over 7 years seems more like business as usual. ![]()

This quarter Q3, Fy24 was quite a weak quarter for the IT service provides (aggregators) in the financial space i.e. the IT companies which have clients in banking and insurance space (example Mphasis).

Whereas it was one of the strongest quarters both in terms of revenue and new deal wins for Newgen which is also servicing the clients in same space with the only difference that they are more of a product company and earn revenues mainly through licensing/subscription of their product rather than implementation of somebody else’s digital product.

This difference about their business model compared to other IT companies and with their expert product built over so many years might be a good bet and seems like it is getting a strong traction. I am not sure what is the USP here - product flexibility (modular design using low code tech), performance, high availability?

This is the most important factor to determine the sustainability of their deal wins. And I am not sure what is that

I have collaborated with Newgen in one of my companies I used to work with. They basically provide an electronic document management system which is a highly competitive space. It also reflects in the lower margin. An EBITDA of 20-22% for a product business is not exciting to me.

That said they are in a growing market as globally there is an increasing push towards digitalization of paper based back-office processes (especially in government offices).

If Newgen can grab and sustain even a small market share, the growing pie gives them a long runway. Expansion in topline should also give them some operating leverage, adding a few percentage points to the operating margin. But despite all this 60+ p/e stock currently trades at is too high.

Is the circuit just a sharp reaction to general sell-off and over-valuation or is there any news around Newgen? Can the better informed members kindly throw some light?

It’s just profit booking. Since stock has 5% circuit limit (under ASM), it has been in Red for last few sessions. I believe it’s corrected 25% from the top, in the last 3-4 sessions, which is pretty much the same for all small caps stock that ran too much ahead of their valuations in last 1 year.

Notes from CEO’s Interview Jan 2024

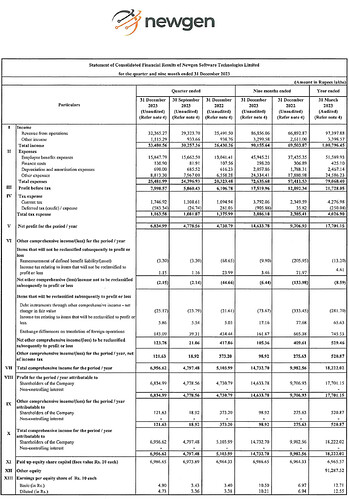

- Newgen Software reported strong Q3 performance with revenue and net profit growth YoY.

- US and APAC growth were slower.

- Revenue growth has been around 27-30% for the last five quarters.

- Q4 is usually the strongest quarter, but sustaining high growth rates is challenging.

- The business is looking strong with good order books and visibility into Q4.

- Q4 growth is expected to be around 25-30%, depending on deal conversions.

- Newgen is still a license-based software company, so revenue depends on making deals in the quarter.

US (00:01:40)

- US growth was up 12.6% YoY, lower than the company’s average.

- Traditional markets in India and the Middle East have been strong for growth.

- The overall slowdown in IT services is not affecting markets like India and the Middle East.

- US growth has been around 25% for the 9-month period.

- Revenue is still small, so a single quarter does not accurately reflect growth rates.

- Newgen is hoping to accelerate US growth momentum in the next few quarters.

- The business in the US is limited to banking and insurance, with traction from larger accounts.

- The US is a more mature geography for Newgen, and India product stories are still emerging.

- Newgen has around 70 accounts in the US but aims to explore growth in the next 3-4 quarters.

APAC (00:03:15)

- Revenue in APAC Q1 FY23 was close to ₹46 crores, but it has not reached that level since.

- In Q3 FY23, APAC revenue was around ₹42 crores.

- Newgen expects APAC to show strong annual growth of about 20% for the year.

- India and the Middle East are growing at 30% and 38% respectively, so even an 18-25% growth in APAC looks lesser in comparison.

- The company is seeing a lot of accounts looking to buy its software and expects to continue the growth momentum for the next two quarters.

Growth (00:05:00)

- Newgen’s growth is driven by logo acquisition and average deal sizes.

- The company has acquired around 38-39 logos in the first 9 months of the financial year.

- The larger push in growth has come from large banking deals in India, the Middle East, and some in APAC.

- Newgen expects the deal sizes to further grow over the next year in both strong and emerging markets.

Margins (00:06:20)

- Newgen’s margins have improved from 17-18% a year ago to 21% currently.

- In Q3, margins were close to 24%.

- The company aims to maintain margins of around 22-23% and net margins of around 18-19%.

- Margins are not expected to be a challenge this year.

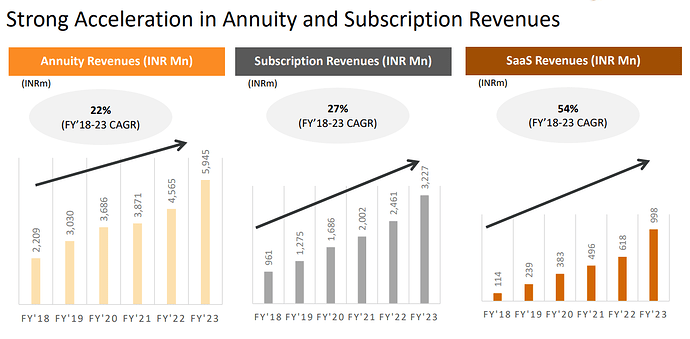

- Annuity revenue is expected to grow as the company grows.

- Once the company size reaches around $300-400 million, the annuity part of the business is expected to be around 70% of the overall revenue.

- Currently, the company is nearing around $150 million in annuity revenue.

Newgen software has been affected by a ransomware incident. They have notified CERT-IN as per regulations. Further information on this to arrive

Newgen software has received total order of arround 100 cr on 30 th March as per notification made on exchangs. Orders are well diversified. Size of orders are increasing now. Discl: Invested since nov 22

Newgen posted very good results for Q4 FY24.

Conference Call – Q4 FY’24 Summary

Revenue and Growth

-

Newgen Software Technologies Limited reported a 28% year-over-year growth in revenue to INR 1,244 crores for Q4 FY’24.

-

The company witnessed strong growth in EMEA (39%) and India (33%) markets, driven by end-to-end automation solutions for customers.

-

Newgen booked its largest ever project of INR 97 crores with a technology organization in Singapore in the APAC region.

-

The company saw an increase in the number of customers with billing of INR 5 crores from 51 last year to 65 in the current year, with an average revenue per customer growth of 29%.

-

Newgen added 51 new logos in the year, including 11 in Q4.

-

Newgen Software Technologies Limited reported an annuity revenue of INR750 crores, accounting for 60% of its total revenue.

Financial Performance

-

Newgen Software Technologies Limited achieved a 42% year-over-year growth in profit after tax, amounting to INR252 crores.

-

The company invested 9% of its revenues on R&D initiatives and 22% on sales and marketing activities.

-

The company’s net cash generated from operating activities stood at INR281 crores, with a net trade receivable of INR444 crores and a net DSO of 130 days.

-

Newgen Software Technologies Limited declared a dividend of INR4 per share post bonus issue of 1:11, which is INR8 on pre bonus shares.

Business Strategy and Outlook

-

The company’s order book grew from INR1,300 crores to INR1,560 crores, indicating a healthy growth in business.

-

The company is optimistic about maintaining its growth momentum in the coming year, with a strong pipeline in traditional markets and ongoing efforts to penetrate the U.S. market.

-

Newgen Software Technologies Limited aims to achieve a revenue target of $500 million by the end of FY 2027, with a focus on expanding into the insurance sector and driving organic growth in the government segment.

-

The company is experiencing strong growth in markets where IT companies are struggling, and its solutions are resonating well in these markets.

-

The business composition is not expected to change much, but there will be a focus on expanding into the insurance sector and accelerating growth in mature markets.

-

The company aims to maintain a healthy net margin of around 20%-21%, but the tax rate is expected to increase next year, impacting the net margin.

-

The company does not expect to revert to the previous seasonal pattern of a step-down in Q1, and aims to maintain a higher growth rate in Q1 compared to the average growth rate.

-

The growth in order bookings has normalized compared to last year’s exceptional growth, but the company does not intend to fall back to a 20% growth target and aims to maintain a higher level of growth.

-

New logo acquisition and average deal size per logo are key factors contributing to the company’s growth.

-

The company is strategically focusing on expanding its presence in the insurance sector and is investing in building capabilities and products to target larger deal sizes in life, general, and health insurance.

-

The company is considering tactical acquisitions for speed to market and access to major markets, but no specific targets have been identified yet.

-

The company expects to make acquisitions in mature markets within the next 1-2 years to accelerate growth.

-

The GSI-led strategy is facing challenges in terms of speed and growth, particularly in mature markets.

-

The company is exploring alliances with consulting companies beyond system integrators to expand its reach in the U.S. market.

-

Organic revenue growth is expected to be 20% or more, with all markets having the potential to achieve this growth rate.

-

The U.S. market is expected to continue growing at a slower rate compared to the company’s consolidated business, but it is crucial for achieving the company’s long-term growth goals.

-

The company is evaluating pricing components of its products and services due to global price changes and increased costs.

Key Initiatives and Developments

-

The company launched several new versions of its platforms, including the AI-enabled version of Newgen One platform called Marvin, a newer version ECM and CCM platform, and IDP Studio, a next-generation low code trade finance solution.

-

The company is developing vertical solutions built on low code, including digital lending, trade finance, and supply chain, and is targeting similar solutions in the insurance sector.

-

A large part of the company’s business is driven by solution stacks beyond horizontal products, with customers purchasing accelerators to build more products.

-

The company is exploring the use of Generative AI (GenAI) across all verticals, not just BPO.

Challenges and Opportunities

-

The company’s business is seasonal, with Q1 and Q2 having lower revenue compared to Q3 and Q4.

-

Deal closures are now more spread out throughout the year, resulting in higher quarterly growth rates due to lower base numbers in Q1 and Q2.

-

The BPO segment is a potential market for horizontal play, but it has not shown significant traction in India or outside.

-

The company aims to reach an average DSO of 120-125 days and a Q4 DSO of 115 days.

-

Mature markets are expected to grow at a much higher rate, potentially reaching 30%-50% growth in some years.

-

The company’s M&A strategy is focused on gaining access to markets to speed up the sales process in those countries.

-

Newgen Software does not provide guidance for the next financial year but intends to maintain its historical growth momentum.

-

The company is resetting its sales strategy in the U.S. by focusing on banks with asset bases of $2 billion to $20 billion, which represents a large number of potential customers.

the company is resetting customers in US from 2-20 B USD to 20 - 200 B USD