Nice work with projections… just curious about PE… why should it trade at historical averages when the business mix and company visibility among institutions has changed for good?

Neuland is setting up 6.37KL capacity for peptides.

PolyPeptides, an EU company which is in similar peptide business, have recently expanded their capacity by 1.6KL in 54M EUR capex. They are expecting this facility to be full utilisation in 2 years. Their current revenue base is 300M+ EUR and they are expected to grow 10% odd, so this implies this new capacity can give them 50M-60M of revenues. This is in line with the asset turns of this company as well. This implies 300-350 Cr/KL revenue.

Wuxi had 12KL peptide capacity in 2023 when they did 3B+ RMB of revenues. This implies 250 Cr/KL of peptide revenue.

Even if Neuland does 100 Cr/KL, the 6KL capacity could give 600 Cr revenues in few years.

Another way to look at this whole thing could be how much peptide (in mg) can be produced in 1KL of capacity, as cost of GLP-1 peptides vary between $100-400 per mg. I could not gather enough reliable information to triangulate this way but if there is any chemical expert, this could be another way to look at the potential.

India_Healthcare_-_GS.pdf (1.1 MB)

Interesting discussion has been going around on Bempedoic Acid in other thread:

https://x.com/rahuja671/status/1771542692213793024

@phreakv6 @Meetkatrodiya …Although Blue Jet has also obtained EC approval for manufacturing API Bempodic Acid, they cannot supply API to Esperion unless there plant is approved by FDA for API.

We know that API supply in case of NCE is a very sticky business, it would not be very easy for Bluejet to become a API supplier also. Intermediates and API are different ball game in my opinion.

If Bempedoic Acid becomes a block buster drug it will further validate and add credibility to the capabilities of Neuland as a reliable CMS partner. It takes decade to reach and achieve this kind of capability and reliability( which will never reflect in current earnings/PE).

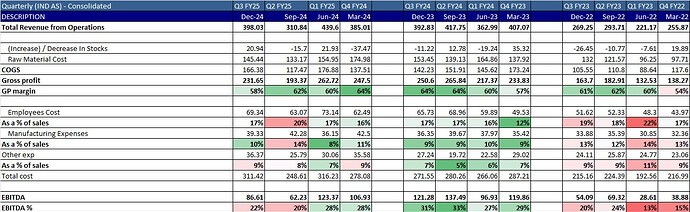

It may not be ideal to directly tally export data with actual numbers, I have some concerns regarding margins over the last two quarters. Despite strong shipments of Bempedoic Acid and Xanomeline, margins have remained under pressure. If anyone can shed light on this, it would be helpful. Can we expect margins to normalize to the 28-30% range by FY26/FY27 as sales from these products scale up?

@phreakv6 has provided valuable insights on this, but any additional analysis or perspectives would be greatly appreciated.

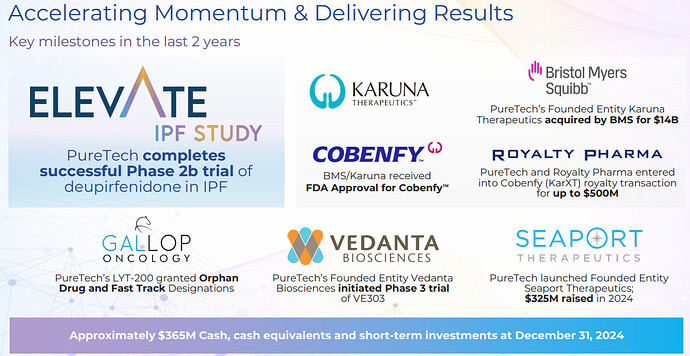

PureTech Health is a biotech incubator and drug development company.

Business Model: Invest early in biotech innovations, develop the drugs through its subsidiaries, and eventually exit via big pharma acquisitions or royalty deals.

PureTech’s Relationship with Karuna:

-

PureTech Founded Karuna (2012)

Karuna Therapeutics was founded by PureTech in 2012 as part of its Founded Entities program, which means PureTech was instrumental in identifying the opportunity, funding initial research, and developing the scientific approach. -

Karuna Became Independent

Over time, Karuna operated as an independent biotech company rather than a direct subsidiary.

It went public in 2019 via NASDAQ listing (Ticker: KRTX), raising substantial capital. -

PureTech Retained a Stake in Karuna

Even after Karuna became independent, PureTech continued to hold an equity stake in Karuna. -

Bristol Myers Squibb Acquired Karuna for $14B (2024)

PureTech monetized its involvement through a royalty transaction with Royalty Pharma for up to $500M.

I guess Neuland is also working with Puretech for LYT-100 (Deupirfenidone).

PureTech is developing Deupirfenidone (LYT-100) for Idiopathic Pulmonary Fibrosis (IPF). IPF is a serious lung disease that causes scarring of the lungs, leading to breathing problems and reduced life expectancy. The drug successfully completed Phase 2b trials, and Phase 3 trials will begin by end of 2025.

Current treatments (Pirfenidone & Nintedanib) are not well tolerated at high doses, limiting their effectiveness. It is a modified version of Pirfenidone, with hydrogen replaced by deuterium (heavy hydrogen). This change improves drug exposure while reducing gastrointestinal side effects, making it easier to tolerate.

Only 1 in 4 patients start IPF treatment, and >40% discontinue due to side effects.

Side Effects of Current Treatments

Pirfenidone causes nausea (36%), rash (30%), and diarrhea (26%).

Nintedanib causes severe diarrhea (62%) and liver enzyme elevation (14%).

Deupirfenidone is designed to avoid these issues.

Key Takeaways from Phase 2b Trial:

It showed ~50% better efficacy than Pirfenidone. Both 550 mg and 825 mg doses showed effectiveness.

Can also target progressive pulmonary fibrosis (PPF), affecting 1.3M patients. Addressable market could grow significantly beyond the current 720K IPF patients.

PPF- Progressive Pulmonary Fibrosis (PPF) is a group of chronic lung diseases that cause continuous scarring (fibrosis) in the lungs, leading to breathing difficulties and reduced oxygen exchange.

How is PPF Different from Idiopathic Pulmonary Fibrosis (IPF)?

IPF is a specific type of PPF where the cause is unknown. PPF includes multiple lung diseases that progress in a similar way but may have different causes (e.g., autoimmune diseases, environmental exposure). PPF patients experience worsening lung function, even if they are on treatment.

.

.

.

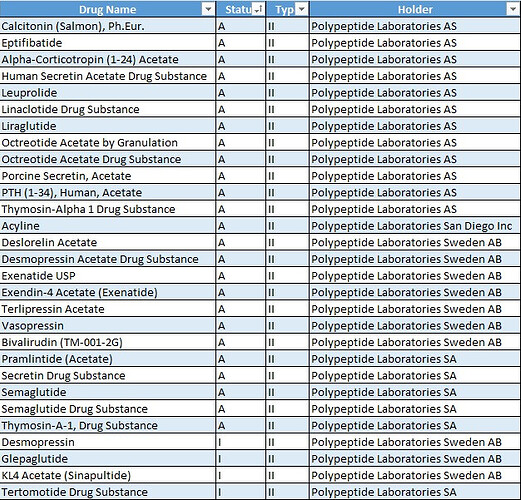

For Peptides one the company with whom they are working is Poly Peptide.

DMF filings of Poly Peptide:

Type II – Drug Substance, Drug Substance Intermediate, and Material used in their Preparation, or Drug Product

This includes Active Pharmaceutical Ingredients (APIs), intermediates, and raw materials used in drug production.

A (Active) – The DMF is currently valid and can be referenced in regulatory submissions.

I (Inactive) – The DMF is no longer in use or has been voluntarily inactivated by the holder.

How did you get the split of those api’s.

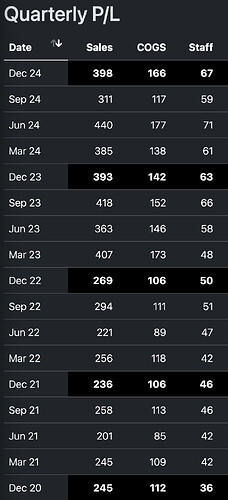

Esperion Q4 FY2024 concall

This was the filing done prior to Q2 results based on some analyst reports tying export data to possible revenues .

However I am not sure why the revenue is not recognised despite the material being shipped ( As per export data shared by you ) .

The management clarifications makes sense since in Q3 the revenues from Prime segment grew ( or CMS share dropped by 10% ) which resulted in lower margins.

The management was also bullish on FY 26 probably because of this gap in revenue to be recognised .

Btw great work on the export data and find on LYT -100 / 200 .

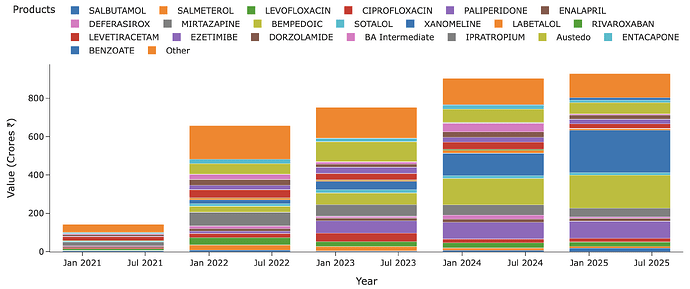

Thanks @Meetkatrodiya for sharing the yearly split-up of exports by products and comparing Sales with Exports. The Q2/Q3 margins are indeed a mystery and I will just put the couple of points that I thought were worth looking at

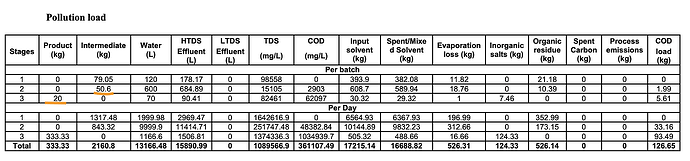

- Yield - Its possible that Neuland isn’t making good margins on BA. I know this might be difficult to believe but the yield that Neuland was getting as per EC is 1 kg of BA for 2.5 kg of intermediate. At that pricing, its hard to make a profit from the Intermediate to API conversion since BlueJet is selling Intermediate itself for $450 and Neuland is selling API for $950.

There is one more fact that goes with this, which is that Neuland has kept increasing API prices in the last 2-3 years - from $600 in Jun '23 to $750 in Mar '24 to $950 since Jun '24. Despite these hikes, the margins are still sub-par considering decent volume CMS API contributing to overall sales.

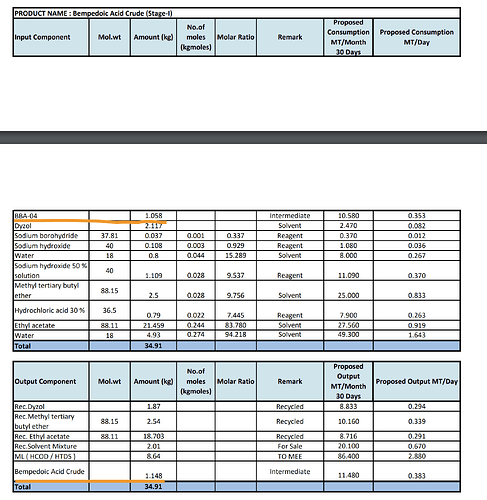

BlueJet EC had some interesting process changes to the one Neuland has.

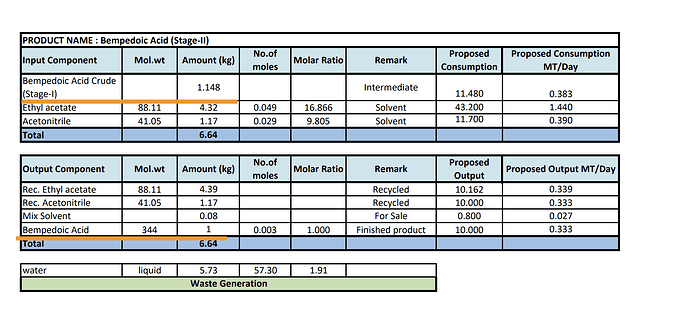

BJ can convert 1.058 kg of intermediate to 1.148 kg Crude BA and further refine this Crude BA to get 1 kg of BA

This appears on paper to be a far superior process as it can mean undercutting Neuland on prices. But its worth noting its only on paper as of today since BlueJet isn’t manufacturing BA API but only BBA-04 which is the intermediate. But their documented process is quite different from Neuland and seems to give a way higher yield.

It is possible that Neuland is struggling with improving yield and so is selling BA at lower margins

- Employee Cost - Neuland has higher employee cost which is having a huge impact on the margins. Neuland has 1600 employees as per AR

This is historic data - sales gone up 3x between FY16 to FY24 but staff cost gone up 5x

In the recent quarters as well Employee cost has scaled up alongside revenues, and so there’s no operating leverage. It almost appears like this is a highly labour intensive industry if you go just by numbers (in Q2 they had very good export at 83% and 50%+ was Xanomeline and BA, both of which are CMS molecules, but margins are 20% and 22% in Q2 and Q3, if they recorded that revenue here. In the unlikely event they upfronted revenue in Q1, you would note, that isn’t spectacular in terms of margins either for the export and CMS contribution.

In contrast, this is BlueJet’s last few quarters, with just 15% increase in employee cost (Employees have gone up from 387 as per AR in Mar '24 to 450 as of date which is in sync), they have achieved nearly doubling of salesin Dec '24 YoY. This is how commercial scaling of volumes should look like - with margins climbing with volumes - BJ margins went up from 33% to 39% and Employee cost went down from 7% to sub 5%.

- There is in general a mismatch of exports to sales in Neuland’s case which the management clarified back in Oct '24 that, that’s to be expected. But we would expect it to match broadly in a year at least - even in a year, there is quite a lot of mismatch (like 900 Cr exports in FY24 which is 58% of reported sales but AR reports exports as 78% of sales)

This is not to take anything away from the business - I look forward to Neuland scaling Bempedoic Acid, Xanomeline and maybe Viloxazine HCl as well in the future. All these are exciting innovator molecules with great potential. However, we need to see if they are able to run large scale production effectively and produce great margins through operating leverage. Difference between a 28% margin running at full tilt and making 40%+ margins is night and day in terms of actual numbers. The way BlueJet has scaled its operations in such a lean fashion is just eye-popping.

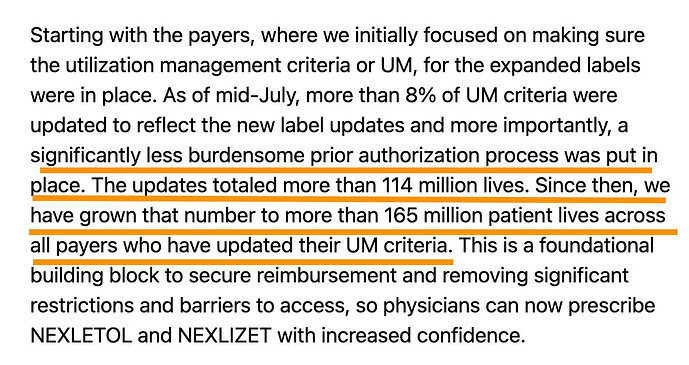

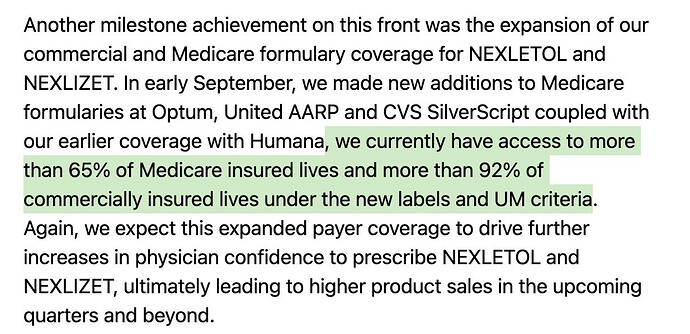

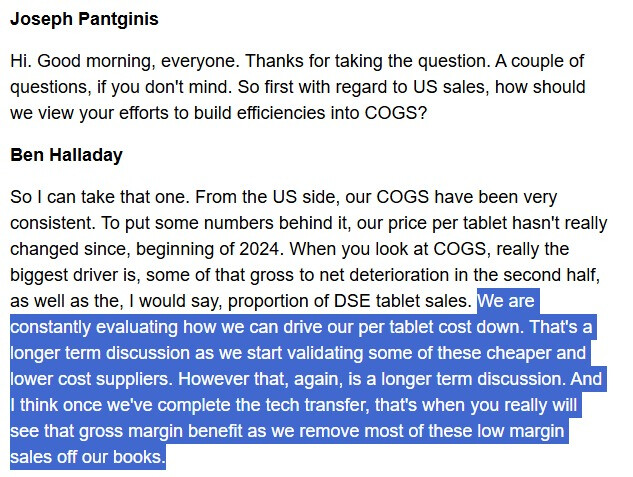

Esperion margins are poor bacause their US sales is flat despite 12% RPE growth in US (same $31m). This is not due to rising cost of tablets. From BlueJet’s side, the Intermediate cost has not changed in the last 2.5 years from between $450-$460. The higher cost is coming from discounts ESPR has given insurers to get their drugs added to the approved drugs list across plans and also from subsidizing medicare plans in last quarter (its called the donut hole or medicare coverage gap where patient has exhausted coverage and has to pay out of pocket which happens in Q4 - this is subsidised by ESPR). These are taken from last call.

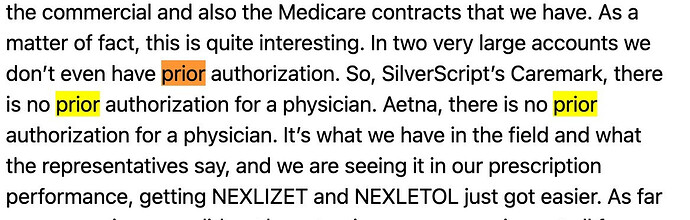

They have also negotiated better coverage by avoiding prior auth or making it less stringent (approval from insurer) and also by removing step-change (trying cheaper ezetimibe before trying nexlizet which might be mandatory from insurer side) - all this requires ESPR to pay from their pocket and impacts margins - but its long term positive for them as it helps improve coverage and increase sales (which is good for BlueJet/Neuland)

Disc: Invested in BlueJet. Interested in Neuland

Some more points to add here as per my understanding:

- Bluejet business in Q3FY24 already had 33% EBITDA margins when its intermediates business was just 27 Cr. This business has scaled up to 140 Cr+ (6x) in 1 year and that would have contributed to additional EBITDA. So base business of Bluejet is already high margin. Compare this to Neuland, where share of prime API business increased significantly in Q2 and Q3 which is commodity and hence would have impacted margins.

- Neuland in Q2FY25 had operating deleverage as they did only 310 Cr revenue compared to ~400 Cr runrate in other quarters, this would have impacted EBITDA margins.

- Additionally, as per my understanding goes, Bluejet is pure play manufacturer who would have more automated systems in place vs Neuland which does pre-clinical to commercial CDMO and would have to have more FTE on payroll for service side of the business. The utilisation of these employees would go up and down on quarter on quarter basis. Pure play manufacturer vs project manager who would take NCE from pre clinical to Ph3 to commercial is expected to have different economics.

- Neuland spent 43 Cr in R&D in FY24 ~3% of sales while Bluejet 5.7 Cr which was 0.7% of sales, so Neuland would be spending more amount which would not be yielding any sales right now.

Blue jet is presently in intermediates of BA and in my opinion API is all together a different ball game. Bluejet might have tested the yields of BA (API) at lab scale but then to scale up to commercial level is very different and difficult as there are lot of challenges in maintaining purity and its yield.

Blue jet is presently a Intermediate focused company and probably will have to travel long path to be successful in API.

Further, once they are able to successfully scale up the API with yield and desired purity, they have to get their manufacturing facility audited from USFDA which is also a long drawn process.

Employee cost in R&D are front loaded with returns lagging by 3- 5 years (probable future returns from current R&D are not reflected in current earnings)

Disc: Invested in Neuland. Tracking Bluejet

Rating upgraded from A to A+ stable.

Key highlights:

- Comfortable financial risk profile: Capital structure of the group remained strong with minimal reliance on external debt and increasing networth. Overall gearing stood at 0.17 time as on March 31, 2023. Expected capital expenditure (capex) will be funded through internal accrual and no significant moderation is likely in the capital structure. Debt protection metrics will remain comfortable with interest coverage ratio more than 15 times in the medium term.

Liquidity: Strong

Bank limit is mostly unutilised (less than 1%) for the 12 months through January 2024. Cash accrual, expected over Rs 300 crore per annum, will sufficiently cover yearly term debt obligation of Rs 35-40 crore over the medium term and surplus will cushion liquidity.

Current ratio was healthy at 1.75 times as on March 31, 2023. Low gearing and moderate networth support financial flexibility, which will help to withstand adverse conditions or downturns in the business.

From Q3FY25 Concall

Segment Performance

CMS (Custom Manufacturing Solutions)

- Revenue for the quarter stood at Rs 156 crore, driven largely by commercial molecules.

- A newly commercialized molecule is witnessing strong traction.

- Early-stage projects and customer re-engagement indicate sustained momentum.

- Management expects continued buoyancy in the CMS business.

GDS (Generic Drug Substances)

- Focused on innovating speciality products, optimizing processes, and expanding market share for key APIs.

- Speciality API growth rebounded, driven by Paliperidone and Dorzolamide.

- Prime segment saw strong performance from Mirtazapine, Ezetimibe, and Escitalopram.

- Confident about meeting FY25 targets for the GDS segment.

Capex and Expansion Plans

- Peptide Synthesizer Expansion: Unit-1 capacity to increase from 0.5 KL to 6.37 KL by FY27. The Rs 254 crore investment supports large-scale peptide production for CMS and GDS businesses.

- Unit-3 Expansion: Rs 88 crore investment to increase capacity by 52 KL, expected to be completed in 15-18 months.

- The large-scale facility investment is critical for long-term growth, with a phased ramp-up over 3-5 years.

Key Business Insights & Future Focus

- Cash Flow Management: Prioritizing working capital optimisation, with DSO at 111 days.

- Revenue Volatility: Development revenues remain lumpy and volatile, inherent to CDMO business.

- Growth Strategy: Focused on high-value molecules, targeting innovative companies on both CMS and GDS fronts.

- Upcoming Filings:

- Two new DMFs planned for generics: GLP-1 (Tirzepatide) and Difelikefalin.

- Both generic peptides will be scaled up in Unit-1’s new facility.

- Pre-Commercial Pipeline:

- Out of 11 molecules, at least one or two are expected to commercialize in FY26.

Guidance and Risks

- FY25 revenue is expected to be flat, with momentum expected to pick up from FY26 due to a strong order pipeline.

- Risk Factors:

- Limited high-value products contribute significantly.

- CDMO & Specialty GDS businesses have inherent volatility due to small-volume focus.

Management Commentary

- The completion of manufacturing facilities and scaling up of CMS commercial molecules instills confidence in achieving FY26 targets.

- Three key factors driving Neuland’s growth:

- Strong reputation in CDMO.

- Strategic opportunity identification aligned with long-term goals.

- Favorable macroeconomic trends.

- Peptide capacity expansion is crucial for next-level scaling.

- Revenue fluctuations in the commercial CMS business are normal due to shipment schedules across different quarters.

There are some notions people have about CDMO businesses. Let me list them all and then we will explore each of them into the mechanics of what causes it and if they are actual universal truths.

- CDMO business is lumpy

- Innovator sticks to CDMO partner from trial phase for production after FDA approval

- $1b drug for Innovator would translate to big earnings for API/Intermediate maker

- High value APIs (say 12 lakhs/kg) would mean big margins

- Frequency of oftake (lumpiness) doesn’t matter as long as you compare YoY and see growth in sales

- A company with 20 drugs is better than a company with 5 drugs

It is important to understand the mechanics of all these because now there are several interesting opportunities for Indian CDMOs - from Nubeqa (Ami), Elinzanetant (Aarti), Cobenfy (Neuland), Bempedoic Acid (BlueJet/Neuland) and so on. All these may go on to do well in end markets and become blockbuster drugs - but are all these same from the perspective of an API/Intermediate maker? Its not an easy question to answer but lets try to.

Although lot of stuff in this post are general, am writing in this thread because lot of the learnings in this post come from analysing Austedo for which Neuland has been supplying since trial phase (2017 FDA approved)

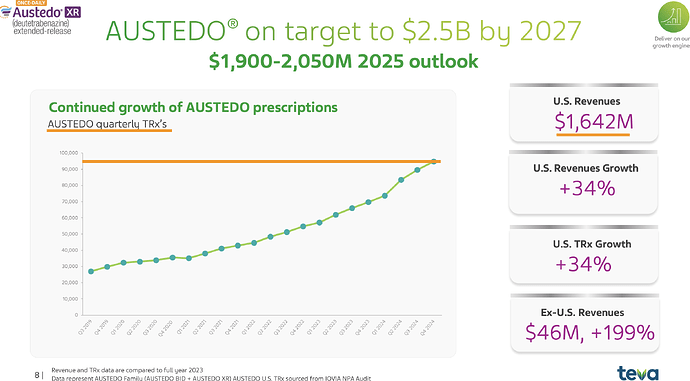

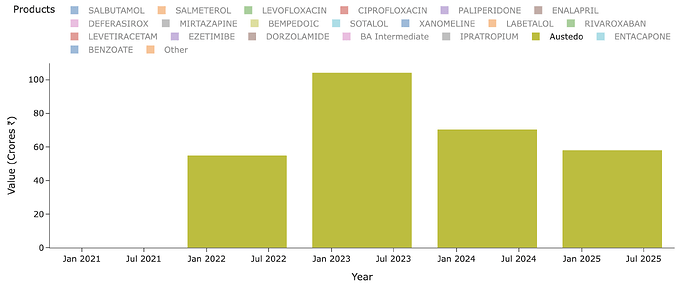

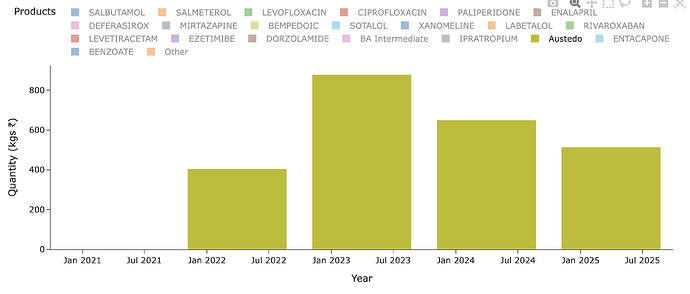

I have really been stuck on the anamoly that is Austedo. People who remember the fanfare this molecule had in '20 on Twitter know why its important. People used to celebrate its sales and assumed it would flow down to Neuland but it never did (Highly recommend reading all posts from this point until about Mar '22 for context). Austedo sales today is $1.6b. It crossed $1b 2 yrs back or so.

Lets see what Neuland exports of the molecule in recent years look like - for Austedo in specific. Peak sales for Neuland was a mere ~100 Cr for a $1b drug. Thats just ~1% or less on most years. Why is this? Why didn’t we see 5-10% of sales of value of drug and thus reaching 1000-1200 Cr levels? (In recent times, Bempedoic Acid sales is probably ~10% of sales for eg. - why didn’t Austedo ever even cross 1% of Austedo sales by value in any year?)

The reason for this as per my hypothesis was that all drugs are not created the same. To understand this discrepancy, one has to understand nature of drug - is it mass-market (statins, glp-1, alzheimer’s) / lifestyle elective medications (erectile dysfunction stuff, wegovy) > chronic niche (RA, parkinsons, schizophrenia, opiods etc.) > acute mass-market (broad-spectrum antibiotics, NSAIDs, painkillers) > acute high-cost (resistant infections, cancer, stroke drugs) > orphan drugs (metabolic disorders, cystic fibrosis).

It requires us to understand dosage - how many milligrams of drug is given per day and for how many days? How is it titrated up and down? (low dose to high dose and vice versa). How is the prescription uptake for the drug? How is the insurance coverage? What’s the drug’s stoichiometry and actual yields like i.e What proportion of raw materials are needed to make the drug theoretically and what are the actual yields in production. Without understand the nuts and bolts of all these, we will be given to platitudes like xyz is supplying solely to blockbuster drug.

So what went wrong in Austedo? Austedo is a drug for Huntington’s chorea and Tardive dyskinesia - these aren’t big market but are very, very high value and niche. It costs almost $60k-90k per patient per year. That also implies the market for this isn’t going to be very large (~30-50k active patients as per quarterly prescriptions above). The patients starts taking 12mg/day and is titrated up at 6mg every week until a max of 48mg/day. So on avg. each patient likely takes around 24-30mg/day of the drug.

What does that translate to, in terms of per year consumption per patients? 30mgx365 = ~10gms/yr/patient. So a 1 MTPA capacity should cater to 1000000/10 = 100k patients (If you remember in BlueJet’s intermediate’s case, 1MTPA capacity could only cater to 7500 patients for context - that’s a pretty wide variation we need to pay attention to - and thats because 180mg/day of drug in BA’s case and intermediate to BA API conversion yields being poor. Even BA API 1 MTPA would translate only to 15k patients - unlike the 100k we see in Austedo’s case). So considering Austedo has only now reached ~40-50k patients in US (100k quarterly TRx), we should see much less than 1 MTPA in exports for Neuland.

The quantity of exports supports this hypothesis. At peak it was 0.8 MTPA and since then lower - so overall uptake of drug is limited by dosage, prescriptions and margins by stoichiometry and yields.

It should be pretty clear by now that a mass market drug, at higher dosage and dosing frequency should do very well and way better than all other categories because of higher MTPA requirement and that means physical constraints would force multiple batches or a continuous process throughout the year (always higher margins from operating leverage) and consequently an uptake that’s not very lumpy (supply-chain stocking level lumpy will always be there).

A look at overall Neuland molecules also sheds further light. There are over 20 molecules in exports but of these, only Austedo, Cobenfy and Bempedoic Acid are NCEs of value. There’s a crowd of generics here from across the spectrum.

And a lot of these generics are degrowing as well (for that matter, even Austedo has degrown as we saw above) - like Mirtazapine and Levetiracetam. You put all these in context and we can see why Neuland’s margins have been under pressure. This is why I feel a company with fewer molecules but molecules with moat - either because they are patented or because of unbeatable high volume/low-cost production or because of limtied suppliers (technical limitation or contracts) will always have higher NFAT and Margins (As we see in BlueJet’s case all these at 5x NFAT and 40% margins!). I would even go to the extent of saying a company with 20 molecules where bulk of them are generic isn’t less risky than one with 5 molecules but with serious moats.

So going back to our initial notions, most of them aren’t universal truths. Lumpiness comes from trial batches and also from post-approval production supply if its to a limited market (which most drugs are but a high dose mass market drug can be non-lumpy). An innovator doesn’t always stick to the CDMO that did trial batches and often establishes secondary and tertiary supplies for high volume drugs (As has happened in BlueJet’s case even though Esperion was engaged with Neuland).

A $1b drug doesn’t have to necessarily make a lot of money for API/Intermediate guys and might be limited to 80-100 Cr/yr if its limited batches. A high value doesn’t translate to high margins - I am yet to work out what margins Austedo would have made for Neuland - it could be high but since sales itself is low, that’s the reason Neuland didn’t make money from Austedo (and not necessarily due to margins as I initially suspected). But in case of BA, there’s a clear case of high value not meaning high value add (2kg of Intermediate is $900/kg and 1kg of API is $950/kg in BA’s case is a case in point at least for this).

Frequency of uptake matters a lot since running small batches few times a year possesses zero operating leverage. Continuous operations or high frequency of batches over several months can give a big fillip to margins from operating leverage. Lot of molecules in phase 3 in a company’s roster doesn’t mean we should automatically get excited before guaging the market size in terms of patients and prescriptions, the competetion, the insurance coverage (post launch), doctor’s opinion on the drug’s standing (some will be reluctant to prescribe for various reasons), volume and frequency of uptake, possible margins, primary/secondary supplier etc.

Disc: Interested in Neuland. Invested in BlueJet as disclosed earlier and no recent transactions. I have been studying the CDMO space in some depth over last 2 months across companies and these posts are my attempts at understanding the nuts and bolts of a sector I am new to. I am not professionally qualified in this field and by no means an expert - so I am bound to have made lot of mistakes.

Neuland Labs has received NMPA approval for Labetalol HCl DMF. Granted by China’s National Medical Products Administration, it allows the Indian company to supply this blood pressure medication in China.

Not sure how big is this for the company in terms of sales. Anyone has any views?

Neuland Labs has submitted its first Peptide API DMF for Difelikefalin Acetate to USFDA, marking a significant milestone in our generic peptide portfolio.

Comparatively CDMO business will have lower tariff impact due to:

-

API component ranges from 0-10% of overall drug cost. Looking to the compliance level expected by USFDA , the margins made by Indian companies are very very reasonable.

-

Manufacturing cost in USA and Europe is 2-3 x of Indian cost.

-

Lack of talent pool.

-

Unit cost of CAPEX in USA and Europe will be at least 2x.

-

Lead time of 3-4 year to start new manufacturing.

-

India will be a preferred supplier when compared to China.

-

With retaliatory tariff imposed by China, its relationship with USA will deteriorate. Reduction of 10% share of China is equivalent to 80-100% gain for India.

-

CDMO business is not a commodity business which can be replace overnight with any other supplier.

Disclosure: Invested and will remain invested as defensive bet in current scenario and growing sector in future.