Earlier 483 observations

796fd218-ede2-429d-82fd-62b696ea78cf.pdf (267.8 KB)

USFDA has Concluded the inspection is closed.

Agree, i have been invested in Syngene for last 10 years, have seen same phenomenon unfolding there.

Disc. : Long term invested

Hello, Any one idea about the below line mentioned in FY 23 Annual report, I mean how can we figure out who is this supplier and whether is it a listed company?

De-risking and digitising our supply chain

We reduced our reliance on China for key materials by qualifying

indigenous suppliers for key molecules. We also identified Indian

sources with strong chemistry capabilities and competitiveness

for other materials and engaged with them to ensure supply.

Our efforts over the years have brought down China-dependent

procurement from over 20% in FY 2019 to 10.2% in FY 2023.

Neuland Labs FY23 AR Notes

Business

- Neuland Laboratories is a leading, global active pharmaceutical ingredient (API) manufacturing and development organisation that caters to the pharmaceutical and biotech industry’s chemistry needs. Right from synthesis of pre-clinical compounds to supplying New Chemical Entities (NCEs) and advanced intermediates at various stages in the clinical life-cycle, as well as commercial & generics, we offer agile and flexible API manufacturing and development service

- Segment Details

- GDS

- 65+ APIs & 10 TA

- Prime APIs - Mirtazapine, an antidepressant and Levetiracetam, an anti-epileptic agent. Other important molecules include Levofloxacin, Ciprofloxacin, Enalapril, Sotalol and Labetalol.

- Specialty APIs - Brinzolamide, Dorzolamide, Deferasirox, Donepezil, Entacapone and Salmeterol.

- The Company leverages its core competencies in process chemistry involving chiral chemistry, hydrogenation and inhalation products for developing specialty product

- CMS

- Caters to emerging biotech companies

- Services include a full range of the pharmaceutical industry’s chemistry requirements, right from pre-IND through commercial manufacturing.

- Offers both small-scale clinical trial quantities and full commercial-scale supply with minimal tech transfer timelines.

- Neuland’s peptide synthesis services include production of peptides from milligrams to multi-kilogram scale by standard sequential chemical peptide syntheses and segment condensation strategies.

- Neuland has expertise in both solution phase, solid phase synthesis and hybrid methodologies.

- Pipeline details

- Total projects = 87

- In commercial = 21

- In development = 15

- Pre-clinical to Ph3 = 51

- GDS

- Facts

- 1200 Cr sales Vertical Mix

- Prime APIs - 32%

- Specialty APIs = 27%

- CMS - 37%

- API Capacity = 907 KL

- North America sales = 51%, Europe = 33%, APAC = 5%, Japan = 3%

- 3 Manufacturing Facilities in Hyderabad & 1 R&D Centre

- 1200 Cr sales Vertical Mix

- Performance Review FY23

- Growth was driven by 10% growth in GDS vs 57% growth in CMS segment

- Better product mix and operating leverage enhanced EBITDA margins despite Russia-Ukraine war, raw material volatility

- Spike in demand from customers for some APIs

- Invested 66 Cr in FY23 in hydrogenation block, R&D centre, and other manufacturing equipments

- Specialty APIs and commercialization of 2 molecules in CMS segment drove the performance

- In our GDS business, growth was driven by specialty APIs such as Apixaban, Paliperidone, Ezetimibe and Donepezil, which involve complex chemistry and advanced technologies. The strong performance of our specialty portfolio significantly contributed to margin improvement.

- In the Prime segment, which constitutes the other part of our GDS business and focuses on mature and competitive APIs, our key molecules were Mirtazapine, Ciprofloxacin and Labetalol.

- Business Focus

- Neuland’s simple yet robust business model, focussed solely on the development and manufacturing of complex APIs, resonates with the customers

- Strategic priority is to build a GDS portfolio that caters to quality-conscious customers and offers products differentiated by technology. This enables them to command a premium and effectively tackle pricing pressure and competition. Our strong focus on maintaining a healthy pipeline of new molecules ensures the sustainable growth of the GDS segment.

- Pure play business model of exclusively focussing on the development and manufacturing of complex APIs and following a ‘no-compete approach’ eliminates conflicts of interest and provides compelling value proposition for innovators

- Build deep competency (through organic and inorganic means) in complementary new technologies like bio-catalysis, flow chemistry, and physical properties, which are valued by the target customers and differentiated from competitors

- Working on digital initiatives and process improvement initiatives to be more agile

- Focusing on right talent and creating succession plans to deliver performance

- Building cross functional teams and empowering them to make decisions to deliver value to the customer

- Management Commentary

- Companies that do multitude of things right, thrive

- FY23 performance culmination of efforts over the years

- Placed weightage on cost management and process improvements

- Found alternate vendors to de-risk the supply chain. China dependence is down to 10% from 20% in FY19

- Flexible capital allocation to ramp up production of high demand APIs during FY23

- Confident to deliver consistent performance over long term but growth will not be linear

- Efficient project management is pivotal in ensuring customer satisfaction and bolstering the growth potential and hence transformation from a product-centric to a project-oriented company.

- Building on the reputation as a manufacturer of high-quality products, we aim to leverage the advantage of securing customer commitments ahead of capacity creation. This strategic approach not only ensures business visibility but also minimises time and risks associated with capital investments, while maximising returns.

- Growth drivers

- The transition of molecules to commercialisation in our CMS business is expected to drive recurring revenues, except in the eventuality of the drug not being commercially successful.

- 2 more molecules expected to become commercial over next year

- GDS specialty business will drive performance as well

- Focus will also be on regaining market share in Prime APIs

- Will invest in Unit 3 to increase capacity and develop more R & D infrastructure

- Key trends in the industry -

- Emerging biotech companies now account for 66% of the R & D pipeline.

- Pharmaceutical companies are now placing greater emphasis on working with API companies who have a proven track record of quality and compliance. This shift highlights the importance of reliability and trustworthiness when outsourcing API development and manufacturing

- China + 1

- Furthermore, the trust quotient has shifted for American companies. They see India as a new home and are steadily showing greater confidence in the country’s capabilities

- 60% of new drug approvals were small molecules which is focus area of Neuland

- Biotech spending to grow at 9% CAGR till FY27

- New DMFs

- 3 DMFs (Tafamidis Form-4; Voxelotor Form-1; Voxelotor co-crystal)

- These products are highly differentiated and enables them to demand a premium

Risks

- Europe is emerging as a strong player in the API space. While some may have predicted the dominance of China and India, the reality is different European companies are competing fiercely, and from an Indian perspective, Europe poses stiff competition.

- Growth will not be linear even on annual basis

- Raw material volatility, commodity prices risk

- Supply chain disruptions

- Prime API segment is commodity and market share fluctuates

- Currency risk

- US FDA risk

- Environmental risk

Neuland is probably the only API manufacturer who gives the pipeline details upto this granulation.

Coming to the projects; seems they have enough charge for next 3-4 years in the meantime more projects shall get added in development stage.

Great performance continues…

Few Concall Highlights -

- Getting lots of queries from new set of customers.

- 2 new molecules from CMS are going to be commercialize next 12-18 months.

- Looking for not only supplier but as partner with customer where customer may not neccessary funds the capex but gives near confimed business orders.

- Reduced substantial amount of debt.

- In GDS focusing on product differentiated with technology and process.

One thing admirable here is the management. Consistent conservative stance on their own business and clear focus on specialty APIs and CSM. This is so unlike Laurus where I get lost with what management wants to convey. They are diversifying into animal health, crop science what not with debt laden balance sheet. Neuland management knows they can deliver 15% topline growth over 3-5 years with margin expansion without spreading legs into multiple segments.

PS: They even took a dig at Laurus by saying their focus is the differentiator and don’t want to do agro or animal health.

Disc: Invested here and maybe biased due to differential in recent price performance of Laurus and Neuland

Major difference between Neuland and Laurus, is how both the management think of their company. Neuland’s management sees itself as a high-tech company with strong R&D capabilities. While Laurus represents itself as manufacturing company, who will put lot of capacities upfront and will manufacture whatever come to the door within their purview.

In my humble opinion, both Neuland and Laurus are strong businesses. However, it would be difficult to see them with a single lens. Neuland is a company that is driven by innovation, while Laurus is a company that is driven by efficiency.

Disc: Invested in both

Management has calrity of thoughts about their business, about their CAPEX, about the kind of cusotmers they are looking for , about the type of products , about the type of segments, about the consistency of business growth and lumpiness, about the level of transparency, about their competitors, about the market and many more things.

Over all a good quality business with a good quality management with a long run way …can come in the radar of Marcellus coffee can investment strategy…

Disclosure: Invested and views are biased.

Neuland Labratories - Q1 concall highlights -

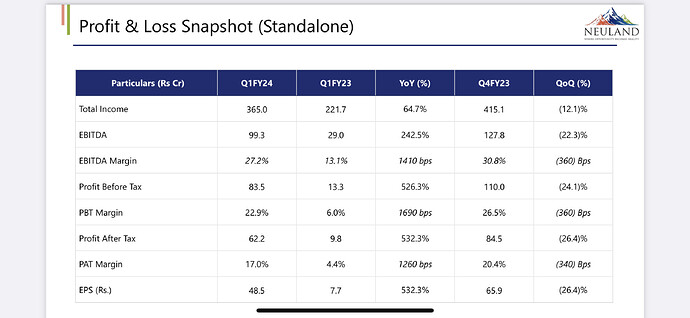

Financial outcomes ( YoY ) -

Sales - 356 vs 221 cr

EBITDA - 99 vs 29 cr ( margins 27 vs 13 pc )

PAT - 62 vs 10 cr

Net Debt at 24 cr vs 160 cr YoY

CMS segment-sales led by commercial molecules. Significant contribution from in the pipeline molecules too

Speciality segment-growth led by Apixaban (anti coagulant)and Paliperidone (anti psychotic)

Prime segment-growth led by Mirtazapine (antidepressant) and Labetalol(BP med)

EBITDA expansion due - improved business mix, lower RM costs and kicking in of operating leverage

Working capital cycle down to 118 vs 141 days YoY

02 NCEs have gone commercial in the recent past (these have improved the company’s growth trajectory)

02 more NCEs are likely to go commercial in next 12-18 months

Receiving increased enquiries from global companies to partner with Neuland for CDMO work

Business to remain lumpy on a Qtr to Qtr basis

Company believes that they have sufficient capacities for next 2 yrs

May have to go for major capex after that, like setting up a unit IV etc

Going fwd, there will be more focus on speciality vs prime molecules

The demand of 02 new NCEs that ve helped company improve its performance in past few Qtrs, looks stable in for the foreseeable future

Disc: core holding. Biased

Hi All,

Regarding the Q1-2024 results, I can see that the Sales and PAT both have decreased on a QoQ basis (as compared to Q4-2023). Isnt this is problem? Why have the sales &profit gone down on a QoQ basis?

In CDMO business, QoQ results are not comparable

One should only compare yearly results

As Ranvir has mentioned above, CDMOs are not comparable QoQ. You will find the management of Laurus, Syngene too using the same lingo in their concalls. There is higher volatility on a quarterly basis and hence yearly comparisons make more sense

Thank you Ranvir and Srinivasan.

How does the business of Neuland, Glenmark Life Sciences, Marksans Pharma stack up against each other (all 3 are good quality small caps) - in terms of which phase of drug manufacturing they specialize and what kind of products?

It is purely due to shipment of commercial molecules. Given you have a basket of molecules you supply- in some Quarters the molecules you supply to the innovator (APIs or intermediates) might not be there in other quarters. Simple reason:- innovator stocks up the supplies quantity. Which means for 2-3 Quarters same supply might not be there.

Thus, it’s a lumpy business. Growth should be looked at on yearly basis

@abhinav_sinha Please refer below post - a bit detailed explained on QOQ comparison:

"Management During Q4 FY2023 Earnings Conference Call”

Saharsh Davuluri: Yes, see, I think commercialization is happening, Sanjaya. I think I’ll also just add another

point here. See, commercialization of molecules are happening. That commercialization is

recorded as commercial revenue. That revenue on an annual level is fairly stable. At a

quarterly level, even commercial molecules can have lumpiness because some of the lowervolume CMS molecules that we do, we don’t necessarily ship out material every quarter. We

ship out maybe twice a year, 3 times a year or maybe sometimes once a year. So again, I think

Q4 by itself for CMS is not a representation of the CMS business as a base. But if you look at the overall CMS business of FY '23, it’s a good legitimate base for the business.

Considering above coent How one should try to model the revenue going forward for Neuland?

In my opinion, on can assume a steady 15 pc kind of bottomline growth every year with scope for positive surprises baked in. No one knows which molecule is gonna go commercial at which time and its revenue potential

However, in serious CDMO businesses like Neuland … one can expect unexpected upsides even if 1-2 molecules end up becoming hit/blockbuster in the developed Mkts

Disc: holding, biased

Hi Sir ,Thanks for very prompt response

I went through detailed thread here and Annual Report and recent concall ,Also saw ishmohit sir video on Neuland ,

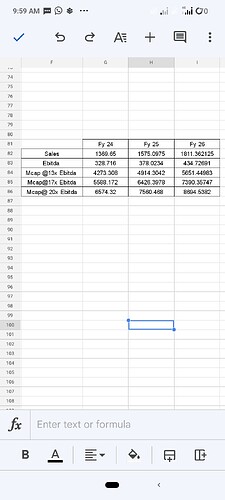

Basis on that I built scenarios which I am sharing here,

Assumption that I taken into account

1)Sales Growth of 15%, Considering management stating Fy 23 as base year and commercialization of 2 molecules

2)Ebitda margin of 24%,Speciality mix in GDS segment increasing and If Commercialization of two molecules will mean CMS segment share in Revenue pie will increase,Hence overall margin to base Fy23 to increase about 1%

I hope to here from folks who are reading or analysing Neuland

invested,Bias