That will be depend upon what the incoterms are. Majority of exporters sell on FOB terms, which basically means their EU customer (importer) pays for the freight, import and insurance costs. So they may be hit harder on import side than on exports for freight rise. But then they claim to be have substantially reduced China dependence on the KSM.

Your understanding of FOB is not correct. Under most common FOB incoterms, supplier pays freight to destination port and charges an FOB rate at destination from the customer. Under EXW incoterms, freight is borne by the customer from supplier’s Plant. I think most exports from India are on CIF basis, hence freight ought to be borne by Indian suppliers.

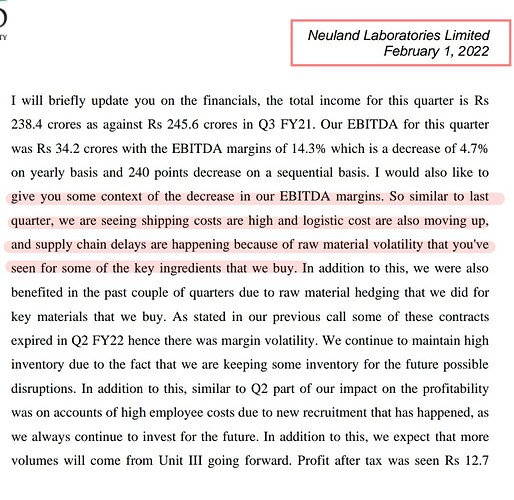

Aditya Khema’s (InCred Health) views on Neuland Labs.

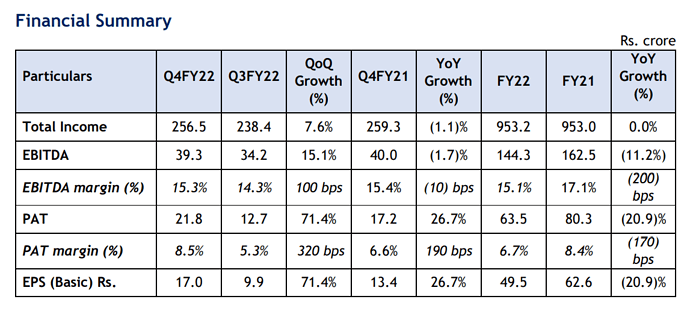

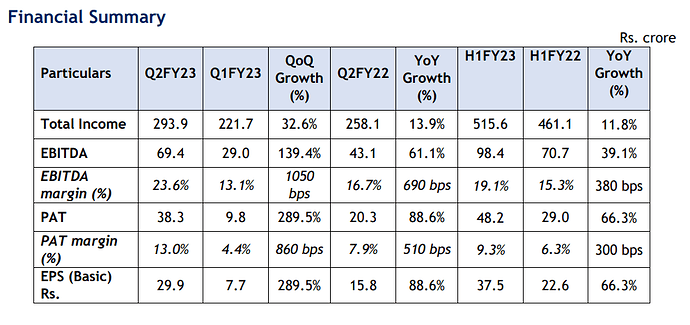

Neuland labs Q4 FY22 results.

Revenue, EBITDA is up on QoQ while it is Flat YoY.

PAT is up both QoQ and YoY.

FY 22 Revenue when compared to FY21 is flat owing to weak GDS offtake from Customers.

Dividend Declared Rs 5/- per share.

Q4 results are decent.

Let us see the management commentary in Today’s Concall sheduled at 8 PM .

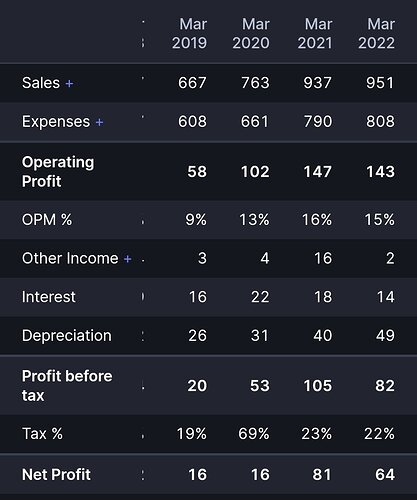

Despite so many headwinds like Raw material pressure, lower off take by customers, higher logistic costs etc. Neuland Labs performance is pretty decent on yearly basis. FY22 revenues are higher than FY21, margins are just 1% down, lower operating net profit due to higher depreciation on account of Unit-3 commercialization

Operating Margins down ~1% despite 3% increasing in employee expenses ( 16% to 19% of sales). Increase in employee expenses is due to higher head count again on account of Unit-3 commercialization, otherwise operating margins would have been higher a little compared to previous year.

If you compare with the Laurus labs, performance of Neuland labs is better. (FY22 vs FY21). Though it is unwise to compare both these companies I did it due to the fact that both companies faced similar headwinds

Disclosure: Invested in Both

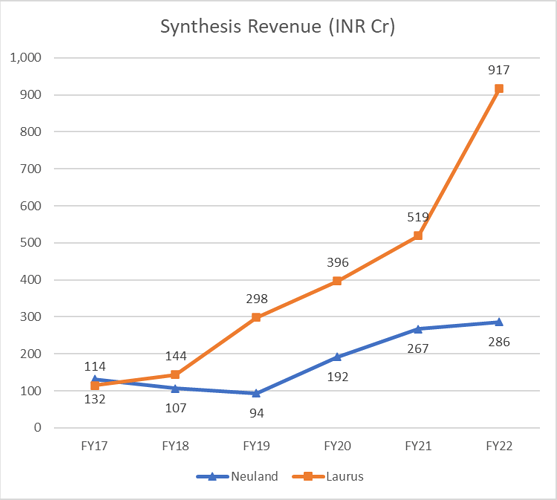

Personally, the next gen management does not appear fully convincing to take the business to next level. When questioned during earnings calls, their typical response is “some products have grown, some have declined which has led to this revenue trend, but we see healthy business momentum going forward.” Their business is still heavily reliant on Prime APIs, where pricing is left to market forces. And they haven’t been able to scale up their CSM business that well.

Look at the below chart on Synthesis revenue for Laurus vs Neuland. Both were at the same position 5-6 years back, and now Laurus is >3x the scale of Neuland.

It’s a clean company from a corp gov and FDA compliance perspective, but I personally see better opportunities to invest in at the moment (e.g. Suven, Laurus). I’d love for them to succeed (and in fact they might post blowout earnings in the future), but this industry seems to be benefiting scaled players.

Disc: was invested earlier, recently sold off my position.

Thanks for sharing this insight Ravindra. Since you seem to have studied both Laurus and Neuland, it will be interesting to know your views on the future growth triggers for both and the probable growth trajectory of each.

Incred reports has some positives.

- RM pricing transient,.

- Well posed for growth.

- Unit III capacity additions will benefit Second order play on innovators.

- Currently (in April-22) 7X FY24 EV/EBITA. They value Nueland at 12X FY24EVEBITDA, still lesser than peers due to generic APIs

Will be interesting to see any other views from any of us.

Disc - invested

Is the Neuland story stuck or is it actually building towards some major revenue/growth unlocks?

I am not invested but do consume all Q concalls and presentations. The business seems stuck to me for the last few quarters without any near term growth triggers being highlighted by the Management. Would be interesting to hear some bull thesis for Neulands, not able to grasp it.

I would also tend to believe that Neuland is one company which has high promise but the delivery fall far short of expectations. This obviously has to do with the competitive Generic industry in which they operate. Even the CSM segment is not able to scale up significantly over the last many quarters. The molecules that they are working on are fairly challenging and complex and taking them to the finish line (themselves and for the partner) is always going to be challenging.

In nutshell, I believe given the industry that they are in and the complexities of FDA/Technical etc and their small size, it is not going to become a secular growth story for some time. even if they do well in 1-2 quarter, business may revert back to mean margins and growth thus disappointing investors. The only way to play this can be buying at fairly low valuations and then hoping for management to deliver numbers for 1-2 quarter and moving out after making some trading profits.

Regards,

NIkhil

Disc: Not invested but following.

There were challenges in the Levetiracetam sales in the past few quarters, which is the biggest revenue driver in prime segment of GDS for Neuland. Management reasoned that it was because of lower customer demand & customer holding inventory. But it hasn’t changed even after 3 quarters. In yesterday’s earnings call also, management said the same commentary.

(You can hear the discussion about Levetiracetam sales from 34:13 in Q1FY23 call)

I’m adding past earnings call snippets to understand the progression of this issue and how management justified the issue.

Q3 FY21: Levetiracetam & Mirtazepine are the key growth drivers in GDS. Will continue to invest in those molecules and become market leaders.

Q4 FY21: Our GDS business was led by key molecules Levetiracetam & Mirtazepine.

Q1 FY22: We have gained market share and increased margins on Levetiracetam & Mirtazepine.

Q2 FY22: For Levetiracetam, we’re strong in the markets that we’re in but we’re NOT seeing very strong spurt over there.

Reason- these are also the CYCLES that you have for these products.

Q3FY22: Products which were historically doing well like Levetiracetam & Mirtazepine didn’t perform to our expectations.

Reason- Lower customer off take & customer holding on to inventory from the orders in the past or they don’t have a production campaign or need right now.

Q4FY22: Levetiracetam which has been doing well for us historically had challenges this year.

Reason- We believe that this is because of low customer off take, perhaps because of high inventories and we expect that the volumes should recover in coming quarters.

Yesterday’s con call

Q1 FY23: Biggest impact in the GDS was from Levetirazetam. It is also the largest product in our GDS segment which impacted our performance. We think it is temporary.

Reason- because of combination of reduction in demand & inventory build up at customer’s end.

As Mr.Aditya Khemka pointed out in the earnings call, if it was due to inventory build up at customer’s end, it would have been temporary. If the challenge is due to increased competition from peers, then it is alarming.

For Neuland the issues with Levetiracetam API sales started from Sept-Oct 2021 and it is persisting even now.

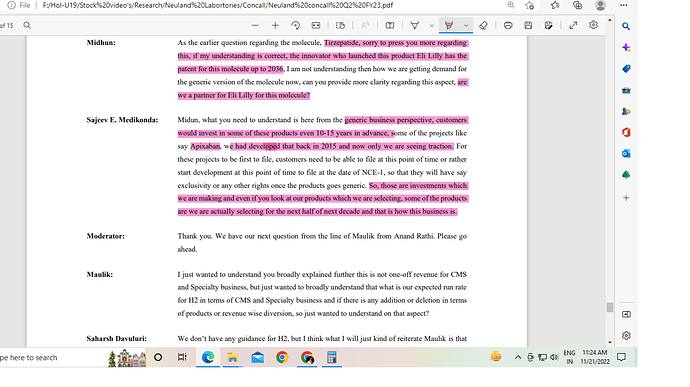

Another interesting thing to note here is that on May 2021, Divi’s has talked about expanding their Levetiracetam manufacturing with improved changes (background integration, increasing yield, solvent recovery, conserving raw materials) and the expansion to be completed within 3 months. That is the time period where gradually challenges arose in Levetiracetam business for Neuland.

Neuland management never acknowledged increasing competition in Levetiracetam sales or losing market share for their biggest revenue driver in generic business. They always had same explanation of “lower customer off take & customer holding inventories”. They could have given more clarity on this situation.

CMS business is also stagnating for so many quarters. I’ve written detailed post about these in the past.

Even after having 21 molecules in the commercial CMS stage, their CMS commercial revenues are not showing significant growth. I’ve talked about how Austedo (Deutetrabenazine) revenues are growing for Teva in clear contrast to Neuland’s CMS revenue growth.

For a different perspective, this is how Laurus scaled up their custom synthesis in the last 3 years.

I don’t know if it is fair to compare custom synthesis of Laurus to that of Neuland since molecules and customers are different. But lack of momentum or lack of growth is pretty much visible in the case of Neuland. In the yesterday’s earnings call, management has said the reason for the weak Custom synthesis was because of technical challenges they faced during scaling up a molecule from lab to commercial scale and subsequent delay in delivering molecule to the innovator. This is something an innovator doesn’t seek in their manufacturing partner. Innovators always want timely delivery from their manufacturing partner and this reason can compel them to give contract to someone else.

The stock has jumped more than 40% in last 3 months. Is there any specific news related to the company?

After doing some research, I found that the export of levetiracetam has increased by 10% YoY in July and 20% YoY in august. I couldnt find the company wise break-up from exim website. But it looks plausible that company reports good growth in its Q2 figures and that is being discounted by the markets.

If someone has more details on export no.s, please share the same. I am also trying to do further research into it.

Excerpts from an FT article on Weight loss. Wegovy (semaglutide) the weight loss drug and similar others ( Tirzepatide )which work as “glucagon like peptide 1 agonists” are gaining traction and facing supply issues. Neuland confirmed in their concall that they are developing both Semaglutide and Tirzepatide.

FT article :

When Novo Nordisk launched weight loss drug Wegovy last year, it recruited US rapper and actress Queen Latifah to front a publicity campaign aimed at tackling the stigma that often surrounds obesity treatments.

A year on, and the Danish company has become a victim of its success. Surging demand and manufacturing constraints have caused widespread shortages of Wegovy, a drug which — in a late stage clinical trial — produced an average weight loss in patients of 15 per cent of their body weight.

Scarcity of the drug, which has the generic name semaglutide and is an appetite suppressant, has forced Novo to suspend marketing and rethink its manufacturing strategy.

It has also provided an opportunity for Eli Lilly, Amgen and several biotech companies developing similar obesity-busting drugs to try to catch up in a market that analysts forecast could be worth $50bn a year by 2030.

A four-week course of Wegovy has a list price of $1,349 a month, although patients with insurance that cover the drug pay less. Given that patients must stay on the drugs for life to ensure they do not put weight back on, obesity medications should generate stable income over long periods for drugmakers, say analysts.

Morgan Stanley forecasts that Novo Nordisk and Lilly will capture about 40 per cent of the market, as they develop and launch up to a dozen obesity medicines. Several other biotech companies — Amgen, Altimmune, Zealand Pharma, Hanmi, Regor therapeutics, Sciwind Biosciences and vTv Therapeutics — are at earlier stages of drug development.

Last month, the US Food and Drug Administration granted fast-track designation to Lilly’s weight loss drug Tirzepatide, a move the company expects should lead to its approval next year. It successfully launched a formulation of this drug, which it branded Mounjaro, in May to treat type 2 diabetes at a list price of $974 for four weekly doses.

Excerpts from Neuland concall :

Midhun : Congrats for nice set of numbers. My question is regarding the peptide molecules in our pipeline, we have been developing Semaglutide and Liraglutide for past 4 years I think, can you give me more color on this? Have you filed any DMF for something or any update on this?

Sajeev E. Medikonda:

So, I think Midhun when it comes to the peptide sect we have in our portfolio and which we have been developing, you are right that we have been working on Liraglutide and Semaglutide and we have made significant progress in the lab. Even as we were looking, this is not a small molecule, so therefore we are not looking to straight away go and file a DMF because we need working very closely with a formulator to ensure that we have the right products which is their need and even as we are looking for the right customer for these two products, we have also started development on more molecules in the peptide portfolio. So, as soon as we find the right partners for these products, we will scale them up, you will see the DMF being filed. Even as we are saying that we are looking for the right partners for these products, we have gone further because we have done the work in the lab for these products, we have added more products to our portfolio and even there we are seeing good interest in those products, so I think we will find that in our product list, a product called Difelakafalin as well as Tirzepatide, both also we have been working for the past 6 months or so.

Midhun : My next question is regarding the molecule, Tirzepatide, are we seeing any demand for this molecule, how is that customer traction for this molecule?

Sanjeev E : So, this is a recently approved molecule, so we are seeing good traction, but we will be expecting certain small development quantities going out over the next 12 to 18 months or so, but from a commercial perspective this is a long-term bet both for us as well as our customers.

Apologies for a longish post. I am sure many would have analysed this opportunity. Just thought of sharing this to the community.

- I am not the person asking the question in the concall.

Invested.

This is the best part of the concall , management is superb undoubtedly & rest will follow accordingly

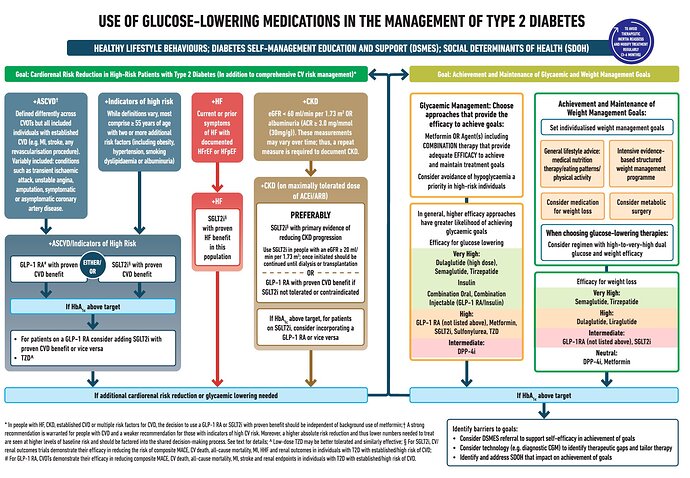

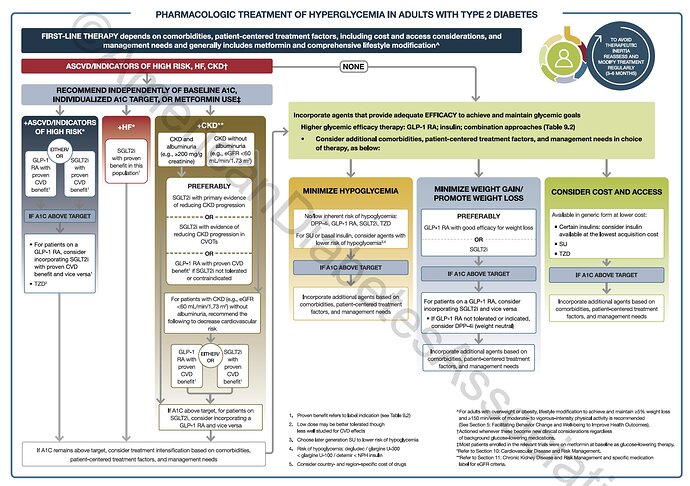

GLP-1 agonists are a class of drugs used in the treatment of diabetes (superior sugar control) & weight loss management. These drugs have superior treatment outcomes & are now used as a first line drug in patients with diabetes having comorbidities such as atherosclerotic cardiovascular disease & chronic kidney disease.

As these drugs become generic & cheaper, these may replace metformin as the most preferred first line drug in the treatment of diabetes.

Indeed the opportunity size is huge for these molecules. One who develops the knack to manufacture the peptide molecules efficiently at scale may win significant market shares for this molecule. (Like Divi’s doing it for many small molecules). At the moment, Piramal & Neuland both are working on these molecules & haven’t filed DMFs. Let the numbers speak first.

Tirzepatide is the newer drug in these class of drugs and it is indeed a wonder drug. Link

That’s why I was interested in Tirzepatide in the peptide development list of Neuland. Turns out, they are not supplying to innovator now & developing it for generic use, once it becomes generic. (15-20 years time frame).

Even Elon Musk attributed his weight loss to Semaglutide drug. (Ozempic/Wegovy)

https://twitter.com/elonmusk/status/1592768518050574336?s=20&t=f9BHffScc9xM0TmLV4VmiQ