But if you compare basic vs diluted EPS then it is only 4% dilution. But people here are saying that 10-15% dilution would be there.

I am not able to add up the things here

But if you compare basic vs diluted EPS then it is only 4% dilution. But people here are saying that 10-15% dilution would be there.

I am not able to add up the things here

As far as I understand, the diluted EPS (Rs. 26.42) mentioned in the Q1FY22 results only takes into account the dilution due to ESOPs, not the dilution due to the shares to be issued as part of the Evosys deal.

As mentioned in note 5(ii) of the quarterly result:

“the equity shares which are proposed to be issued have not been considered for calculating the earnings per share till such time that the acquisition is recognised in the standalone financial statements. If the 4,235,294 equity shares had to be considered as issued on the date of acquisition, the resultant basic earning per share would have been at Rs. 23.50 per equity share of Rs. 5 each, for the quarter ended June 30, 2021.”

i.e. considering the dilution due to the Evosys transaction, the diluted EPS would be Rs. 23.50, implying a dilution of 14.3% over basic EPS.

Someone please correct me if I am wrong.

Promoter buying from open market

Latest commentary from the new CEO Mr. Hiral

Though they have cash of about 1000 crores on books, nothing is available for cheap out there in the market. The best deal that can do is the way they acquired eVosys, part cash and part equity. Along with US growth this is another trigger to watch out.

Just started reading up about this company and it’s been a great wealth creator for anyone who’d have invested since the demerger days or even during the Covid crash last year. Going through the thread, I can see a few folks from VP definitely made great returns here, kudos to them!

For fresh investors at current valuations, I think there are many concerns/risks which one should consider before entering:

Client concentration - Top 5 and top 10 client concentration at 34 and 48%. Think this is something lot of mid-size IT companies have in-common but if these include government clients then Mastek’s risk is much higher in my view

Government dependence - Business from public sector clients at 34% of revenues. This has come down from 50-60% few years back, however I doubt this can be a seamless transition to private companies without some bumps on the way (market may offer better valuations during potentially rough quarters)

Currency / geo location risk - 70% of business from UK & Europe as per latest presentation. I wonder what’s the exposure to UK out of the 70%…events like Brexit had a massive impact on the currency and that time 95% of the business was from UK, so every 1% decline in pound led to 1% decline in revenues (listen here - Brexit to hit revenues, but Q1 is a safe period: Mastek)

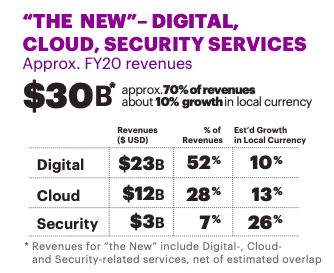

This is how Accenture reports digital business performance and growth (FY20)

Tracking on my watchlist.

Myself from IT background and am still struggling to understand what is text book definition of digital ?

A typical software company offers following services

Software Development - Develop, Test and Deploy solution on the client infrastructure or clients cloud infra.

Software Testing - QA services

Software Maintenance - Post production maintenance of the solution

Product Development - Develop and sell the product (Intellect Design ) and charge the AMC charge on the product every year, this can be a SaaS based solution where selling the product as a service .

Along with this, migrating client existing (legacy) systems to cloud , this again can be broken down into many pieces.

So what is digital means ? Which piece of work is considered as digital ?

from the ARFY21 I can see below which of these fall under digital ? And how to calculate the margins in these segments ?

Please share your thoughts.

At one point people used SMAC (social, mobile, analytics and cloud) to define digital but I don’t think there is a single yardstick that can be used to find who is more digital and who is less. Especially in IT service industry. Personally I find the term “digital” as a glorification of commodity skills of today’s world where on-prem Java platforms are the new legacy.

The Digital Transformation can be achieved in may ways. It can be related to Process, Infrastructure, Customer interaction, Marketing, Automation, Improve plant uptime, Using IoT . I will try to summarize the same

a. Process- A company can transform its processes by adopting Digital wherein earlier they were doing a particular task without a Digital intervention and then start doing the same using Digital Infrastructure e.g. capturing all the paper work and doing OCR to use it at later stage for other process and shifting all the paperwork in phases to Digital

b. Infrastructure- Here customer can transform his network and compute infrastructure using new gen technologies like SDN, SDWAN, HCI and give better user experience to their customers and their own employees

c. Customer Interaction- Customer can adopt new ways to interact with his clients by using multiple ways. This can termed as Communication as a Service, Contact Center as a Service and these services customer can use to increase the interaction with their clients and satisfy their client needs

d. Marketing- here customer can adopt new ways to reach out to their clients using new Digital ways using Social Media, Ads on Mobile

e. Automation- Using Automation customer can convert their current processes to save time by using RPA(Robotic Process Automation)

f. Improve Plant Uptime- here customer can use various methods like predictive maintenance to improve the overall production time. There are multiple uses cases with plant Automation

g. IoT- using IoT customer can use various sensors within the plant and offices to save energy costs, automate plant machinery. Predictive maintenance uses can will also be achieved using IoT

All the above use cases can be termed as Digital and various companies provide these services as per their domain knowledge. Customers are rethinking on saving the costs and how they can be agile in post Covid world so that they do not lose against the competition.

I am not sure which category will be applicable to Mastek but as I said there are multiple ways you can enable the Digital Transformation at customers place.

Disc: Invested. Initially as momentum strategy and increased the holdings subsequently

Forgive me for little technical post. I am working as software engineer for past 14 years too. Digital is nothing but buzzword created by managements and consulting companies. How can any piece of software be not digital?

Except for traditional infrastructure management and support work, it’s really difficult to categorize something as digital. The management will classify revenue as digital even if a small % of work is using cloud.

Yes the cloud, automation IoT etc. are real things but every tom dick and harry is using it now a days. There’s no other option left. So don’t go overboard thinking company X is more digital than company Y. It’s all about people who learn and use new technologies.

@nikrod look at cars. An ICE engine car is also a car and and a BEV is also car. Nothing great about BEVs. Technology has been around for years.

Let say there are 3 manufacturers: (1) “A” who makes ICE engine cars only, (2) B who makes ICE engine cars and also makes EVs and (3) “C” who makes only EVs.

Who do you think will grow fastest and who will be slowest over next 20 years. I assume C > B > A. Which company will get a higher multiple? I assume C > B > A.

Legacy = ICE and BEV = Digital.

Happiest Minds is almost a “C” (or perceived as a “C” even though it is not growing that fast). Check out its trading multiple. You would be in a better position to tell us who is “A”, given your IT background…we will avoid the As

You (given your background) can also help us understand which company is B-, B or B+ which will help us take investment calls

And yes given your background is Happiest Mind really a “C” or we are being fooled into believing so?

In my firm, I used to do the split of projects which are digital and non-digital, which will be consolidated and shared at company level. We even sometime confused about the word “Digital”. I classify a project as non-digital, another client account classifies similiar project as digital.

My two cents, though the question is not directed to me…

Pretty much all IT service companies come in different shades of B. The older and larger organizations have lots of A for obvious reasons but here is the thing. C in IT is not always a greenfield. It is mostly built on top of A, Or A is migrated to C. Either way, knowing A makes a massive difference.

Also, ICE cannot be converted to EV but human resources can be re-skilled, and that is what everyone’s doing in a big way.

End of the day, IT services thrive on human capital (with a few products offerings thrown in) but IMHO all that matters is how much revenue you bring in per employee, and below is a comparison for three organizations that get discussed in VP more often.

I would eat a humble pie if some of these show non-linear revenue in the future for their products, accelerator, or whatever they call those, but at this stage I don’t see anyone standing out.

| IDA | MASTEK | HM | |

|---|---|---|---|

| # of Emplyees in 2021 | 4260 | 3792 | 2818 |

| Sales (in Crs) | 1497 | 1722 | 761 |

| Revenue (in Cr.) /Employee | 0.35 | 0.45 | 0.27 |

How does Birlasoft measure up. Anyone has numbers for the biggies Infy, TCS, Wipro, HCL Tech, L&T Infotech, Mphasis, Tech Mahindra?

Wrong comparison with Cars. Can an ICE be converted to EV? Very difficult. Can GM turn into Tesla in 2 years? Again no.

Can people who know just JavaScript learn Angular/React? Within 2-3 months.

Traditional architecture to Microservices? 3 months.

Normal deployment to Orchestrators? 3 months if you have right guys (we did it in 1 month on one of our projects).

Reskilling is very real and happens fast in IT. Plus there is possibility of hiring lateral talent. This is industry where 1/3rd of your people might leave you within 1 year (check Cognizant) and you will still grow.

Just being digital business doesn’t guarantee your growth. GE’s digital + IoT business was a massive failure and they almost scrapped it after spending billions.

What makes you think Happiest Mind will grow at greater rates than Mastek and Persistent? Their past growth rate is not inspiring. I’m not arguing with market’s wisdom here. I might be completely wrong.

Mastek on the other hand is organically growing at 25%+ even after EvoSys merger.

Disc - I own Mastek from 800 levels and it’s my 2nd largest position. So I obviously have ownership bias. Please take my views with lot of salt.

An extract from my collectibles for Mastek. We can’t help but notice that Mastek has used EvoSys’ sales engine to great effect in order to get a ‘foot in the door’ of many a clients. We keep hearing about it as cross-sell and co-sell. I got a hint from Hiren’s address on the last concall that they’re now focused on increasing the wallet share. If you look at the Rev per client in table below you’ll see that they are right. One cannot however get their hopes too high simply because Mastek is really only specialized in 2 or 3 verticals whereas the likes of Infosys have far more to offer. Once the biggies get a client they continually mine them and offer ever increasing services covering a very wide range of activities within the client organization.

| Company | Mastek | Wipro | Infosys | Mindtree | LTI | Persistent | Zensar | Happiest |

|---|---|---|---|---|---|---|---|---|

| Clients | 651 | 1071 | 1626 | 260 | 435 | 1000 | 138 | 173 |

| Employees | 4302 | 209890 | 259619 | 23814 | 35991 | 14500 | 10000 | 2990 |

| Revenue | 1857 | 65480 | 104704 | 8351 | 12883 | 4187 | 3781 | 761 |

| Rev/Client Cr. | 3 | 61 | 64 | 32 | 30 | 4 | 27 | 4 |

| Rev/Employee Cr. | 0.43 | 0.31 | 0.40 | 0.35 | 0.36 | 0.29 | 0.38 | 0.25 |

Nikhil, thanks for sharing your views. I deeply appreciate the value you added. This neeeded to be said. coming from IT background myself (working at Google), all this talk of digital sounds like a marketing technique. Of course underlying changes in engagement models (on prem to cloud, monolith to micro-services singleton sales to SAAS model) are real. But, it is incredibly hard (imo) to objectively measure how digital a company is. All we have is management’s word to go by. And management’s word for mastek is 80% digital transformation revenue. even the word digital is a misnomer. Since all programming is fundamentally digital (who even does analog programming).

What i wanted to ask you is whether you might have been able to scuttlebutt mastek’s software services or products, either directly or through someone else. If so, please do share. I have not been able to but this would be a great value add to the forum and also me personally.

I wish I could, but wasn’t able to do scuttlebutt on Mastek. So am relying only on numbers, management commentary and collective market wisdom reflected in price.

Sometimes it’s useful to look at history to understand DNA and culture of organizations - esp with services and talent driven organizations.

A personal exp with Mastek - year 2018. Was offered a delivery leadership position in Mumbai, ended up joining Accenture though among choices.

Note that 3+ year lot can happen but evolution is longer esp if legacy is decades old.

Summary - till few years back they were quite low in preferred employment pedigree, employee experience, salary levels - at best mediocre- add to it staffing DNA and UK concentration and Majesco at that point. But hey IT was mostly backoffice focus till 2015 or so.

I do believe they are trying to be very different from what they were to play digital waves of future - market are forward looking and if Mastek can deliver confidence, there is good times ahead

what makes us think so

Key things to monitor at near term will be

Atleast till certain size Digital deals - it is level playing field for right skills organizations ( Tech + consulting + domain) - up to $10M type deals. Game and league is different beyond that.

Invested with tracking – watching execution closely - bigger positions in HM from lower levels

Time stamp : 34:00 talks about revenue per employee has gone up in UK.