Hi, i could be wrong but the reserves is retained earnings added on the books of the co every year. for example lincoln had 293 cr of reserves as on 31st march 2020 and with 60 cr of profits, they added it to the reserves taking the balance to 355 cr on 31st march 2021.

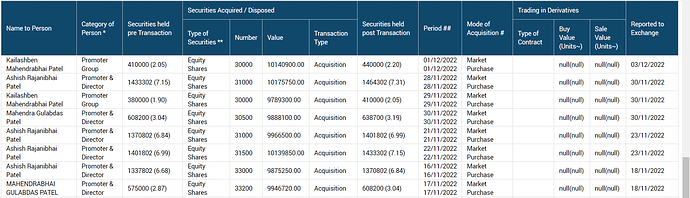

Promoter bought some shares again in the open market

Company looks good at the current price

Thoughts ?

promoter has been buying shares very regularly especially when price is in range of 320-350 band. i believe lincoln pharma is in consolidation mode right now. we will not see big price movements. next year their exports revenue will increase by 15-20% and also the new unit of Cephalosporin will add to revenues. I see the co growing its revenues by 15-20% yoy. it is good to buy currently. this year they are on track to do 500 cr of revenue ad in next 3 years touching 1000 cr. at that point it should get significantly re rated. my personal view is to hold it for 3-4 years for a 4-5x growth.

strong sign of growth in Lincoln. total no of employees increasing handsomely

aug 21 1119

sep 21 1126

oct 21 1246

nov 21 1265

so in last 4 months, the co has added 146 employees. the per employee cost has not gone up which suggests that almost all of these employees are sales people. it seems to me that Lincoln is expanding the domestic sales push aggressively. the export sales in Q3 came to 58 cr which is flattish vs Q2. so my best guess is sales in Q3 will be same as Q2 but employee expenses can go up marginally. Q4 would be interesting. the co has been repeatedly talking about starting exports to european union in Q4. so far they have sent some shipments to france but will be interesting to see them scale up to more destinations in europe in Q4.

where do we get the employee numbers from?

Average results from Lincoln: https://www.bseindia.com/xml-data/corpfiling/AttachLive/e7bb9a00-d7e3-4531-8048-8ad3406f3cf8.pdf

Retained earnings are not directly available for reinvestment, as they are part of the company’s equity, while cash reserves are the funds set aside by a company to be used in the future.

Company came out with decent nos, with sales and profits growing at 11% in FY22. Management had an interaction with Zee business where they mentioned that the cephalosporin capacity will start in a month, which can contribute to 20-25% sales growth in FY23. Notes from interview is below.

20.05.2022 (Zee Business interview link)

- Production from expanded facility should start from June, most of the expansion is in tablet segment

- Expect 20-25% growth in FY23 (will be visible from Q2FY23)

Disclosure: Invested (position size here, bought shares today)

don’t you think the company is not aggressive enough??

120 crore it has already achieved in a couple of quarters last year, not sure where the growth for the years ahead will come from , though valuation looks good

Disc: Invested

A very basic question. Why would Lincoln succeed in achieving projections of Rs 150 Cr. (in 3 years mentioned in the past or earlier) of Cephalosporin ? If its a USD 18 bn market with multiple players, how would a new player get its feet in ? Searched write ups on the net including rating rationale, but didn’t find any answer to this.

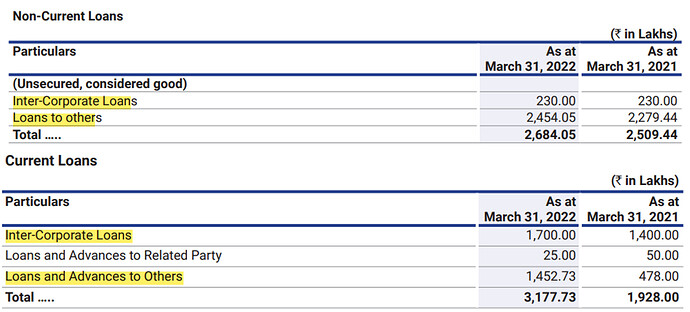

Lincoln Pharma came out with their annual report, a brief summary is below. Related party loans continue and have actually increased in FY22. FY23 growth should come on the back of new launches from Cephalosporin facility in Australia and EU.

AR22 notes:

- Revenues grew by 11.3% from 424 cr. to 472 cr. with PAT increasing by 11.3% to 69 cr.

-

Revenue break-up:

o India: 205.9 cr. (vs 163.55 cr. in FY21)

o Export: 266.18 cr. (vs 260.63 cr. in FY21)

o 1 customer contributes 17.69% of revenue (vs 15.37% in FY21) - Subsidiaries: Zullinc Healthcare: Sale 36.41 lakhs| PAT -0.32 lakhs

-

R&D (breakup not given)

o 30+ scientists, received 7 patents (same as FY21) and filed 25+ patents (same as FY21)

o 1700 product registrations with 700 more in pipeline, developed 600 formulations (same as FY21) - Received approval from Australia’s medicines and medical devices regulator – Therapeutic Goods Administration (TGA).

- 86th rank in IQVIA in July 2022 (vs 90th in June 2021)

- Launched 14 products in India and filed 110 dossiers in other geographies. Looking to build a chronic portfolio in India focusing on women’s healthcare, dermatology, gastro and pain management to complement acute portfolio

- 2 manufacturing units (same as FY21)

- Due to amalgamation of Lincoln Parenteral Limited, share count increased by 29,728 (from existing share count of 2 cr.)

- Acquired plant in Mehsana, Gujarat for Cephalosporin product range (tablet, capsule, dry syrup, injectable). Invested 30 cr. for capacity expansion. Plant is expected to contribute 150 cr. sales in 3-years and EU-GMP, WHO-GMP, TGA and ISO-9001:2015 certifications

-

Growth drivers

o Expansion in Cephalosporin products

o Foray in EU and Australian markets

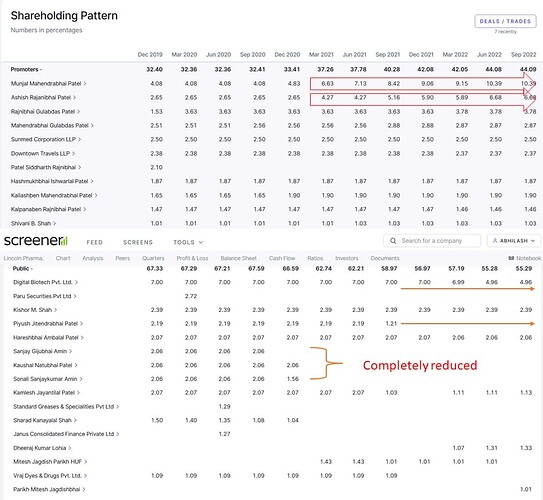

o Expand presence in Africa and South East Asian countries - Promoter holding: Increased to 42.05% (vs 37.26% in FY21)

- Number of employees: 1’525 (vs 1’246 in FY21) (managerial remuneration increased by 15-16% and other employee by 20-21%), contractual workers: 750 (vs 700 in FY21)

- KMP remuneration: 1.59 cr. (vs 1. 6 cr. in FY21)

- Anand A. Patel is appointed on board. He specializes in procuring of raw and packing material, business, administration, distribution channel and social activities. He was Whole Time Director of the erstwhile Lincoln Parenteral Ltd since 2010

- CSR: Spent 1.48 cr. (excess of 10.93 lakhs which will be setoff next year)

- Shareholders: 32’975 (vs 21’415 in FY21), price (low): 221.3, price (high): 414.75

- Audit fee: 11.5 lakhs (vs 11 lakhs in FY21)

- Income tax dispute: 0.23 cr. (vs 2.3 cr. in FY21)

-

Current loans given

o Inter-Corporate Loans 17 cr. (vs 14 cr. in FY21)

o Loans and advances given to others 14.53 cr. (vs 4.78 cr. in FY20) -

Non-current loans given

o Inter-Corporate Loans 2.3 cr. (vs 2.3 cr. in FY21)

o Loans given to others 24.54 cr. (vs 22.79 cr. in FY21)

Disclosure: Invested (position size here, bought shares in last-30 days)

Promoter holding increase seems to be transfer of shares between one gentleman and promoter (Not sure) as the said person has exited and approx equal proportion of promoter holding has increased.

Company is giving out many plans but the scale up doesn’t seem to be happening. EU and Australia approvals are not resulting in good scale up of business. Not sure whats happening.

The balance sheet seems strong. But recently margins have dropped.

Stock price has barely moved here.

Anyone has met the promoter or visited the plant?

Sorry for the digression.

Hi @ayushmit,

From a corporate governance standpoint, I think you would agree that these transactions (images below) create doubt in the mind of an investor as to its legitimacy.

My question is more on:

- How much do you weigh them in your investment process (Do you discard a company right away) or

- Do you still continue the research and even invest in such situations ?

Just trying to understand, is this an absolute deal breaker according to you ? Also, how do you see companies purchasing inputs or selling most of their products from/to related parties ? Again a deal breaker or you continue further.

If these are not your deal breaker, can you please share your major red flags beyond which you move on to the next company ?

Thanks in advance!

Hi All,

A couple of questions from my side:

- In the FY2022 Annual report Pg 139, Ishwarlal A. Patel is shown as part of the promotor group while at the same time is an Independent director of the company. How is he independent?

- In a board of 11 directors, only 4 are shown as independent (1 of which is Ishwarlal). As far as I know there should be equal of independent and non-independent directors, right?

@ayushmit and more experienced members of the forum, please help us here if you have ever come across such scenarios.

Regards,

Ashutosh

Disclosure : Not invested

Hi,

I’m ok and flexible with these things in small caps if the valuations are very attractive and from number perspective I can get a feeling that nos are good and true. For eg in the case of Lincoln, there has been material repayment of debt and now they are having surplus cash. All this is possible only if the business is there and it generates free cash flow. I don’t think that a pharma co is available at such low valuations (and the reason is corp governance and lack of aggression). But things do change and at certain point good advisors come and companies transform too.

Cheers,

Ayush

Thank you so much Ayush for sharing your wisdom! It helps refine my thinking on these items.

Any views on recent promoter buying

This seems to be some case of transfer of shares from some promoter entities listed as public to the main promoters. I am not sure about this.

The numbers don’t completely add up.

However, what can be pondered is that why would the promoter take up all this stake on him? Who is funding this purchases? No shares pledged.

IMO, this seems to have a positive spin given the balance sheet and credit rating is indeed strong. Waiting for them to scale up and grow and have meaningful exports (As being commented consistently over the last couple of quarters w.r.t entry in Australia and European markets)

Agreed. Just wanted to understand is this some kind of inflection point for company