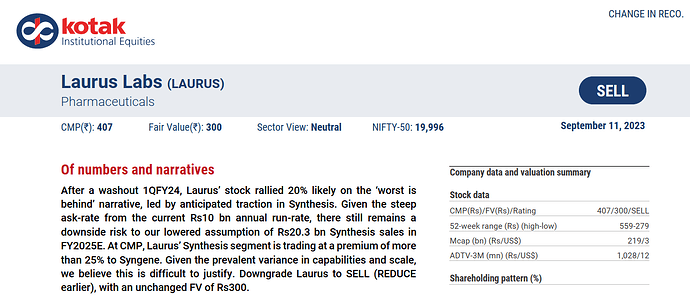

Laurus Labs Q1 concall highlights -

Financial outcomes (YoY)-

Sales - 1182 vs 1539 cr (-23 pc)

EBITDA - 168 vs 454 cr (-63 pc)

Margins @ 14.2 vs 29.5 pc - due operating de-leverage

Net Profit - 25 vs 250 cr (-90 pc)

Gross margins at 50.6 pc, down 700 bps YoY, up 90 bps QoQ

Segment wise sales -

FDFs - 285 vs 349 cr

APIs - 597 vs 583 cr

CDMO - 250 vs 577 cr

Bio - 50 vs 30 cr

FDF demand firming up, expected to go up in near term

API sales are up 2 pc but down 16 pc QoQ. Expect to rebound from Q2 due CMO opportunities in Non ARV molecules

CDMO had a large base in Q1 FY23. Otherwise, business is tracking well

Signed first agrochem multi yr manufacturing contract in Q1 - commercial supplies in H2 FY 25

Dedicated animal health manufacturing to go commercial in Oct 23

Bio business growth continues due CDMO orders

API sales breakup -

ARVs - 68 vs 65 pc

Onco - 9 vs 11 pc

Other APIs - 23 vs 24 pc

Basically, Non ARV APIs had a soft Qtr

CDMO - 60 active projects ( Ph- I,II & III ). Commercial supplies for 10 projects ( 4 APIs, rest intermediates )

FY23 sale contribution of ARV API+Formulations at 37 pc vs 73 pc in FY 18

Infused Rs 80 cr into Immunoact. Laurus now holds 34 pc stake. Fast tracking Ph-II,III trials for scalable manufacturing of CAR-T cells treatment

Company believes its API and FDF business will return to normal levels from Q2

Steep fall in Onco API sales in Q1 due execution of a large order in Q4 LY

Demand for Cardio, Diabetic APIs should pick up going fwd

Formulations revenue breakup- 188 cr ARVs, 97 cr non ARVs

Expect ARV FDF sales to peak out at around 1200 cr/ yr. All the incremental sales to come from non ARV FDF. Expect good orders from Europe and strong approvals from US

FY 25 growth to be led by animal health, crop protection contracts and ramp up of large volume generic APIs

The agro chemicals product to be supplied by the company is under patent protection

Confident that Onco API sales will bounce back from Q2 based on orders at hand

For Q2, ARV FDF order book is also strong

Positive impact of RM softening to be avlb to company from Q2 onwards

Hence Q2 margins should be much better

The agrochem CDMO contract is medium vol, complex chemistry contract hence the margins should be good

Expect to hit FY 23’s topline in FY 24 as well. FY 25 to be the growth year when full effects of animal health CDMO will also kick in

Company continues to be extreemly bullish on human CDMO business

Don’t expect any significant price erosion in ARV business this year. Also expect volumes to go up this yr. LY, price erosion was steep

Disc: hold a tracking position

If someone, somehow … figure out the amounts involved in the multi year animal health and crop protection CDMO projects, that would be a great great advantage. Even ballpark figures would be helpful