Hello all forum members

This is my first stock coverage post on the forum, please bear with my mistakes.

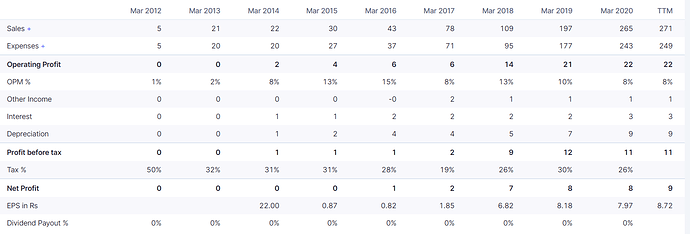

Financial profile

Current market cap: 60 Cr

Debt: 23 Cr

Investment in liquid funds + cash: 14 Cr

PAT (TTM): 9 Cr

EV per share: ~8

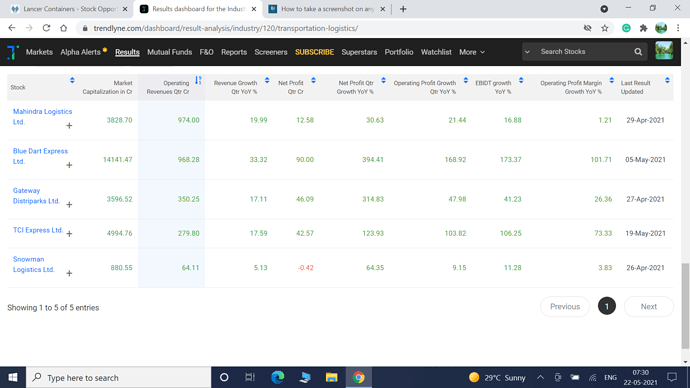

Lancer is a small NVOCC (non vessel operating common carrier). In the shipping value chain, below are the stakeholders:

- Exporter / importer - who are actually selling / buying goods

- Freight forwards - like DHL which act as agents for exporters / importers and help them manage the freight movement

- Custom handling agents - for processing custom related documents

- Shipping lines - which actually own the vessels that move the goods

- NVOCC - which don’t own ships, but own / lease containers that go on the ship and optimise inventory on ships

Putting it very simply, NVOCCs aggregate demand from exporters and package it efficiently onto carriers. Since they only own the containers, it is an asset light model.

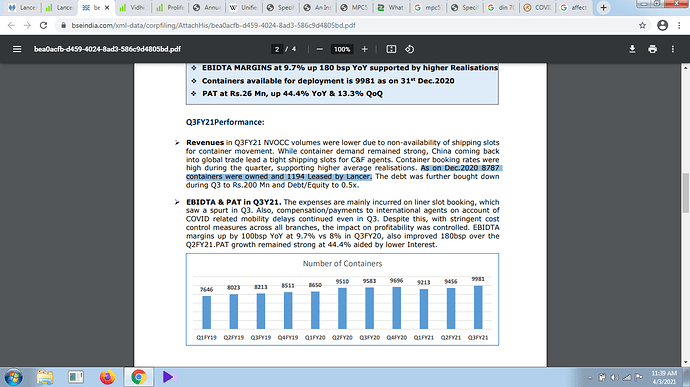

Growth in the business has been driven by increasing the number of containers. In one of the interviews (Growing Volumes - BusinessToday), the CEO mentioned that they are targeting 25% CAGR. Company owns and operates around 9000-10000 containers. In comparison, India exports 7-8 million containers.

Promoter and management team seems to have reasonable amount of experience in the shipping industry.

Pros:

- Strong growth exhibited historically, which has also withstood the times of Covid

- Efficient cash conversion - seems the company has a negative working capital cycle, so CFO has been healthy

- Company has been expanding its portfolio - have international operations as well as expanded beyond container based freight into liquid / break bulk as well. Company also leased a 20,000 square metre parcel of land which is used as a yard for empty containers

Cons:

- Company is young - was founded in 2011

- No dividend has been paid, although acceptable considering company’s growth delivery

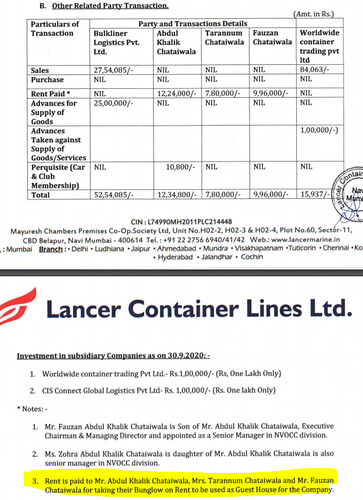

- Related party transactions with promoter family where they are leasing their bungalow as a guest house to the company and are charging as rental expenses

4. Promoter is drawing a salary of 90 lakhs on a PAT of 8 Cr. In addition, his son (22-24 years age), daughter (younger than son) and wife are also drawing some salary. As per FY20 annual report, promoter intends to increase salary to INR 5 Cr if profits increase.

5. Thin margins in the business - so growth has to be driven via volumes.

6. On going litigation case (although the promoter is the complainant here)

7. Stock is highly illiquid. Volumes of just a few 1000 every day.

Request if other members can post their views - especially around related party transactions.

Disc: on watchlist, no investments made into the stock yet