Lancer is considering bonus and also rasing funds via FCCBs

64cb1d6e-890f-49bb-a886-766fcd018453.pdf (637.7 KB)

The company has come out with investor presentation.

Lancer- Oct2021.pdf (2.8 MB)

The management is guiding, quote,

“The management expects the revenue to grow at 80% for the year FY22, mainly on the account of robust exports and elevated freight rates. EBIDTA margin will improve to 10-12% due to increase in the advance slot booking with the vessel operators which

gives cost benefits to Lancer.”

On this guide, we can expect a topline of Rs. 540 crores, with EBIDTA of around 60 crores. With a depreciation of 11 Cr. and Interest of 5 crores, net profit maybe around 30 crores in FY22, a jump of more than 200% over 2021.

Positives:

- 80% Revenue growth and Margin Expansion(Primarily dependent on Port Operator)

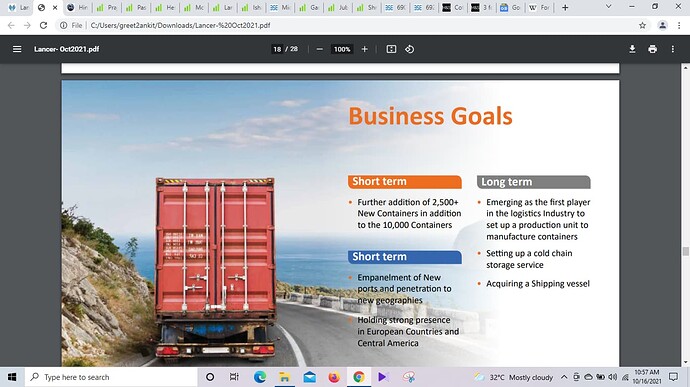

- Container addition of 2500+ in Short term(No Timeline mentioned)

- New purchase can be managed with Cash on Hand and a bit of Debt since they are very Cash efficient(No Moratorium Taken)

Negatives:

Points Mentioned in Long Term Side seems negative to me(Barring Cold Chain Service)

Rationale

- Vessel Operating is not every one’s game very cyclical and it’s like owning a Elephant which can only be productive in very limited times(Like the current one)

- Container Manufacturing, I have to research this area

- Cold Chain storage area looks promising since Gov is pushing this

Stock Price Calculation:

Before Split based on Sales of 400 Cr and EBITDA Margin of 10% and Considered Mcap/Sales factor of ‘2’ and arrived at Share Price valuation of ‘600’ INR.

If we consider 540 cr Sales and not Sure if contribution of incoming 2500+ container shall be considered or Not for Time being let us ignore that.

at current Market price Mcap is ‘429’ Cr with 540 Cr Sales and Mcap/Sales factor of 1.5 , MCAP shall become 810 Cr so there is valuation Gap of 810 - 429 = 381 Cr

After Split 270 is the Target which i will be looking at and in Future we come to know about dates of 2500 Container again a 25% can be further added in Target 270+65 = 335 INR

Shared My calculation based on My Broad Understanding.

Reserve the right to be wrong

Invested since Price of ‘97’

This is some seriously bullish guidance. Shipping sector started doing well few quarters back and these guys were reporting margins all over the place. Last 2 quarters showed big jump in revenues at the expense of margins. Q1 had almost a 100% revenue growth on a low base, but operating profit was flat. After this sharp run up in shipping sector/dry index, they are talking about advance slot booking. Now if the prices drop, where will they sit on the margins front?

How can we value a business like this on a Price to sales multiple? Isnt this method suited for secular businesses with stable margins? It is already trading at a MCAP

The 3 items are all very different from the current operations. We need to watch out for how they handle this. If a management takes a calibrated approach to expansion into new areas, then its acceptable. However, these items can have large investment requirements. A shipping vessel will be a big expense. Even cold chain is a highly capital intensive business. We can see that an already established player with a decent scale like Snowman is finding it difficult to grow its revenues. This is just one data point, and there may be others who might be doing good.

Video about Container Manufacturing

Going by data of ‘CMIC’ Container manufacturing is low Margin Business.

As you rightly said Although Revenue growth was there Profit was Flat , One thing is clear it’s not only demand that caused Profitability there are other factors too to consider. If check their Sales CAGR we can easily see sales has been since 2012 and as per screener 5 year Sales CAGR is 47% So Company was growing even without industry triggers. If Management has given 80% growth guidance i don’t know if they were conservative or aggressive one thing is sure they will continue to grow in near term.

I agree on this point and will revisit my Targets.

I used to hold Snowman back in days idea was to bank on synergy between parent GDL and Snowman but seems like Cold chain logistics is tough nut to crack. While for Lancer i would expect them to focus more on Cold Chain Warehouses required at Mandal/District level and that will make a stable source of revenue while no doubt it will need Cash as well.

Overall My assessment , Company is going to make Cash in near to Medium Term and They are either eying or vying for growth. But where they are trying to venture are murkier waters and could easily become cash burning Machine.

Together we learn ,Together we earn

Management had commented about the rise in sales in some business update or quarterly results. It is due to the global container shortage - they increased their prices (almost doubled) but at the same time liner charges increased which kept the bottomline to where it was before. This is also mentioned in the AR’21.

I completely agree with you on this. Existing large players can be looked at to see why owning a vessel is not a great business. However this is not a big con as it is a ‘long term’ goal and I believe the management is well aware of this.

One of the greatest thing I love about this company is the rate at which it has grown since 2011, the management knows the stuff they are doing.

Do you know if they are going to be leased or not?

In Q1 the management said that they are going for asset light model and I liked the idea. I couldn’t find details about the 2500+ new containers they are aiming to add.

Lot of random mauritius companies buying shares from promoters.

Promoter, his wife and son have sold recently in multiple open market deals. They are open market technically but execution looks like pre-planned negotiated deal.

When I search these companies online they look like shell companies with no details available online.

Is it a red flag or standard practice to shift ownership to mauritius to save tax in future?

Khambatta Securities published a detailed investment report on the Company. Here is a link for the same -

Disc. - Invested

Q4FY22 results -

- Lancer has added ~2,600 containers in FY22, taking total tally to 11,000+.

- Mgt. expects freight rates to stay at elevated levels for the next 12-18 months also.

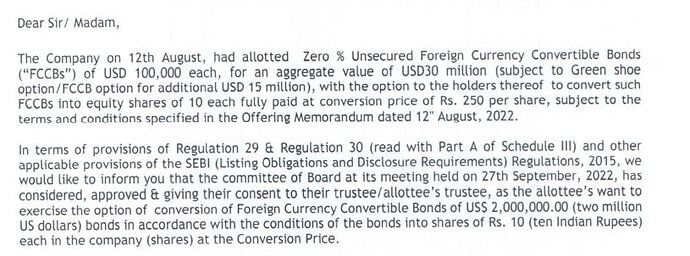

- Lancer is presently in process of issuing unsecured FCCB upto USD 50 million. Bonds are proposed to be listed on Luxembourg stock exchange. All or majority of this sum will be utilised for investment in 100% overseas subsidiary ‘Lancia UAE’ for expansion of overseas business.

- cash and equivalents has increased significantly to 45+ crs.

Management guidance for FY23

- Aim to add ~3,000 more in FY23 (earlier they had mentioned plan to double the capacity to ~20,000 TEUs by end of Q2FY23, but I guess they are not going ahead with this plan)

- Expects the revenue to grow by 30% - 40%, mainly on the account of increase in geographic footprint, sustained high freight rates, new TEUs addition, addition of new customers and aggressive sales strategy.

- EBITDA margin will improve further by 50 to 60 bps.

Any updates on their long-term goals of acquiring a vessel/setting cold chain storage service/manufacturing

containers?

Disc. - Invested

I think they said confcall every six months , if it happens, we will ask this and can get more clarity on cold storage and manufacturing of containers

Good to see the remuneration reducing to decent levels despite record numbers by the company. FY22 remuneration - Abdul Khalik (MD): 45 lakhs/annum, Tarannum Chataiwala (wife of MD): 7.5 lakhs/annum, Fauzan (son of MD): 9 lakhs/annum and Zohra (daughter of MD): 4.5 lakhs/annum.

https://www.bseindia.com/xml-data/corpfiling/AttachLive/397a0fcc-a761-46c3-9ed2-3512722d456a.pdf

Disc. - Invested

they are still drawing rent but against the current net profit its very negligible now.

Promoters however have reduced their stake by ~3 percent.

Some really good discussion on this thread.

I was studying Lancer and found some Red Flags.

First, within a period of 04/19 to 02/20 half of their management resigned. Though this could be obvious due to career opportunities, but I find it strange that they even let go of Manesh(who at one point earned more than the founder and promoter).

This was after the MD’s son resigned as director 6 months after being reappointed. I don’t even want to comment about the son’s qualification to be running such an operation and earning a salary more than the CEO?

Second, the spend on vehicles is absolutely astonishing. A 2016 report details out 47 lakh expenses on Mercedes. Ofcourse not much, but it’s a recurring expense and now just detailed out as vehicles. I wonder if its their retention strategy.

I know there is a great potential as the opportunity size for next 2 years is phenomenal. But I am worried about the board structure and family members qualification in execution of the business.

Any anti pointers against these observations are gladly welcome. Cheers.

There has been massive selling by the promoter & chairman - Mr Abdul Chataiwala.

His holding has dropped from 58% to 44% in one year.

On the other hand FII holdings have reached 13.6% from 0% last year.

No MF holding yet in Lancer.

Just a few observation about shareholding pattern. I don’t usually draw any conclusions from pattern change. But these are massive changes and a drop in promoter holding can be indicative of expected poor performance.

Disc: Invested.

Can someone knowledgeable please explain how this FCCB conversion might affect the retail investors?

Any potential relation between promoter selling and this?

Thanks

Disc: ~6% of portfolio

Net impact is that 0.96Cr of new shares will be issued to the bondholders. The o/s shares will increase from 3.01Cr to 3.97Cr and each investor’s share of profits/EPS will decline by 32%. So if you were projecting an EPS of 15/share this year, it would get reduced to 10.2/share. This is a substantial dilution in my view.

PS: Haven’t studied the company, don’t know anything about the industry, just reacting to your query.

Small correction:

At the moment 2M$ bond are being converted to shares @ 250rs.

= 652000 shares. (1 USD = 81.5 Rs)

= 0.065 cr shares

~0.96cr shares would be when the all FCCBs worth 30M$ would get converted. Which can eventually happen but hasn’t yet.

Wondering the same. Although I see no economical benefit to the promoter for selling. Mr Abdul has been selling his stake since last year at prices < 250 rs as well. Selling the shares just to buy FCCB and then getting it converted back to equity for what?

Disc: invested