Hi @nitin_verma any update on how is KSE or cattle feed business faring currently including price trend of cattle feed? Thanks

I am invested in Godrej Agrovet. While checking SHP I noticed that Godrej group has increased stake in KSE Ltd.

Godrej Agrovet 2.83%

Godrej Industries 2.05%

Nadir Godrej 1.37%

Not sure if they are slowly trying to take stake like how they did in case of Astec life. Just sharing an observation.

D: Not invested, Just tracking.

In Q1-FY24, cattle feed segment has turned profitable. As the company doesn’t do any concalls, we could get some insights from Godrej Agrovet concall.

Few excerpts from concall:

Godrej Agrovet talking about increasing stake in KSE Ltd

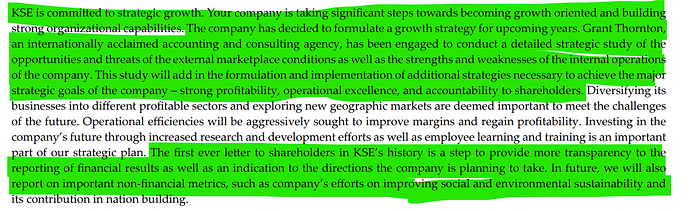

Some excerpts from 2023 Annual report - 2023 - https://www.bseindia.com/xml-data/corpfiling/AttachLive/88e75776-48ce-41ee-abbd-a28393521d8f.pdf

MD interview (bit outdated - 2022)

Disc: Invested

I do not understand what they can really do (in short term) to reduce volatility in the stock price? Agri input prices do fluctuate wild time to time, also govt as competitor and controller of milk price (+ may be feed price also), will continue to swing company’ bottom line.

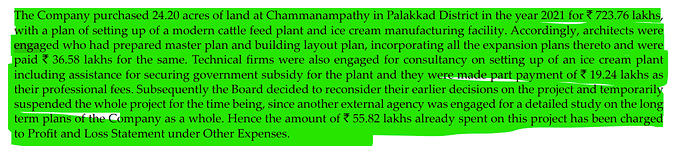

Developing alternate non seasonal business (Ice Cream?) and where price can be passed easily is the only way. But that will take some time and money.

Disclosure: Currently a minor investment, will increase on dip.

Good data here, thanks! Seems like a good mean reversion play, with capex decision (hope they go ahead with it) being the key long term growth trigger.

Feed : Key ingredient is Copra along with other grains , this is the key variable that determines the margins. High Coconut oil price is the indicator, if oil price is high they can earn better margins.

Ice Cream : I think they are on the right track, I have checked their google reviews, for every review there is one standard response, a dedicated social media team to monitor these channels will help

Milk + Mil Products : Zero profit , Zero margin business. I am wondering how come other players (state players like KMF/ Nandini, Milma etcc… ) making good money ?

They appear to be serious by hiring a consulting firm to look into the bueinss but unless they conduct calls it is really hard to know what is going on inside.

I have asked around people based in Kerala, they said in feeds they are number one. Very strong brand recall.

Risks :

There are government players in the feed , who get substantial discounts so they sell the feed cheap

Same with Milk

Godrej Agrovet is into all the product categories Feeds, Milk Products including Ice creams (Creamline acquisition )

Promoters + One retial share holder has in total 51% stake , very illiquid stock hard to find decent quantitity to buy.

Discl : Tracking Postion

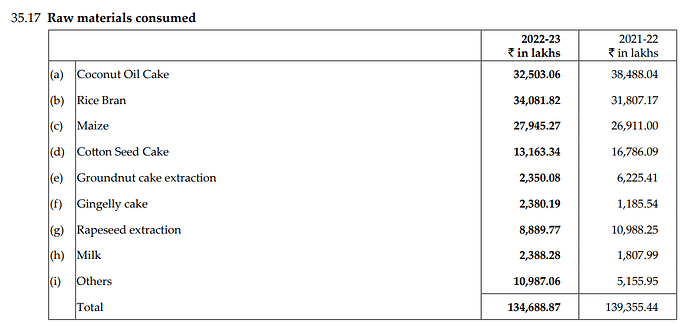

I think Rice Bran and Maize are also major raw materials used in animal feed segment. You can refer 2023 Annaul report.

As per my knowledge, rice bran , maize are at elevated levels. They have softended a bit but stalilized at higher levels.As the monsoon is below average in south India and excess in North need to see how prices move going farward.

Also India has banned export of rice bran to control the infaltion of animal feed. This is helping manufacturers a bit. Coconut prices are inching up slowly (I feel this also will have an impact on copra in coming days).

Copra prices have it rock bottom in South India. Selling way less than the MSP price. Farmers did protest in few places of Karnataka recently against the price collapse (you can Google for more info).

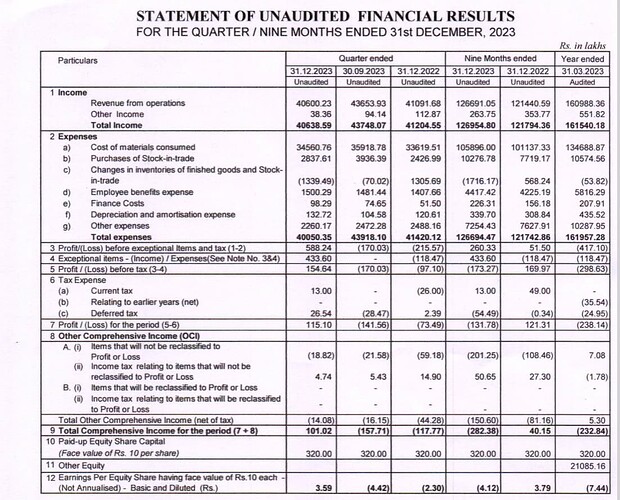

Weak set of numbers - Q2FY24

https://www.bseindia.com/xml-data/corpfiling/AttachLive/9ce9e3b1-38b8-45cf-9d0b-12a447e6a9bc.pdf

Is there any update or insights on their initiative of evluating their current business by Grant Thornton ?

Nothing disclosed in public till now.

I got an email from the company which gave more information about this (see below).

Chairman’s Letter

I’m delighted to announce the 3rd quarter results, showcasing a growth of 4.3%. Our objective at KSE is to deliver value to investors. As previously mentioned in the annual report, M/s Grant Thornton(GT) was engaged to provide strategic recommendations by conducting a detailed market analysis and evaluation of the company’s internal strengths and weaknesses. The growth strategy proposed by GT comprises of segment level, functional level and corporate level recommendations which are poised to enhance our growth and presence in the market. These interventions are pivotal in emphasizing our progress and the steps taken to ensure sustained growth.

We are now going to examine the recommendations provided by GT for implementation. Following are the key highlights of the growth plan proposed by GT.

· Market expansion to new geographies, introduction of innovative products and diversification of product offering across Animal Feed, Ice Cream and Dairy segments.

· Strategic restructuring of the organisation structure to elevate decision-making processes with new positions comprising of a full-time professional CEO for Animal Feed & Oil Processing and a full-time professional CEO for FMCG products which include Dairy and Ice cream segments.

· Enhancement of cost accounting measures to clearly understand performance of all the four business units – Animal Feed, Oil Processing, Dairy and Ice cream

· In the Animal Feed segment, to achieve enhanced growth in the next financial year, phased market expansion and penetration in other states with emphasis on cost optimization through dynamic procurement and strategic pricing adjustments.

· In the Dairy & Ice cream segments, strategic pricing of portfolios, strategic positioning of the brand, team enhancement with specialized expertise and new products.

· Strengthening branding for “Vesta” as an FMCG brand of KSE to enhance its market presence and brand recall through strategic marketing initiatives.

· To enhance functional performance, initiatives are planned across five areas of People Excellence, Digital Transformation, Financial Excellence, robust Governance & Compliance, and Environmental Stewardship.

· As technology is poised to assume a central role, as part of digital transformation initiatives, the ERP systems would be strengthened and a tech-driven performance culture would be implemented.

· To instil a performance-driven culture, enhanced incentive pay structures would be implemented for marketing team across segments to drive the growth strategy goals.

Under the renewed vision, the suggested growth strategy is poised to fortify KSE’s position and pave the way for continued success in the evolving market landscape. These strategic initiatives signify our dedication to operational refinement, performance enhancement, and sustained growth. Looking ahead, we anticipate a steady growth in the upcoming fiscal year, further enhancing our top-line performance.

I thank you and solicit your continued support as we navigate these dynamic markets and pursue our growth aspirations. I will come back to you all again after examining the recommendations put forth by GT.

Disclosure: Invested (position size here, no transactions in last-30 days)

KSE sell Ice -creams

Here is the email sent to share holders

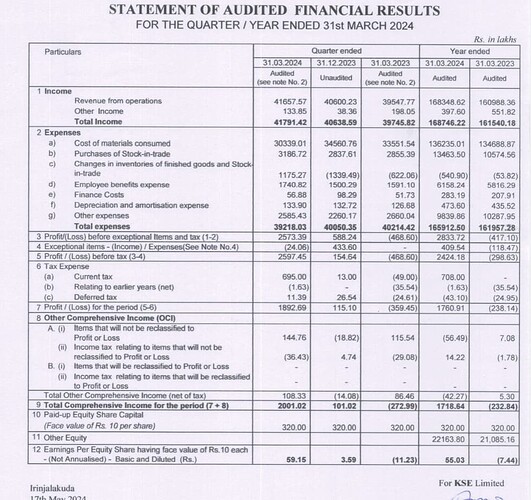

I’m delighted to announce the 4th quarter results with a profit of Rs.25.97 crores, showcasing a growth of 4.5% with a revenue of Rs.1687.46 Crores and profit before tax of Rs.24.24 crores for the financial year 2023-24. The company is into its 60th year of operation and our steadfast growth at KSE continues to deliver value to investors. Our core segment Cattle Feed delivered a profit of Rs.40.43 crores for the year ended 31st March 2024. Following the strategic recommendations provided by Grant Thornton by conducting a detailed market analysis, and evaluating the company’s internal strengths and weaknesses, the company is planning significant strategic growth. The recommended strategy comprises of segment, functional and corporate level recommendations which are poised to enhance our growth and presence in the market. These interventions are pivotal in cementing our progress and the steps taken to ensure sustained growth.

Following are the key highlights of the 3-year growth plan which your company has started implementing.

· By embarking on market expansion to new geographies, introduction of innovative products, and diversification of product offerings across animal feed, ice cream and dairy segments, the company has already increased its market base in southern part of India on cattle feed and in three years your company will make its footprints in northern India as well.

· Though the oil cake processing division was into negative margins during FY 2023-24 due to material prices inflation and downward trend in selling price, your company put in various measures to keep the prices under control and the year 2024-25 started with an increase in selling price of our refined oil. Your company foresees the oil cake division delivering good results in the coming year.

· In ice cream segment, our brand ‘Vesta’ is becoming popular in Kerala region resulting in increased market share and growth. This will continue in the coming year as well. Strengthening brand image for ‘Vesta’ as an FMCG product of KSE to enhance its market presence and brand recall through strategic marketing initiatives is on the anvil.

· Dynamic approach towards cost accounting bringing out clearly performance of all the four business units – Animal Feed, Oil Processing, Dairy and Ice Cream

· In the animal feed segment, to achieve enhanced growth in the next financial year, phased market expansion and penetration in other states with emphasis

· optimisation through dynamic procurement and strategic pricing adjustments is planned.

· In the dairy & ice cream segments, strategic pricing of the SKU portfolio, positioning of the brand, team enhancement with enhanced expertise and new product variants are planned.

· Based on the recommendations by GT on functional performance, initiatives are in place to implement the same across five areas of people excellence, digital transformation, financial planning, robust governance & compliance, and environmental stewardship.

· As part of digital transformation initiatives proposed, the ERP systems would be strengthened, and a tech-driven performance culture would be implemented.

· To instil a performance-driven culture, enhanced incentive pay structures would be implemented for marketing teams across segments to drive the growth strategy goals.

Your company under the renewed leadership and vision has started to witness positive signs and the outcome is evident from our last quarter performance; further, the suggested growth strategy is poised to fortify KSE’s position and pave the way for continued success in the evolving market landscape. These strategic initiatives signify our dedication to operational refinement, performance enhancement, and sustained growth. All strategic decisions will be result oriented and futuristic; we anticipate a steady growth in the upcoming fiscal year, further enhancing our top-line performance.

As your company steps into its 60th year of operation, a special mention of appreciation to all share holders, customers, suppliers, employees and business partners who associated and cooperated in our march towards professional excellence. We solicit your enhanced and continued support in all our ambitious, future endeavours.

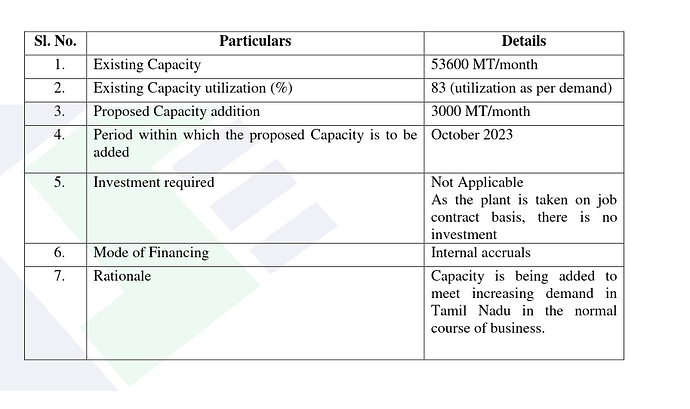

The company operates in 3 segments and all the three segments are very cyclical. The animal feed segment do swing from negative margins to as high as 8 %. The major raw material for the Animal feed segment seems to Rice bran, maize, sorghum, soya meal etc. Most of these grains are seeing softening in their prices. Maize prices seems to be pretty hard to predict. Q3 margins for the sector should be better with Khariff crop harvest. Expansion into Tamil Nadu and growth in poultry feed may aid the company further.

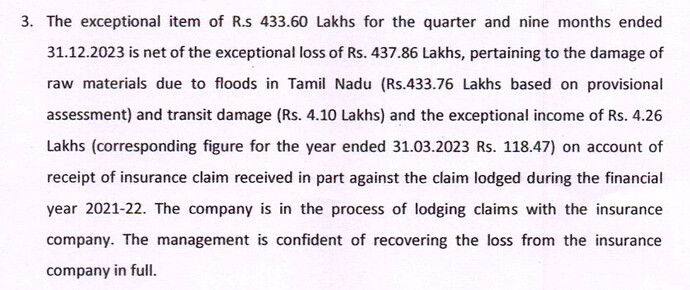

Oil cake sector seems to be even more cyclical with margins going into negative quite often. But, company needs to run this segment as oil cake is needed for the animal feed segment. They have to process around 1,25,000 tons of copra cake, to meet requirements for deoiled copra cake, which is one of the major ingredients in feed The company seems to be depending on import of copra for most of its needs. A major factor affecting the margins of this segment is coconunt oil prices. In March, 2021 the coconut oil price was around Rs. 1.90 lakhs per ton which came down to the level of Rs. 1.15 lakhs per ton in

March, 2023 and the company has witnessed lowest selling price of Rs.1.03 lakhs. Coconut oil prices seems to have rebounded recently which should aid company’s margins in this segment. Copra prices may also have increased. Declining freight costs may also aid company’s margins. Company could also get some inventory gains in coconut oil.

The company has never been able to increase the sales in milk segment for a very long time. I dont think they will be able to increase the milk sales. This market is dominated by cooperative sector players in the south like milma, malanad and aavin. Its good to see that they are focusing on ice creams now. Kerala is one of the fastest-growing carry-home-pack market of ice creams.

It would be interesting to see how they scale up this segment. This segment could be one where cyclical swings may be much lower. The losses in this segment has been continuously trending downwards. It would be wonderful if they can use the cash flows from animal feed segment to build the ice cream business. Bulk of the ice cream segment in Kerala seems to be dominated by local brands which could make it possible for vesta to penetrate this market. The company is adding new dealers in this segment and also providing freezer subsidies to dealers as per AR.

All together company seems to be in a sweet spot cyclically.

Discl: Have investments and is biased