This is part of long tussle existing between RBI and kotak bank.Both tries to tighten each other.In past also kotak has challenged the authority of RBI and it seems RBI will tighten its grip even with slightest deviation from existing procedure which kotak has to follow.

In my view more important is to look for kotak quarterly results along with succession plan which will set the further course of direction

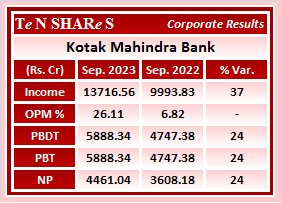

3QFY23-24 Results

Presentation

https://www.bseindia.com/xml-data/corpfiling/AttachLive/df34e601-1ddd-4af9-8b43-4e2cdfbeb385.pdf

Conference Call

Financial

https://www.bseindia.com/xml-data/corpfiling/AttachLive/be1afdcb-bbde-4868-8d56-552716d871a2.pdf

Finally Kotak gets a new boss, CEO appointed for 3 years.

BVPS q2fy23/24 = 519/605 gwt=16.6%

Price/book (21/Oct/23) = 2.9x

Advances q2fy23/24 = 2,94,023/3.48,284 gwt=18%

GNPA = 1.72%

NNPA = 0.37%

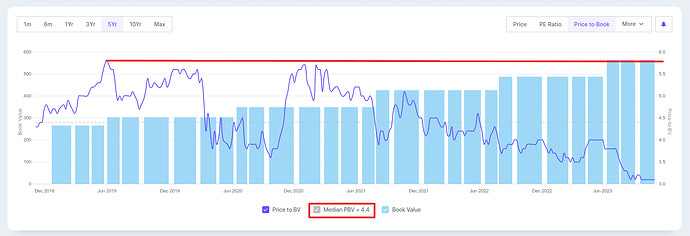

The stock is trading at multi-year low price to book value.

Disclosure - Invested.

One of the apprehension that was weighing down the stock might have been the exit of Uday Kotak. Hopefully, Mr Ashok will be able to continue the growth juggernaut, he seems capable.

While calculating BVPS of a bank like KMB where lot of value lies in the subsidiaries, it is better to check the standalone BVPS, assign a P/B multiple to it and then add the value of the subsidiaries on an sotp method.

Kotak’s standalone BVPS should be ~420 and assigning a high 3x book value, it gives us 1260 per share. So, one has to justify paying ~500 per share or 1 lakh crore valuation after a certain holdco discount on the subsidiaries (securities, prime, amc and life insurance)

A very pertinent question is how does one assign a multiple to bank like Kotak? The bank is growing it’s book value per share at the rate of 15% yoy every quarter without fail. Also, the bank has been able to keep NNPA close to zero with advances growing at 15-20% yoy every quarter.

With Indian economy projected to grow at 6% for next decade this bank is well poised for a healthy long-term growth.

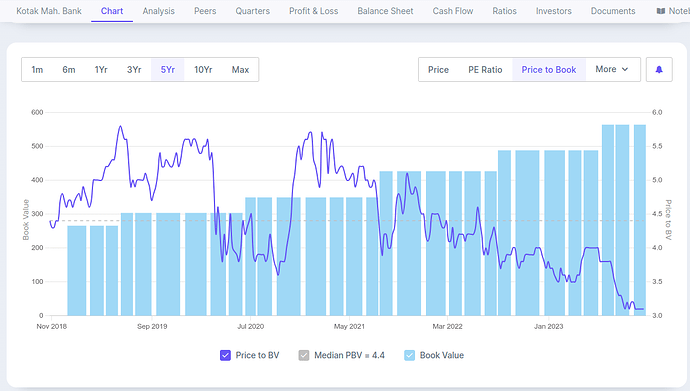

If history is any judge here are the historical multiples for the bank

Price/Book

21/oct/23 = 1769/605 = 2.9x

22/jul/23 = 1971/584 = 3.4x

21/jan/23 = 1760/540 = 3.25x

22/oct/22 = (1800/519) = 3.5x

27/apr/17 = 4.3x (900/209)

30/apr/18 = 4.5x (1222/264)

19/jul/18 = 5.1x (1400/272)

01/may/19 = 4.3x (1300/305)

22/jul/19 = 4.6x (1450/313)

Also look at the historical price to book value from the screener, median price to book is 4.4. So again the same question what price to book multiple will you assign to Kotak bank??

I think sometimes Mr. Market gives us Gold at the price of Copper and this is one of the case. Of course no one can time the market so we don’t know how long we have to hold to get some returns.

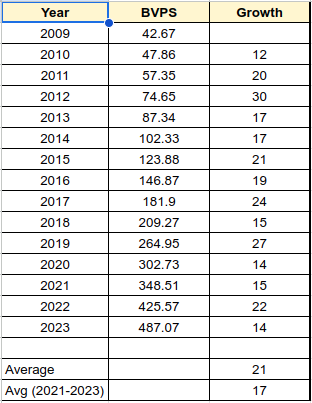

The only unsolved question from my end is, has the price to book value growth of Kotak bank slowed down, was it growing at 20% on an average between 2010 and 2020? I don’t have data for this.

Disclosure - Invested and biased.

I tell myself that the historical valuations are indeed…historical. Based on the current position of competing private banks which are all in very good shape, growing very well, well managed now and corp governance issues non existing (I hope), Kotak and HDFC bank may not enjoy the historical valuations going forward. So I expect that 3x may be the valuation going forward…which means from here, the stock price may move along with improvement in the book value, and no rerating in P/B multiple.

Arey sir, forget about the 3x book value which I just assumed for calculation purpose to arrive at some price for sotp. You are again taking the “consolidated book value” of 605 for calculation, which means you are valuing the bank AND life insurance, securities, amc etc at book value as well.

Rather than doing that, it is better if we check the “standalone book value” of Kotak and then value the subsidiaries separately using other valuation metrics which were more relevant to the type of business. For example - PE for amc, securities etc and embedded value/vnb multiple for insurance and so on

I have collected book value per share of Kotak Mahindra bank for last several years from Screener.in. I have prepared the table below

Except for a little slow down recently the growth seems to be intact. Growth slowdown has happened historically also for intermittent periods of time.

According to a data source Indian GDP has grown 5.13% on an average between 2009 and 2020.

Similar or a little higher growth is projected in next coming decade also. So what could be reasons for investors pessimism in the stocks?

One reason could be PSU banks taking share of private banks and thus slowing them down. Second could be technological changes hurting these banks in future.

Thanks for your time, I would happy if you could speak your mind on the forum.

Let’s think of this in terms exit multiples… Year 2028, Book Value consolidated should be Rs. 1200 @ 15% PA growth… taking an exit PB multiple of 2.5, the discounted share price in 2028 should be around Rs. 3000 and at 3 times PB, Rs. 3600. This is between 12% to 15% kind of compounding from here on… there could be some optionality in case they decide to de emerge subsidiaries or if the new CEO does some wonders.

It’s for each of us to decide individually if 12 to 15% compounding is good for us or not.

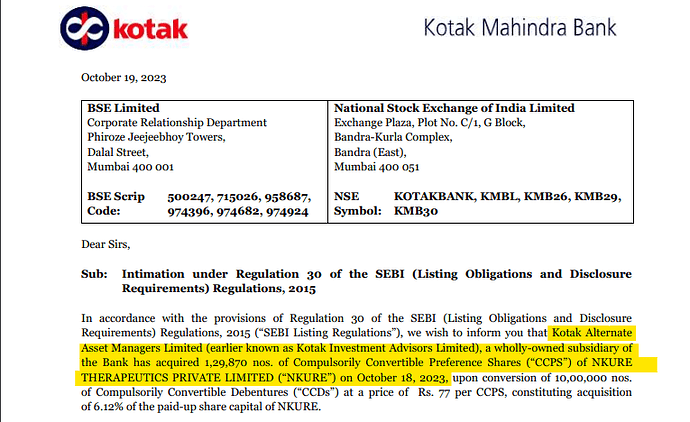

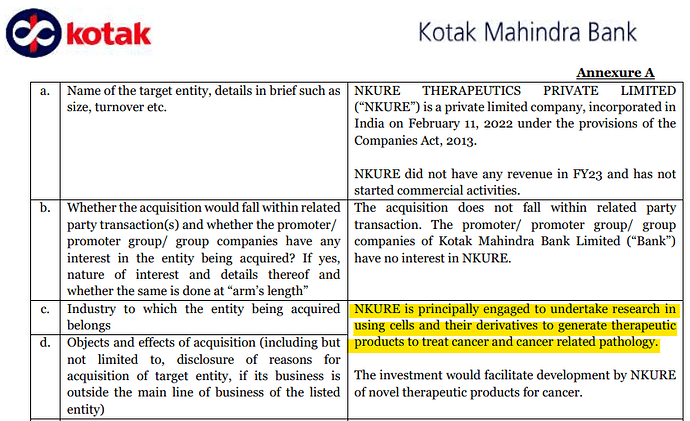

Any suggestion as to why Kotak acquired a stake in NKURE?

NKURE is basically producing therapeutic products to treat cancer.

And it has generated 0 revenue in FY23 and has not started commercial activities

First link explained kotak business intention and business verticals model and second link explained the company they take stake

I think it’s business as usual but sentiment is bad so it may create some anxiety

kotak is extremely professional and focus company (bias due to holding since IPO time)

Thanks

PPFAS started buying in Kotak mahindra bank, can there be a turnaround after very long under performance?

PPFAS entry might suggest, kotak mahindra bank entered into GARP (Growth at Reasonable price) zone on valuation front, may not gurantee the outperformance, However the whole sector is still undervalued as per my latest readings.

Valuation is a function of growth and risk free rate. Do you think it still makes sense to pay a high P/B even when interest rates are comparatively higher? Looking at the P/E or P/B in isolation imo is not a good practice.

may be true… but mean reversion is also a possibility…as rates have reached peak and possible to go down in the coming quarters.

The NIMs should also stabilize going forward with the deposit rate hikes being completed. Maybe we are looking at the fast credit growth leg of the cycle. Balance sheet is also pristine.

Profit growth with re-rating can be on the cards.

Disc - Invested

be40bd0b-f5a1-4243-99e5-6c4a3ce52f47.pdf (2.8 MB)

Earning update