Concall

Presentation

Financials

A poor show last quarter, mainly due to reduced other income affecting bottomline. Otherwise, its business as usual at the bank… growth/improvement in almost all areas. Looking forward to next quarter.

The results of the semi annual review of the FTSE Global Index is due tomorrow. A sales note indicates that if FTSE decides to include Kotak Bank with full investibility weightage then the potential inflow would be around $700 mn

Interesting interview on digital upgradation of Kotak bank

Q2FY22-23 Results

Consol highlights:

Consol PAT for Q2FY23 Rs. 3,608 cr up 21% YoY

Assets under mgt/advisory ~Rs. 3,90,526 cr up 2% YoY

ROA was 2.61% for Q2FY23

Consol Cap & Reserves crosses Rs. 1.03 trillion

Q2FY23 PAT of Major subsidiaries:

Kotak Mahindra Life Insurance: Rs. 270 cr

Kotak Securities: Rs. 224 cr

Kotak Mahindra Prime: Rs. 222 cr

Kotak Mahindra AMC & TC: Rs. 106 cr

Bank Q2FY23 highlights:

PAT at Rs. 2,581 cr up 27% YoY

NII at Rs. 5,099 cr up 27% YoY

Fees & Services at Rs. 1,760 cr up 24% YoY

NIM at 5.17%

CAR as per Basel III, as at Sept 30, 2022 was 22.6% & CET I ratio was 21.5%

Customers as at Sept 30, 2022 were 36.6 mn up 28% YoY

Deposits:

CASA ratio as at Sept 30, 2022 at 56.2%

Avg. CA for Q2FY23 Rs. 53,971 cr up 7% YoY

Avg. Fixed Rate SA for Q2FY23 Rs. 113,408 cr up 2% YoY

Avg. TD for Q2FY23 Rs. 139,871 cr up 20% YoY

Advances:

Customer Assets (Advances + Credit Substitutes) Rs. 321,324 cr up 25% YoY

Advances at Rs. 294,023 cr up 25% YoY

Asset Quality:

NNPA at 0.55%

PCR stood at 73.7%

Credit cost for Q2FY23 on advances was 26 bps (annualized) (including standard provisioning; excluding reversal Covid & restructuring)

Conference Call

Call Transcript

Presentation

Financials

The Ken had covered Kotak811 and Kotak Mahindra Bank in their story (paywalled) a few weeks ago.

Sharing summary points for reference:

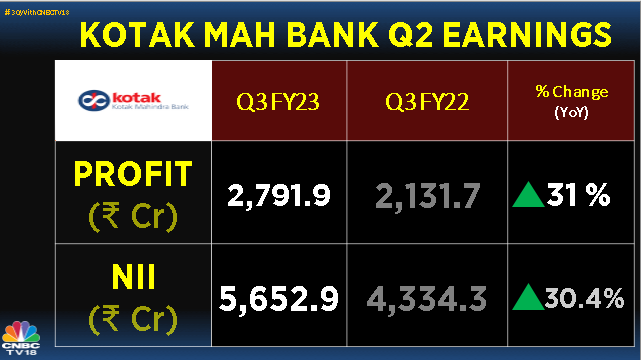

Q3FY22-23 RESULT

Concall

Call Transcript

Presentation

Financial

What is the reason the media is quoting the standalone numbers instead of consolidated ones?

The consolidated PAT increase is soberer.

YoY

3,403 → 3,995

Can someone help me build a bear case for Kotak Mahindra Bank? I see this as a stable 15% compounder going forward. My bull thesis are:

Ofcourse, there is an overhang of Uday Kotak retiring. But pretty sure he would have top quality leader taking up his space while he continues to monitor things from arm’s length.

Another overhang - Deposit’s not picking up as fast as Advances. But needs to be watched overtime.

Looking forward to a bear case here.

It seems that, Mr. Market is factoring slow growth compared to the past, as it is trading at moderate valuations now.

Apart from Uday Kotak retiring, are there any other major concerns? I believe that, current price is certainly attractively valued as compared to its past P/B multiples.

According to this document Kotak bank has fund based exposure of 129cr and non-fund based exposure of 300cr to Adani group which totals to 429cr.

I don’t think this is an exposure of any significance.

Disclosure - Invested.

Good to see that, Kotak Group has low exposure to risky businesses with very low credibility and low corporate governance.

It is becoming an important parameter while investing in Banking business, that, there exposure to risky businesses with high Debt to Equity ratio is low.

Banking is the tough business as we have seen from time to time in past 20-30 years and conservative approach is very important for long term success in banking.

The Single largest issue with Kotak in my opinion (and other respectable investors I have spoken with) is that they are OVERCAPITALISED

The High capital adequacy directly leads to lower ROE. Uday Kotak can Obviously not afford to keep low capital adequacy ratios like SBI (Guaranteed recapitalisation from GOI when needed). But it would be nice if he kept it at similar levels as HDFC-ICICI.

They own fantastic subsidiaries and we won’t see a banker like Uday, But a little focus on ROE would be needed.

It has fantastic subsidiaries, and the 3 years of sideways movement has made the valuations reasonable.

While it can continue as a great low double digit compounder, getting outsized returns seems tough.

That’s probably due to their conservative stance due to COVID. Not that the economy has opened up, they will do the necessary. Comes a recent acquisition of Sonata Finance.

Can someone highlight what would be the steady state roe for kotak bank if the capital adequecy ratio is bought down to 16% similar to hdfc-icici? How can we calculate this!!

Think of it a little differently.

Compare ROA and ROE. Roughly ROE/ROA = Leverage.

I have annualised latest Q profits and denominators are 31 Dec 2022 numbers. Numbers are standalone to remove impact of non bank subsidiaries and have a LFL comparison.

Kotak Mahindra Bank

ROA = 2.4%

ROE = 14%

Leverage = 5.8x

HDFC Bank

ROA = 2.1%

ROE = 18.3%

Leverage= 8.7x

Effectively HDFC Bank is sweating its equity capital more than Kotak and running an efficient capital structure. Both have high quality liability as well as asset franchises.

Kotak runs a fairly conservative liability side (high CASA and higher capital) and a conservative asset side as well (they reduce growth when they feel uncomfortable whereas HDFC actively finds best risk reward across segments to gun out that consistent growth)

Excess capital allows Kotak to make acquisitions, although small ones won’t make a dent. And also capitalise the other subsidiaries - although not sure how much of that has been happening.

For what is worth - SBI leverage is in the high teens given ROE is closer to HDFC Bank whereas ROA is around the 1% mark.

I don’t think Kotak (in the short - medium term) gets to HDFC Bank or ICICI or Axis levels of leverage given management philosophy is different and you’ve got a controlling promoter who’s fairly conservative.

But never say never. Maybe they make a big acquisition and start to run the business at 7-8x.

There’s routinely news about them acquiring Federal, Yes, IndusInd etc. Not sure if any of them would meet their asset quality criteria without being heavily restructured.

To conclude.

I would imagine that a ROA to P/B relationship is much stronger than a ROE to P/B one.

In that case the question is does kotak bank deserve the same kind of valuation as hdfc bank?

ultimately the eps growth and value creation will be the function of ROE

with 2.2% roa and 6x leverage kotaks roe has always been in the range of 12-14%

over last decade the eps growth has been strong given banks ability to raise equity capital cheaply @ 4-6x book value and acquisition of ing vysya value accretive on price to book level.

with valuations correcting and no possilble big acquisition in sight, kotak may not be able to compound profits @ >14%

Leverage also brings with it added risk, which depresses the PBV to an extent. Market likes a good balance between leverage and ROA levels.

As an aside (more relevant for NBFCs than banks), there are 2 ways to increase ROE. One is by increasing leverage and the other is by increasing non funded income (Fee income, co-lending income etc.). Market would value a bank/NBFC which increases ROE by the 2nd method, higher than a bank/NBFC which increases ROE by the 1st method.