Jindal Drilling is not purchasing the 51% remaining stake in the JV. It is purchasing the asset owned by the JV outright for USD 75mn (Jindal Pioneer). So Jindal Pioneer as a whole is valued at 75mn USD (INR 630 Cr). Considering that this is a rig built in 2013, a 75mn USD valuation sounds very fair (Considering new build rigs are costing 250-275mn USD).

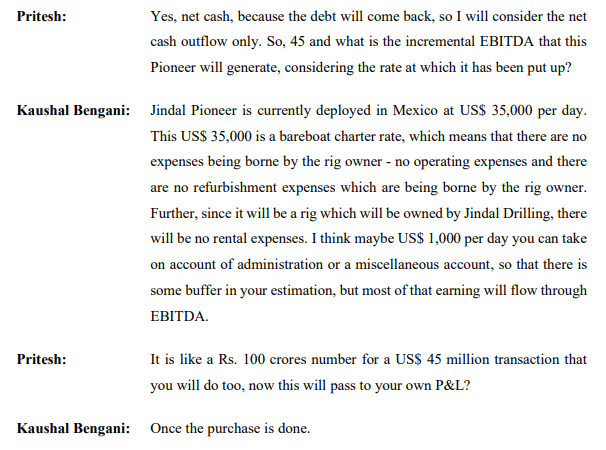

Once JV is paid this 75mn USD by Jindal Drilling, it will pay back 30mn USD loans that it owes to Jindal Drilling. So the net cash outflow for this purchase for the company will only be USD 45mn (INR 380Cr)

Also, once purchased, Jindal Pioneer will add INR 100Cr EBITDA and cash flows to Jindal Drilling’s P&L and balance sheet as per the current contract in Mexico.

Currently, since the Discovery JV is not consolidated in Jindal Drilling’s financials, the Jindal Pioneer asset does not contribute any EBITDA to Jindal Drilling. At a PAT level it contributes between 8-10Cr INR per quarter right now. Post asset purchase, this should double to 16-20Cr INR per quarter.

This purchase is financed completely by internal cash flows. For a net cash payout of INR 380 Cr, the company recovers ~INR 100 Cr cash each year from the asset’s operations. These terms for purchase seem to be as good as minority shareholders could have hoped for.