I was again checking on leading tobacco companies of world, on their charts and strategies like FMCG transformation, international markets etc. One thing strange I noticed yet to figure out that all of them, including ITC, peaked out somewhere around 2017 after multidecadal bull run. What happened across the globe for tobacco companies in 2017? Tax regime changes or acceleration, consumer slowdown etc can be but related to one country but all US, UK, India, Japan following same trajectory for no apparent global event is strange. Would be good to know thoughts of leaders here @dd1474 and others…

Also, one more aspect wanted to understand is when you compare a VST to ITC…ITC have and had so much more financial commitment to other segments but still had equal div yield like VST earlier and now with revised div policy, much more. Why? VST is a purely sin segment, as many would describe it, so why it does not feel need to increase payouts to attract or reward investors more considering that moreover it doesn’t have any financial obligations to other segments and why no investor pressure as other tobacco company has increased payouts? Thanks

Looks like ITC Infotech planning to make inroads in African markets :

Disc : Invested in Satellite portfolio.

Looks like ITC have found a new baby to invest more money into. The DNA of this organization is to invest and keep investing for future in one business or another. A clear roadmap is needed for management but who will give that roadmap to them when there is no distinct promoter…When Hotels etc were a clear no, they now found their new love in IT! Hope they have clear strategy. Look how Jio was built as supreme digital company with clear strategy of a committed Promoter, which is lacking in ITC so far…

I have a different opinion… ITC Infotech is not a new entity… it has been in existence for many years, with primary business coming from ITC itself… but if we see the history of major conglomerates and their subisidiary entities, there was significant value created at later stage by some well-managed subsidiaries… for example, Tech Mahindra for M&M (which started with just 1 client for many years), L&T Infotech for L&T (which picked up wings in the last few years with right management being at the helm) etc… if managed well and with some key wins, it can contribute meaningfully, and generally IT business is always margin accretive and asset light

Things are indeed moving in an intrsting direction @ ITC :

My two cents : Any great company, growing at a fast pace, would focus on creating JV’s & partnerships. The core thesis, for acquiring Sunrise seems to me as - Mkt leadership, rich heritage & brand legacy (for 70 yrs). This sounds more like ITC’s legacy as well.

My only problem is how do I value ITC -

As a Cig. Co (Sin Stock) with good Div. Yield. Then its a dividend stock.

OR

As a fast growing FMCG co with high growth rates.

Would like to have insights from seasoned members on valuing ITC here.

Disc : Invested in satellite portfolio.

Warren Buffet said “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” If you can follow this advise then ITC is a very good stock. FMCG is a business in the initial stages even though they are making significant inroads. In the current profits majority is coming from Cigarattes only.

However with the kind of investments made by ITC over the last few years and the direction provided by the company stating FMCG as the next growth engine. It sound very positive. Cash is not an issue with ITC, its only execution that matters, which they proved with FMCG in the previous years.

ITC do have other business, however business such as Hotels are capital intensive with very low ROCE’s so they should not have entered it in first place. But Agri business seems to be an interesting one as it adds good synergies with FMCG and has good export potential.

Also the company gives a good dividend yield of more than 5% currently, and this is supposed to grow every year as the profit increases. The dividend payout ratio mentioned by management is 80 to 85% So with a 10 year outlook, it wont be bad to say you will get 10 to 15% of your today’s investments as dividend yields every year from the 10th year.

I was recently looking at how Atria or Philip Morris was expanding their business, looking at the way they have placed the bets, ITC should take clues. But ITC have made their right bets with FMCG as its high ROCE and good growth potential.

Warren Buffet states “The stock market is designed to transfer money from the active to the patient.”

Don’t be impatient when it comes to your money…

Disclosure: - ITC is the largest holding in my concentrated portfolio of 7 stocks. Bought ITC during the recent market collapse and is now 40% of the portfolio. So my views may be biased.

Agree totally JJoy. One thing people don’t realise is how genius the move of 80 to 85 percent dividend payout is for capital protection for new investors. Older investors will never sell since the dividend they are paying is extraordinary for them. This gives a strong base. Also, let’s assume FMCG re rating happens after a decade… until then ITC can easily increase their profits by 10 to 15 percent every year subsequently increasing the dividend yield every year . Not to mention they have huge cash reserves to give special dividends/bonuses etc anytime they have a poor year. This increasing dividend yield will almost ensure the price of the share goes up 10 to 15 percent every year since there is no way the market will allow a 10 percent dividend yield from a blue chip like ITC compared to the interest rates offered in other instruments. So when you buy ITC your capital is protected, the company will never go bankrupt and you are guaranteed some returns until you wait for the FMCG re rating for huge returns which will happen at some point.

The only issue is patience and opportunity cost. With pharma/chemical stocks etc rising 50 to 100 percent ITC looks like a tortoise in comparison and hence why it’s unfashionable at this moment.

However, compounding is key. Everyone talks about it but it’s very difficult to hold a stock for 20 years+. ITC is perfect for someone looking at passive investing over being too active since it’s one of the only companies id trust for that time period and hence would be sure about the compounding effect actually happening and would save a lot of money via transaction costs/failed bets/taxes etc by chasing other stocks while paying you the equivalent of an increasing salary every year and offering a growth driver not yet priced in by the market.

ITC seems to be fairly valued now.

Sum of parts valuations using 3 broad buckets:

FMCG: Assuming 20,000 cr revenue. Giving value of 4xSales = 80,000 Cr

(Discount to Nestle and Dabur as lot of FMCG are lower value add/lower margins/not market leaders)

All other biz including tobacco: 12,000 cr profits. Giving 10PE= 120,000 Cr

(Tobacco, agri trading, paper and hotel don’t deserve any higher valuation)

Cash and investments: 35,000 Cr

Total = 235,000 Cr

This is market valuation of ITC currently.

So fairly valued currently.

Can get re-rated only if FMCG starts showing high growth and margin (unlikely in near future) of Tobacco shows good growth (50/50).

Stock can continue to be range bound if taxes continue to increase.

Downside seems to limited as dividend yield will provide floor to current price.

Wow 40% of portfolio thats some number! ITC is one of very few companies where investors can afford to do that. Indeed, patience is the key here and from my experience, the day you totally lose it and frustration levels reach the peak is the day of the turnaround for the company. So, I would be eagerly waiting when many in this forum would have given up on ITC as then the rise of ITC would begin. (hopefully no one will as they all are patient long term investors ![]() and know what they are doing)

and know what they are doing)

I have experienced this personally in Tata Consumer which frustrated me a lot until a point where I was evaluating of selling it after holding it for almost half a decade with negligible returns and thats when its transformation began - When everyone had given up on it, all investors including me. Luckily I did not sell it as I believed in Tata group.

The main issue with ITC, when I compare it to say a Tata or RIL, is that in RIL I say I trust Mr Ambani, in TATA - its the group while in ITC - All are managers. They have been doing a good job but strategy seems to keep changing. I do not know how big an FMCG they want till the point they decide to make it self sufficient. Point to note is that ITC is today also a full fledged FMCG company. If they want they can improve margins/profits and bring it close to top FMCG in matter of few years if not months…BUT do they want to do that or keep creating new brands? I do not know.

I do not know when they will stop their quest for new brands, new areas of investing. I do not know when they decide to let each business grow on their own and behave like a big brother standing up on its own feet.

I do not know the DNA of the company as it hardly seem to have one because of no distinct promoter or key man yet for the shareholders return in mind.

All i know is I like its FMCG brands as a consumer and believe in them and hence ITC is part of my core portfolio. Hoping I am not entering a value trap here, which only time will tell. As, if not for valuations and dividend yield, I would have chosen a Nestle/HUL over ITC among the big boys.

Yes indeed, my average purchase price is around Rs 155 per share and still buying. I’m certain of the future prospectus but time is the factor. Dividend yield of 6% give some comfort though. Its like an Fixed Deposit if nothing happens on the stock price.

I believe the day is already here, most of the analysts and investors are pessimistic on ITC, or else how could be a stock as ITC trade at such valuations. ITC can buy good companies or make strategic investments in great companies with the profits generated in 1 year alone. Is that not highly positive.

You are absolutely right, even i was an investor of Tata consumer, i managed to benefit 20% only in two years but my exit timing was completely wrong.

I can see a different perspective from the new CEO, he is targeting to make big in FMCG and there are very clear signs of it. It is very visible. The best part was acquiring of Sunrise Spice business. Its not the acquisition which i liked its the shift of strategy from creating own brands to use the cash at hand to buy good business and generate returns. Hopefully soon we will see more of this in the FMCG sector.

Yes NESTLE is already a part of the portfolio.

With ITC my bet is on growth and value unlocking of FMCG and Agri business supported by Cigarette business. Nevertheless, ITC is a monopoly / market leader in Cigarette business with 80% plus more market share and this cash generating machine is working in parallel which no one seems to be talking about. Intrestingly when you read the annual report and you see everything except Cigarettes.

Todays AGM event was just PR PR PR. So much marketing on what ITC was doing for social good. I don’t appreciate management doing such a marketing with shareholders. I mean come on, the core of the business is cigarette business. One should not do marketing of social good with a cigarette core at least in an AGM targeted towards shareholders. Even though I like it as a business, here are my concerns:

1 - The main pillars which drive the economics of ITC as a whole are - Cigarette Business(obviously) and FMCG. You may also include some ITC tech that is key to drive supply chain optimisation for those two.

2 - Now my main problem is a huge amount of cash is generated in Cigarette business. The cash that can be used to power unique brands with better customer recall. An economic structure only unique to ITC. But the management has clearly seems to fail at capital allocation. They are using that cash to push into more capital intensive business like stationaries or hotel business that don’t have the economics of FMCGs with great brands.

3 - An FMCG if run well like HUL or NESTLE or BRITANNIA should be another cash machine like the cigarette business. But rather ITC pushes all that cash into these capital intensive businesses. In short every rupee earned in cigarette business is used to run a business that might not even return that 1 rupee back to ITC at least in case of their segment like hotel business or other segments that have no significant pricing power advantages over time like soaps or notebooks or even atta. I am in a dilemma whether the capital allocation history by the current management is sound. I would rather be comfortable if all the proceeds after selling the hotel business would have been used to engineer some buybacks by the company.

While I like ITC as a business, I think it needs to be very, very FOCUSED on its pillars - Cigarettes and FMCG and definitely IT for supply chain infrastructure optimisation. Thoughts, Insights, Criticisms?

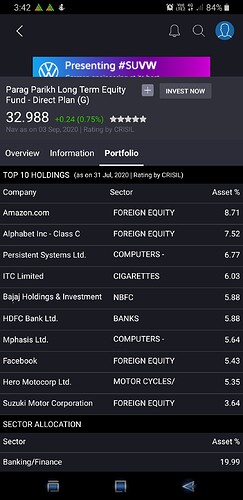

Well PPFAS is counting big on ITC too…some consolation for those of us okay on return around dividend until and if re-rating happens ![]()

Invested

ITC: Agility in Adversity, Synergy in Diversity, Compassionate in Crisis - text of the address by Chairman, Mr Sanjiv Puri at the 109th AGM of ITC Limited.

ITC Limited - 109th Annual General Meeting

Although your concerns are genuine I am not much bothered about same.The reason being ITC cigarette business is a behemoth when it comes to cash generating capability.All these capital intensive business takes less than 5% of there cash flow.Since they have committed to 80% dividend payout and FMCG is in a stage which requires some more investment(keeping in mind 1 Lakh crore FMCG revenue by 2030) I don’t think they have a lot of money to throw away into lousy businesses.

I feel they are playing down the cigarette business intentionally.Its good for shareholders

1)They can escape esg concerns

2)We are all waiting for the day when it is viewed as an FMCG business.

3)Future belongs to non cigarette business.

disc: forms 45% of my portfolio

This has been quantified and in this thread before… All other issues you mentioned also discussed thoroughly… If you read the complete thread you will get a idea for each of your concerns.

Please flag this post if inappropriate.

I’ve gone through most posts in this thread and what I’ve realised is… noone is questioning that ITC will be a huge wealth creator. Almost everyone here knows it will happen at some point. The main issue is timing. For eg

If you have 20 lakh rupees right now you can buy about 10000 shares of ITC. Everyone knows that ITC offers an amazing dividend yield, is as safe as nails and there will be a re rating in the future.

There are 2 camps though:

1 camp wants to buy the 10000 shares of ITC now sub 200 and have no problem sitting and waiting.

The other camp wants to invest that 20 lakh rupees in other fast growing companies and sectors and try to convert that 20 lakh to 40 /50 lakh over the next few years and buy ITC the day it moves out of consolidation and shows actual signs of a re rating. The second camp will be able to buy even more shares of ITC (even at a higher price) as compared to camp 1 in this scenario if things go their way.

And this is the only thing that we are actually debating. You need to figure out if you want to buy your allocation today or take a chance that itc stays stagnant for a few years and buy a higher allocation later when it shows signs of a re rating. Both camps could be right… buying cheaper lets you lock in ITC at a low price… buying later may give you a higher price but you may be able to buy more(though timing the stock market almost never works). It’s not a question about whether ITC is good or bad… we all agree it’s a fantastic, safe long term wealth creator. We all know FMCG takes a while to give meaningful margins and profits (HUL was flat from 2001 to 2010 for eg) so its just about picking a wait and buy later or buy now strategy. The ideal strategy could be a mix of the two.

Edit: as Shardhr and eyesice mentioned below there is a camp 3 who sip in it too on dips. And it dips every year due to tax worries, ex dividend date etc. People trust leveraged institutes (banks), so I dont see any reason people shouldn’t trust a cash printing institute (ITC) instead.

At the end of the day no matter what camp you belong in if your goal is financial freedom picking up around 10000 to 20000 shares over the next 5 years will almost guarantee it in 10 years. Think of it as a job application to work at ITC a decade from now. In a decade they’ll pay you a salary of 4 to 8 lakhs a year with a bonus of 10 to 20 percent salary increase every year and a pension fund for retirement with your capital protected and compounding.

In continuation to what @Malkd has said to which i fully agree, one thing which no one would disagree here is that ITC is a wonderful company. But a wonderful company need not be a wonderful stock. We know that markets are irrational most of the time but not all the time. So its better not to argue with the market all the times. Market knows most of the things before we come to know about it. we have several examples of stock prices being in down trend but nothing seems to be wrong with the company and we keep averaging down. But most of the times, in the end, it proves that market was right.

Market needs 2 things in a stock for it to do well or PE to re-rate. Certainty and visibility. The stock may be an absolute bluechip and would have done wonderful over past 50 years. But market is least concerned with it. All it sees is the future outlook. No rosy picture of past would come to rescue a stock here. The past figures only help us satisfy ourself with our thesis in MS excel.

As market hates uncertainty in a stock, we find it enough in ITC. Earlier excise hike mainly was once a year during the budget. Now under GST regime, the GST council meet is held every month. Not that every month there will be hike in GST or compensation cess on tobacco but nothing can stop them from recommending the hike whenever it is seen that there is a need for revenue increase on account of one or the other events. And there is no end for these events. when covid ends, there will be flood somewhere, then hurricane disaster. So the first thing that comes to mind is cigarettes and liquor to compensate. As i said there wont be tax hikes often but its the sword of damocles hanging always. And markets hate it. Other reasons like ESG etc. add on to it.

Coming to visibility. Famous Peter Lynch quote which goes something like this - In the long run what matters is earnings, earnings and earnings. Is there no earnings in ITC. ITC is a cash generating machine. It is a business that work on negative working capital. Receives advances from buyers to supply cigarettes whereas pays their suppliers who extend credit. Who needs a external borrowings when you can generate cash so fast.

If you see cigarette business, the earnings are increasing yoy which is very good but earnings without volume growth is not a good sign. You cant squeeze customers beyond a point. See what is happening to a wonderful business like castrol. All they are doing is increasing price and cutting costs to maintain margins, which cant be done beyond a point when the volumes are comes down. But cigarettes are sin products so even if increase in taxes, the same can be passed on. This may be correct to some extent but beyond a point if it becomes heavy on the pockets of customers and he is likely to switch to illegal cigarettes. By illegal cigarettes many of us have impression that they are unsafe (even I had that impression long back  ) but its only that they are smuggled without taxes and hence cheaper. Product loyalty beyond a point doesnt work. If you dont increase prices, either taxes eat your margins. If you do beyond a point, you lose the customer. Covid is one more reason for smokers to experiment cheaper brands. I myself was a Bira drinkers but had to switchover to Kingfisher beer to reduce monthly expenses. Not many may go back to old brands, if they develop a liking for new one.

) but its only that they are smuggled without taxes and hence cheaper. Product loyalty beyond a point doesnt work. If you dont increase prices, either taxes eat your margins. If you do beyond a point, you lose the customer. Covid is one more reason for smokers to experiment cheaper brands. I myself was a Bira drinkers but had to switchover to Kingfisher beer to reduce monthly expenses. Not many may go back to old brands, if they develop a liking for new one.

Globally including India, the cigarette volumes are on down trend. The promotion about how cigarette is bad (which it is), the health risk associated with it all makes it not a good product with Millennials. I may be wrong with the reasoning of millennials not having a liking for cigarettes and one can argue against it but Volume trend which is going down cannot be ignored.

Coming to the other segment being FMCG Others has shown less than 10% topline growth in past and here the hope is that it would do well going forward. Most FMCG companies are growing around the same range but still are commanding higher PE. So why not ITC? The answer may be lower margins compared to other established FMCG companies. So the returns generated from cigarettes are used in businesses which are generating poor ROEs. considering the size of ITC, we can ignore the poor allocation in hotels theory. Even otherwise, considering their FMCG-Others alone, the returns generated are poor. We all agree that building brands takes decades and the ones against which you are competing are not decade old companies but century old like HUL, Britannia, Parle so the market may be skeptical here in giving this segment of the business its proper dues. The other part being, a leader in a sector always commands a premium which the brother or cousin may not. See-Asian Paints - berger, Crisil-Icra.

So will ITC languish all its life like this. The answer to me seems to be No. Other things being constant, the day FMCG margins improve more or less in line with other peers, the market will re-rate it and new story around it will be woven (though it will always remain a brother unless it does something drastic, which is highly optimistic thought and I wont buy that point), unless they screw up something big time or a cigarette ban which is highly highly unlikely.

So there are 2 options. Either buy ITC and wait patiently for it to deliver may be in next 3 years, 5 years and lose the opportunity cost of utilizing the money elsewhere or invest only when it starts delivering and when there is visibility, which means losing on some X in the process, which is perfectly fine because when business does well and market feels it deserves 5X, you still win when you enter after it has become 2X.

Disc: 10% of my portfolio. Last added during March April 2020

I saw couple of posts where people are of the opinion that one should wait till there are some positive movement in stocks.My genuine doubt is how do you figure out when it happens.

It can go up 10-20% and stay there for years.some months back it was 150 rose 20% and now at 190 it’s stuck.

In future it may go up 50% but may come down 60% with another tax hike.all sort of crazy stuff can happen to the share price.None of us are going to get a magical insight about the date when breakout or pe rerate is going to happen.it may not be knee jerk movement it can be years long of slightly above par performance.

My advice is get on board only if you have patience of atleast decade.Its not very difficult considering the very attractive dividend rates.My family always wanted me to start a fd.I have invested in itc as if it is an fd.