I think there was a 2:1 bonus a couple of years back. Remaining increase may be from ESOP.

You missed the bonus shares of 2:1 issued by ITC in May 2016.

Share capital rise from 774 cr to 1229 cr is too drastic and no company would issue ESOPs worth 50% of their original share capital. The Esops issued are prudent enough and I don’t think they are affecting the rating of the company.

Look at the above news feed, its not like ITC management do not know about the valuations and is not targeting for fair price of shares and it seems they are working on it.

@Malkd @laxman_sreekumar @kpc I believe ITC should think put more focus on inorganic growth in FMCG sector by acquiring good companies instead of developing brands from scratch as it involves decades to start seeing some results. I will say ITC should have easily acquired Eastern (Rev 900Cr) at 2000 Cr. Why should you leave Norwegian Orkla’s to acquire Eastern when ITC’s own goal is to develop FMCG business. That’s a missed opportunity.

When ITC is sitting on cash the mangement needs to focus on inorganic growth by aquiring companies which can show immediate results on the revenue and profits.

Here we are confusing price movement vis-a-vis business. Why did most of us, including me bought at 150. Because for me it seemed that it didnt deserve that price. So that was the best time to average down and they had already come out with their new dividend policy. So overall it was a good price because nothing changed business wise, neither for good or for bad.

Without improvement in business for reasons said, the upside is always limited. The re-rating what you talk about will not happen unless business delivers or somethings change drastically like no ESG issues, no tax overhangs etc. very steep upside generally wont happen without a reason. The other point as you said assume FMCG others do very well hereon, in such a situation, it wont remain a cigarette company and the market then undermines the Cigarette taxation etc. and new story woven would be of the FMCG others. However, even if the FMCG others does really well and the markets punish it whenever there is tax hikes etc., then no one can do anything with that as cigarette companies are used to it and we have to live with it.

Having magical insight about pre rerate or breakout as you said no one can have. Then these are again when you look at price movements. But one will know about business insight and numbers tell you that. So the question needs to be asked do you need to invest in it when one is not sure about the future or wait for things to better. Also there are many opportunities which weigh well compared to ITC.

Completely agree. A little bit of goodwill accounting is not bad when you can acquire a business with unparalled transactional economics. Thats my point management can do a lot better in terms of capital allocation. Because ITC is the one company that can do that. But again I think they have got a hang of it. The acquisition of brands like sunrise spices inspires some confidence as to the strategy management might be aiming for.

There is one more aspect need to keep in mind…if comparing with HUL stagnation is right. Market is very intelligent, it is not keeping ITC priced so low just because of gestation in FMCG…everyone knows that and the bigger question, at least for me, here is that HUL’s only commitment was FMCG baby…ITC has many babies and keep having one more every few years! Strategy is the biggest uncertainty and as a shareholder, I am so far not conviced. I was also never convinced with Tata Global, until Chandra happened and TCS stagnated with headwinds, Tata motors in losses and the group wanted to look beyond! In case of ITC, a Chandra and the above realization is yet to happen. Tata Global sold many non-core investments…I was excited when ITC shut down Wills Lifestyle (although I liked that premium retail brand and thought that they have shut down something they could have grown and instead could have shut down one new hotel plan)…so in short, the undervaluation, according to me, is not because of FMCG gestation period…It is because of lack of trust on STRATEGY of ITC. As a long term investor, I will watch out on this aspect more than any other.

Disc. Not a recommendation to buy/sell. Only my thoughts and I maybe wrong. Invested, hence biased.

Let us go through ITC historical performance other than its share price.

Dividend CAGR:

2016 - 2020 - 14.6%

2011 - 2020 - 15.6%

2000 - 2020 - 22.8%

*(Dividend(incl. DDT) / PAT: 2000 - 28.3%, 2011 - 80%, 2016 - 83%, 2020 - 81.5%). Above Dividend CAGR calculation does not include effect of DDT, which has been removed from this year.

Financial assets of company:

2010 - 4452 Cr in Bonds & MF + 1347 Cr Cash & Bank balance = 5799 Cr

2020 - 27730 Cr in Bonds & MF + 7277 Cr Cash & Bank balance = 35007 Cr

19.69% CAGR in above mentioned Financial assets.

Only somewhat negative which I could find out was that ROCE is consistently declining since 2015. But, I think we all know the reason for this. They are in investment mode in last decade which has yet to generate sufficient return and its not possible for FMCG & Others business to generate the ROCE similar to cigarettes.

Despite all these investments in hotels, FMCG & others, their last 10 year dividend CAGR is 15%+ and they have increased financial assets 6 times. Also, as they have now stopped large investments in hotels, most of the investments related to ICML will be over soon and with time FMCG & others will start contributing their bit, i think ROCE will move upwards.

*Apologies. I missed the bonus issues of ITC in year 2005 & 2010 in previous 2000-2020 Dividend CAGR calculation. Please see the updated value.

Disc: invested, 9% of my portfolio

This is excellent insight in very simple way through numbers showing the strength of business. Few posts in this thread talk about significant equity dilution via ESOPs and other means. What are your thoughts on that and also if you can share that through years on that aspect it will be good to know. Request others also to share their knowledge in equity dilution aspect because other than Strategy, I see this as a point I should take out of my mind first. Thanks

Disc: 10% of my portfolio value currently. Starting adding it in recent downturn. Largest holding in terms of invested money. Biased. Not a recommendation to buy/sell.

Hi All

Seems there is a lot of interest in ITC among folks everywhere.

Thought will share raw data for those interested to compute returns etc. My data is picked from annual reports all the way back to 1992. Please help yourself.

Rgds

| ITC | ||||||||

|---|---|---|---|---|---|---|---|---|

| EPS | Price | PE | EPS Change | Price Change | Dividend/Share | Bonus | Split | |

| FY1992 | 0.16 | 19.10 | 119.49 | 5 | 3:5 | |||

| FY1993 | 0.22 | 10.36 | 48.02 | 34.90% | -45.78% | 6.5 | ||

| FY1994 | 0.28 | 15.10 | 53.64 | 30.56% | 45.84% | 8.5 | 1:1 | |

| FY1995 | 0.35 | 6.33 | 18.14 | 23.91% | -58.09% | 5.5 | ||

| FY1996 | 0.34 | 5.04 | 14.63 | -1.19% | -20.35% | 2.5 | ||

| FY1997 | 0.46 | 7.96 | 17.37 | 32.89% | 57.82% | 4 | ||

| FY1998 | 0.69 | 15.86 | 22.83 | 51.62% | 99.30% | 4.5 | ||

| FY1999 | 0.82 | 21.39 | 25.99 | 18.47% | 34.87% | 5.5 | ||

| FY2000 | 1.05 | 16.33 | 15.60 | 27.17% | -23.68% | 7.5 | ||

| FY2001 | 1.33 | 18.09 | 13.62 | 26.93% | 10.80% | 10 | ||

| FY2002 | 1.57 | 15.48 | 9.85 | 18.29% | -14.43% | 13.5 | ||

| FY2003 | 1.81 | 13.96 | 7.71 | 15.26% | -9.82% | 15 | ||

| FY2004 | 2.10 | 23.18 | 11.02 | 16.10% | 66.05% | 20 | ||

| FY2005 | 2.43 | 29.82 | 12.29 | 15.41% | 28.65% | 31 | ||

| FY2006 | 3.01 | 65.05 | 21.61 | 24.03% | 118.14% | 2.65 | 1:2 | 1:10 |

| FY2007 | 3.56 | 50.38 | 14.15 | 18.27% | -22.55% | 3.1 | ||

| FY2008 | 4.11 | 68.75 | 16.73 | 15.45% | 36.46% | 3.5 | ||

| FY2009 | 4.29 | 61.62 | 14.36 | 4.38% | -10.37% | 3.7 | ||

| FY2010 | 5.31 | 87.68 | 16.51 | 23.78% | 42.29% | 10 | ||

| FY2011 | 6.45 | 121.40 | 18.82 | 21.47% | 38.46% | 4.45 | 1:1 | |

| FY2012 | 7.88 | 151.27 | 19.20 | 22.17% | 24.60% | 4.5 | ||

| FY2013 | 9.39 | 206.30 | 21.97 | 19.16% | 36.38% | 5.25 | ||

| FY2014 | 11.05 | 235.23 | 21.29 | 17.68% | 14.02% | 6 | ||

| FY2015 | 11.99 | 217.23 | 18.12 | 8.51% | -7.65% | 6.25 | ||

| FY2016 | 11.59 | 218.83 | 18.88 | -3.34% | 0.74% | 8.5 | ||

| FY2017 | 8.40 | 280.30 | 33.37 | -27.52% | 28.09% | 4.75 | 1:2 | |

| FY2018 | 9.20 | 255.50 | 27.77 | 9.52% | -8.85% | 5.15 | ||

| FY2019 | 10.17 | 297.25 | 29.23 | 10.54% | 16.34% | 5.75 | ||

| FY2020 | 12.31 | 171.70 | 13.95 | 21.04% | -42.24% | 10.15 | ||

| Current | 11.77 | 186.70 | 15.86 | -4.39% | 8.74% |

ITC Corporate presentation 2020

BAT is there to take care of this.

https://www.business-standard.com/article/companies/sanjiv-puri-bats-for-employee-stock-option-scheme-calls-it-best-option-119071201285_1.html#:~:text=Even%20as%20British%20American%20Tobacco,ESOP%20was%20the%20preferred%20choice

Thanks for sharing, the last two lines of this article are very critical in which BAT says - That other Indian companies issue ESOPs in a manner which is not dilutive to existing shareholders. Now, what is different in the way say an HDFC Bank or HUL issues ESOP and the way ITC does?

Also, I am aware many companies issue ESOPs but none of them are in news or in investor radar for ESOPs that often and that significantly as ITC, Why?

Would be good to know you and others thoughts on this. Thanks

BAT cant increase their shareholding as per govermental law. ESOPs in long run have diluted their shareholding significantly. So they ask for ESAR ( employee stock appreciation rights), where employee will get, postive delta in share price from the ITC balance sheets.

This way BAT wont have equity dilution

But for us (one who can buy shares from open market) both are one and the same.

I will get ESAR money as dividend and buy from open market if its issued as ESOP. So my equity wont get diluted.

If its issued as ESAR, my dividend get reduced.

ESAR is good for investors (irrespective of company) so that our dividends wont get taxed --> leading on to higher returns

ESAR or ESOP, anyhow employees are going to pay LTCG.

I’m going to weigh in regards esops, hotels, lack of direction, underperfomance issues if thats ok

- Esops are a good thing for me. You have to remember that ITC doesn’t have a group of promoters with skin in the game. They do have majority share holders but they aren’t involved in the day to day running of the company. So the best way to get skin in the game is by providing esops to the top management and employees. Over the years bonuses has caused dilution far more than esops… and I don’t mind the small loss due to esops due to the increase in skin in the game

- I know Capital allocation has always been a worry but I had both an ex professor who worked at ITC and have a friend who works there too. As far as they are concerned hotels may have low margins and low roe but they offer the best possible way for them to nab big shareholders, keep shareholders happy, keep employees happy, get new distributors, help with acquisitions etc(via having meetings, stays etc in these hotels). Having your own hotel line is a fantastic way to help all of the above. Infact try staying at one(I’ve stayed at the one in goa). It’s like a mini itc advertisement with their own brands everywhere. Being a cigarette company they have to work extra hard to get people to trust them as a non cigarette company and this helps.

- While we have short horizons and outlooks ITC has an Outlook which spans decades. Sure we d be happy with ITC concentrating on just being an FMCG Other company but they are aiming for being the biggest company in all their fields in India… not just biggest FMCG company in india. And this kind of outlook may cause pain in the short term but it’s what keeps companies alive and performing for 50+ years and this is ingrained in their employees

- People say ITC has underperformed… ask any long term ITC holder and they’ll say otherwise. Their dividends increase at a CAGR of approx 14 to 15 percent per year. That means the dividends offered doubles every 5 years. In the markets there’s always a chance you can be proved wrong. There is a chance we may be proved wrong about an FMCG re rating too… but atleast in this case if you are wrong you ll get 40 rs. Per share dividend in 10 years, 80 in 15, 160 in 20 years… 640 in 30 years(if 80 to 85 percent is maintained… and considering the amount of cash they produce and have I don’t see why it wont). So even if you are proved wrong you’d still get a salary in a few years and if held can provide a salary to your next generation too. There are plenty of ways to skin a cat. Some shares make you wealthy with fast growth. ITC makes you wealthy without you noticing. And if the re rating does happen I can’t even imagine the worth of those shares in 20-30 years.

- As mentioned before never discount the value of compounding. ITC will make it easy for you to hold it for 20, 30+ years so it has a huge advantage by offering that. You just need to have patience and keep your eyes on a decade long prize if you do buy it/start buying it. It’s the only share I own that I cheer when it falls since it gives me a buying opportunity to add more since I’m planning on buying for 5 years to hit my target and do not want it to rise too high until then.

Apologies for posting again. If anyone has issue please flag. Cheers

I beg to differ! Imagine ITC decides to sell off these hotels and acquire existing FMCG business in India with the money received from the sale, that will be what the street is excited about and not having a big hotel chain with significantly low ROCE’s. I would love to see ITC concentrating only in two business, namely Cigarettes and FMCG (packaging, Agri and IT support as subsidiaries of FMCG) that will do all the magic.

Why the company is stuck with this much amount of money ? Are they not finding interesting buyout offers in the market. Are they not serious in acquiring businesses !! ITC should allocate this money in Cigarettes or FMCG to generate serious returns.

Dividend CAGR update :

(Below, I have calculated dividend CAGR considering if there was no DDT in any year and company has distributed 81.5% of profit in all years similar to this year.)

2016 - 2020 - 11.15%

2011 - 2020 - 12.56%

2000 - 2020 - 15.33%

I agree. And I wish that in an ideal world ITC did that too. However, we need to be realistic when picking companies and have to accept that they also have a hotel business now and the only thing we can hope for is that they handle the current hotels well and we need to study and track their hotel lines too and not just pretend they don’t exist or will be sold. Atleast they’ve stopped capex for the same from now on in.

Also, I like that they have a war chest. It gives you comfort knowing they are financially safe and that’s important for someone who wants to trust the compounding process for 20+ years. Plus they’ve already acquired sunrise foods this year so they’ve shown their intent. Established Brands are expensive buys, and emerging brands are in a similar or worse position than ITCs current brands… so I’d rather they spend that money advertising and building their own brands than buy new fledgling brands at huge prices tbh. It may take longer but over a decade they can create some mega brands with the same. They can’t go out and buy a Britannia/nestle/hul/matico/Tata consumer size brand so why settle for a smaller one when they can build their own with their warchest? They have shown intent and sunrise was a shrewd buy so there is hope of inorganic growth too and if the management finds good brands/companies at good prices I’m sure they’ll buy them.

With their dividend payout of 80 to 85 percent having such a huge war chest ensures they can give cash to shareholders even if they have a bad year or two with low PAT growth though 35000 cr is equal to just 30 rs via dividends considering the huge equity base so I’d rather they use it for special dividends only sparingly(Maybe just add a rupee or two in years that PAT growth stalls).

ITC’s acquisition of Sunrise(Rev 591 cr) @ 2150Cr Vs Norwegian Orkla’s acquisition of Eastern(Rev 900Cr) @ 2000Cr. Does not reflect good on ITC acquisition strategy

Orkla took 67.8% stake while ITC did a complete buyout. Have you adjusted figures for that? Also, other than revenue there are various other aspects that I do not know…need to check those also before we compare…

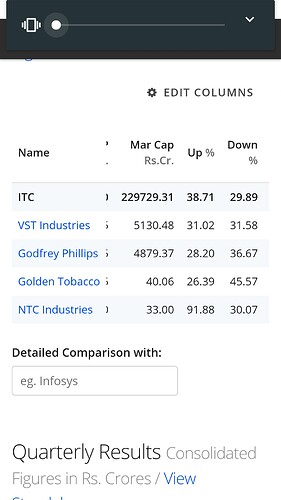

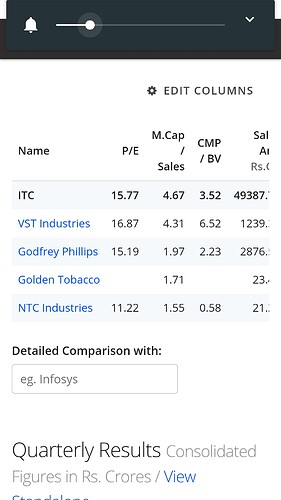

Looking at similar PE and similar up & down % for all three cigarette companies, maybe it’s just that cigarette companies are not the flavour of the season. Since in terms of strategy, vst is super focussed on cigarettes, Godfrey Phillips slightly diversified and ITC very diversified. But all three derive major profits from cigarettes.