Background:

Established in 1910, ITC is the largest cigarette manufacturer and seller in the country. ITC operates in five business segments at present — FMCG Cigarettes (since inception), FMCG Others (since 2001), Hotels (since 1972), Paperboards, Paper and Packaging (Since 1977), and Agri Business (since 1990).

More details are provided on company website:

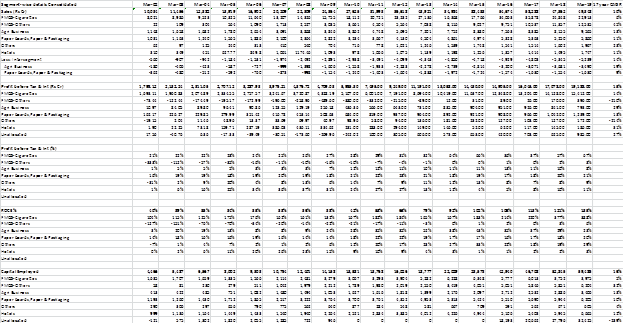

Segmentwise details:

Since the company has presence in multiple business, it may make sense to look segment financals provided by the company over the period. Since 2002, ROCE of the company increased from 40% in FY02 to 135% in FY19. FMCG -Cigarette ROCE improvement (despite lower sales growth) has been main driver to growth in ROCE. Hotel /FMCG-Others/ Agri business has mediocare ROCE (less than 10%) over the years. The company valuation are partially adversely affected by adverse capital allocation decisions of management in Past.

Positive Consideration:

-

Attractive valuation:

At current price of Rs 160 (19 March 2020), the company is trading at lower than April 2012 close of 163 (31 times PE). From FY12-FY19, PBIT has almost doubled. Current TTM (trailing twelve months) PE of around 13 was last seen in September 2003. So current valuation appears modest if one compare with historical valuation parameter of the company. -

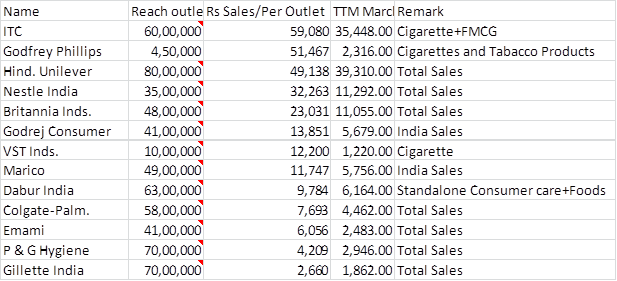

Among most productive distribution

I have compiled from various public information sources for various peers of ITC about retail outlet for distibution with March 2019 (or latest Audited sales) in Rs crore for various player. While the information has scope for factual imperfection, still from the compiled information, I find ITC having highest sales per retail outlet among Indian players.

Enclosing extract of my working:

Building world lcass brands on leveraging on distribution network:

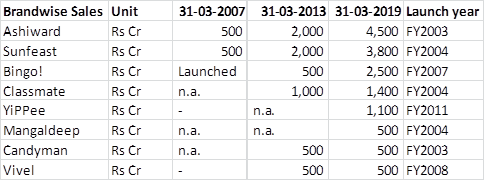

The company manage to scale its non-cigarette FMCG business over the large distribution network it built over the years.

The company has scaled up sales very well with almost no presence in 2000. It is also important to note, that the company started its Other FMCG business by entering into Expression Greeting card and WLS Lifestyle brands. In both these businesses, due to change in market dynamic, it was not able create impact and hence exited the business. However, the learning from failure has been used well by creating large brands.

3) Environment friendly operaton

The company has unique identification of being only company in the world to be Carbon positive (since last 14 years), Water positive (Since last 17 years) and solid waste recylcing positive (since last 12 years). This information is sourced from Sustainability report of the company. The company has been publishing sustainability report since 2004 which provide very good insights about company efforts in sustainable growth.

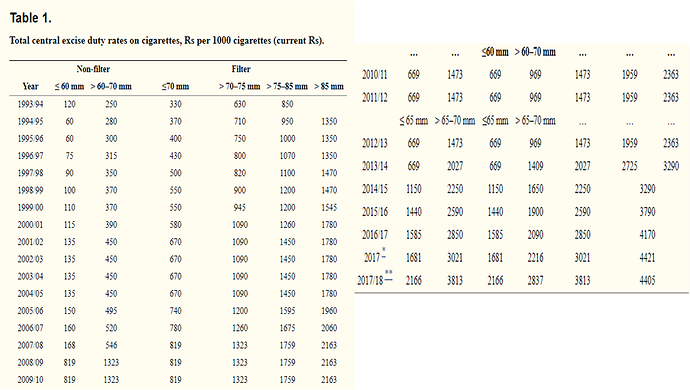

4) Cigarette: Giant cash generating machine:

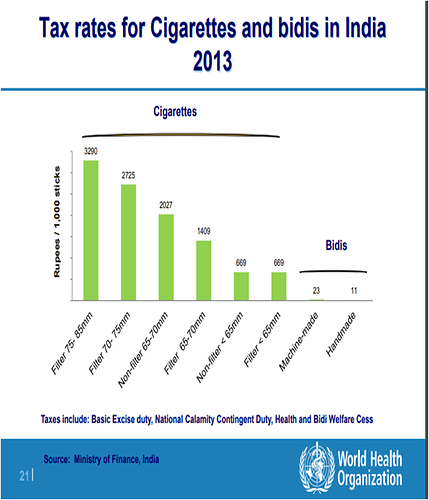

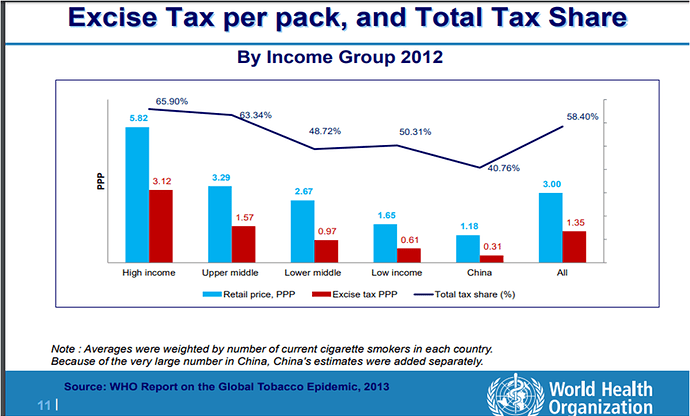

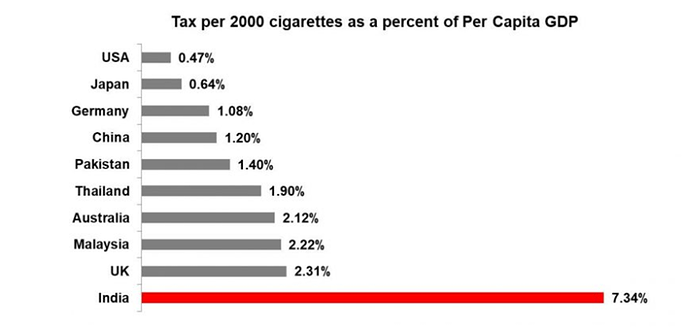

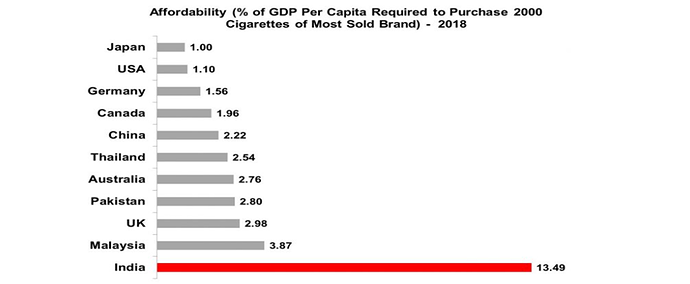

Despite volume de-growth and high taxes, the company enjoy great dominant market position. The company has till now manage to successfully pass on tax hike and also improved profitaiblity in Cigarettte business. ROCE in this business improved from 100% in FY02 to 388% (yes, I mean it) in FY19. PBIT from Cigarette business has grown at 14% CAGR over 17 years to reach Rs 15,412 Cr during FY19, which account for nearly 80% Consolidated PBIT of the company. This increase in PBIT needs special attention in the context of multiple hike in tax/lavies and negative volume growth during significant period under consideration.

Negative Points:

1) Adverse capital allotment

While the company generate large size of cashflow from Cigarette business, same are not utilised appropriately. Capital allocation to Hotel business is neglible 3% in FY19 and FMCG-other segment is around 6% in FY19. The ROCE of Agri business and Paper business are moderate at around 20%+ in FY19, still much inferior to Cigarette busniess.

While, hotel is definitely deserve special attention (or divestment) in my limited understanding, I would see FMCG-Others as future growth driver and Agri and Paper being critical support to growth of FMCG business. Nearly 1/3 of Agri business and Paper Business sales in value being utilised by the other segment of the company. Investment in Agri business is also critical for sourcing of Tobacco and wheat. More details are provided in E chaupal section. I personally would look at Agri Business as core component of business and would merge it with FMCG business.

While there is scope to hive off Paper business generate higher than cost of capital, still, none FMCG players have ventured into Paper business and highly successful. Hence, in my understanding, the company can improve ROCE by divesting from ROCE diluting non-core business of hotel and paper.

2) Higher Management Compensation

While BAT own ~30% stake in company, they are still not in control of operations. In past, the top managment (during 1990s) have defied BAT efforts to increase its stake to majority with support of Indian financial institution (specially LIC+SUUTI+General insurers), which own around 29% stake in company, and further 7% by MF which take difficult for BAT to control the operations.

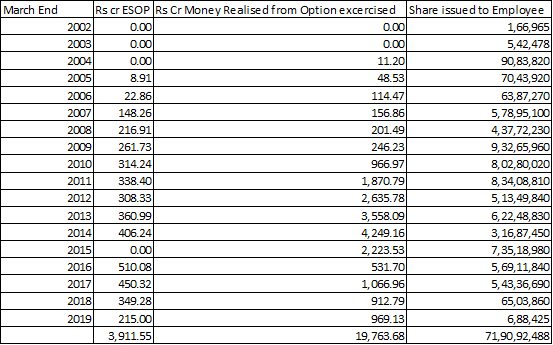

Since, there was no entity in direct control, the remuneration to employee is relatively more relaxed in ITC. During FY2005-FY2019, Total ESOP cost (in respective year accounting standard) is around ~ Rs 4,000 Cr. Enclosing yearwise ESOP

On positive side, the employee has contributed around Rs 19,763 Cr towards ESOP. While it is difficult to understand how much shareholding employee currently hold as employees might have sold share in stock market post excersing ESOP, still amount involved is substantial enough align employee interest with wealth creation in my opinion.

3) Sin product and not fitting ESG requirement

One of reason for lower relative valuation of ITC as compared with peer companies is due to Cigarette being not good for society health. As a result, many institution are liquidating their holding in ITC and future demand for shares may be limited despite improved financial performance. Government also find Cigarette industry when it need to look out for additional resource to mobilise welfare for regular and contingency plans. This may continue to adversely affect ITC valuation in my personal opinion.

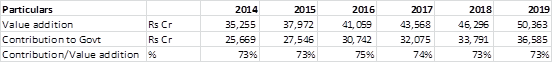

It may be noted that significant share of value addition in ITC is also shared with Government. This factor may provide sufficient breathing sector to keep going .

Barriers to Entry:

1) Regulatory constraint

Cigaretter has huge regulatory entry barriers as license to manufacture are not issued to new players. Also, there is no scope for a new player as advertising of product is not permitted.

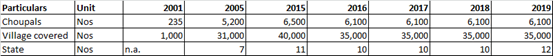

2) E Choupal: An Indian micro entperising effort

Since 2000, ITC has develop an unique social infrastrcuture called E Choupal which reaches to rural area and farmers. One reason for successful brand building and having more than 40% market share by Ashirvad/Bingo to procurement of woods for paper is direct access to E Choupal.

Summary:

While there are issue about high taxation, inferior capital allocation and not fit to attract financial investor, given the valuation comfort and scope to improve margin in FMCG products and recent announcement of higher dividend payout, ITC may be interesting company to watch for.

Also, enclosing return for an investor who has invested in ITC IPO (not particpated in right issue and other issues) and calculated holding total shareholding return since 1970s. The XIRR for investor are 24.3% p.a. over 5 decades decades !!! This is excellent TSR for sure in my view. Having said that, past may not be indicative of future and hence one has to evaluate business propsect and growth before making any investment.

Disclosure: My view may be biased due to my investment. Bought share in last 15 days. Not a recommedation, Not SEBI registered advisor, Reader shall do his/her own due diligence before making any decision

ITC Past return 1971-2019.xlsx (24.0 KB)