Hi does ITC not do conference calls? I am unable to find any management commentary for the future or conference call recordings or transcripts?

In the best case scenario if everything goes right

Assuming Fmcg others excluding espb continues to grow around 18.8% … with sunrise foods and other possible acquisitions over the next few years and espb getting back to growth next year let’s assume the growth rate is 20 percent overall for Fmcg others then Based on the current revenue per year we can expect the revenue of fmcg others to be approx 35000 Cr in 5 years which will be higher than cigarette revenue considering the rate at which cigarette revenu has been increasing. At the rate ITC are improving their margins let’s again assume a best case scenario of 10 percent margins. So Fmcg others would now contribute 3500 Cr profit per year PBT to the company. Now assume Hotels, agri, paper continue at 10 percent so would contribute PBT of 3500 Cr by then . So the total contribution would be around 7000 Cr from this segment. Even in this best case scenario cigarettes would still be way ahead of fmcg others since they already contribute above 140000 Cr PBT per year! My question is even in this scenario (that I may have calculated really wrong and with a lot of assumptions) cigarettes would still contribute more than double the profits of the others. My question is… would you consider ITC getting re rated from a cigarette company to a Fmcg company in this scenario? Or do you see this as an even longer term 10 year story(where it does look like Fmcg others will overtake cigarettes) before that happens? The 85 percent rate for dividend distribution is nice but we may be looking at a really, really long term investment of a decade plus before the story we are looking at actually plays out and during that time we need to dodge the pitfalls of a cigarette company ie increased taxes/bans/sin company etc. Would it not to be better to just track for now and add in a few years due to opportunity cost of not owning faster growing companies?

Note: I’m very bullish on ITC but I’m trying to look at some contrarian views to temper my expectations and set a timeline so that I can manage expectations. Also, my calculations may be wrong so please add in yours so that we get a good idea of when to expect the transformation story playing out. Makes it better to look at quarter results too since will know exactly what to look at in the future to ensure the story plays out.

Just one addition…for any re-rating, FMCG need not completely overtake cigarettes but form a meaningful contribution to be able to control the overall growth of revenue and profits needle somewhat. As a vert raw example, Jio has not overtaken petrochemicals part of RIL, but investors have begun to see the roadmap of the meaningful control of the needle in future, hence the re-rating at the moment.

Disc. These are only my views and I can be wrong and biased as I recently invested in ITC. Evaluating if I should include it as part of core portfolio at the moment.

True. Plus ITC has such huge cash reserves so in the same way we saw reliance go on a " gathering investments " spree… ITC may just go on a buying spree with sunrise foods just being the first of many which would quicken the process of increasing profits from Fmcg others. However, with 85 percent distributed to shareholders they’ll just be adding 15 percent to their cash reserves every year. So they may not be able to crazy in this department. True though… the rerating could happen the moment the Fmcg others margins increase to 7.5 to 10 percent. And with ITC it’s better getting in at the ground floor ie sub 200 and getting a benefit of a nearly 6 percent dividend yield than jumping in later post 300 and risking stagnation and lower dividend yield. I know dividend isnt a reason to buy but I know people who bought ITC back in 2005 before the split and I can’t even calculate the dividends they receive right now haha. They’d bought about a 1000 shares back then and now own around 45000 shares due to splits and bonus. So the recent 10 rs a share has basically given them a salary this year. It isn’t a reason to invest in ITC but the cigarettes business being a cash cow and soon to be aided by the other segments combined with the 85 percent distribution could lead to a retirement salary if invested early. Again, don’t invest for dividends but it’s a failsafe while we wait for the rerating hence making this in my opinion a safe bet which will allow patience. However, the point of this post is to see realistic bear views since everyone knows the plus points so apologies for going off topic.

Edit: also, I know that the same 1000 shares wouldve given more returns if invested in HDFC/Growing companies in 2005. My point being jumping in now will provide both the benefits of dividends and the growth that we foresee over the next decade.

That’s a good approach. I am still building my investment thesis around ITC…and one point that hovers around is that the cigarette revenue and profits are so huge that the re-rating from an increase of FMCG revenues may eventually never happen unless substantial degrowth happen in cigarettes many years later. I had also read history of tobacco company in US whose footsteps somehow itc seems to follow by understandable diversification in FMCG and the value unlocking in that case was not from a re-rating of the entire company but by demerger of FMCG etc.

Although ITC says no demerger on cards but if above happens with no re-rating for years ahead, ITC may have to give in to a real frustrated set of investors and finally demerge at moment when they need not fuel stupendous growth of FMCG from profits from cigarettes business but rather FMCG becomes self sustainable.

I suspect, ITC re-rating and/or value unlocking may be much more than 5 years journey…maybe 10 or more, unless management acts differently than how they have so far. Until then, it should give better than FD returns including dividends.

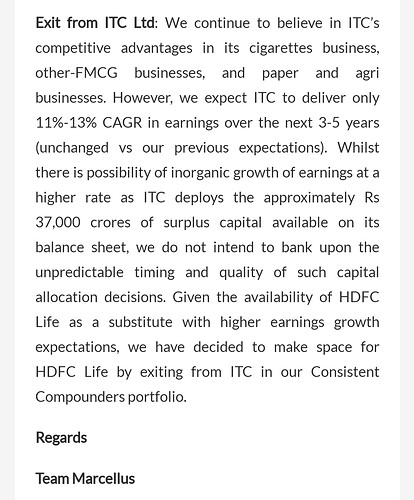

The revered Marcellus team has dropped ITC from their portfolio of consistent compounders.

Their rationale is on similar lines.

We continue to believe in ITC’s competitive advantages in its cigarettes business, other-FMCG businesses, and paper and agri businesses. However, we expect ITC to deliver only 11%-13% CAGR in earnings over the next 3-5 years (unchanged vs our previous expectations). Whilst there is possibility of inorganic growth of earnings at a higher rate as ITC deploys the approximately Rs 37,000 crores of surplus capital available on its balance sheet, we do not intend to bank upon the unpredictable timing and quality of such capital allocation decisions. Given the availability of ****** as a substitute with higher earnings growth expectations, we have decided to make space for ****** by exiting from ITC in our Consistent Compounders portfolio.

NB: Feel free to flag this post if doesn’t add any value to this thread.

Interesting! Only difference is that Marcellus dropped it from their portfolio while I added it new for this very reason. Same reason I added more of Marico to an existing long term position. I am not buying ITC because it’s relatively cheaper than other FMCG or for desire of its re-rating. I am buying it for the same reason I bought maybe a Tata Consumer or Marico…I like it’s FMCG products and see them growing significantly. Understand, ITC is not pure play FMCG and hence the discount in valuations and I should only buy it if I am fine with that discount continuing until FMCG is demerged and listed seperately. My experience so far has not been good with diversified plays but that’s the reason I avoided RIL at significantly low prices although I liked their digital business a lot right from its infancy.

Marcellus is right on just one thing and that’s everything is unpredictable…

Disc. Not a buy/sell recommendation. Hold ITC so views will be biased.

Thats a great return figure according to me

13%capital appreciation + 5% dividend Yield =18% till rerating.

After re rating sky is the limit

I have heard that internationally there are cigaratte companies which have transformed into fmcg. Do any body know such companies. I would like to study more about them

to my knowledge its one of the few companies which does not take concalls

This is one of the few reasons I like ITC, it’s focus on sustainability, make in India, and other such social initiatives are one of a kind

If it was about quoting the source, i could have done it relentlessly. The information shared was nice though.

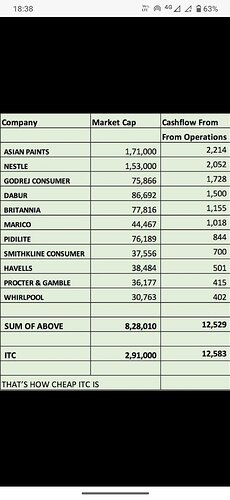

ITC is in a deep discount!!

Source

Marcellu’s comment on itc exit

Source

Anyone has MCA data on Sunrise spices, at what multiple was this acquisition completed? How has been the past growth and return metrics for this company?

Acquisition took place for roughly 2000 cr. Sunrise had a PAT of 62 cr. That gives us a multiple of around 30.

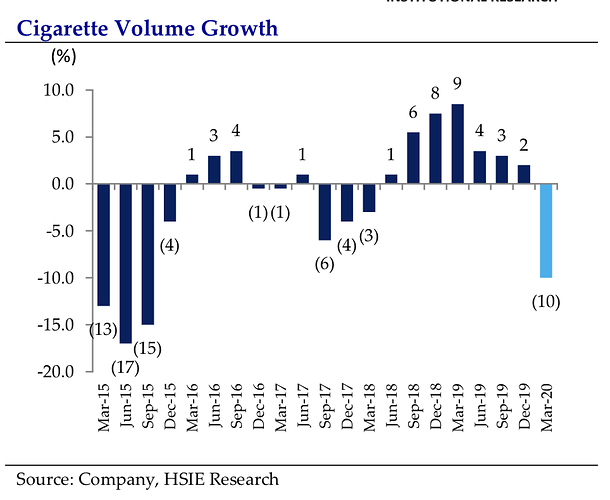

ITC seems to have slipped into a bond like avatar of stock - where there is a regular yield but prospects of any appreciation are unlikely. This has happened due to the fact that its core and highly profitable cigarette business is showing a decline in volumes. This was once an inelastic business which has now turned elastic impacted by price and health concerns. Of course ITC is making great efforts to replace it with FMCG and other businesses. But one thing is certain that no other business will ever be as high margin business as cigarettes. As a result over all profitability will keep on dropping even if FMCG business starts showing higher margins (which it has yet to do even after more than a decade). Consequently, even if revenue keeps on growing the profitability will decline. Which would mean that the bottom line growth will be poor or non-existent as cigarette volumes keep on declining. For a while, price is unlikely to go up even if the dividend is maintained.The management commentary has already said that they will distribute bulk of the profits as dividends. Depending on interest rates, the stock may become attractive for dividend yield seekers. Beyond that there is unlikely to be any appreciation, unless the cigarette volumes show a turnaround.

Disclosure : invested

The Wildcard with itc is that they have more than 12000 crores of free cash flow. Check JJoys post above. Also watch the interview with mr puri on CNBC from 2 months ago. It’s 30 minutes long but after watching it you’ll realise how big a priority FMCG othrrs is for itc. Link is here: https://youtu.be/PYFSjlcswpw . The main threat for cigarettes is the unorganised sector. Taxes were an issue but the higher the tax the bigger the unorganised sector gets so I don’t see the government eating into their profitability too often. Also, the unorganised sector will face huge disruption due to covid. So cigarettes should be stable (q1 was a one off) and will free up cash for dividends. They have no need to spend too much on capex since it’s already done and accounted for. People do not talk about ITCs ICML’s enough. They have 20 commissioned and 9 more almost commissioned if in not mistaken. Imagine the improvement in their margins! Plus their incubation period for some off their brands has now reached inflection point. Now imagine a company like ITC sitting with 12000 crores of free cash flow with facilities for backward integration already set up(their paper and agri business included in backward integration too… plus they make profits from this!). They have already shown that they are capable of acquisitions. Sunrise foods will add to both top and bottom line and barely touched their cash flow. They can go on a spree of acquisitions and that looks like their priority atm. This could happen at any time and we’ve seen them aggressively do this already with savlon, b natural, sunrise etc. there will suddenly be a quarter where the margins and contribution of fmcg others will surprise the market. Due to their giant cash flows and backward integration and completed capex and brand building that can happen in ANY quarter. The moment it does you will not see ITC at its current valuation. There is a risk this may take some time but hence why we have a dividend yield to keep us happy till then.

Disc: Invested. Please flag if not relevant. Stated facts based on the past few years and posted links. Can post more if needed. Here is the icml link… and imo it’s huge

: https://www.itcportal.com/stories-pop/Getting-Future.aspx

You can read that they have 8 to 9 more commissioned in the dividend payout increase article from March 2020. The link is too big so not posting it here. You can find links for cash flow, sunrise etc anywhere on the internet. There’s no link to my speculation of what they’ll do with their cash flows but our job is to try to find things in companies that the market hasn’t priced in yet and ITC isn’t a small cap… so some speculation is required to find triggers

There are few things that are repeatedly asked and discussed…

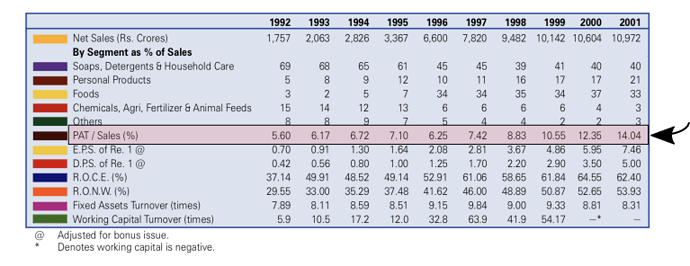

it takes time to establish a product and brand especially when one is competing with well established players like Unilever, Nestle, Brittania, Dabur. FMCG margins are low but improving… One can look at the history and margins of successful FMCG cos today…

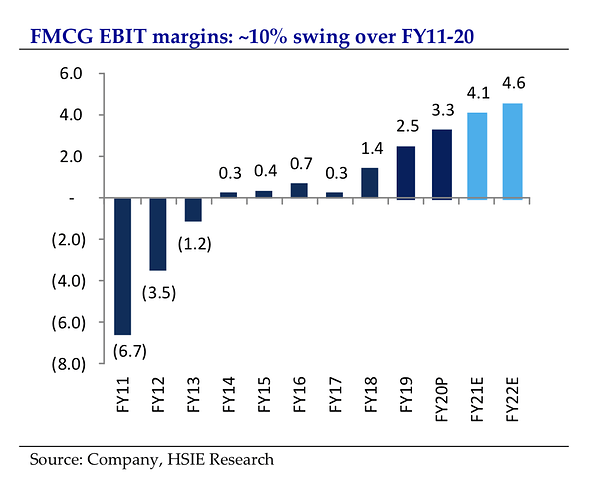

I had already posted this ( when HUL & ITC was one thread), but this has been continually asked here. During product gestation periods HUL also had as low at 5% margin. Please note that HUL was already a existing player for long. lets have a look at the ITC FMCG margins now

One can clearly see that its constantly improving…

ICMLs are coming up which will deliver the snacks fresh, increase margins due to scale, improve the logistics. These are strategically located close to the agriculture outputs so that its fresh and backward integrated.

Yes, it will take time and its a long process. But comparing them with already existing players who had enough time to launch and establish the product is unfair.

This is not the first time that volume growth has declined. Higher excise duty always dented the volume growth, and excise duty was hiked in FY21 budget as well. In addition to that we have a respiratory disease and its obvious that growth will be tepid.

Disc: same holding as my last post. My views could be heavily biased, please do your own due diligence.

The facts about low profit margin for FMCG in the formative years, new ICML facilities are known to all investors. (BTW most FMCG companies prefer to outsource production rather than set up their own and increase the headcount. IMO, this increases the capital in the business and pulls down ROCE) So all of these is built into the price. So unless margins improve for FMCG business, the turnaround is unlikely to happen. As they say, the proof of pudding lies in the eating. And right now we are all riding on hope rather than certainty. (As I have disclosed earlier I am invested and was lucky to get in at the bottom price levels, which enables me to hold on despite the headwinds).

This is true for any business we invest unless one has insider information. Nothing is certain in stock market.

True, no one knows when will things turnaround but isn’t that nature of long term investing.

agreed… valid point. ITC has always been employee friendly and projected itself as a employment provider of india since 1975. Its a true atmanirbhar co ( if thats of any relevance ).