Thanks for seeking my view. My disclaimer, I hold IndiaGrid InvIT, IRB InvIT and Embassy REIT (latest addition, with major holding purchased yesterday).

Please also note that I am not expert and my understanding may be completely wrong.

I see InvIT/REIT as structuring of cashflow which changes when the trust purchase new assets which get financed from debt equity mix to provide stable cashflow over a long period to investor. So business wise, Powergrid shall be theoretical similar to India Grid. However, it would also depend on valuation of underlying assets, what price that units are issued to invest and access to new assets in future by Powergrid InvIT. This would be critical input to decide whether to invest or not for me.

In my limited understanding, while InvIT are currently providing higher current yield, over a decade, I find REIT are better than InvIT, other thing being same. REIT has main income (lease rental) which normally increase with inflation.

Transmission assets provide very stable cashflow, but limited (in many case no linkage to inflation). If one go through portfolio of assets of IndiaGrid, except for 1-2 Transmission assets, none have inflation linked increase. Revenue is almost stable over a very long period. Hence, the future growth in distribution can broadly came only from acquisition of new assets and change (mainly decline in interest rate).

In case of Road assets, while IRB InvIT assets has superior on inflation and growth fronts (with toll being linked to inflation and traffic growth linked to economy), it has relatively higher volatile cashflow which can result in cash distribution from toll assets. Second point, life of road toll agreement is generally 15-20 years while that for transmission assets is generally 30 years. On third point, ownership of assets of Road is handed over to Government after completion of concession agreement, while in transmission agreement, revenue would technically terminate on end of agreement, the assets are still owned by Transmission InvIT which would have some terminal value.

In case of REIT, the revenue (lease rental and leasable area), assets are owned by REIT (with average life of around 50 years with maintenance), revenue having inflation linkage and income earning capacity over life of assets (unless Work from home results in major decline in Commercial real assets). So I see relatively lower current distribution, but potential to grow distribution to grow over a long period of time. Also capital value appreciation in Real estate is more likely to benefit over a longer period, to REIT over Transmission InvIT and Road InvIT.

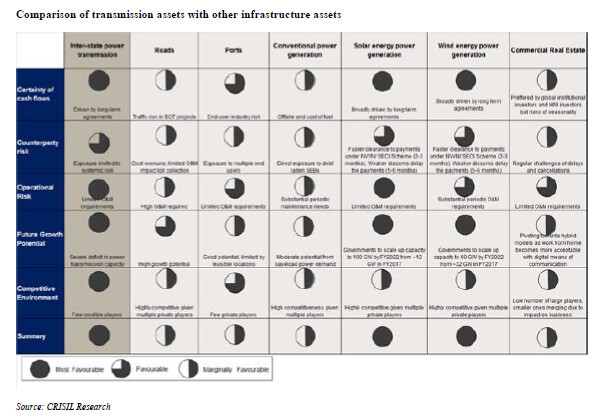

Find enclosed comparison of various infrastructure assets in India, sourced from IndiGrid Letter of Offer in 25 March 2021, Page 168 (in pdf) which I find very useful.

Please note that this is my personal view, may be biased and may be wrong.