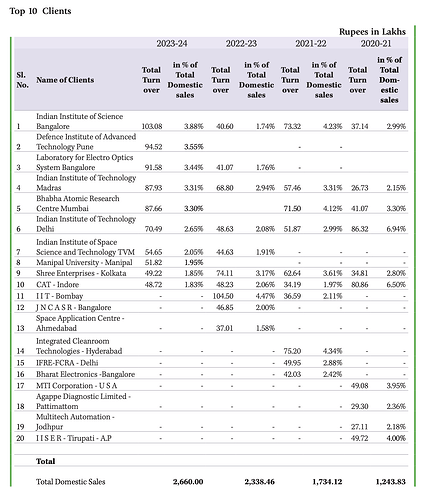

Holmarc was started in ‘93 by Jolly Cyriac and Ishach Sainuddin and is located in Kochi, Kerala. They manufacture scientific and engineering equipments used in research labs (DRDO, ISRO, BARC) and engineering institutions (IITs, IISc, BITS) and of late also have very strong exports to academic and research institutions abroad as well, from US (29 unique buyers from US), Canada and APAC region (35+ countries, 12 of them added in the last FY). The company has 438 domestic customers and 98 foreign customers (20 domestic and 19 foreign are new customers added in FY24).

I was skeptical at first to see such a company in the SME space, that too out of kerala, so dug in quite deep to figure out a lot of things which I have tried to cover in this post. What surprised me is the amount of information in the AR for such a tiny company. There’s a certain preciseness to the reporting of numbers here that’s uncommon (Most of them check out when dissecting with third-party data).

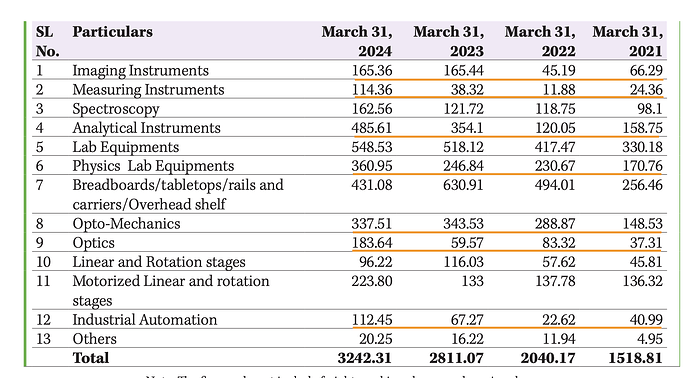

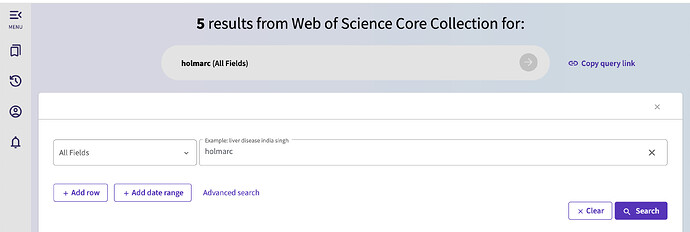

Product segments

These are the segments the company operates in. What’s nice to see is that there are a lot of segments which are growing over 2x in the last 3 yrs. Some of them like Optics and Measuring instruments are at over 4x!

Products

The company has a plethora of products across the categories listed above. Though they haven’t mentioned a number, I believe there’s easily a few hundred products if you click through the links under products.

Their youtube channel has over 100 product demos. A few which I liked

- Quantum Efficiency & Spectral Response Measurement used for testing solar cell efficiency

- Spray Pyrolysis equipment

- Confocal Raman spectrometer

- Solar simulator

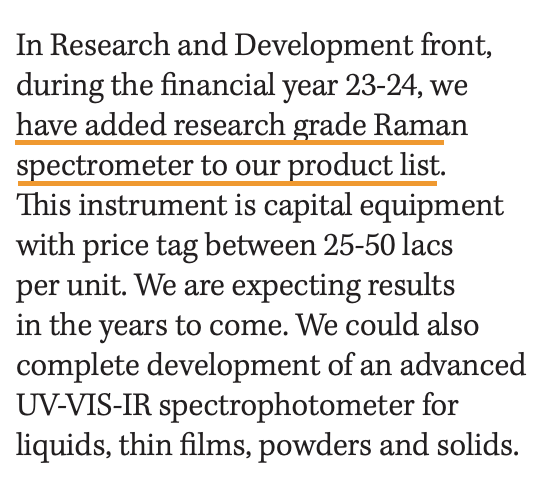

What is also nice is the consistency in introducing new products to the market. They introduced Digital in-line holography microscope, inverted fluoroscence microscope, triboelectric measurement system, solar simulator, quantum efficiency measurement system (for testing solar cells), LBIC etc in FY23 and Raman spectrometer, Laser scribing/ablation/cutting station, UV Laser lithography system, thermocycler etc. in FY24 (10 listed in FY24 AR).

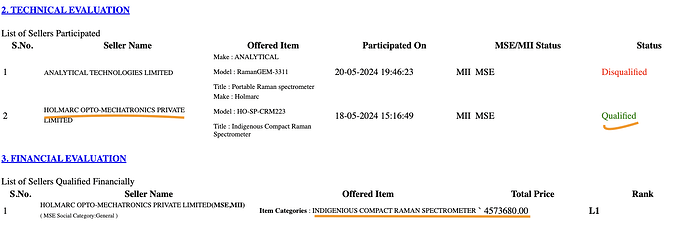

Some of these new products are already finding takers in the market. Take for eg. the Raman spectrometer which has a value between 25-50 lakhs!

ISRO had a tender for one. This tender was won by Holmarc. The total value of the spectrometer is 45.7 lakhs for 1 unit!

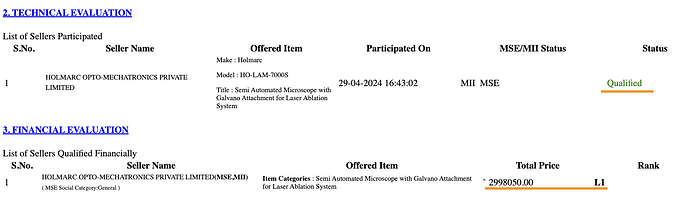

Here’s one more from ISRO for Semi-automated microscope with Galvano attachment for Laser ablation system.

This too won by Holmarc and its for 29.98 lakhs for 1 unit.

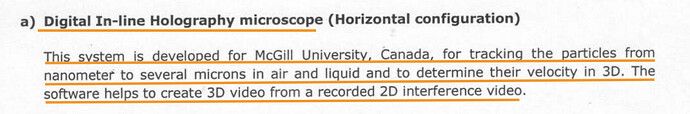

This one as per last year’s AR was developed for a Canadian university (I could locate this in the export data and it checks out)

I think these should demonstrate the capability of the company and the trust these institutions have in Holmarc’s ability. In some of these bids, Holmarc is the only vendor capable of doing the customisations required by the customer. The customer has the technical spec as well provided and Holmarc is able to custom build it for them.

One more thing i see post IPO is that there are high-value items in the exports as well. The number of items with value > 10 lakhs is

'20 - 2

'21 - 1

'22 - 4

'23 - 8

'24 - 16

We still have a quarter to go in 2024 and there are already 2x the number of > 10 lakhs products in exports. The capital infused in IPO is certainly helping the company take up multiple higher working capital products is how I see it.

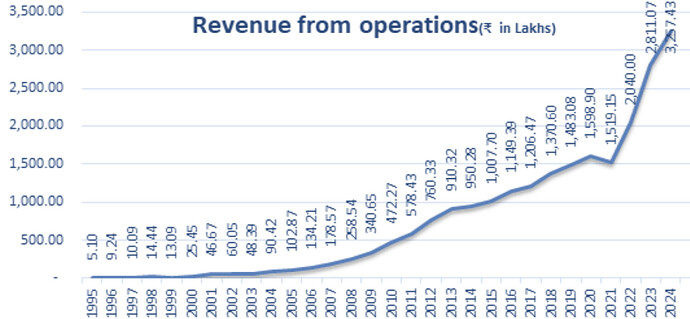

Growth

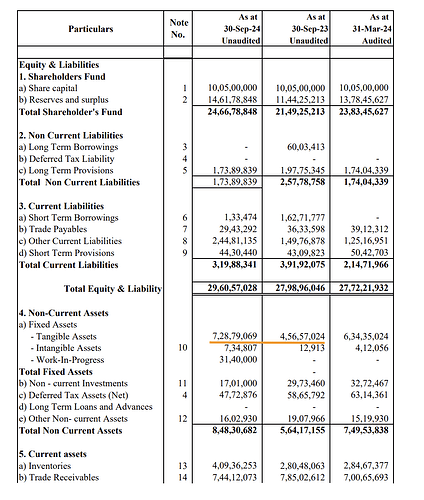

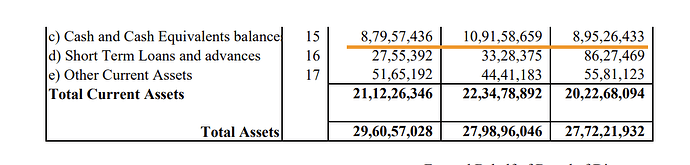

Overall company growth as well has been very good.

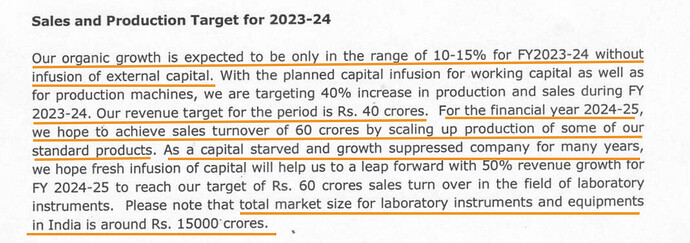

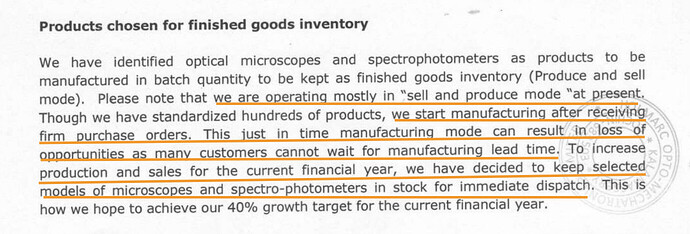

One would quickly notice growth slowing down between 2023 and 2024. The company has been starved of capital for growth once they crossed the 25 Cr revenue mark. The same can be seen in AR from the year before the IPO

Unfortunately the IPO happened only in Q3, FY24 so the target mentioned here can be assumed for FY25 (40 Cr) and 60 Cr for FY26. Also worth noting is the TAM mentioned of 15000 Cr. This is a small fish in the ocean and can grow for several years if the promoters do the right things (which they have for the last 30 yrs from their bootstrapped base to the IPO).

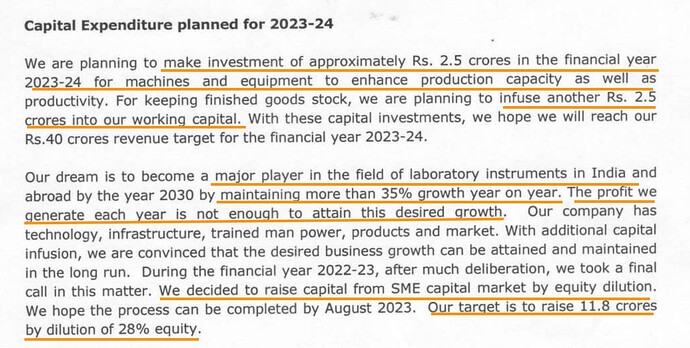

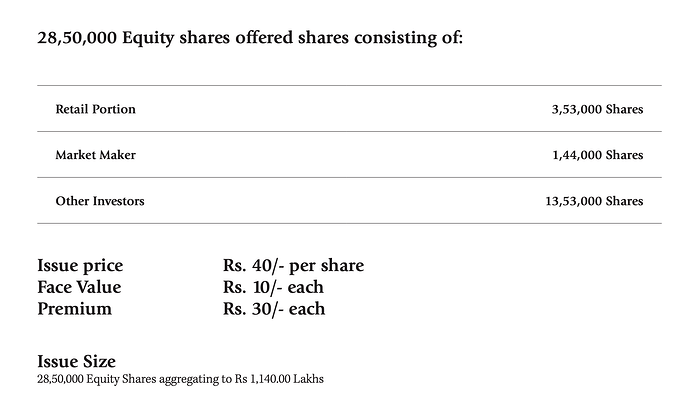

IPO

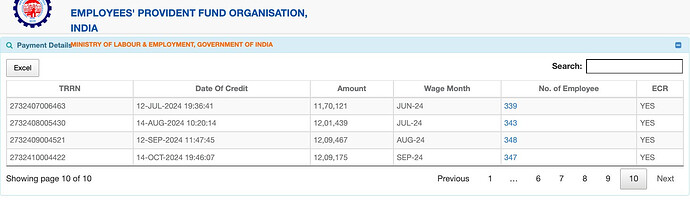

This was the company’s thought-process - again very precise in how much to raise and what it will be used for.

That is exactly what they ended up doing as the FY23 AR mentioned.

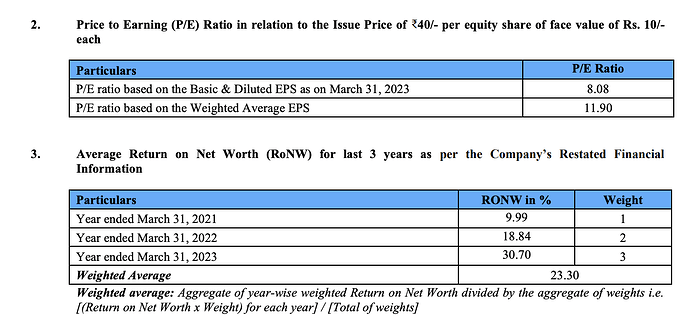

Out of naivety or misguidance, they actually priced the IPO reasonably at 8x TTM earnings in a sea of expensive SME IPOs (This missing greed is somewhat of a concern - more on that later)

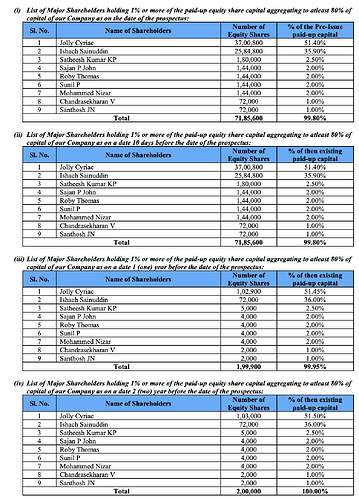

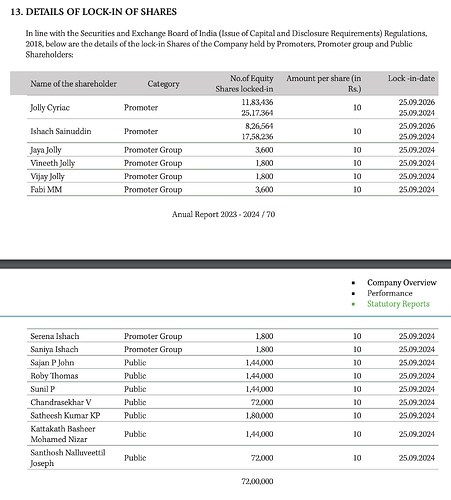

There’s also no hanky panky as usually happens in IPOs where there’s dilution and shares issued cheaply to promoters before a huge markup in the IPO. The SHP looks the same before IPO as it did 2 years back

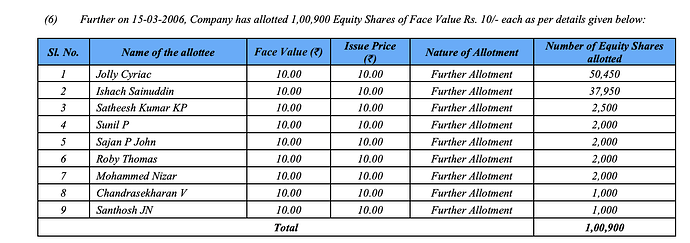

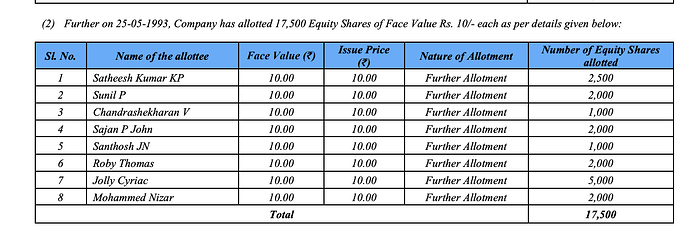

In fact looks the same since 2006. In 2000 and 2006 dilution Jolly Cyriac participated while Sainuddin didn’t which is why he has higher than the CFO. Otherwise both were equal partners at incorporation in '93 (They were classmates from IIT Madras)

The prices have been flat for a year around 100-120 levels with occasional dips below 100.

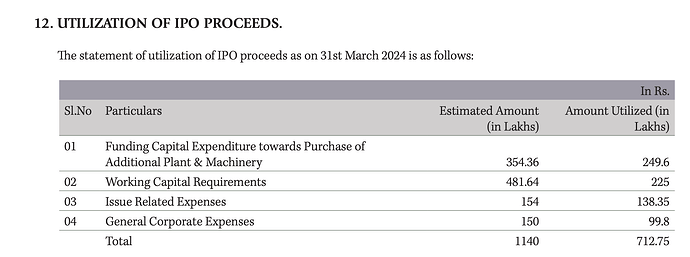

Now onto how they utilised the IPO proceeds vs what they said they will do in FY23 AR.

2.5 Cr capex as envisioned and 2.25 Cr in WC utilised. The rest will be used to expand further.

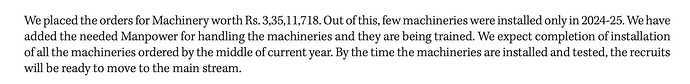

As per the Chairman’s letter, the first phase of expansion was completed by March 31, 2024 to increase production capacity to 3 Cr/month of products. Current expansion would have brought it to 4 Cr/ month as of Sept '24. As of Apr '25 this would be at 5 Cr/month making it ready for FY26 to do 60 Cr topline.

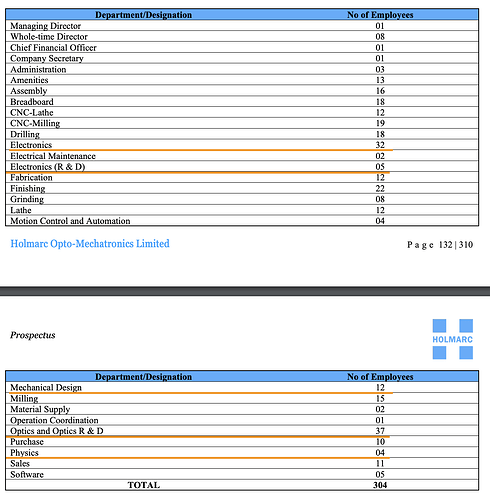

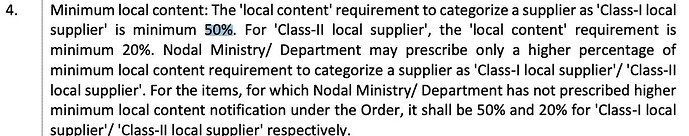

The company has also hired employees at a brisk pace to fuel this growth.

FY22 - 216

FY23 - 260

FY24 - 343

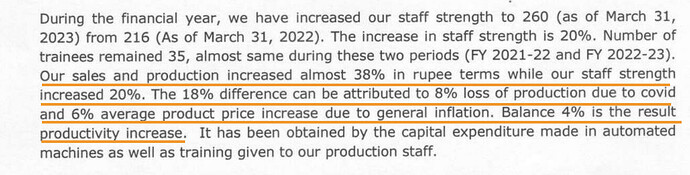

Haven’t seen a AR that explains how a 38% gain in topline was achieved. While most managements will take credit before the IPO, here they are saying 8% is due to low base and 6% due to inflation and so on (again, the precision!)

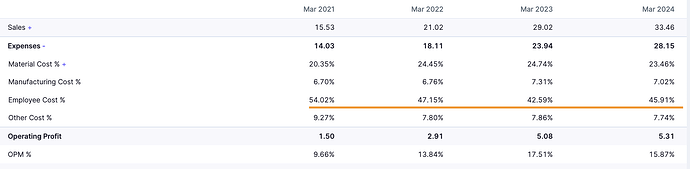

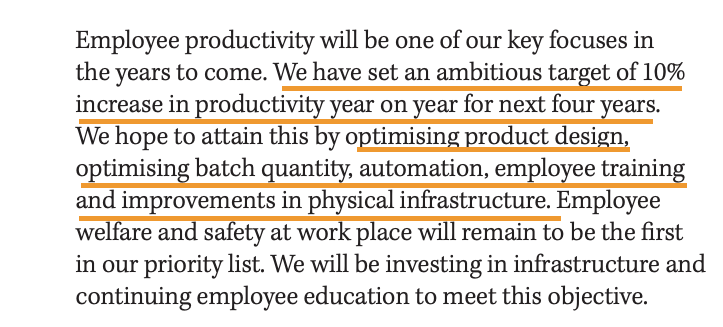

Now onto the productivity bit, because the company’s employee cost is a major component in the costs.

oYou can see the 5% producitivty improvement between FY22 and FY23 as mentioned in the above screenshot but since then lot of hires have been made and training for them is underway even as the capex is underway.

So there’s lot of scope for margin improvement in the next few years. They are targeting a 10% producitivity improvement for the next 4 years which should augur quite well.

While we speak of employees, its also worth noting the number of people in design and r&d roles in the payroll who create these products

One more major change since IPO (this is from FY23 AR before the IPO) is to move from “sell and produce mode” to “produce and sell” mode for at least some products which are standartised and have good demand. This is why the inventory days have gone up as well. The receivable days are however stable.

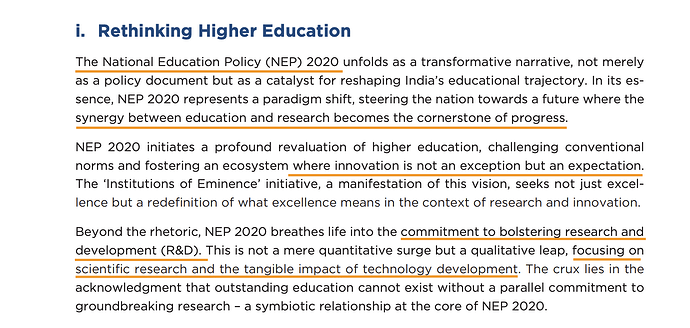

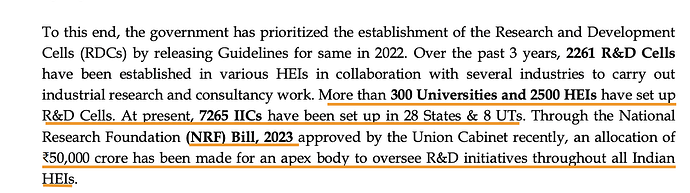

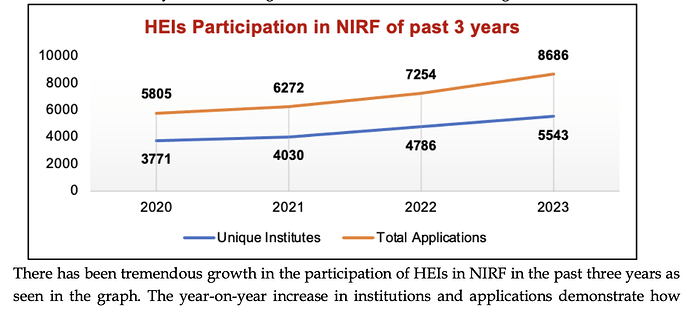

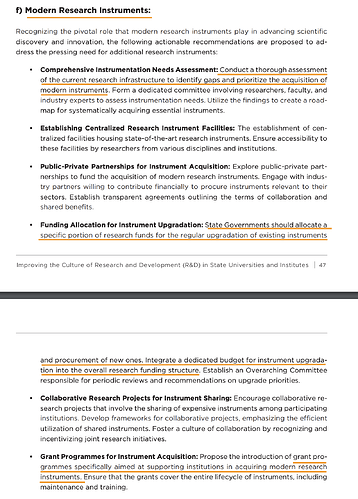

Industry

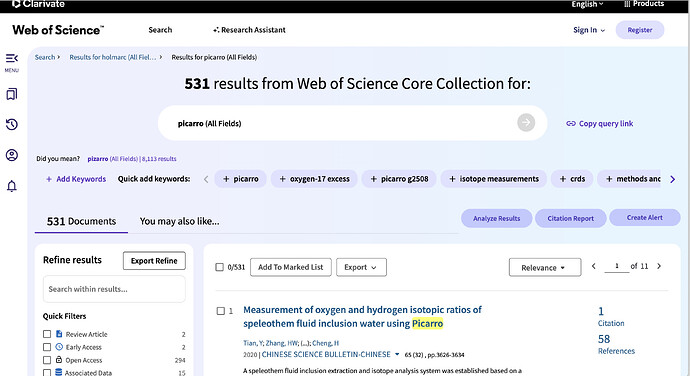

Some of the biggest players in this space

- Thermo-Fisher Scientific

- Bruker

- Horiba

- Renishaw

- B&W Tek

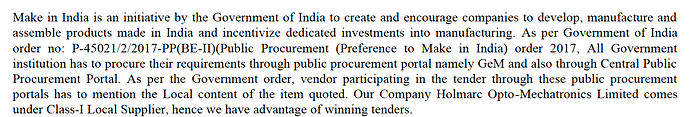

There’s no point doing any industry analysis considering the size of Holmarc (33 Cr sales) and the TAM (15k Cr in India alone and $44b worldwide). The have a strong cost advantage and as per AR have invested in marketing post IPO, so we can hope they can grow fast.

Valuation

The company is fairly priced and is not very cheap like it was at IPO. However, if they do manage to grow 35% CAGR till 2030 and get to 200 Cr topline, a 110 Cr market cap is perhaps not a lot. In the near-term in FY26 they should be able to do 60 Cr and with producitivty improvements, I think they can do a PAT of close to 10 Cr in ~2 years time. Technically I think 100-120 should be a strong base so not much to lose.

Risks

- I am worried there are little communist tendencies (employees vs shareholders as in communism vs capitalism), especially while looking at the employee costs. However, on looking at median remuneration and how much the MD/CFO are taking home (1 lakh per month + 1% sales commission), I think this fear might be misplaced

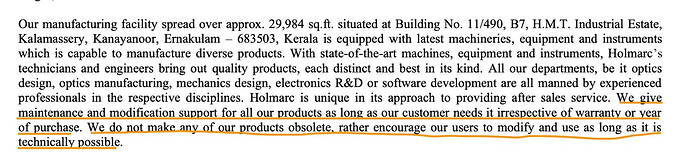

- Warranty is lifetime on their products. They seem to be proud of it also. They want customers to repair equipment and reuse them and not throw them away ever. There’s a definite lack of greed and a leaning towards sustainability from what I can see

- Irregular power supply (seriously!). This was mentioned in DRHP and also AR. This might be an issue since its in a non-industrial city like Kochi

- So far growth has come from academic institutions and govt. R&D labs. They should try to break into institutions like pharma companies to be able to grow further as they grow bigger. There’s no track record here to speak of yet (They have attended numerous trade fairs, pharma expos, machinery expos etc. in FY24 as per AR which shows a lot of intent to change this)

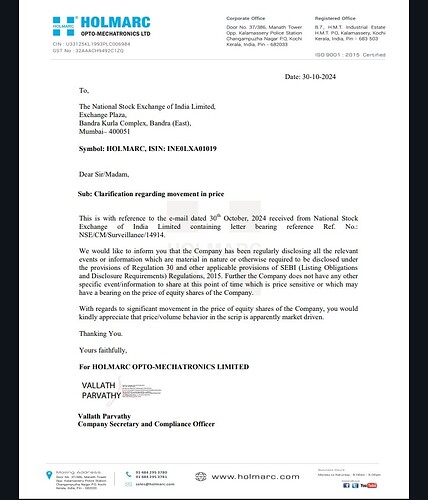

- Lock-in shares have been unlocked a month ago. Typically there’s a post IPO dumping once lock-in gets over. It could happen here also (No sign of it however at current valuations though lot of them were unlocked 26th Sept)

Also important to note that these investors have been holding from 1993 upon company formation. Dont think they are playing the IPO pop game.

Conclusion

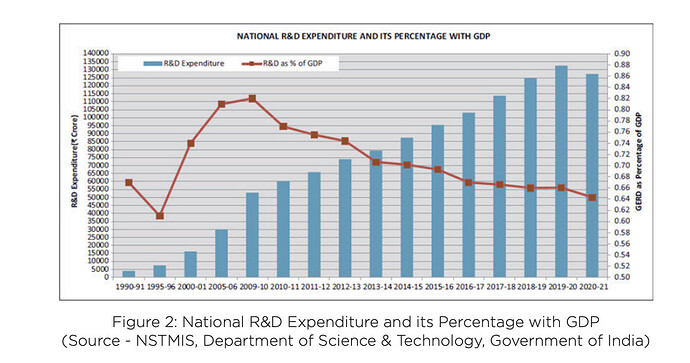

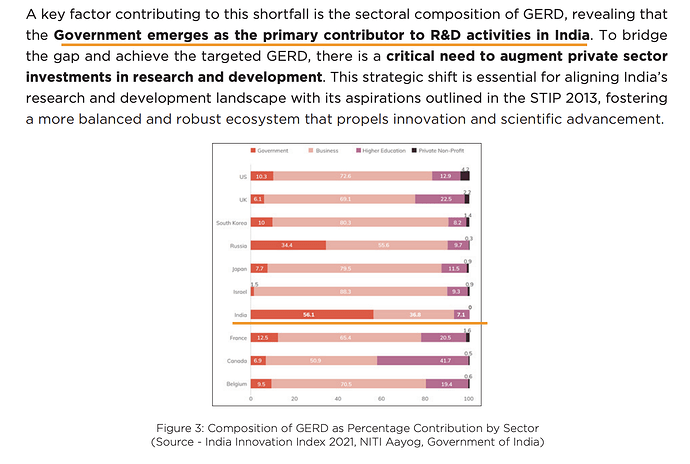

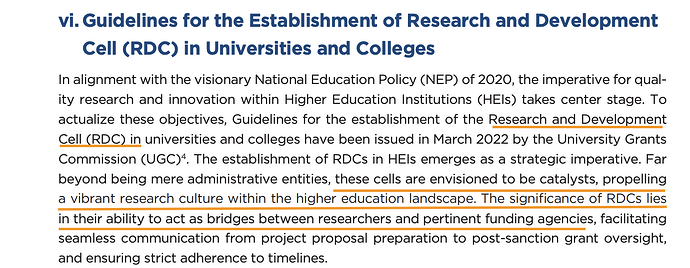

I’ve perhaps rambled on for too long. Simply put, the bet is on India investing more on R&D in the coming years and the company growing its exports strongly (wants to take it from 20% to 50% by FY28) and also in getting into high value products (> 10 lakh products) while also improving producitivty. It may or may not play out but with my leaning towards companies doing interesting things, I was tempted to take the bet though I don’t typically touch SMEs

Sources

- 2024 AR/2023 AR

- DRHP

- Website

- Youtube channel

- Tenders / Exports

Disc: Have a small position from around 100-120 levels taken last week (whatever was available to buy in this range). This is a highly illiquid stock with even 10-12% spread sometimes, so please be very cautious and don’t place market orders without looking at the ASK. I am not qualified to advise, please do your due diligence