Trying to play the devils advocate here.

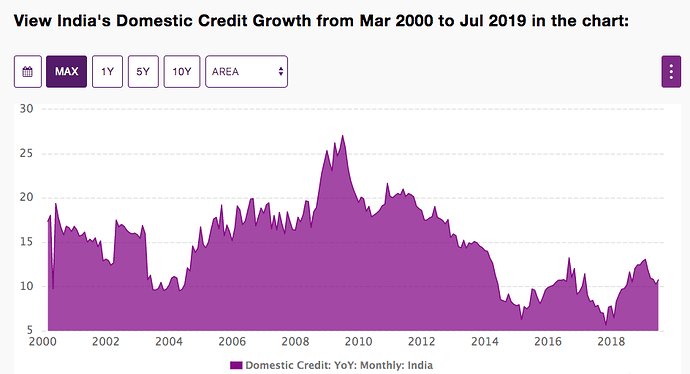

At 30 times FY 20 earnings multiple, the PE ratio seems stretched. While a consistent growth of 20% yoy would have been feasible during years of credit boom, it seems outright improbable thanks to the base effect (book going beyond 8 lakh crores requiring an asset addition of almost a lakh crore here onwards). Not sure if a valuation of 4.5 times book is justified in the face of falling GDP and rise in delinquencies (not withstanding their impeccable performance during past down cycles on a much smaller base).

In the absence of incremental credit growth from existing customers, HDFC Bank only has recourse to the following

-

Growth through securitisation involving purchase of retail NBFC portfolio (low risk immediately considering RBI backstop till 2020)

-

Increase in rural (NPA experience of > 1 historically) and consumer discretionary funding (retail financing where books have been pristine till date but could see rising delinquencies owing to job losses)

-

Increase in midcorporate / SME book expected to weather the second round of delinquencies owing to slowdown in auto / infra loans.

-

Reduce client selection criteria to BB below rated clients in the absence of too many bankable BBB- names

Any minor uptick in NPA numbers on a gross / net basis would weigh heavily on the counter. Even a downturn in credit pick up would be detrimental to valuations. The thrust on participation in retail loan melas (never seem them selling themselves so heaving in the past) and festive offers (customer acquisition by offering a 5% discount on iphones which traditionally doesn’t believe in deep discounting) comes across exercise in propping up the counters by showing a bump up in retail book.

Though this article seems to suggest all is well, wondering what prompted to leak this data selectively during the silent period. Expect some additional senior level share sales similar to the one exercised by Mr Puri recently

I would be happy to hear counter views.