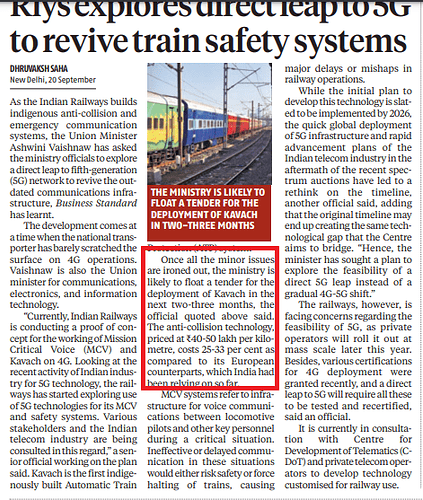

KAVACH’s financial opportunity.

Notes from yesterday’s AGM:

Chairman’s speech

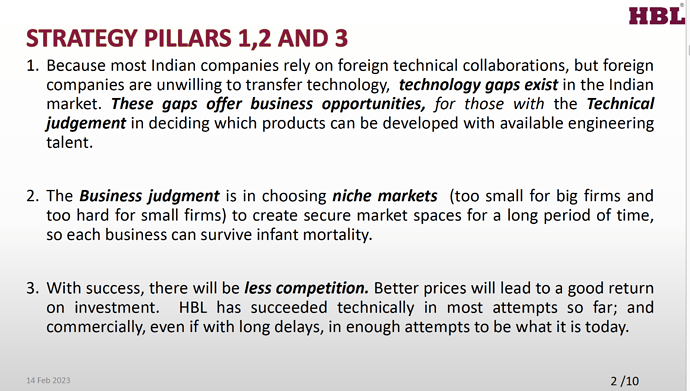

- Co’s vision – HBL wants to be a high margin business not focussed on top-line. To be in businesses with limited competition within the industry – achieve this by developing niche technology within the company across different product lines (which provides necessary diversification and stability).

- Current net margins are low as defence and railway are long lead items in India from R&D to commercialization - the fruits of which should come in years to come. FY 24-26 should see results of years of efforts in electronics, defence and mobility. FY 23 Sales should be similar to that in FY 22 and profitability marginally better than FY 22.

- We now have a strong balance sheet, with negative debt after so many years.

-

Key opportunities for this year

-

TCAS

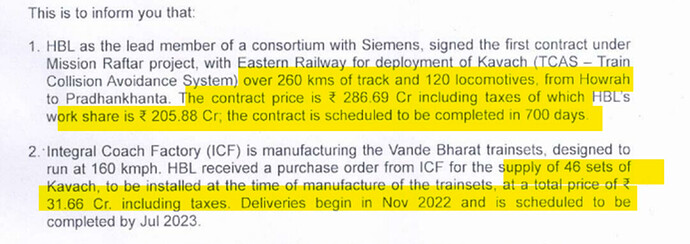

- Announced orders for TCAS in last 2 months

- Electronic rail signalling is an engineering intensive business largely occupied by MNC cos earlier– HBL started work on TCAS technology in 2007 – got developed by 2012 – But did not get commercialized as they were a monopoly then – waited for 4 years for competitors to join in – finally got rolled out starting 2020

- Today there are 3 players, and may be 1-2 players will join in few years

- Product quality and delivery performance of HBL has been excellent

-

Thermal batteries for missiles

- HBL supplies batteries for most missiles made in India

- DRDO - Agni 5 missile powered by HBL battery – performed very well – appreciated by DRDO. Now also exporting these batteries

-

Batteries for submarine propulsion

- Won against Exide in 3 successive tenders, who is a monopoly in this business. Also exploring export business

-

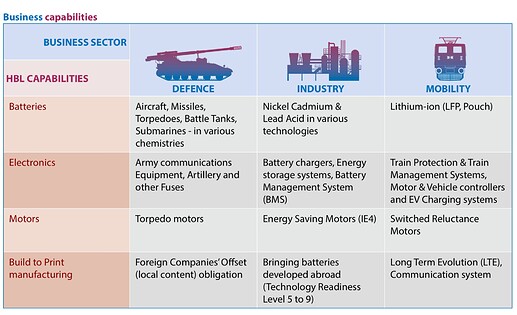

Electric mobility

- Not in mass market – buses, 2-wheelers

- Technology gap existed in motors and electronics for these vehicles which was being imported from China (earlier Canada)

- Plan to convert old trucks into electric vehicles – Viability will increase as diesel price increases - no other company in India doing this

-

Telecom

- Long period of decline, now customers coming back for battery replacement to ensure satisfactory performance, 4G/5G rollout might help too

-

TCAS

Question and answer session

- R&D spend over last 10 years across products c. 300 crs which was mostly taken through PnL (not capitalized) – huge R&D spend gives them a competitive advantage – they expect payback to commence now

- TCAS

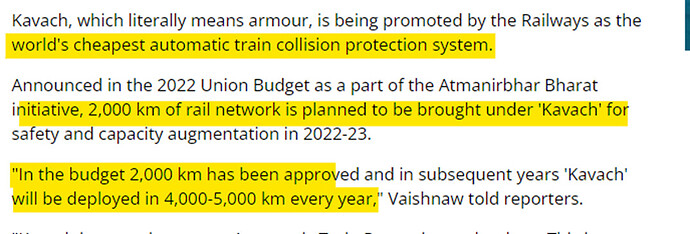

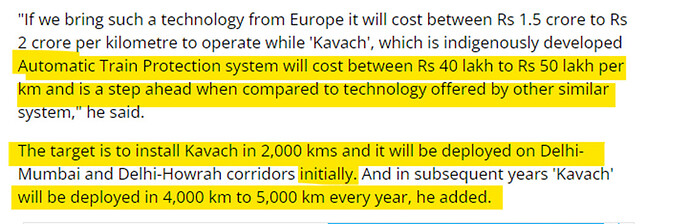

- Government plans to implement TCAS on 50,000 kms over 10 years c. 5000 kms / year i.e. 3000-4000 crs of industry size / year – with 1.5-2.0 year execution period

- Lithium ion

- HBL is working on LFP technology for lithium-ion cells – HBL has an order from DRDO for underwater applications – HBL has set up first lithium-ion cell plant in India – Don’t want to sell OEMs as low margin business.

- PLT batteries / data centres

- HBL and Enersys are only 2 cos commercial selling PLT, Developed 20 years ago

- PLT batteries started as an engine starting battery, HBL was selling to Cummins regularly

- Data centre market grew in last 4 years – PLT batteries are efficient w.r.t. charging time (10 mins for PLT vs 20 mins is industry norm currently), occupy lesser space. No competition in 10 mins charging time category.

- HBL export PLT batteries for engine starting - to use in battle tanks. Can export for data centres too but building global customer trust takes time. We are selling to Indian office of few foreign cos and that should open doors for other global cos. Had expanded nickel cadmium batteries in similar manner.

- On PLT vs lithium for data centres – Cost differences are huge c. 3x – lithium may not be sustainable given higher payback, and higher space requirements (as lithium needs BMS)

- HBL’s PLT cost is c. 20-40% lower than that of Enersys depending upon the application

- TMS

- HBL did DFC Corridor work with Siemens last 2-3 years

- Competition – No Indian approved vendors in TMS, only MNC cos – HBL is much cheaper than MNC cos

- TCAS had taken priority and therefore TMS was moving slow. Expected to pick up momentum in FY 24.

- Electronic Interlocking system

- In EI, HBL has a 2 out of 3 architecture while all other cos including MNCs are 2 out of 2 architecture

- Commercial orders expected from FY 24 – product development / field trials

- Capital allocation

- More conscious of amount we spend on RnD – not like how we did last 10 years

- Conscious of return on capital employed – currently at 13%, aim 18-20% in 5 years

- Not making capital intensive investments – In batteries other cos are making investments to the tune of 5-10k crs, we limiting ourself to 100 crs for now.

- Overall visibility

- Overall sales should atleast double in 5 years 1200 – to 2000-2400 crs

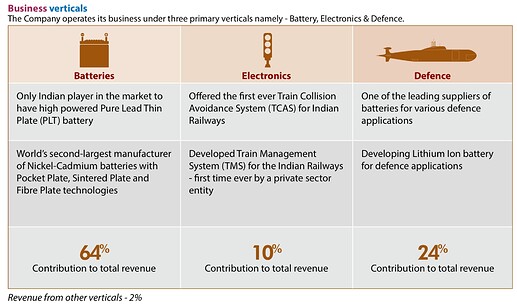

- Existing set up - Total batteries are 65% of turnover, Defence 25% and Electronics 10% – In 3 years Batteries c. 40%, and balance defence, electronics, mobility

- Lithium-ion is a specialized product for military, not huge in size

- PLT will grow, lot of potential

- Telecom – Lead acid battery is coming back- competitive with Chinese – with volume can give decent margin as overheads get absorbed – from 8% to 10-12% in 2 years – so no incremental investment

- Defence – we are a leading supplier with no competition – every defence product needs batteries – missile tanks, artillery guns, radar systems etc. - huge scope of growth

- Overall intend to invest less in battery business, invest more in electronics (for industrial and defence usage)

- Defence

- Scaled up well from c. 100 crs in FY 21 to c. 300 crs FY 22

- Integrated Communication System for Tanks – HBL had executed large orders for tank ICS around 2017. Every armoured vehicle that will be produced over next 10-20 years will be fitted with HBL system – but production capability for armoured vehicles in India right now is very low – overall a stable low volume business – with no competition

- No presence in Brahmos supply chain

- Command console for submarines - P75 / P75 I – projects running delayed – All cos bidding – But not a core area as HBL wants to focus on decent volume products.

- Artillery fuse – Approved by Ministry of Home Affairs for fuses for grenades by ARDE who has given Development cum production partner status–got it earlier this month – HBL has no competition in this space – Only competitors were BEL, BCIL who were majorly importing (c. 60%) main components so far and assembling in India

- High working capital requirements in defence cos 12-24 months – HBL’s WC cycle in defence is less than 4 months.

Cheers

Yachna

Disclosure: Invested

Notes from Kernex’s AGM (one of HBL’s competitors in TCAS space):

1) TCAS Orders received by Kernex

a) ICF Rs 32 crs + NCR – 255*2 = c. 540 crs confirmed +

b) ECR/Ashoka Buildcon under finalization / negotiation (where Kernex was L2) Rs 140 crs

2) TCAS - Annual revenue potential

a) c. Rs 1000 crs with Medha/HBL/Kernex each having 1/3rd share, Any new players will take atleast 2-3 years’ time for product development, field trials, certification etc. Currently, there are 2 players who are working on product development – Quadrant Future Tek and GG Tronics.

b) TCAS has export potential too since it is globally certified – in markets like Africa etc.

c) This product has been in development for 15 years and now has reached an inflection point where Indian Railways are ready to implement high speed trains etc.

d) Also, instead of retro fitting the Kavach system, Indian Railways has decided to install Kavach at loco manufacturing stage itself.

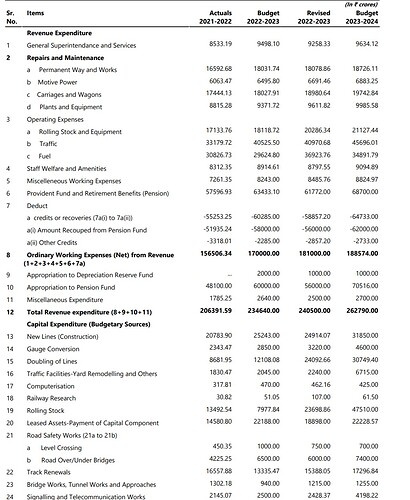

e) Budget 2023 is in works; TCAS expenditure estimates are for c. 4000 crs (c. 2x of 2023).

-

Unit Metrics of Kavach – Estimated EBITDA margin at c. 25-30% and net profit margin at c. 15%

-

Total WC requirement for 600 crs of order is c. 80 crs (c. 45 days) – To be financed by c. 30crs of incremental WC funding from banks and 50 crs preferential issue of equity shares (dilution of c. 12-15%). There are no funding issues with Railways. Get paid < 7 days of arising an invoice. Also, there is a bonus clause for early completion. Initial WC requirements might be slightly higher due to site preparation etc.

-

How much capex required for execution of TCAS – Existing set up will suffice for next 3-4 years upto 500-1000 crs topline, no significant capex, small upgradation may be required

-

Billing Cycle – Of new TCAS orders of c. 600 crs - FY 23 and 24 topline guidance – c. 60 crs in Q4 FY 23, c. 70 crs per quarter in FY 24 and balance in FY 25

Cheers

Yachna

Disclosure: Same as before

I took time to buy into HBL Power systems because hitherto I was used to buying companies where the numbers are there but HBL is a company where the numbers will come in future. So, the past looks hazy but the future looks bright as amply written by the folks following the company closely.

Some observations:

- Debt NIL

- RoE = 10% (Low but cyclical low)

- Last 10 years NIL revenue growth & so is share price (doubled in 15 years). So, market has been efficient. Not much future is baked in the current price.

Now, the numbers:

FY 22:

Batteries ~ 780 Cr

Electronics ~ 120 Cr

Defence ~ 300 Cr

What FY 25 looks like?

Batteries: 1000 Cr

Electronics: 1000 Cr

Defence: 300

Rationale: Batteries, I assumed average growth even with 5G.

Electronics: Assuming 3000 Cr per Annum of Railways business & HBL takes 1/3rd of it, assumed not much from electric drive train.

Defence: High base of FY 22, so assumed NIL growth.

In all the three segments, I have filled in conservative numbers. Even though Railways ministry has been super efficient, at the end of it it’s a Government business so I assumed Kavach project to overshoot by 4 years & finish by FY30 only (30000 crore budget spanned across 10 years). The fly in the ointment is 2 new competitors. By then I assume HBL would have showcased enough project management skills. I assumed stable government till then & fair budget allocations. Given the fiscal status & GDP growth, this is fair for India in the coming decade barring anything cataclysmic.

FY 25E, on 2300 crore revenue & margins of 15% (12% is last year margins & Railways business is highly margin accretive & less working capital intensive as well given that MoR has been paying in a week), EBIDTA comes out to be ~ 350 crore. There would be servicing revenue which is annuity type where HBL TCAS is serviced by HBL only for eternity. Servicing revenue is very high margins. Triveni Turbine too is increasing service revenue, which grew by 80% last quarter, of course on a low base. But I think Triveni can service any other turbine as well not only proprietary turbines.

It all comes down to -

So, Conservatively, For a business making 350 crore EBIDTA in FY25E, NIL debt, RoE >15%, 12-15% growth, 15% margins, it seems fair that 15 times EBIDTA which makes the market cap to 5250 crore, while the current market cap is 3000 crore.

Risk: Most of the thesis is predicated on Railways!!! Key man risk as pointed out by others. I would have preferred the MD appoint a professional CEO.

Someone interested can point out chinks in the armour?

The Annual report is amply positive:

Important snippets below:

Yesterday’s budget gave good vibility on next round of orders for TCAS. Signalling and telecommunication works allocation (Line 24) increased from c. Rs 2500 crs for FY 23 (of which Kavach was c. Rs 2000 crs) to c. Rs 4200 crs for FY 24.

This was also reaffirmed by Railway minister wherein he mentioned Kavach alloation for 5000 kms in FY 24 compared to 3000 kms in FY 23. Refer Ashwini Vaishnaw Talks About Budget Allocations To Railways | Budget Townhall | CNBC-TV18 - YouTube

Delighted to present to VP Community HBL Power Systems Stock Story .

Kudos to @YachnaBhatia for doing a super (dedicated) job in meticulously compiling another very interesting VP Business story. A business that many might characterise as having a chequered-past, especially those invested for long.

She has succinctly brought forward what has “changed” in the business/product mix, huge “Optionalities” that the business now exhibits - that can make for an exciting future for another high-tech, import substitutive, Atmanirbhar (primarily B2G) business. Others like @Anant @Rokrdude @dd1474 @Donald have added value, and collaborated.

Despite some easily identifiable missing “Investor wishlist” parts (like high Re-Investment requirements and lack of an intrinsically scalable business model) this is a business thats NOT easy to ignore, B2B or Not. Might even be positioned uniquely for a disproportionate “atmanirbhar” future should government policies/budgets remain stable and encourage sustainable progress.

Hope you enjoy the story as much as we did the process in bringing this to publishable shape.

HBL to acquire 34-35% stake in defence applications startup Tonbo Imaging for 150Cr via CCPS. Tonbo is into developing electro-optics solutions for defence applications. The implied acquisition valuations for Tonbo are 8.7x FY23E sales. Tonbo’s investors include Qualcomm and Edelweiss.

As per this old article on Tonbo, the company has a large sales pipeline and immediate order visibility. However the nos mentioned in the article (2400Cr of immediate visibility orders) have far from translated in the current revenues (FY23 9M revenues 37Cr). So most of this story is still one of potential. HBL hasn’t mentioned in the disclosure whether the company makes profits or losses.

This is perhaps another example of aggressive/adventurous capital allocation by HBL, ploughing in 16-17% of its net worth into an exciting but yet to scale technology company. In the past, Management themselves have admitted that their capital allocation has been more adventurous than warranted (Beautifully captured in the stock story). Will it be different this time or the same old? Investors are probably hoping that management doesn’t plough capital into another 10Y horizon business ![]()

Another bit of information that may or may not be relevant to the investment thesis is that Tonbo Imaging has come under the scanner along with the likes of BEL for supplying military technology to the Myanmar junta.

Disc: Have a small position in HBL.

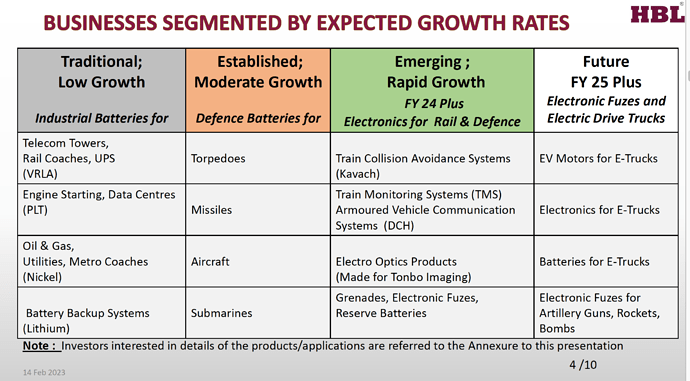

HBL Investor Presentation Feb 14, 2023

- Think this is a great first step by the Company on Investor communication/clarity

- If this is followed up by Con calls - they will be held to the same standards of transparent communication

Sharing selected excerpts that bring more clarity on HBL strategy, and how Management segments current business trajectory

-

Judging by the presentation - that is HBL strategy vs say a focused next level for business approach. They wont make things happen, but wait for right tailwinds, having made sunk investment choices. Case in point, clubbing PLT batteries for Data Centre Applications under traditional low growth segment doesn’t look right when the only other competitor and market leader EnerSys is growing at 20% plus.

-

Having said all that, the more important thing for us to notice is the “Change”. Both in Mgmt opening up/bringing clarity (obviously internally too), and equally in the Operating Environment (Atmanirbhar)

-

This business/design has many long shots - which are NOT ignorable

Interesting to take note of Lots of details shared in the Annexures about each business segment including the recent Tonbo Investment.

Very welcome development.

How the business performs in next 2-3 years we will only know in hindsight.

Disc: I have a small investment. My views are biased.

PS1: Slide 7/10 Business segment Projections for next 3 years should be taken with due pinch of salt, read along with company disclaimers and the punchline “There is many a slip, between the cup and the lip” ![]()

PS2: Important to understand/get the direction right, rather than get fixated on the specifics

Snippets from Recent Ken Article on Tonbo Imaging (where HBL has recently brought stake)

In the budget for 2022-23, the Indian government allocated US$17.6 billion to spend on weaponry. The market size for electro-optics—which constitutes 30% of the spending in any modernised equipment—is expected to be US$2-3 billion.

Lakshmikumar cites the example of the Arjun Mk-1A tank, which is significantly indigenised and has a price tag of ~Rs 50-60 crore (US$6-7.3 million) per tank. The “eyes and brain” of this tank, formed by the electro-optic component, are valued at ~Rs 15-18 crore (US$1.8-2.2 million).

The company expects to post Rs 110 crore (US$13.4 million) in revenue in the year ending March 2023 and aims to capitalize on the prospects presented by the Indian government’s indigenization initiative.

With the capital raised, Tonbo is now targeting new revenue streams. It plans to license its technology and sell electro-optic subsystems to competing OEMs, such as Elbit from Israel and Qioptic from the UK, as Tonbo’s products are cheaper than what they are currently building. It achieves this by using lighter materials. “Instead of selling thermal weapon sights, I want to take the guts of it and start offering it to different people,” said Lakshmikumar.

On the back of these opportunities and orders, he believes Tonbo will “comfortably” achieve revenues of Rs 250-300 crore (US$31-37 million) in the year ending March 2024.

Informative video on the operational aspects of TCAS.

Tail collision avoidance. Head-on collision avoidance. 2-way SOS alerts between station and loco. Dynamic speed limits.

Most importantly Automatic override of loco pilot when needed in situations above; braking, slowing down.

Much needed centralised view and control of locos. When fully implemented will be a game changer for Indian Railways as the information gathered by these devices goes beyond just collision avoidance. In future may help railways plan train schedules and even optimise them.

A. Total Indian Rail Network = 1,15,000 KM

B. Cost/Km of deployment (basis last order received) = 0.5 Crore

C. Size of Opportunity for TCAS Deployment on Tracks (A*B) = 57,500 Crore

D. No of Operating Trains in Indian Railway - 22,000

Freight - 9000

Passenger - 13000

E. Cost of Kavach Instrument/Train (basis last order received) - 0.7 Crore

F. Hence Size of Opportunity for Kavach Instruments on Train - ~15,000 Crore

G. Hence Total Opportunity Size of Kavach Instrument + Track Deployment = ~73,000 Crore

Plan is to add 4000 - 5000 Km on TCAS every year, thus it will take approx 29-30 years to deploy TCAS on 1,15,000 km. Since this is govt work, and Modis and Gandhi’s will come an go, we should take atleast 25% buffer on time taken. Thus approx 35 years will be required for this entire opportunity to play out.

Thus Revenue Potential Every year = 73,000/35 = ~2100 Crore per year

Assuming 50% Business goes to HBL - Revenue potential for HBL will be 1050 Crore

Assuming this is a 10% Net margin Business (i.e after Working Capital Cost, assuming that Op Margin is 15% ) will lead to 100 Crore incremental Profit

Existing Operating Profit = 100 Crore

So max PAT = 200 Crore (Incremental + Existing)

Giving 20 Times Multiple to this PAT - will lead to market cap of 4000 Crore, means an upside of roughly 30% max

Is this correct assessment @hitesh2710 @Donald @basumallick @Rokrdude @Anant

PS : Value per order was derived from following

deployment of 4000-5000 km per year was derviced from

Correlation of my working on Price/unit done from

@ashwinidamani suggest you to go through this thread, the HBL stock story thread posted by @valuequest07 , HBL presentation on the exchanges and Kernex AGM recording (not sure where it is) to get to understand the HBL story in detail.

On the TCAS side: As per multiple government sources (public) the TCAS opportunity is for 35000 Km to 60000 Km. Last year around 3000 Km was tendered at roughly 60 lac/KM. The budget target this year is for 5000 Km which should be around 3000 cr. for all three players. The government intends to complete 35000 Km in next 5 years, there is also a possibility of more players coming in. As per Kernex AGM the EBITDA margins are over 25% and with very little dep. would mean around 15% PAT margins. There is also an O&M component for 15 years 2/3 years post installation at 5% of the tender value. Assuming HBL at the end of 5 years does around 10000 Km, the O&M itself would be at 300 cr annual run rate and assuming they do a good job at TCAS most of it should flow to PBT.

HBL is not a one race pony there are so many large high margin opportunities like Artillery fuzes, TMS, Electro Optics, Grenades, PLT batteries etc. There are also risks since a lot of these are B2G opportunities but what TCAS does is it gives at least a 2 year time period for these opportunities to come to fruition.

Highly recommend going through the stock story by @valuequest07 .

The only difference between what I said, and what you say is

PAT Margins - 10% considered in my assumption vs 15% in yours

O&M - 300 Crore yearly revenue run rate - which should acrrue after 2025-26 atleast

Meanwhile I have been extra optimistic by assigning 50% order wins to HBL, whereas we all would appreciate, govt wouldnt let this be a 2 player market

Other questions or Risks to consider

All this movement has come because of Modi Government. With Elections round the corner, shouldnt we wait. If at all there is some upheavel, entire Railway board may change. Remote risk as of now, but still exists

Why Banyan Tree had to exit 10%+ of the stock in a piece meal basis. No Institutional buyers came forward for a block deal ??? Typically such large stakes are first offered via block deals. What did the Institutions miss in the entire thesis that we are seeing.

Infact HBL has now shared a good explanatory PPT and still no buyer interest.

I am not implying Institutions arew godsend. But atleast think what risks are they seeing ?

The difference is how we perceive things other than TCAS and as I mentioned in my response. The 300 cr O&M by itself is significant and should not be brushed under.

Not just Banyantree even Oman India took an exit since Dec. 21 almost 20% equity was sold in the markets and no significant institutional buying has happened hence. The stock is up 3x since Dec21 and the profitability around 5x.

My take is don’t care. If you have conviction in the business/mgmt/growth/quality etc. general disbelief is a great opportunity. In hindsight almost all of my recent picks have been where forget institutions some of my good friends had reservations to begin with and some still have.

A lot of risks are pointed in the stock story by @valuequest07, what risks an institution sees is something only they can answer.

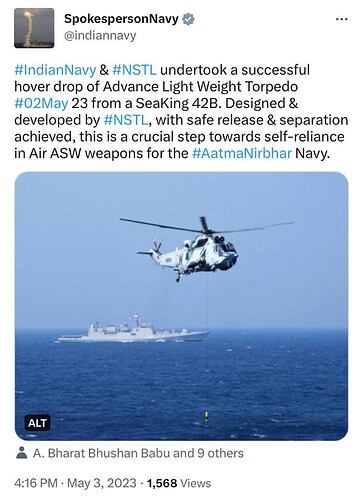

Source https://twitter.com/indiannavy/status/1653712681449426944

FY22 Annual Report- HBL has made more progress on the development of advanced Light Weight and Heavy Weight Torpedo batteries for Indian Navy and expect to complete these development orders in FY24

Earlier update Mar 2021 Lightweight torpedo test-fired successfully - The Hindu

News on Advanced Heavy Weight Torpedo - Varunastra

DRDO has been testing the submarine-launched variant of the Varunastra torpedo using a swim out tube. The laboratory has initiated the process of testing this torpedo in a simulated environment before firing it from a submarine of the Indian Navy. The swim out tube is 8 meters long and is designed to exactly fit the 7.8 meters long Varunastra. The tube mechanism includes lowering the tube into the water and then launching the torpedo as if it was launched from a submarine. The test structure also has recovery mechanism with winches, HD camera to record the launch for analysis, and other electrical setups required in an actual submarine torpedo launch system.

Powered by an electric propulsion system with multiple 250 KW silver oxide zinc (AgOZn) batteries, the Varunastra can achieve speeds in excess of 40 knots (74 km/h; 46 mph) and has a range of 40 km (25 mi).

The torpedo has already been ordered by the Navy in two batches and has also been exported to Vietnam and another country.

Source https://alphadefense.in/testing-of-varunastra/

More details https://delhidefencereview.com/2020/01/14/indias-varunastra-heavyweight-torpedo-all-you-need-to-know/

BDL launched manufacture of the Varunastra under technological guidance of DRDO in FY20 and later received a contract worth Rs 1,188 crore for supply of 63 of torpedoes in next 42 months. Battery Cost is around 20-40% of the Cost of the torpedo.

HBL is one of two suppliers in India which have been supplying batteries for Torpedo Propulsion to the Indian Navy. HBL also exports these batteries in limited numbers. HBL has two contracts from NSTL/ DRDO for development of state of the art Al AgO Torpedo Batteries. Only two companies in

the world make such batteries today

Source HBL 2023 PPT https://www.bseindia.com/xml-data/corpfiling/AttachHis/bf42f239-a7c1-4192-824c-7f3d15347c6f.pdf

FY22 Annual Report- HBL has made more progress on the development of advanced Light Weight and Heavy Weight Torpedo batteries for Indian Navy and expect to complete these development orders in FY24

An Update on Tonbo (in which HBL is planning to acquire 34-35% stake)

Tonbo is providing seeker and launcher unit for BDL ATGM Amogha 3 which was tested successfully in March 2023. The product seems to be on par with world’s best product like Israeli Tank-Buster ‘Spike’ Missile and US’ Combat-Proven ‘Javelin’. Orders can be over $500mn over the next couple of years.

https://twitter.com/GODOFPARADOXES/status/1640806481342746655

Pretty Average Results. PBT has declined YoY

https://www.bseindia.com/xml-data/corpfiling/AttachLive/321ec77f-70fa-456e-a442-256209ff9ddf.pdf

interesting thing to note that just a 1% drop in EBITDA margins from guidance given earlier has been pointed out and the reasons for the same has been given by the management.

Sad and tragic accident.

This might and should pick up pace atleast now.

Best

Divyansh