HBL power systems promoted by Dr A. J. Prasad was setup in 1986. It has built substantial expertise and research capabilities in batteries. He along with Ms. Kavita Prasad (daughter)- whole time Director and a team of experienced professionals, look after the day-to-day operations of the company. HBL has been a well-known name in the manufacture of industrial batteries catering to various industries telecom, railways, power, defence, etc. Over the years HBL has diversified over multiple industries other than batteries like electronics and engineered products based on in-house developed technologies. The company’s product portfolio mainly caters to niche sectors namely telecom, UPS, solar, defence and railways in India. Although, batteries continue to remain the major revenue contributor for HBL, with HBL being the second largest supplier for telecom batteries, the company is gradually working to reduce its dependence on telecom sector and increasing its concentration towards defence and railways.

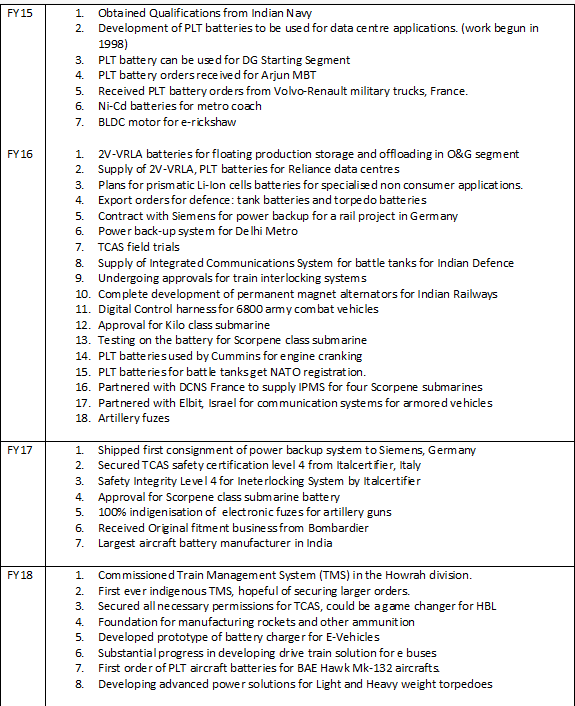

HBL, a history of R&D over the years:

HBL has a history of developing significant R&D capabilities. The below table gives some idea about various projects/R&D initiatives that HBL has taken over last many years (from annual reports):

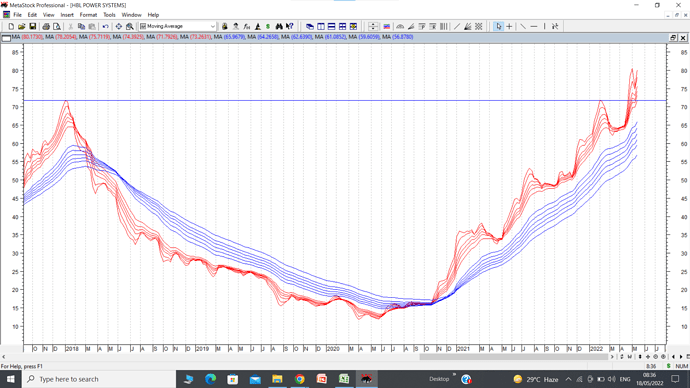

As one could see HBL over last many years have undertaken several long-term projects. Despite some critical and complex projects HBL has been a rank underperformer and has shown significant issues in commercialization of this R&D.

Is something changing here?

HBL has become virtually debt free from incurring an interest expense of 126 cr in FY13 also the margins in Q3FY22 were the best.

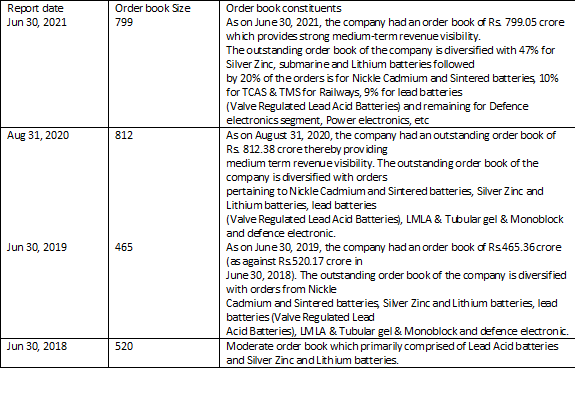

HBL’s Order book over the years as reported by care ratings:

Two things which are visible are

a) Increase in order book from 500 cr to 800 cr

b) Change in order mix from Lead Acid to more specialized segments.

The latest care report also says this on new capex:

The company is planning to set up its own manufacturing facility at Mahbubnagar, Hyderabad to manufacture Lithium Ion cells and Electric Drive Train (EDT). The total cost for proposed capex is expected to be around Rs. 110.00 crore to be completed in two phases. The capex is proposed to be funded through term debt of Rs.80 crore and balance through internal accruals. The financial closure for Phase I is partially achieved. The Phase I of the project is envisaged to achieve COD by Q4FY22 and Phase II will be started on successful completion of Phase I.

As of date no company in India makes Lithium Ion cells.

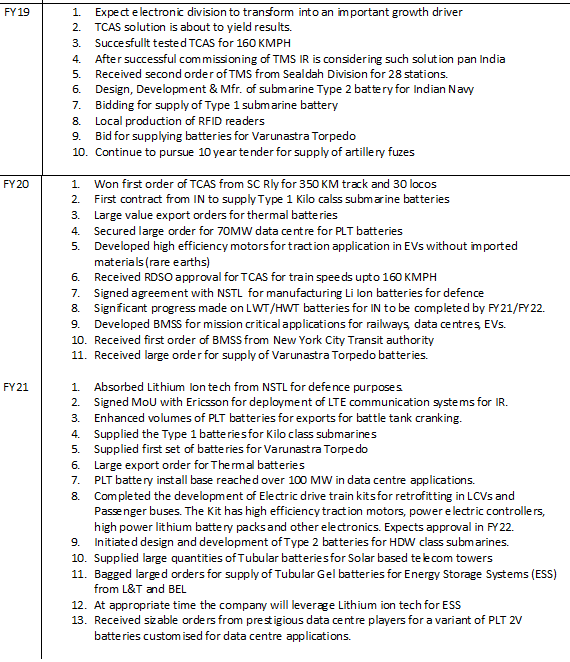

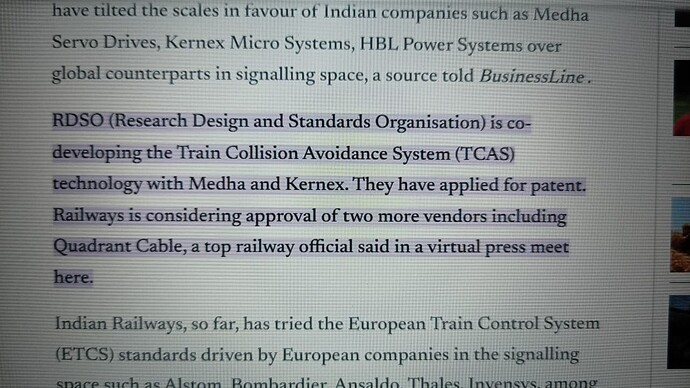

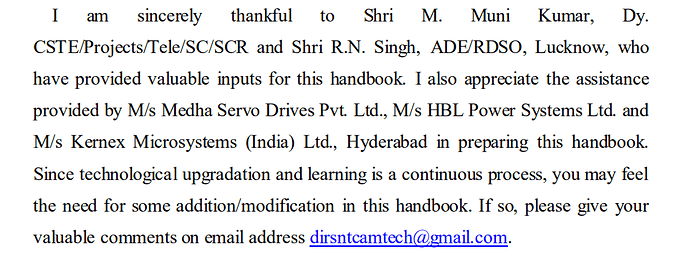

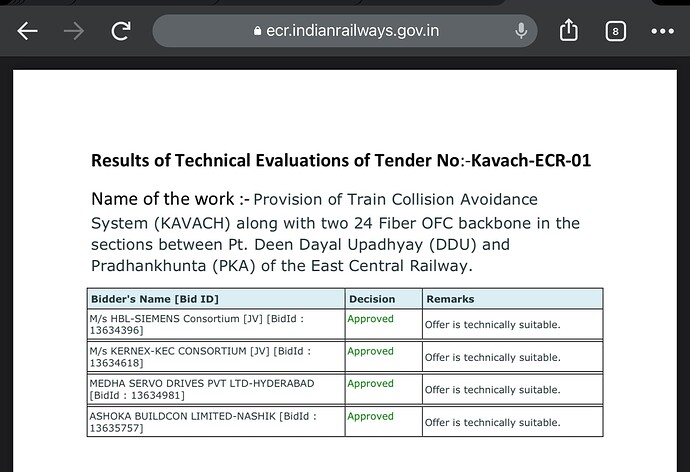

Further there is significant activity happening on the TCAS front. TCAS is now renamed as Kavach and tenders for Kavach for Delhi Howrah and Delhi Mumbai routes (3000 KM) are already out. As per my understanding TCAS which was earlier required for safety reasons has now become an operational requirement for trains running under 160 KMPH mission raftaar.

As per government plans Kavach will be installed phase wise on around 30000 KMs. Kavach has only three approved vendors as of date Kernex Systems, Medha Servo and HBL. The total opportunity size is estimated at around 15000 cr (for 30000 KM) at 50 lac per KM. Some tenders listed on railway site are as follows:

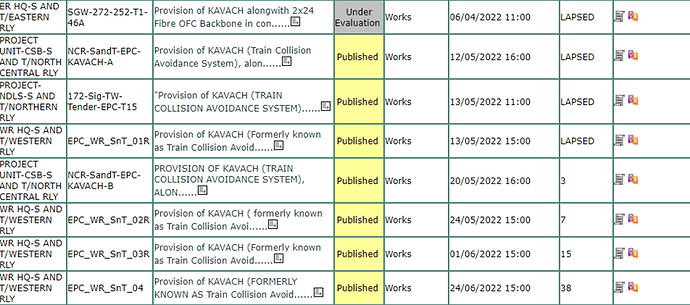

Kavach Work Status:

Some promotional material for Kavach from Railways:

In conclusion HBL is at an interesting stage in its evolution. Going by its track record the company has never failed to deceive, its products, R&D have always been impressive but the execution never up to the mark. The execution on Lead Acid side also shows company’s deficiencies in its operating structure including issues with a management focused heavily on R&D, lack of processes and a failure on pretty much every side of the organization like marketing, sales, strategy except R&D. Despite the above HBL today is at a place where it is into areas of significant future growth. Its capabilities in Railway electronics (TCAS/TMS), specialized and differentiated batteries for defence, data centres, aviation, mobility and energy storage solutions can each be a very large vertical. All these make HBL a very interesting play.

Risks:

a) HBL’s core business of lead acid batteries is shrinking and in most of the other things it is doing there could be significant lumpiness and delays.

b) HBL has a very bloated balance sheet in terms of receivables and inventory. HBL’s inventory management has been extremely poor over the years. Some of it could be due to the nature of work it does too.

c) Dr. Prasad is the brain behind HBL. He is 77 years old and this creates a significant key man risk for HBL.

d) The company’s annual reports mention several projects since many years with little to show up for. TCAS/TMS/Interlocking etc. have been delayed multiple times.

e) TCAS orders are for L1 player only, so orders are not guaranteed.

f) A lot of what HBL does is B2G in nature which brings its own set of uncertainties and business longevity issues.

Discl.: Invested

Aircraft Batteries

http://www.hblpower.de/uploads/media/Aircraft_brochure_March_2021_02.pdf

Newsletter highlighting tank batteries:

http://www.hblpower.de/uploads/media/HBL_Newsletter_Issue_4-_Oct_01.pdf

Newsletter highlighting ESS and German rail project and data center

http://www.hblpower.de/uploads/media/HBL_Wire_-_Issue_3.PDF

Command consoles made by HBL for Kalvari class