Couldn’t find any discussion about HG Infra hence initiating this topic.

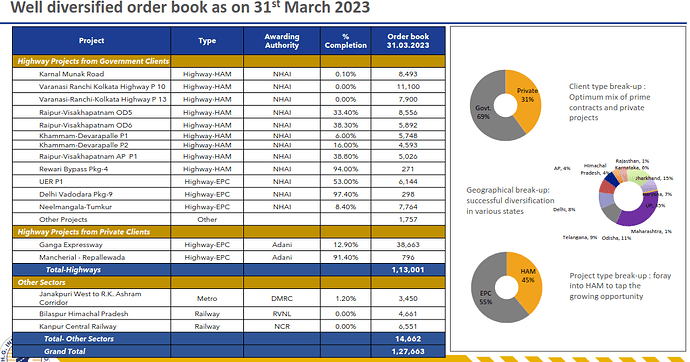

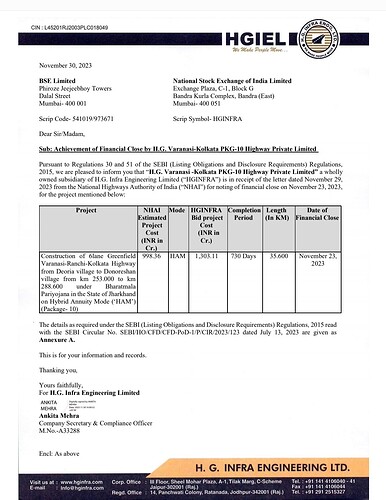

- The company has achieved phenomenal growth and diversification in its order book, securing three non-road projects and entering into a share purchase agreement for monetizing four HAM projects.

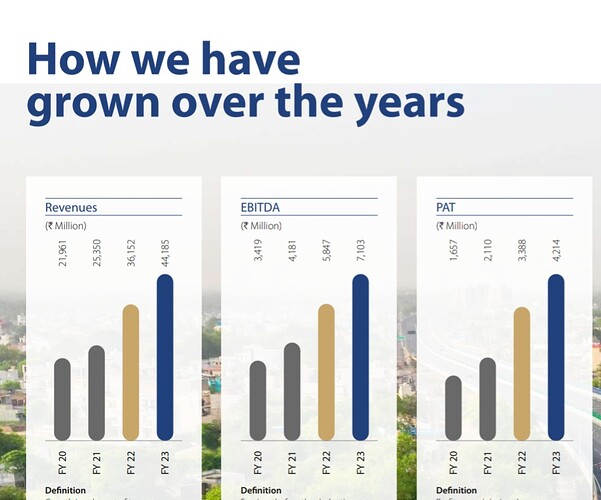

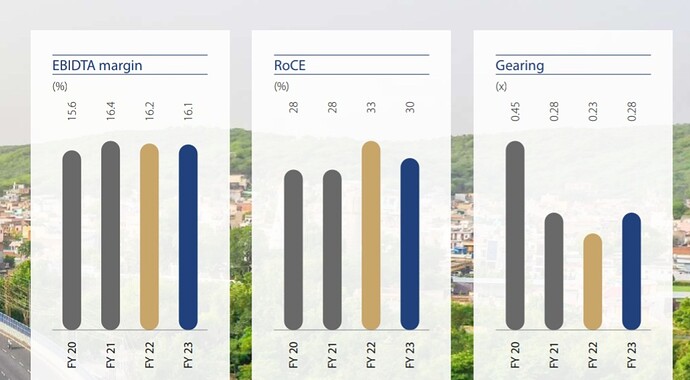

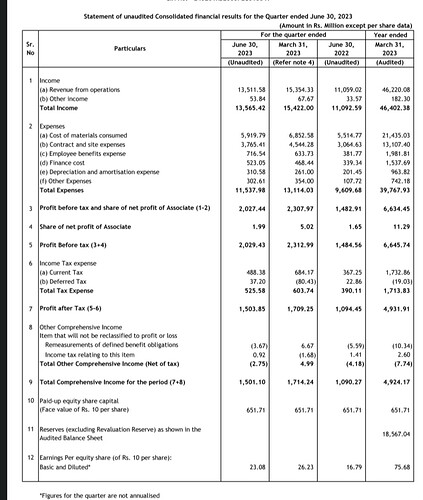

- The standalone overall revenue for FY23 increased by 22.2% YoY to INR 4,419 crores, and the EBITDA grew by 21.5% to INR 710 crores with a margin of 16.1%.

- The profit after tax for FY23 was INR 422 crores, showing an increase from INR 339 crores in FY22, with a PAT margin of 9.5%.

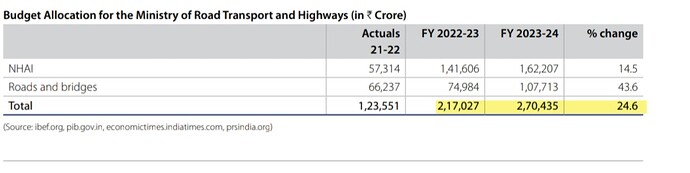

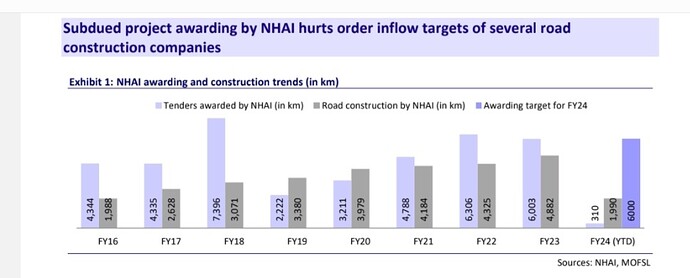

- The central government plans to accelerate road construction in FY24, awarding new projects of 12,000 to 12,500 kilometers and aiming to build 45 kilometers of roadways each day.

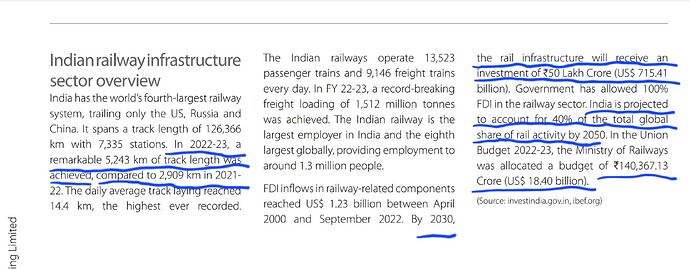

- The railway sector’s capital expenditure is expected to reach INR 2.5 lakh crore in FY23, with a focus on station redevelopment under the Amrit Bharat scheme.

- The government has allocated INR 98,000 crores for the monetization and expansion of airports, aiming to increase the number of airports to 220 by 2025.

- The Jal Jeevan mission provides business opportunities in the water sector, with increased budgetary allocation for safe drinking water in rural households.

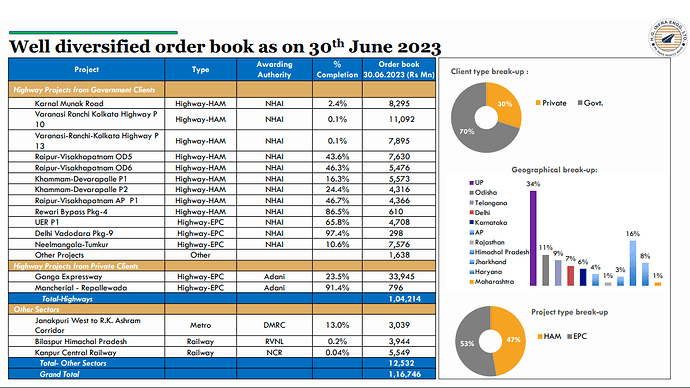

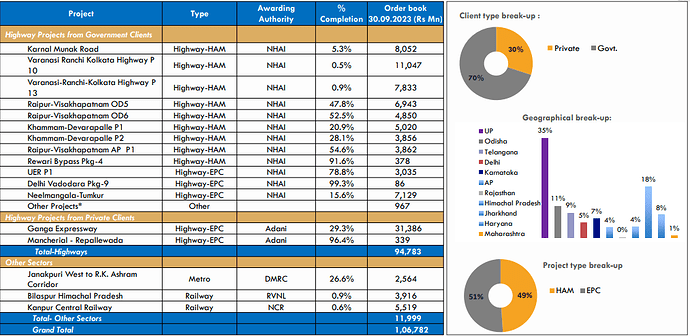

- The company’s order book stands at INR 12,595 crores with an order inflow of INR 8,650 crores in the past year, and it aims to grow the order book further.

- Ongoing projects include the Ganga Expressway, Karala-Kanjhawala project, Neelmangala-Tumkur project, Adani-Mancherial project, and more, with varying execution progress.

- The company has monetized four HAM projects through a share purchase agreement with Highway Infrastructure Trust, resulting in an enterprise value of INR 1,394 crores.

- The transaction will be completed in two tranches, strengthening the company’s balance sheet and releasing capital for future growth.

Thesis:

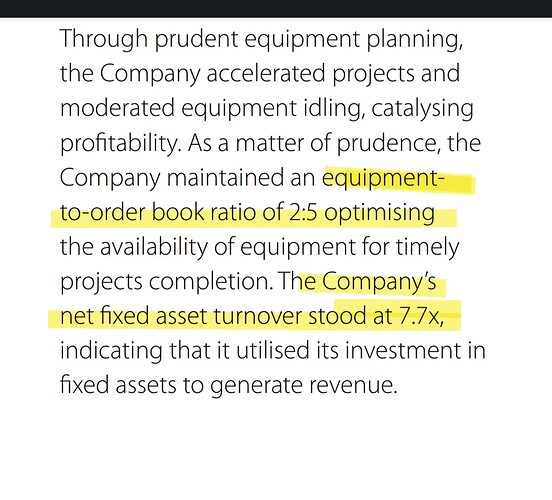

- Strong Execution Track Record: H.G. Infra Engineering Ltd has demonstrated a consistent track record of executing projects in a timely manner, leading to repeat projects and early-completion bonus payments. This showcases their robust execution capabilities and enhances the potential for timely project delivery.

- Healthy Order Book and Revenue Visibility: The company boasts a sizeable order book, providing strong medium-term revenue visibility. With a diverse range of projects in the pipeline, including highways, roads, railways, and water infrastructure, H.G. Infra Engineering Ltd is well-positioned to capitalize on the growing infrastructure development opportunities in India.

- Established Clientele and Government Associations: H.G. Infra Engineering Ltd has fostered long-standing relationships with key clients such as NHAI and MoRTH, along with reputed private road developers. This not only highlights their credibility but also offers a steady stream of project opportunities through government associations and repeat business.

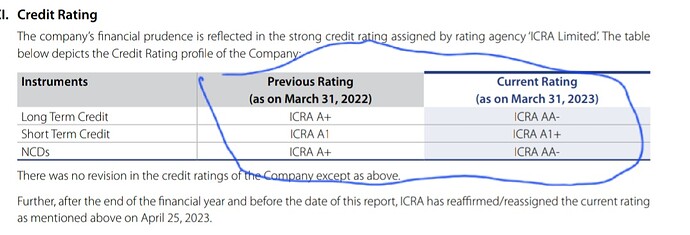

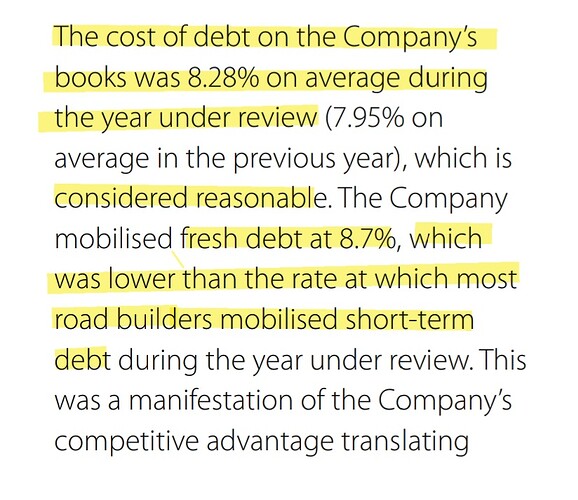

- Healthy Financial Profile: The company maintains a comfortable financial profile with stable operating margins, low leverage, and robust debt coverage metrics. These factors contribute to the company’s financial stability and reduce the risk associated with debt repayment obligations.

Anti-thesis:

- Project Concentration and Client Risk: H.G. Infra Engineering Ltd heavily relies on road works, with a significant portion of its order book concentrated in NHAI and ARTL projects. This concentration poses a risk if there are delays or issues in these specific projects or if the company fails to diversify its client base adequately.

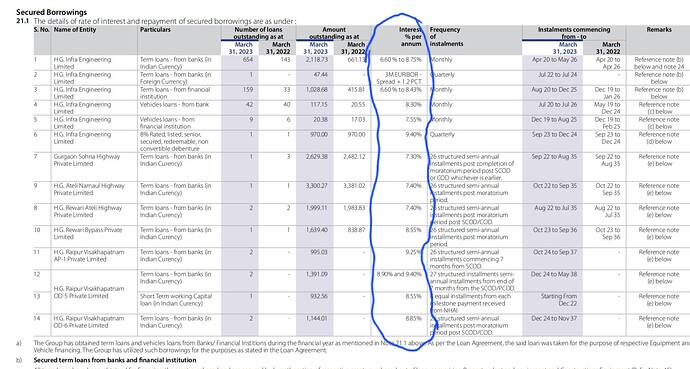

- Liquidity and Equity Commitments: While the company has a healthy project pipeline and equity commitments, the addition of multiple new projects and higher equity requirements may strain liquidity. The ability to manage working capital efficiently and secure timely monetization of HAM assets remains a key monitorable for investors.

- Refinancing and Debt Structure: H.G. Infra Engineering Ltd faces potential refinancing risk due to cross-default linked debt acceleration clauses. If triggered, it could put pressure on the company’s financial position and hinder its growth prospects.

- Execution and Operational Risks: While the company has a strong execution track record, there are inherent risks associated with large-scale projects such as the Ganga Expressway. Ensuring timely completion and payment realization from clients like ARTL may pose challenges and impact project profitability.

In terms of valuations, H.G. Infra Engineering Ltd’s valuation appears relatively attractive with a PE of 12 (Industry PE of 34) and PEG of 0.29.

According to the management’s guidance, the revenue for FY24 is expected to be around INR 5,400 crores. Considering a profit after tax (PAT) margin of approximately 9.5%, the estimated PAT for FY24 would be around INR 515 crores.

Assuming a conservative price-to-earnings (PE) ratio of 12, the market capitalization in FY24 would be approximately INR 6,180 crores.

| PE Ratio | Initial Market Cap (INR) | Final Market Cap (INR) | Return (%) |

|---|---|---|---|

| 12 | 6,019 | 6,180 | 2.67 |

| 23 | 6,019 | 11,845 | 96.21 |

| 34 | 6,019 | 17,510 | 190.79 |

Seems like the management’s guidance is already baked into the stock price (However the stock currently gets a PE of just 12 vs the industry average of 34).

Disc: Hold a tracking position