It is my long term investment with an eye on the India-Middle-East corridor.

Hi,

What are probable methods to value this as charter rates and profits will fluctuate as demand/supply mismatch occurs.

First: What could be an approximated normal EPS on yearly basis stripping out all this war/red sea block and pandemic related stuff.

Second: What can be approximate range of PE or Price to NAV which can be assigned to this.

Would love your thoughts on this.

If you consider, say 10 years before , they used to do 500 cr yearly plus 400 cr in interest, by the time this uncertainty vanishes their debt would be zero, and rerating of rigs and vessels happening slowly, so considering min 120rs + eps per year going forward shouldn’t be a problem,

Thanks and typically i have noticed internationally shipping have PE of 10-15. Is that a good way to look at it.

I think Pe is not the right metric to value shipping business with balatic dry index at an all time high ,revenues would be elevated and shipping is a cyclical buisness.Price to book value would be the right metric to judge this company according to me and it is at an all time high currently.

Consolidated NAV as mentioned in the Nov 2023 concall is Rs.1263 a share whilst standalone NAV/share > 1000. Current CMP is 925. Price to book value as per screener currently is 1.18 so is that worth considering given since average earnings per day have decreased?

the stock on an average has traded at a value of .5 to .6 to its book value and during bull run it has gone upto 1 and the highest it has been is 2.5 right now we are in shipping supercycle ,dont know how long this will last but if managmanet is able to increase there book value for 3 to 4 years then it would trade at similar valuation it traded historically and if the shipping cycle goes through headwinds i feel the stock will correct again hence sold the stock.

Can anyone pls advise why the tax rate is less during the past few years (less than 5% for the last many qtrs) despite the profit has grown. thank you.

The company operates under tonnage tax regime where tax is calculated based on notional income, not operating profit.

Can someone help me evaluate the intrinsic valuation here of the stock here , the stock is 8.5% percent down from 1045 level in straight sessions , smaller players like Sadhav and SJ logistics are commanding good valuation multiple in the market , Great Eastern’s subsidiary The Greatship Group is a offshore business like Seamac , not if they are not getting the correct valuation for it than shouldn’t they divest it to generate more value for shareholders or maybe a buyback, even the dividends are modest nothing great. What are your expectations from the stock two years down the line ?

Results are too good., with asset value at 14k cr and reserves at 9k cr. Offshore visibility and global disruption atleast going to stay for a while., isn’t this no brainer investment at this stage., or am I missing anything here…

Important point in presentation :

SUEZ CANAL/PANAMA CANAL DISRUPTIONS:

In the first two months of 2024, Suez Canal trade dropped by 50 percent from a year earlier while trade through the Panama Canal fell by 32 percent, disrupting supply chains

• A severe drought at the Panama Canal has forced authorities to impose restrictions that have substantially reduced daily ship crossings since last October, slowing down maritime trade through another key chokepoint.

• Attacks on vessels in the Red Sea area reduced traffic through the Suez Canal, the shortest maritime route between Asia and Europe, through which about 15 percent of global maritime trade volume normally passes

• As a result, several shipping companies have diverted their ships around the Cape of Good Hope

Company has also started a new subsidiary in GIFT city to be engaged in leasing ships and there has been a change in one director position . The only thing that is unfavorable is the management commentary on not going aggressive on fleet expansion till the end of FY 25 as in current cycle prices aren’t favorable , so with too much cash on hand with too little deployment opportunites this quarter PAT of 905 Cr is very big base to grow from.

I am interested to know aboout the earnings growth potential in offshore segment , I estimate an increase of 80-90 Cr EBIT from repricing of 12 offshore vessels - also curious with improvement of at least $3,000 to $4,000 a day on each contract repricing - why does acquistion of more offshore vessels up on the cards of GESCO , can someone from oil and gas research background quantify the impact of repricing to come from offshore rigs , two of the offshore rigs are up for repricing within this financial year . Also do there exist inorganic growth opportunites in offshore business?

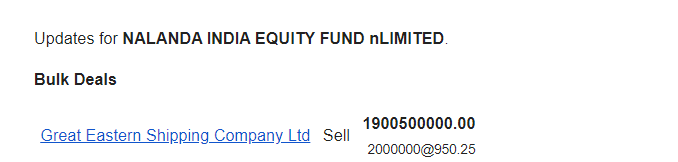

Nalanda looks to have sold its entire 7.37% stake.

No it’s just 1.4% for 190 Cr

Yes you are right. Misread one zero there ![]()

Ghisallo Master Fund LLP brought similar quantity @ 950

It will be interesting for shipping & cargo businesses in the future w.r.t. India-Iran deal for Chabahar Port and International North-South Transport Corridor (INSTC) as it is strategically important location for India:-

Route accessible through Chabahar Port:-

Reference:-

It’s hard to understand markets prudence in giving a better valuation to Great Eastern. Management doesn’t give guidance coz it’s hard to predict the spot market but the valuation is as per the assumption that shipping cycle has topped out . Whereas the cycle has already lasted two financial years , PAT growth in FY-23 was 4x YoY but the share price didn’t rise proprtionalely. OS and LPG segments are doing exceedingly good and dry bulk is getting better.

The stock has downside protection as it is undervalued today if in case there is 40% EPS degrowth at constant price than P/E only increases to 9 which is in line with the entire industry infact cheaper than SCI. NAV / share and P/B remain favorable in a down cycle. I am losing in my mind as to why there is no buying interest.