This is what I make of:

-

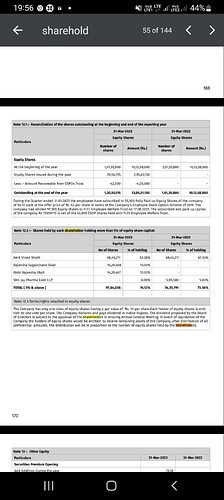

Focus is a projects company and not a consumer one, hence do not expect such characteristics - it is inventory heavy and hence WC heavy, cashflow will be delayed. (it made 51Cr in PAT during 2012 till now but total cash generated is 11Cr - 70Cr is stuck in inventories/Receivables currently). It is capex heavy too.

-

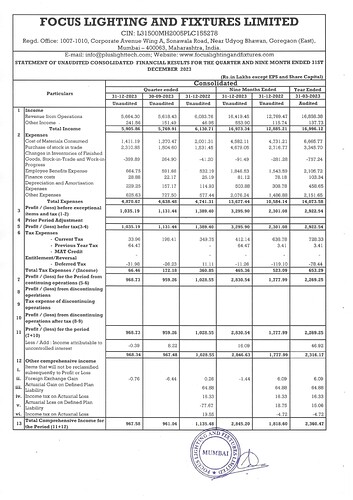

The MD has a long term approach and is brave enough to ask the analysts not to look at Q-o-Q movements, instead look at 3-5 years, reason being a projects company, without an order book, revenue is not predictable qtr to qtr. This is refreshing among managements who try to catch up to quarterly estimates and the analysts/market which chase it.

-

Due to the above nature, company wont likely merit a high multiple, atleast for now. May be a 20+, but not 30+ or 40+.

-

MD is a product and tech fanatic, very passionate. He knows his stuff too. Whenever there was a question about product/tech, he was quite gung ho and talked at length. The recent interview also showed it, he dreams big, executes well.

Focus has all the ingredients of a small company that can go places.

At the same time, I am disappointed the way the MD responded to my question on associate company Shethvinod (Focus Lighting & Fixtures Limited (SME) - #61 by johnsgeorge.cet), which is the manufacturing arm of Focus. And same with my other question of about raising funds.

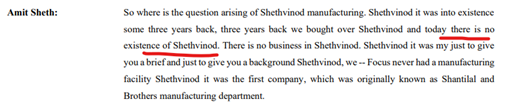

- Regarding Shethvinod this is what the MD said - Shethvinod was merged with the main company 3 years ago already, this question is not even relevant.

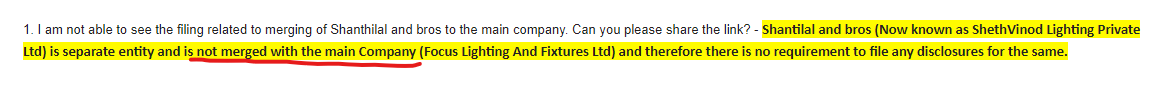

However, in my earlier email communication (dated Mar 24, 2023), this is what he had to say about Shethvinod - that it is a separate entity and is not merged with the main company!

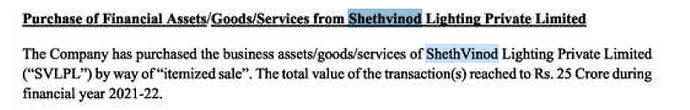

Anyhow, I checked the 2022 AR again and could see this, they bought over all the tools/dies from Shethvinod and all manufacturing is now only in Ahmedabad. This is good and I assume there wont be any related party txn with Shethvinod from now onwards. If there is, it will be a red flag.

But why did he then say it was merged 3 years ago, why could he not simply say this in the email. And why did he reply to my email that it is not merged and sounded like there is no plans to do this at all?

Note that I had sent this questions to him before the call and he knew this was coming.

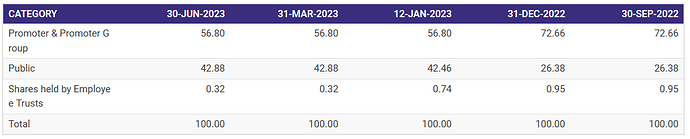

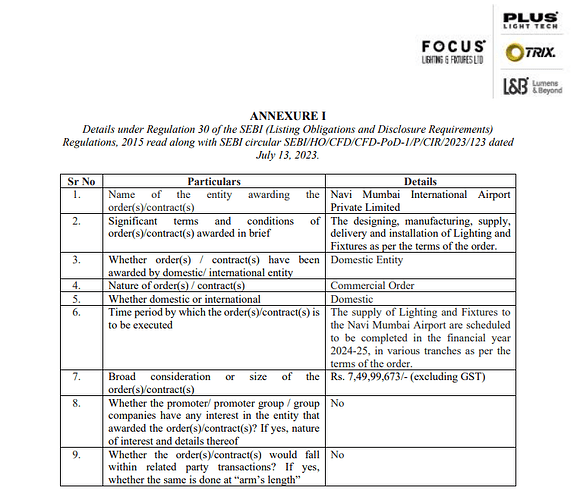

- I also asked about the 31 Cr pref issue raised in 2022. My question was simple - There was heavy capex of around ~28Cr in recent years and in previous interviews/calls MD said this is sufficient capacity for next 3-4 years of growth. If that is the case, why raise this funding, diluting the shares?

He again became uneasy and didnt want to answer, as if this is not at all relevant. He shrugged it off saying that it was for future requirements like new line of products. But if each time such heavy capex is needed, we must have an idea to what extend. He could have given some more details around it and the reason why he didnt go for debt, instead chose to dilute the shares.

Should I just take these as whims of a small fast growing company, led by a passionate founder who just executes and does not care about looking good on governance? Contemplating on this. ![]()

May be I must start moderate size and judge more in the coming quarters.

Disc: Not invested