Overview on Payment banks

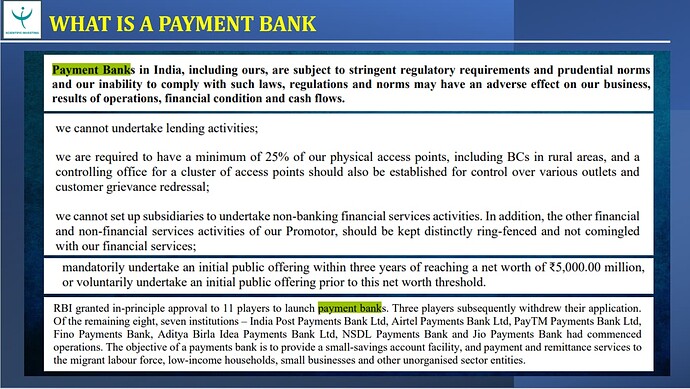

In 2015, RBI gave “in-principle” licences to 11 entities to launch Payments Banks and awarded SFBs licences to 10 players. However, of the 11 in-principle payment licensees, three withdrew their application subsequently. Aditya Birla Idea Payments Bank also closed their operations in September 2019. The payments bank which are currently operational include Airtel Payments Bank, India Post Payment Bank (IPPB), Fino Payments Bank, PayTM Payments Bank, NSDL Payments Bank and Jio Payments Bank. RBI, in December 2019, released the final Guidelines for ‘on-tap’ licensing of small finance banks in the private sector and opened

. Additionally, existing Payments Banks (PBs) which are controlled by residents and have completed five years of operations will also be eligible to apply for SFB licence. The minimum paid-up voting equity capital for small finance banks shall be ₹ 2 billion. In case of an existing NBFC/MFI/LAB/PB, the entity shall have a minimum net worth of ₹ 2 billion or it shall infuse additional paid-up voting equity capital to achieve net worth of ₹ 2 billion within 18 months from the date of in-principle approval or as on the date of commencement of operations, whichever is earlier. Listing of the small finance bank will be mandatory within three years after it reaches the net worth of ₹ 5 billion for the first time. Currently, the share of newer banks in the system, i.e. SFBs and Payments Banks, is less than 1.0%. Nonetheless, with increase in scale and operations, and deeper penetration in unserved and underserved areas as well as increase in number of customers entering the formal banking system, the share of these segments is also expected to increase going forward. While the share of metropolitan areas in the deposits distribution has reduced over the years, share of urban areas has remained stable and semi-urban areas have seen the highest increase in share of deposits.

What can a payment bank do?

Banking services - Demand deposits, ATM/Debit cards, payments and remittance services • Other ancillary services – Cash Management Services, Recharges, Bill Payments, Fast Tag etc. • Can act as Business Correspondent to another bank and offer savings, deposits, credit and investment products • Can act as Corporate Agent to offer insurance products and loan products

Basically, a payment bank can set up ATMs, Banks, business correspondents accept demand deposits( non –NRI), issue ATM cards/ prepaid instruments. And offer remittance services including cross border remittances, internet banking services,BC for other banks and selling non risk sharing financial services such as mutual funds, insurance,pension products, utility payments etc. They can accept deposits upto a holding limit of 2 lacs per customer( increased in April’21)

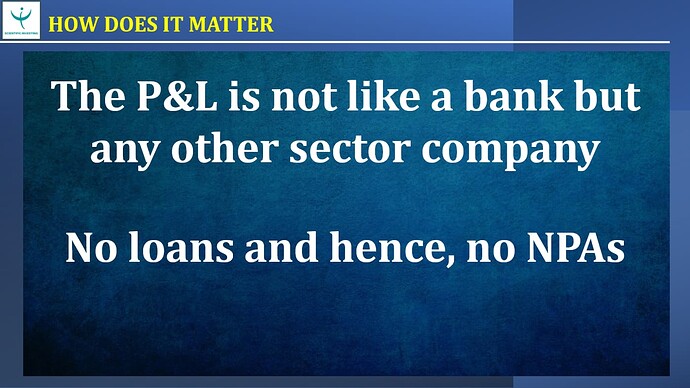

Now coming to deployments of funds, these banks cannot undertake lending activities, As per regulation they are obligated to keep 4 % of its outside time and demand liabilities as CRR with RBI. 75% of the demand liabilities are to be invested in SLR securities. And can hold a maximum 25 % of the liabilities in current/time deposits with other scheduled commercial banks.

Due to this restriction the interest income of payment banks is very small compared to a traditional bank. Interest income is the spread the bank receives on depositing the funds in SLR securities/ time deposits with scheduled banks.

Capital requirements:

The minimum paid up equity capital of payment bank shall be 1 billion. The payment bank shall be required to maintain a minimum CRAR of 15 % on a continuous basis. Tier 1 capital should be atleast 7.5 % of RWAs.

As payment banks are not allowed to lend, the risk weightage on SLR securities and Bank deposits are much lower and hence payment banks rarely have CRAR of 10-15 % that the traditional banks have.

Fino Payments bank is a subsidiary of Fino paytech Ltd. It got listed in bourses in Novemeber’21. The IPO price was fixed at 570 per share, since listing the company has lost nearly 60 % of its value.

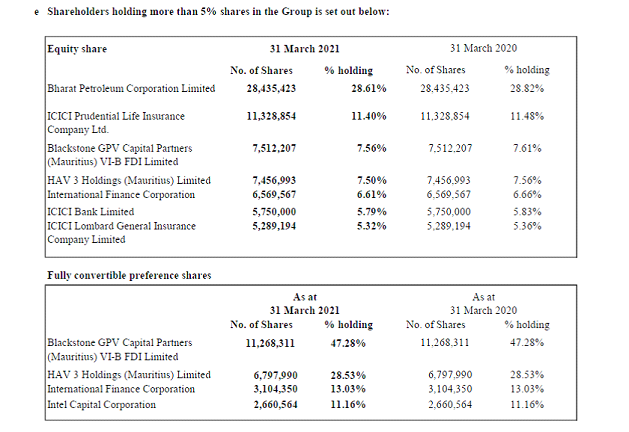

The Bank is a subsidiary of Fino Paytech Ltd( 75% holding)

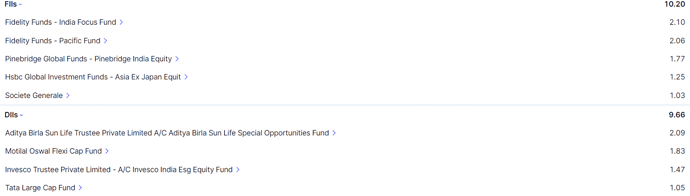

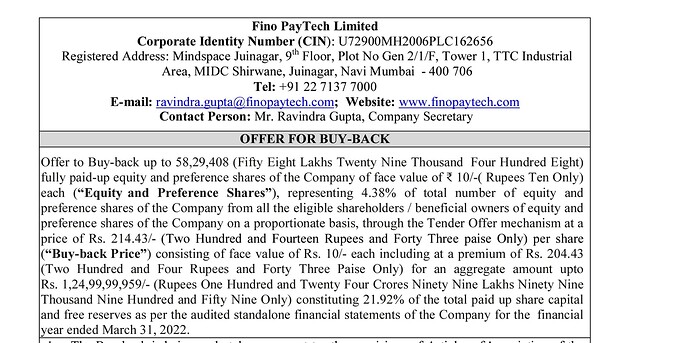

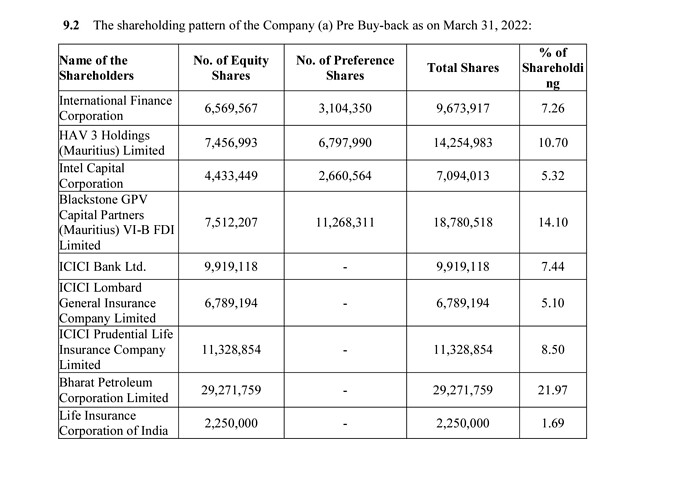

The major investors in Fino Paytech are

Source: Finotech AR 20-21

Now coming to the shareholding of Fino payments bank

Fino paytech Ltd: 75 %

FII: 10.20 %

DII: 9.66%

Public: 5.14 %

source: Screener

Rationale

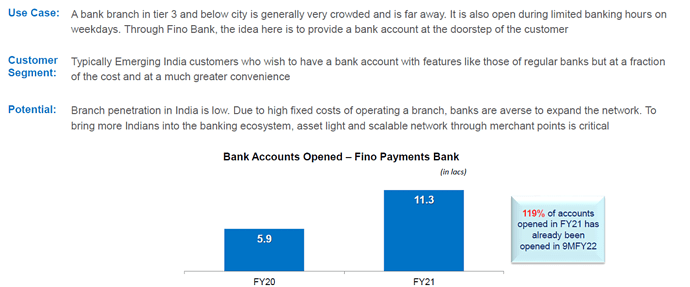

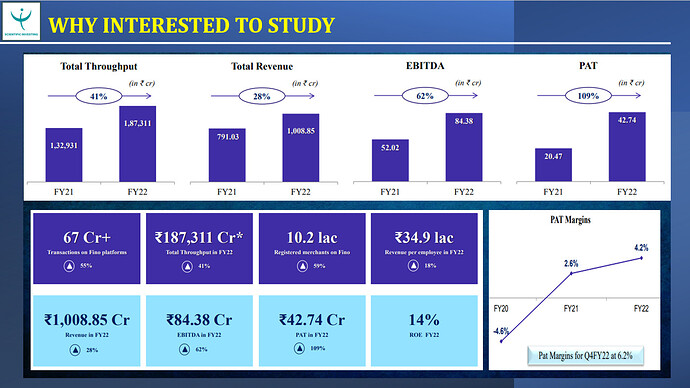

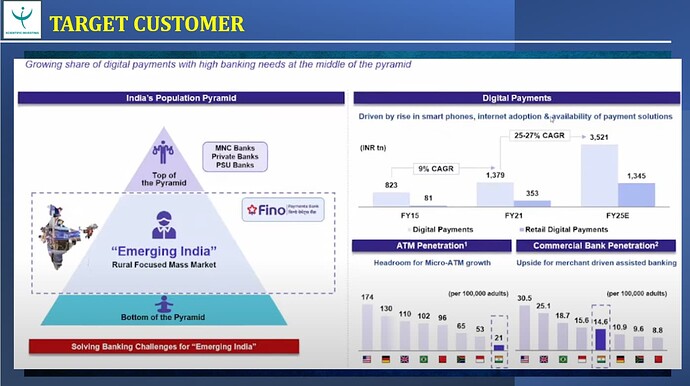

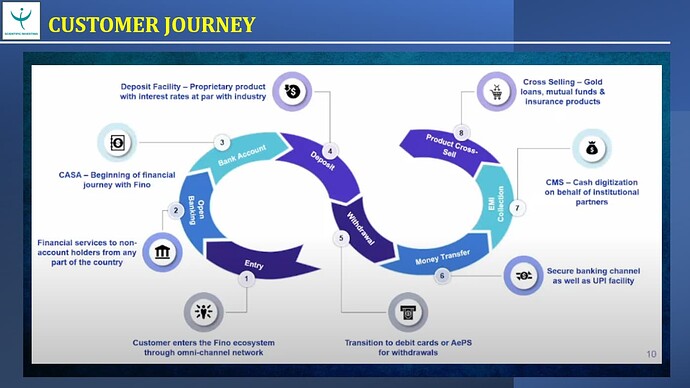

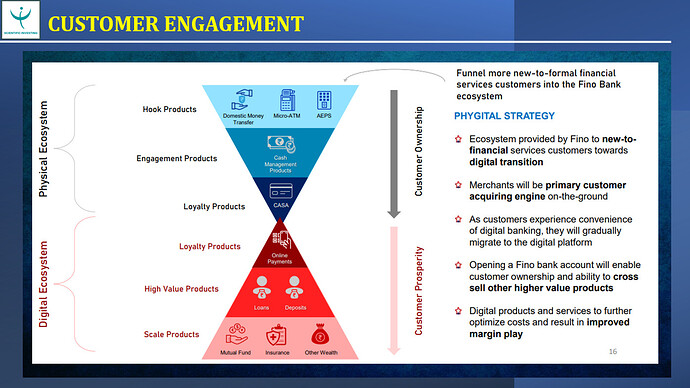

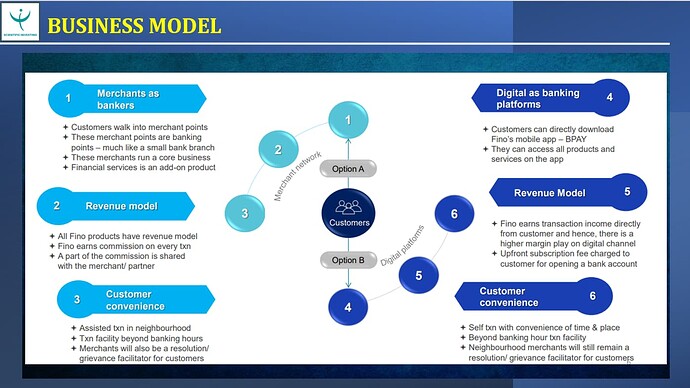

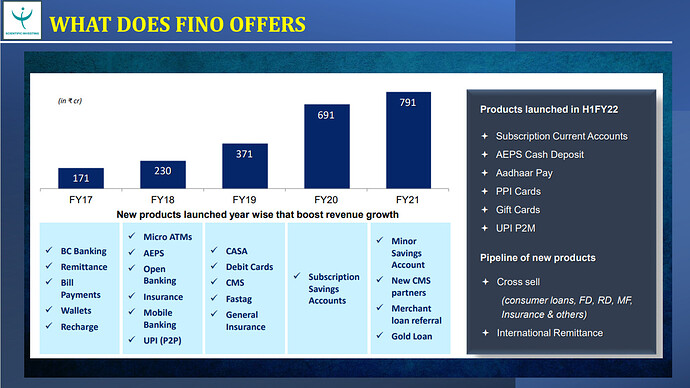

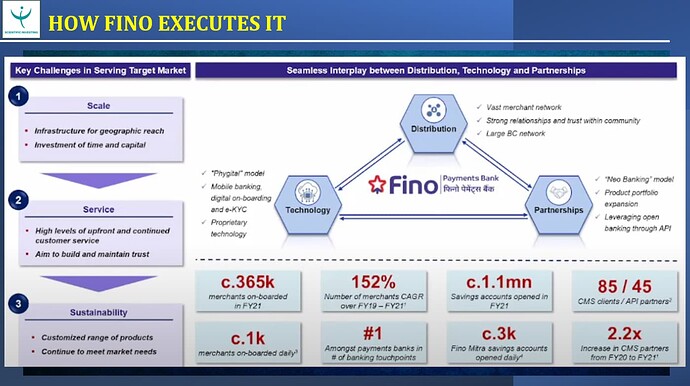

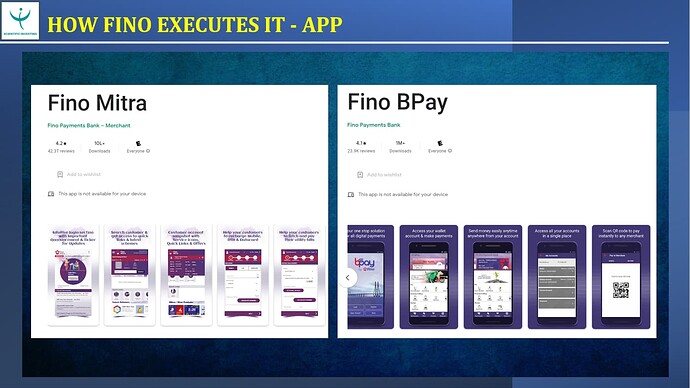

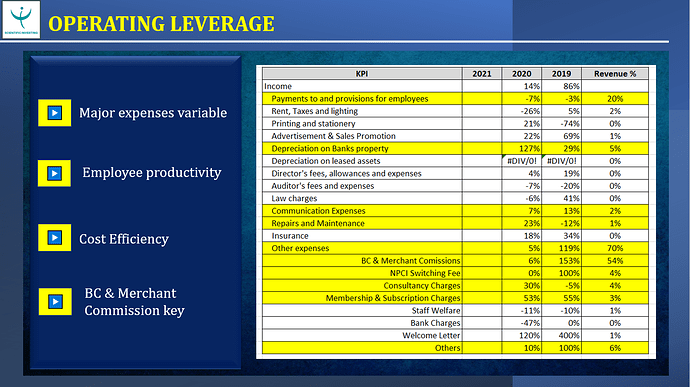

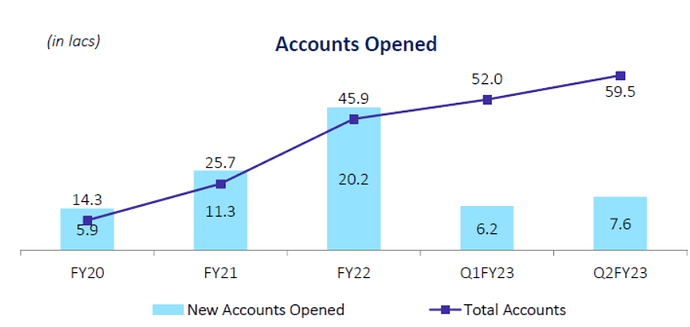

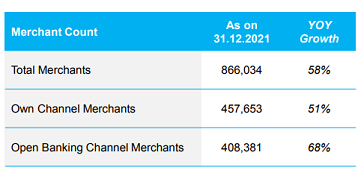

For me, Fino is a kind of a bet on Financial inclusion. Fino calls its business model, a phygital model where they assist in delivering digital services. And they target mainly customers in rural and semi urban areas. It already has the largest number of physical customer touch points among all payment banks . It turned profitable in Q4’20 and has remained profitable since.

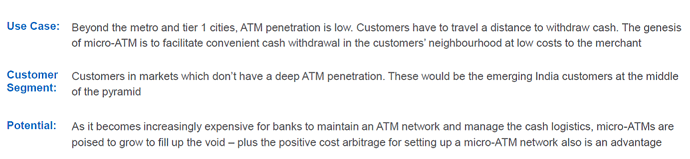

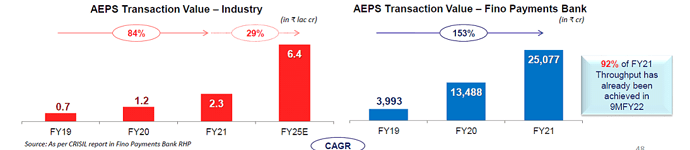

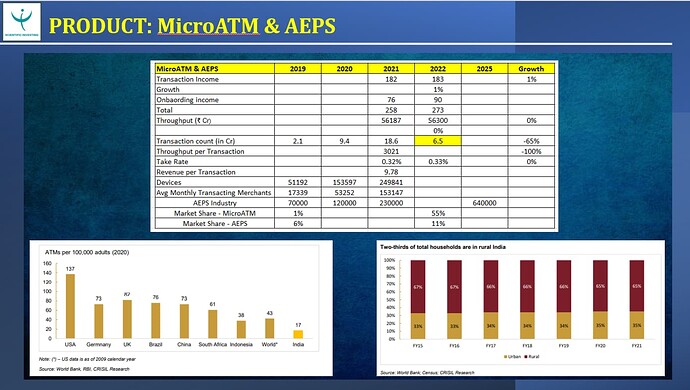

The clientele is mainly customers from rural and semi urban areas from low income groups which are not the most sought out customers for the traditional banks. As such these customers are easily available for grabs. They dont have to directly compete with banks nor with the fintech companies who have minimal physical presence. Initially, I got interested with this idea due to this target customer differentiation coupled with their MATM and AEPS business. For the rural customers their neighbourhood merchants/ BCs became Banks. With financial inclusion and emphasise on DBT. the rural and semi Urban population has become more and more dependent on bank accounts for withdrawal of the benefits. Due to non availability of ATMs or banks nearby, banking correspondent business of payment banks/ other fintech companies started gaining traction.

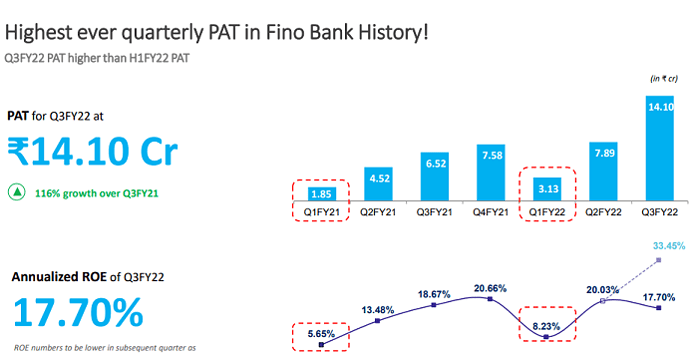

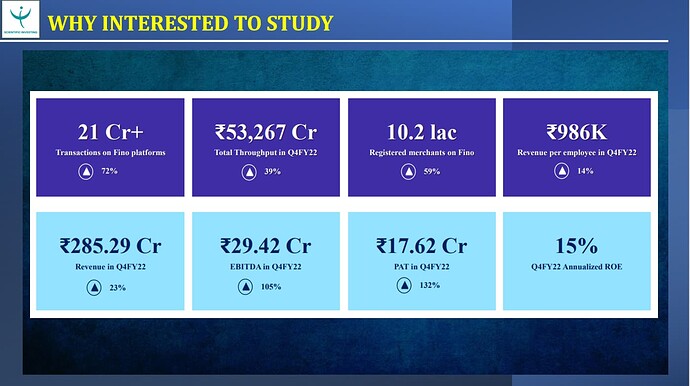

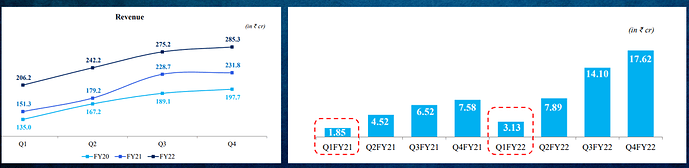

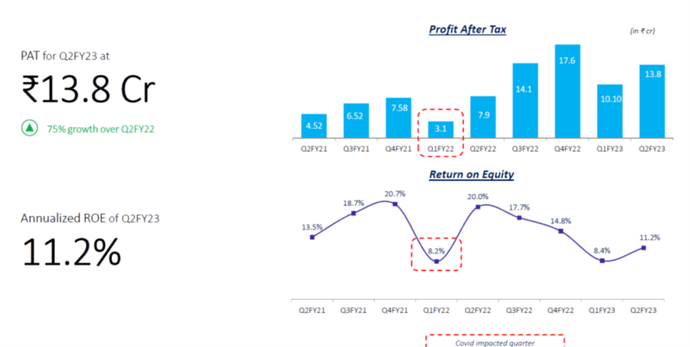

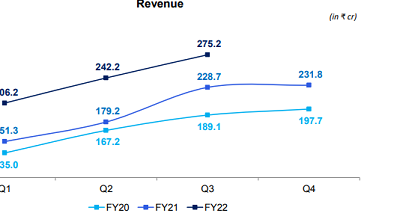

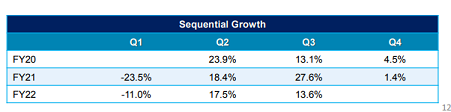

The Bank has been able to post continous growth in the previous quarters except for the covid affected quarters and the highest ever PAT was lodged in Q322.

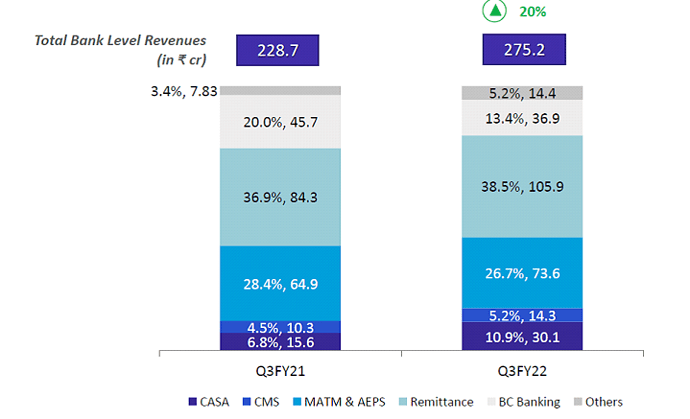

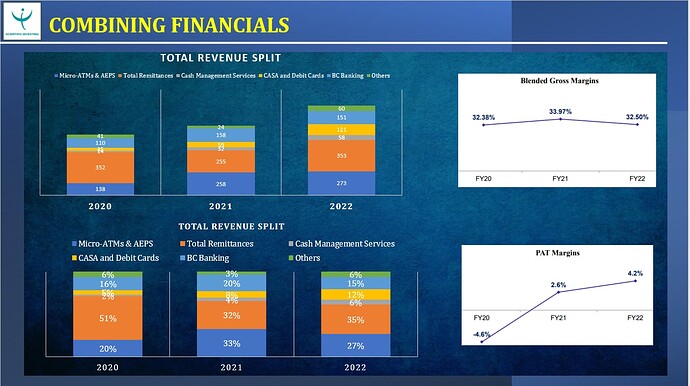

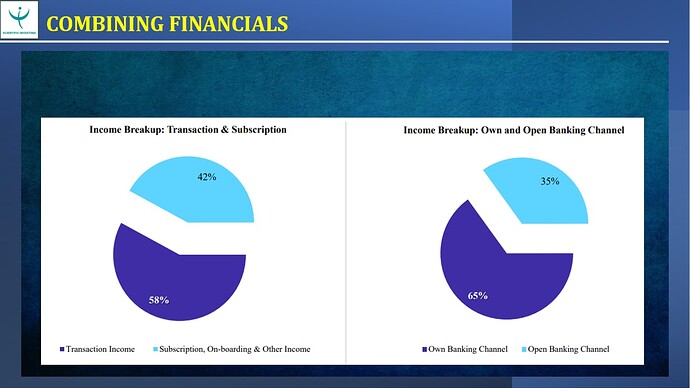

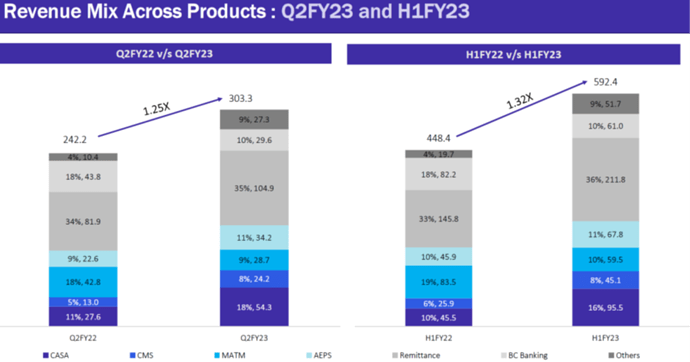

Revenue share

Source: Investor presentation Q3’22

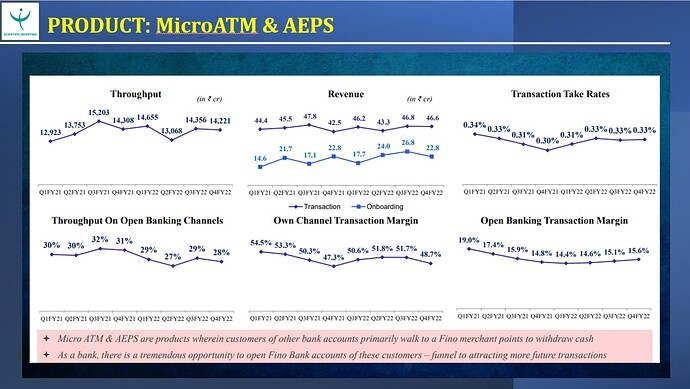

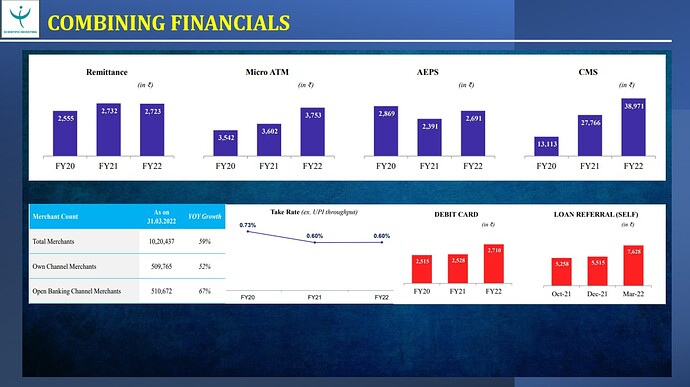

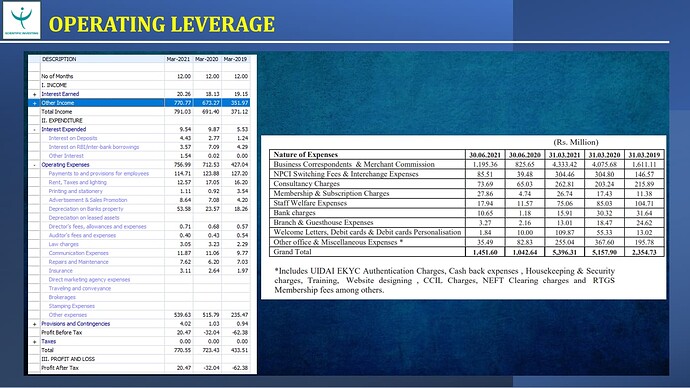

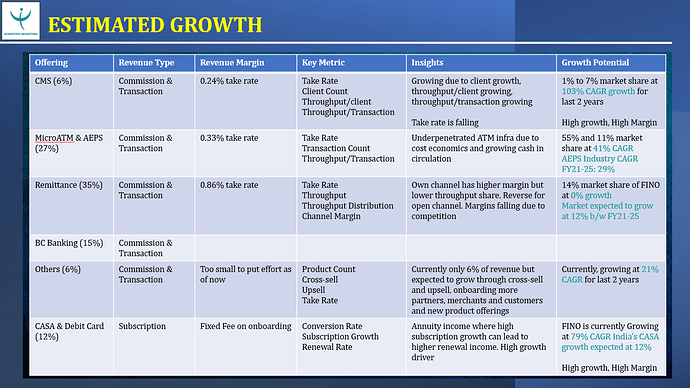

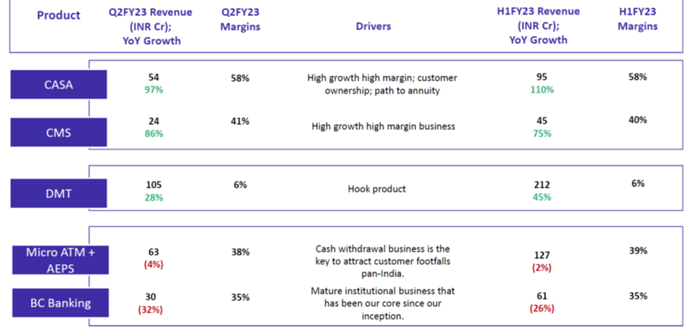

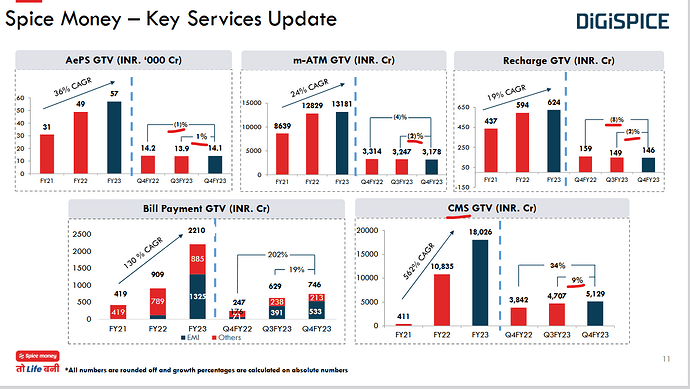

As per ICRA credit rating in FY 21 44 % of the revenue was derived from Micro ATM and AePS services, 25 % from BC banking, 12 % from CASA and other 19 % from other products and services. The revenue mix has changed significantly.

So lets just focus on the main revenue earner

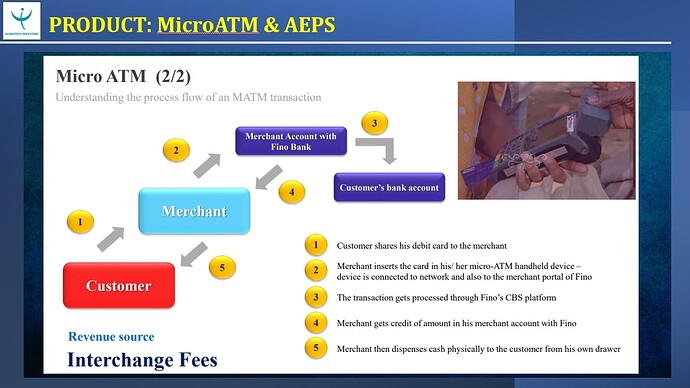

Micro ATMs

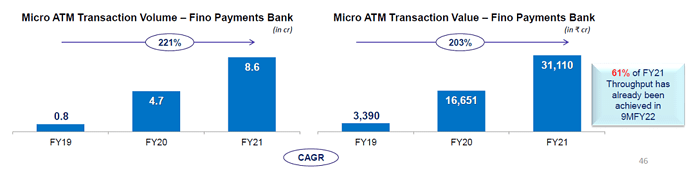

Micro-ATMs are handheld terminals (similar to a point of sale (“POS”) terminal) that typically require a card to be swiped or dipped by the customer, rely on mobile phone / internet connections and are most often used in geographies where it is not practical for the relevant bank to locate a physical bank branch and/ or facilitate doorstop mobile banking by BCs. Customers use micro-ATMs to deposit cash, withdraw cash, check account balances and request mini-statements. The micro-ATM has a maximum limit of ₹10,000 (regulated limit).

Micro-ATM transactions are either conducted on “own” channel or on the API channel where bank interface with third party financial services entities with whom the merchant is registered. Such third parties financial services entities as API Partners and as of March 31, 2021, Fino have arrangements with 45 API Partners, including BankIT, RNFI, Mobisafar and Spice Money. API Partners are unable to handle the remittance end-to-end as they do not have a banking license, and accordingly require assistance of a bank and its core banking system infrastructure to complete transactions.

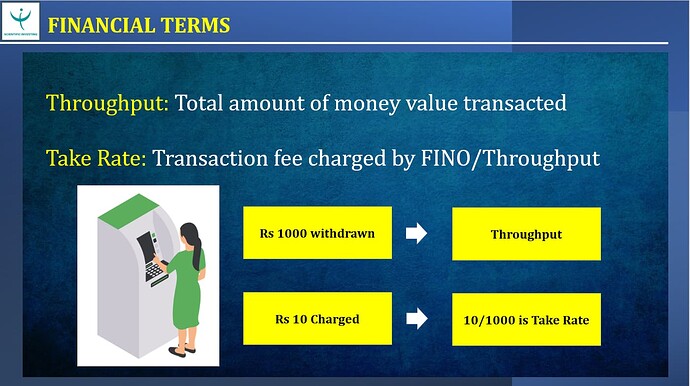

Bank generate interchange commission for every transaction that is conducted through micro-ATMs on Fino’s system, regardless of whether the user has a bank account with Fino or is a customer of another bank. This commission is 0.5% of the transaction amount or ₹15.00, whichever is lower. The revenue earned through our micro-ATMs depends upon whether the micro-ATM is operating on our “own” channel or on the API channel. On “own” channel, the transaction commission is split between the merchant and Bank, whereas on the API channel, the transaction commission is split between three parties, being the merchant, Bank and the API Partner.

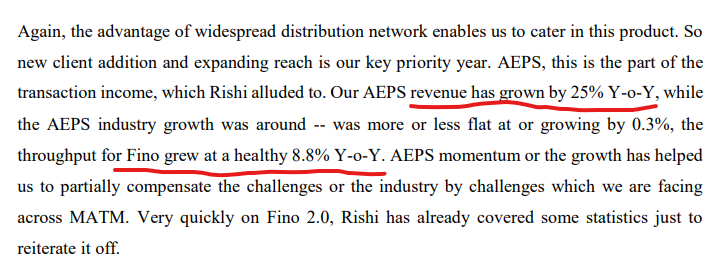

AePS

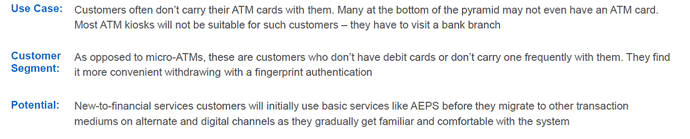

AePS is a bank led model that uses AADHAR authentication to allow interoperable transactions at POS terminals. It was launched with an objective to facilitate banking services in the underserved regions of the country. Unlike a typical micro-ATM, Aadhaar authentication does not require a signature or debit card to be swiped or dipped by the customer and instead uses account details as the basis for an AePS transaction. Customers primarily use AePS to deposit cash, withdraw cash, check account balances and Aadhaar to Aadhaar remittances that are interbank or intra bank in nature.

Interchange commission is generated for every AePS transaction that is conducted through bank’s system, regardless of whether the user has a bank account with Fino or is a customer of another bank. This commission is 0.5% of the transaction amount or ₹15.00, whichever is lower. Commission is split as in Micro ATM.

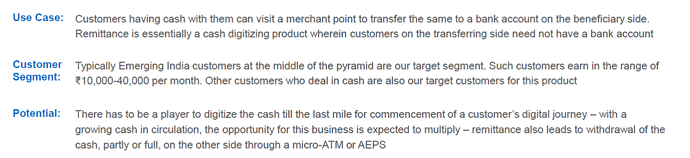

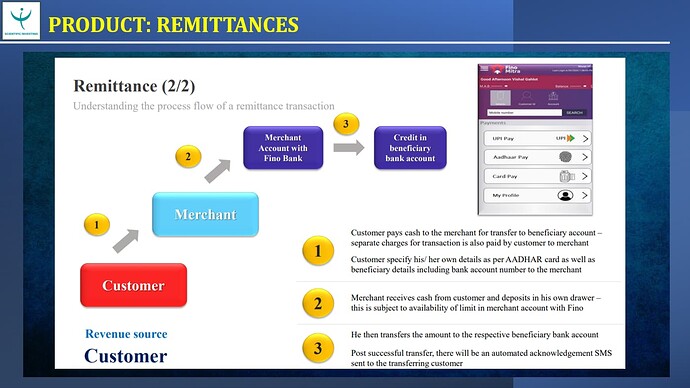

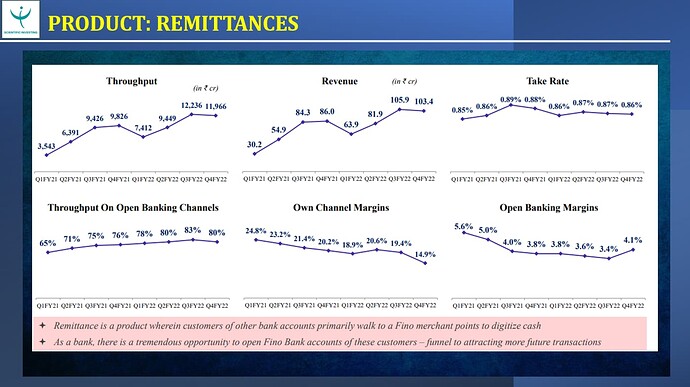

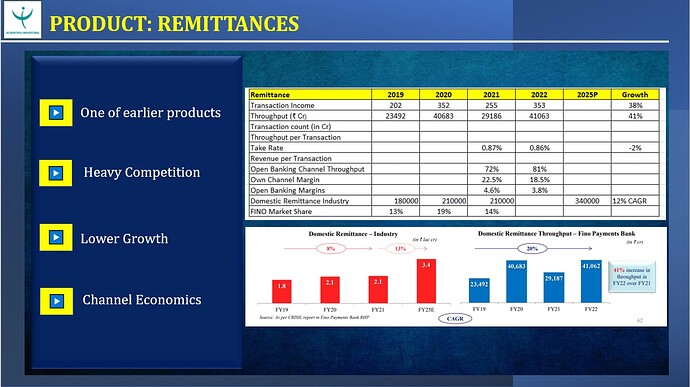

Remittance

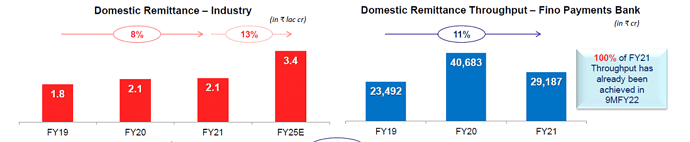

Domestic remittances

Refers to migrant workers sending money from places where they work to their homes in their states or their regions for meeting the day to day expenses

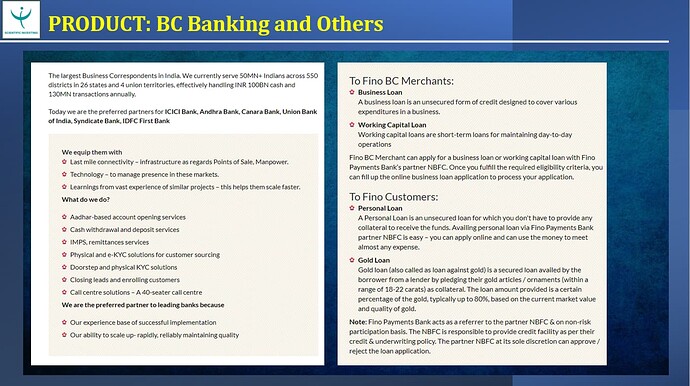

BC Banking

BC Banking describes the BC’s that are engaged by Bank to provide banking products and services on behalf of other banks (such as Union Bank of India and Canara Bank) and are authorised to perform a variety of activities. As of March 31, 2021, we have approximately 17,269 active BCs across India and derive revenue through commissions on each transaction they process. Income derived from our BCs in the financial year 2021 was ₹1,512.15 million.

As per the bank website company is the preferred partner for ICICI Bank, Andhra Bank, Canara Bank, Union Bank of India, Syndicate Bank, IDFC First Bank.

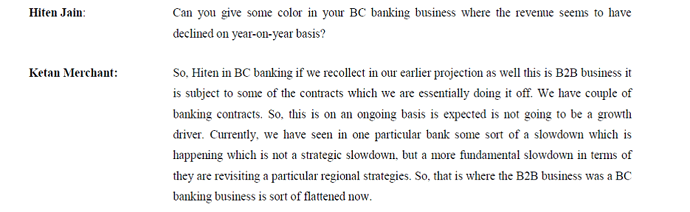

Share of revenue in BC Banking has declined significantly as of Q322.

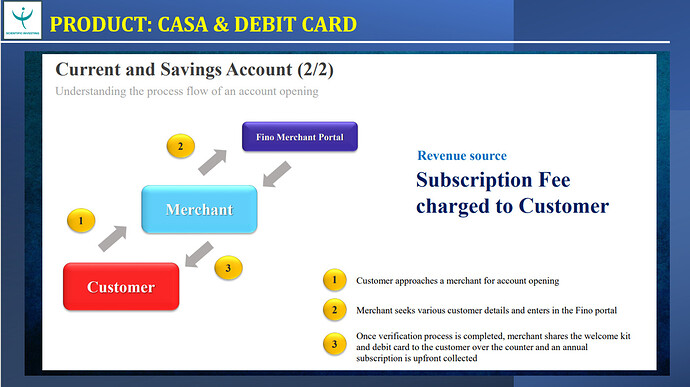

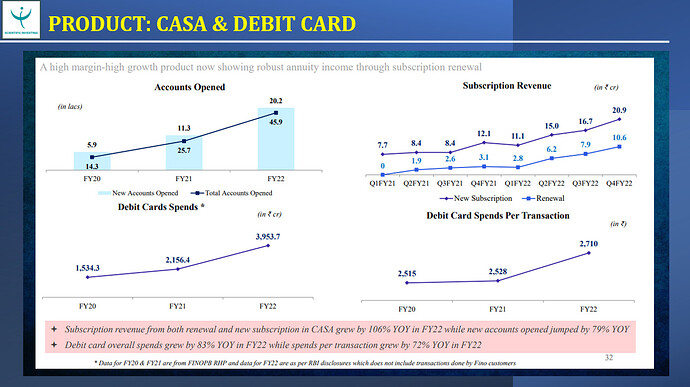

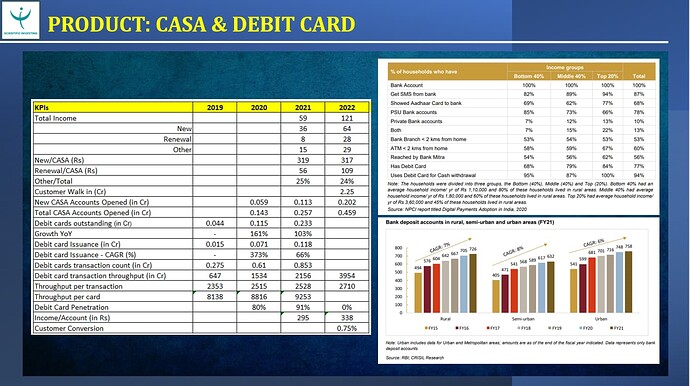

CASA

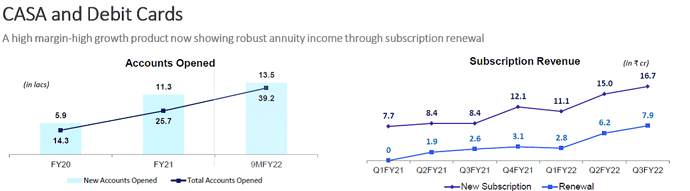

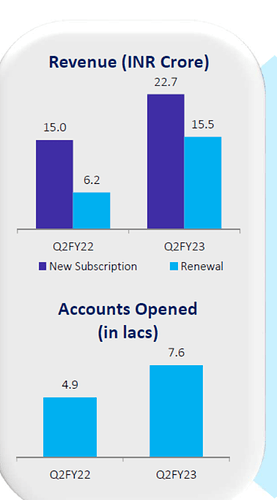

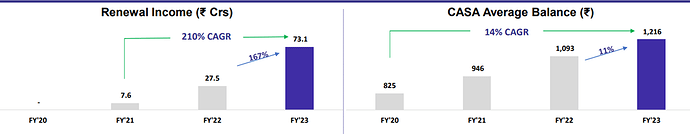

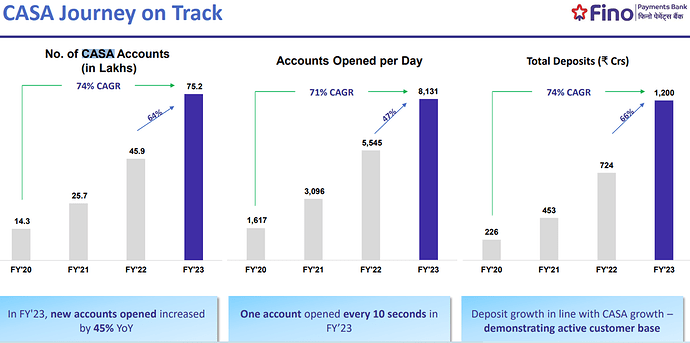

This was one of the services which I didn’t count as a severe revenue driver in my initial thesis, however it has started looking quite attractive as on Q322.

Revenue source

an annual subscription fee on Shubh Savings Account, Jan Savings Account and Bhavishya Savings Account;

fees where the customer is unable to maintain the MAB on our Pratham Savings Account & Pragati Current Account;

for fund transfers made from CASA accounts (i.e., account to account transfers and IMPS);

for cash transactions such as cash deposits and cash withdrawals

other miscellaneous fees in connection with certain SMS alerts and physical account statements.

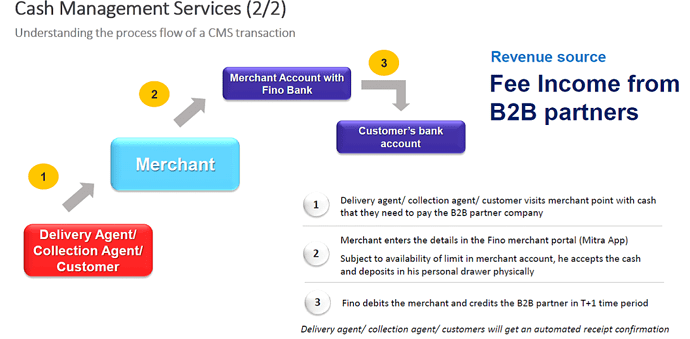

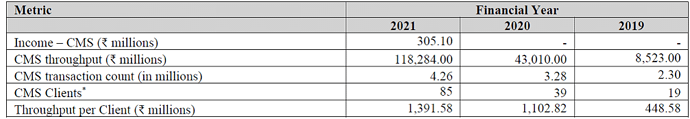

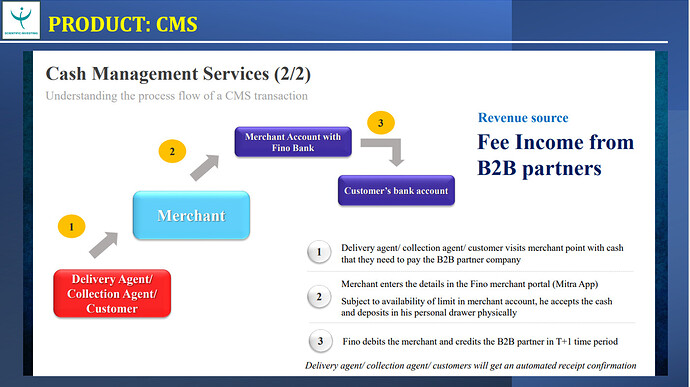

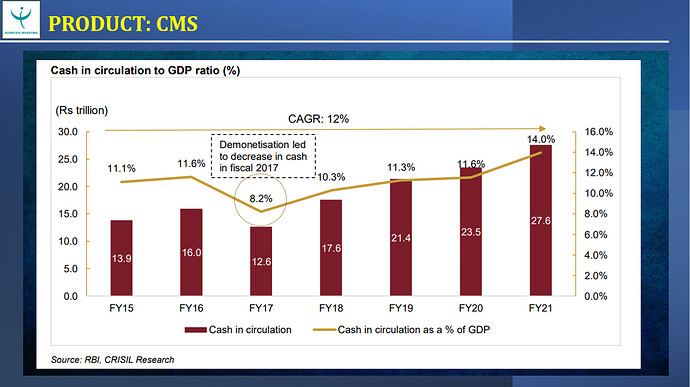

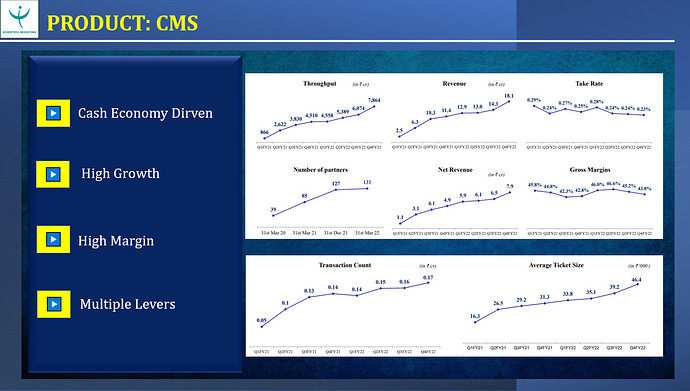

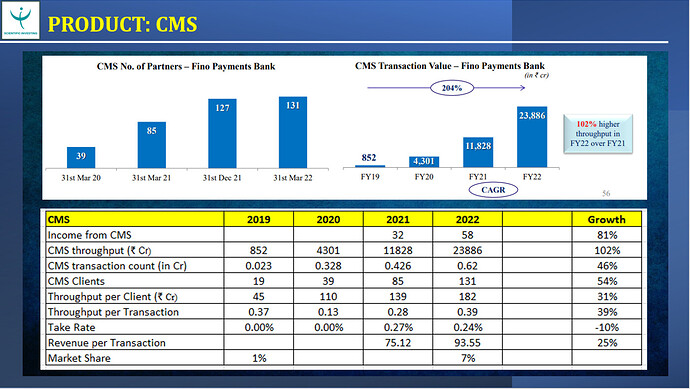

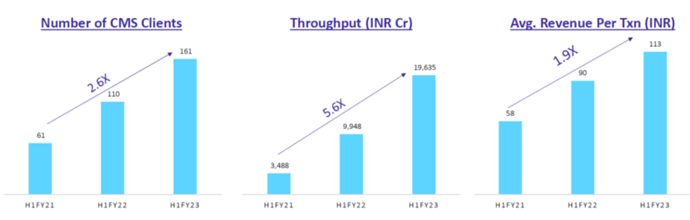

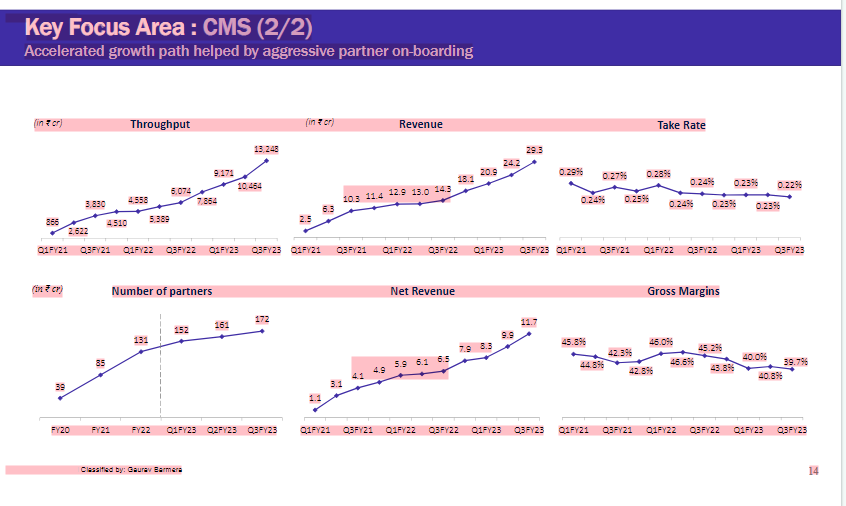

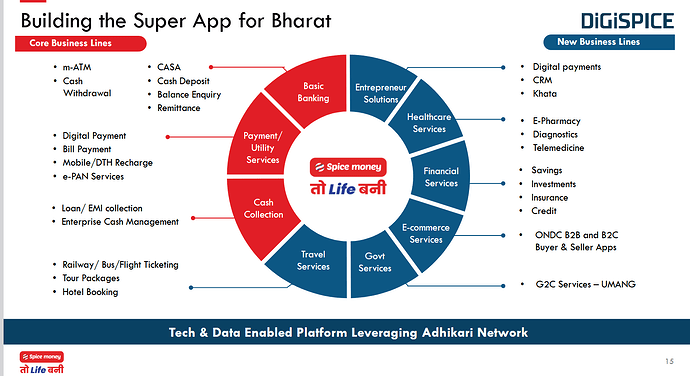

CMS

CMS offering principally includes cash collection services and cash payment services across traditional physical channels and help digitize physical cash to clients who manage significant volumes of cash. The service involves providing physical locations where agents of corporate CMS customers can attend and deposit the cash collected from their customers, acceptance of EMI payments, the provision of acknowledgement of the collection/payment transaction through SMS and providing live dashboard (i.e.,web portal) for viewing real time transactions. current clientele is spread across industries, including banking and financial services (“BFSI”), logistics, e-commerce, and retail industries.

A typical CMS transaction involving a loan with equated monthly instalments (“EMI”) requires the borrower to visit dedicated deposit point within the community (which is typically at a merchant location) to deposit their EMI, at which point bank take a commission and client receives the net proceeds. Bank earn revenue from CMS on a commission basis according to throughput volumes.

Major clients based on monthly throughput volume being L&T Finance Limited (Microfinance), Satin Creditcare and RBL Finserv

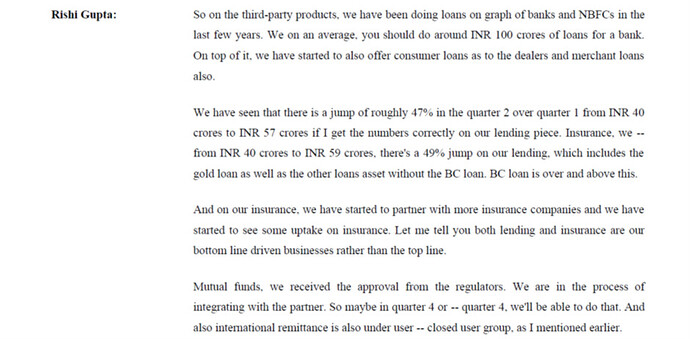

Third party Gold loans and other loan referrals.

Gold loans are cash loans made against the gold jewellery of a customer. They have entered into strategic business relationships (i.e agency agreements) with an NBFC to cross-sell gold loans via BCs. Such third parties are incentivised to offer products due to the extensive retail network

The revenue is generated on a commission basis, charged to the credit service provider, calculated as between percentage of the total throughput value of gold loans transacted with customers on a monthly basis. Income derived from facilitating gold loans for the financial year 2021, was ₹102.69 million.

They have entered into strategic business relationships with third party lenders such as Riviera Investors Private Limited to cross-sell business loans (including working capital loans) to Fino’s merchants and BCs. Such loans are for amounts between ₹0.2 million and ₹5.0 million with varying interests rates of between 18.0% to 30.0% per annum, or 1.25% to 2.50% flat rates per month. The loans are offered for periods of between 30 days and 36 months. Such loans are not available for retail customers.

The revenue is generated in the form of commission received from the service provider, which may differ depending on whether the loan is new or being renewed, and also as to the amount being loaned, where for greater amounts we will received a high percentage commission. Income derived from third party business loans in the financial year 2021 was ₹0.66 million

Third party insurance

Offering customers the opportunity to purchase third party insurance products through Banks’s distribution network. To provide such insurance products, Fino has obtained registration to act as a corporate agent from IRDAI and have entered corporate agency arrangements with ICICI Lombard General Insurance, ICICI Prudential Life Insurance, Exide Life Insurance and Reliance General Insurance to distribute certain insurance products.

Revenue is generated in the form of commission on every insurance policy that they cross-sell, the commission varies according to the type of policy.

Bill Payments and Recharge facilities

Facilitation of payment of bills and Direct-to-home (‘DTH”) recharges (of television connections, prepaid mobile phone connections and FASTag) via branch network or at merchant locations. To facilitate bill payments, Fino operate as a Bharat Bill Payment Operating Unit under the National Payments Corporation of India Bharat Bill payment system which is a RBI-led system for payments of bills, accessible to consumers across India. Customers may pay bills relating to electricity, gas / LPG, insurance premiums, landline phones, mobile postpaid phones, municipal tax and broadband.

Revenue is in the form of commission charged to the service provider. Income derived from facilitating bill payments and recharges in the financial year2021 was ₹10.45 million

Fastags

Reloadable tag which enables automatic deduction of toll charges, assisting customers pass through vehicle toll stations without stopping to make a cash transaction. FASTag is linked to awallet account or CASA account from which the applicable toll amount is deducted. The tag employs radio-frequency identification technology and is affixed on the vehicle’s windscreen after the tag account is active.

The FASTag can be obtained by the customer from merchants for a flat fee of ₹99.00. The merchant registers the customer’s vehicle and issues the tag by linking it to the customer’s account . Bank gets a share in the interchange income of 1.5% for every toll transaction. Income derived from FASTags in the financial year 2021 was ₹0.48 million.

Fino PB has also recently received regulatory approval for cross border remittance through money transfer service scheme. Under this approval Bank will be able to undertake inward money transfer activities in partnership with overseas Principals. Bank sees tremendous opportunity in this area. Bank is already tied with various MTOs for this.

Recently, it received approval for referral services for mutual fund distribution in tie up with Fisdom and for demat accounts with 5 paisa capital.

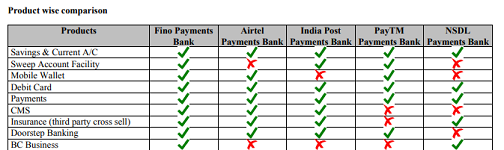

So how does Fino’s business varies with that of Paytm?

Source: DRHP

A comparison makes it clear that the BC business is very unique to them.

As far as I see it, the target customer is what makes the biggest difference for Fino and Paytm. Fino targets mainly the semi Urban and rural population( mainly the unbanked). Also the phygital model of delivery differentiates the two. Through marketing and other initiatives Paytm has been able to onboard customers in a very short period of time. But they have never been able to make it profitable. Paytm ventured into many business where it came directly in competition with the large established banks.

MATM/Aeps business coupled with physical remittance business made sure that revenue is more stabilised and sustainable. On the other hand paytm was focussed mostly on digital payment business where the margins were continously getting eroded. Govt cut the MDR rates on UPI transaction to zero since 2019 as opposed to MDR on cards varying from 0.9 % to 2.6 %. Payment business share has come down drastically for even big banks. India made a quick transition from cash to UPI / IMPS totally skipping plastic money. I agree that Paytm has set up an excellent payment infrastructure, but has not yet been able to capitalise on it. As most of the analysts it has its hands in too many things, and the path to profitability still looks distant.

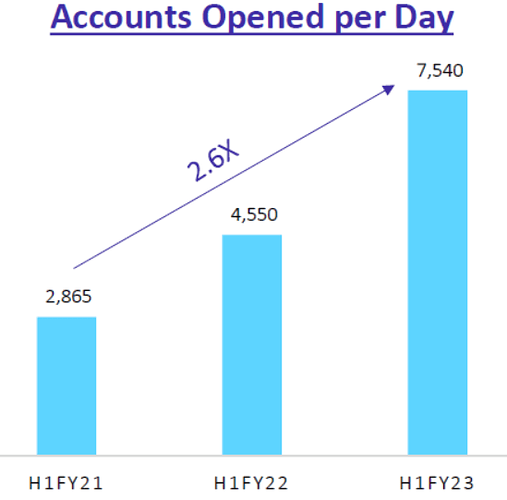

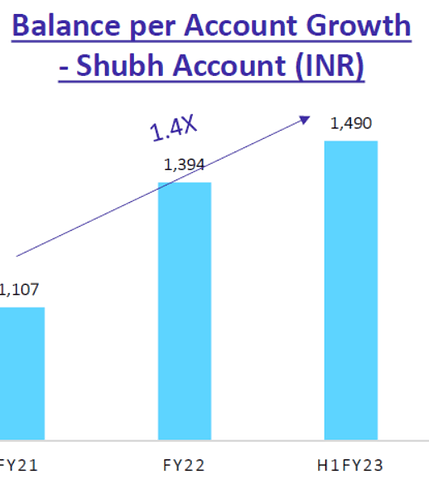

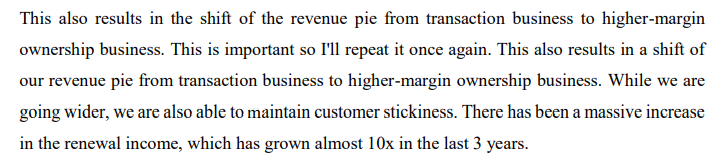

The Phygital model of onboarding clients is what makes the bank interesting. The interchange fee earned by the bank for the acquirer transaction was shared by the Bank and Merchant. Of late, it is seen that the high margin CASA subscription income and CMS income has started to grow significantly. Subscription charges vary from Rs.249 to 449. I was wondering initially as to who would pay these kind of subscription charges. While going through some old news reports I came to know that Banks charged close to 10000 crores as min balance penalty in 2016 to 2019 period. SBI as per some reports alone charged 2400 crores as penalty in FY 17 -18. However, SBI is said to have waived minimum balance charges since 2020. But most other banks are still charging minimum balance charges. Ease of transacting at a Fino touchpoint along with availability of merchant point nearby is another advantage.

The subscription income increased from 8.3 crores in Q3FY21 to 16.7 crores in Q3FY22.

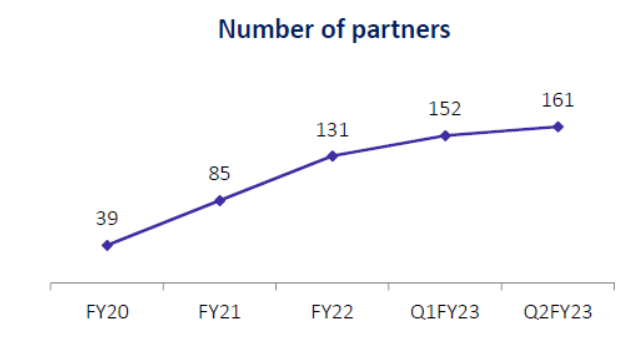

As already mentioned Fino is showing good traction in their CMS business as well with number of partners increasing to 127.

Bank has just started loan referral services in Gold loan, personal loan and business loan to Fino merchants. This is a very interesting development and is in the very initial stages. With the very large rural presence they can be an ideal partner for Microfinance NBFCs. Loan referral services has excellent growth prospects without having to share the credit risk. I expect good pick up in revenue from loan referral services going forward.

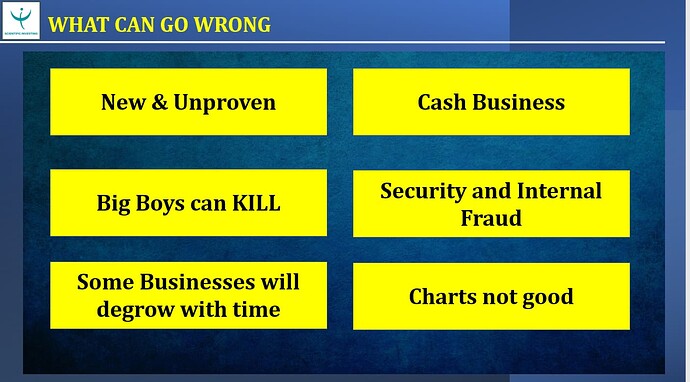

Key risks

- One of the key risks that Fino face and explained well in the RHP is the significant amount of risks involved due to handling a large amount of cash. This makes them susceptible to embezzlement, theft, fraud and unauthorized transactions by BCs, merchants etc exposing them to significant operational and reputaional risk. Eventhough, they have internal controls some of these frauds or unauthorized transactions may go unidentified for a long period of time. Some of the control measures are taking security deposits, capping transaction limits etc. Some payment banks have mandated that the OD limit should be brought to credit limit before the end of day. On a perusal of Bank’s RHP regarding criminal litigation by bank it is found that the Bank has filed criminal cases for misappropriation of funds against some of its employees. Such incidents can cause severe reputation risk to the Bank.

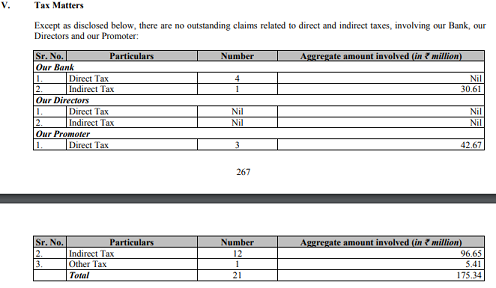

Source: RHP page 265 - Tax litigation pending

i. The Office of Assistant Commissioner of Income Tax Circle (15)(1)(1), Mumbai (“Assessing Officer”)passed an order dated December 21, 2019 (“AO Order”) in relation to income tax return filed by Bank for AY 2017-18. The Assessing Officer disallowed: (a) legal and professional expense of 41.76 million; (b) training expense of ₹ 21.87 million on the ground that it was for a new business; (c)disallowance of provision of ₹ 3.63 million on the ground that there was a change in ownership; and considered share premium worth 278.05 million in excess of fair market value. The Assessing Officer added all these amounts (i.e. a sum total of ₹ 345.31 million) to the income of the previous year. Further, the Assessing Officer has ordered for rejection of carry forward losses of earlier year under section 79 ofthe Income Tax Act. Our Bank has filed an appeal before the Commissioner of Income Tax (Appeals), Mumbai, on January 18, 2020, and the matter is currently pending.

ii. The Office of Assistant Commissioner (ST), Kadapa-I Circle (“Assessing Officer”), passed three orders on December 31, 2019 under IGST Act, CGST Act and SGST Act respectively. The Assessing Officer conducted an inspection of branch in Kadapa and asked for production of books of account. On failure of our Bank to produce books of account, along with copies of original purchase invoice and tax invoices, the Assessing Officer computed our tax liability under IGST Act, CGST Act and SGST Act on a best judgement basis on the basis of one-way bill utilisation, GSTR3B returns, SAS Reports etc. The Assessing Officer computed the tax amount to be ₹ 13.20 million under CGST Act, ₹ 4.20 million under IGST Act and ₹ 13.20 million under SGST Act. Bank has filed an appeal against these three orders on June 15, 2020 and the matter is pending hearing. - Intense competition from other fintech companies in MATM and Aeps business.

Bank in the last concall mentioned the intense competition from fintech in acquiring new merchants/ BCs. For Fino, they were able to keep the capital expenditure at a minimum level as set up capital expenditure were borne by merchants/ BCs. However, as per some reports many new fintechs are incentivising the BCs by providing devices free of cost. The intense competition may also push them to shell out higher payouts in the future. The merchant acquisition is very crucial in the Fino’s model. - Any major disruption in digital payment mode

Any new payment mode that disrupts the currently existing digital modes may be a serious threat. The way UPI disrupted the whole payment system make this a serious risk. The 0 MDR in UPI made a srious dent to the payment revenue of many banks. - Any regulatory change

Any regulatory restriction putting a cap on the subscription charges on savings accounts or downward revision of interchange charges on MATM/AEPS may significantly affect the revenue of the payment banks. However, the reduction in interchange charges looks unlikely as the Banks have requested for a further increase in these interchange fees. There was a hike of 2 rupees in the last FY.

To sum it up, Fino payments Bank is quite unique in its business model in Payment Banking industry. While peers like paytm did acquire large chunk of customers through marketing and incentives Fino grew its revenue over a period of time from 2006 through phygital model of delivering assisted digital services. Govt mandating DBT for transfer of various subsidies/benefits further helped them in their growth. They focussed on semi urban and rural areas and became a neighbourhood bank focusing on domestic payments, MATM and AEPS business mainly for offus customers. It has come to a point wherer network is large enough that they have enough oppurtunities to cross sell.Bank has been able to constantly introduce newer products every financial year. Due to the low base many of these cross sell oppurtunities can add significantly to the bottom line. Bank has just started loan referral services and is closely monitoring the disbursal and collection trends. With the kind of phsical presence they have they can be an excellent partner to microfinance NBFCs. Also high margin CASA and CMS business is showing good growth. However, there are severe regulatory risks like the one Paytm faced recently where they were stop onboarding of new customers. Bank need to obtain regulatory approval before launching each new business like digital gold, Fixed deposits etc. The growth in legacy business like MATM, AEPS, domestic remittance depens a lot on their capacity to acquire new merchants/ BCs which is facing severe competition from some peers.

So in all the pessimism and drubbing the payment banks have received in the market, can it actually spring a surprise?

Discl:Iam not a registered investment advisor and my views are biased due to my holding. Has a tracking position in Paytm as well. This is merely for educative purposes. Most of the data mentioned is picked from DRHP and quarterly presentations, hence be cautious before taking any investment decisions based on it

domestic remittance walk in customer charges.pdf (522.2 KB)

MDR on upinew report on min bal charges collected

RBI approval for cross border remittance.pdf (647.4 KB)

Approval for demat.pdf (410.5 KB)