I am impressed by the growth of loan disbursal of paytm. I took a position in the company when it was barred by RBI from onboarding new customer in 2022. Exited later on. Paytm is still EBITDA negative and has a market cap of approximately 28 times that of FINO. I didn’t like the buyback they did as well. The holding structure of paytm and parent is also confusing. I think FINO has more downside protection. In case of FINO I agree that the growth of matured products like MATM , AEPS and cross sell especially has been disappointing. But I would like to keep watching to analyse if there is any structural improvement or green shoots visible here. Q1 is a weak quarter as per them. Will like to see if there is any effect of 2000 rupee withdrawal on the overall CASA

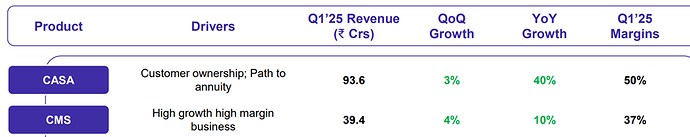

In my opinion CASA and CMS are the verticals to be looked at. CASA is annual and each year renewal income keeps increasing. The Margins are too good for renewal, as there’s no cost directly associated with that.

For CMS, the growth is good even though take rates are coming down little.

Other verticals are hook product IMO, so I don’t read much into those.

Disc: Invested

Fino payments bank has very few branches, so its merchants and the CASA franchise are the 2 pillars on which their business will develop. In view of this, I did a deep dive into their merchant network and CASA franchise to answer a few questions like:

-

How well are the merchants faring when they work with Fino? How is their commission income changing? What is the review from merchants of the bank?

-

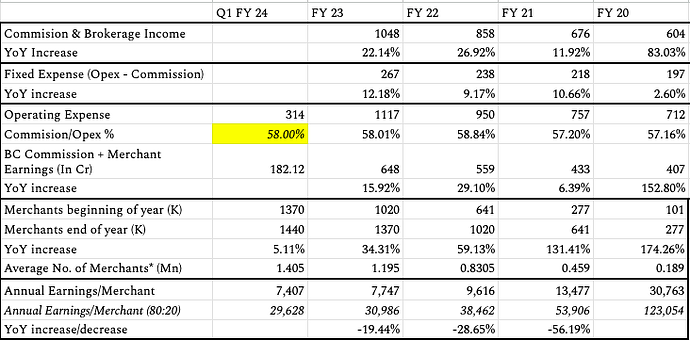

The bank has been able to increase its merchant network (own + partner) to 1.37 Mn points by FY 23 from 0.27 Mn in FY 20. A lot of the increase in merchant network has come as the company expands geographically into south and west. This represents a 5x increase in merchant network in 3 years.

-

During the same time period (FY 20 end to FY 23 end), commissions paid out to merchants has increased by a mere 17% CAGR from 407 Cr to 648 Cr. So, the average earning/merchant declined from ~30K/year to ~7.5K/year (assuming a 70% active ratio - Q2 22 con-call). Pending - Compare merchant earnings with Airtel/Paytm/Others in the same line - members pls feel free to contribute.

-

This decrease in average earning for the merchant can be mainly due to newer merchants created in last 2-3 years not being been able to generate enough business and thus earning quite less. Older merchants should be earning similar to before with may be a little decrease because of cannibalisation - Although we should get clarification from management on the extent of cannibalisation of merchant earnings due to new merchant additions.

So, there might be quite a lot of merchants (~2L) who are making 25K-30K/year with Fino, especially considering that 20% of merchants bring in 80% of the business. -

The management is also quite focussed on helping the merchants earn more by providing incentives to bring in more business just as Ola, Uber, Zomato etc do. Merchant retention is crucial as a network of lakhs of merchants each of whom depend on Fino for 20%-30% of their total income may be quite a competitive advantage.

-

I also found a few interactions of Fino with merchant base (link 1, link 2) in rural areas of Bihar which is quite interesting. One concern from merchants is that Fino charges 400 Rs upfront because of which merchants are often not able to convert customers - this is actually good for investors as it maintains quality CASA franchise as long as the CASA customers keep renewing.

-

Also there are many youtube videos on joining as merchant with fino that often have ~20K-50K views and mostly favourable comments. Seems like Fino is already quite decently known in its target demographic in rural regions.

2. How much value is the CASA customer deriving from their Fino account? Is the value worth an upfront payment of 300-400/year? Is the fino account customers’ primary account?

-

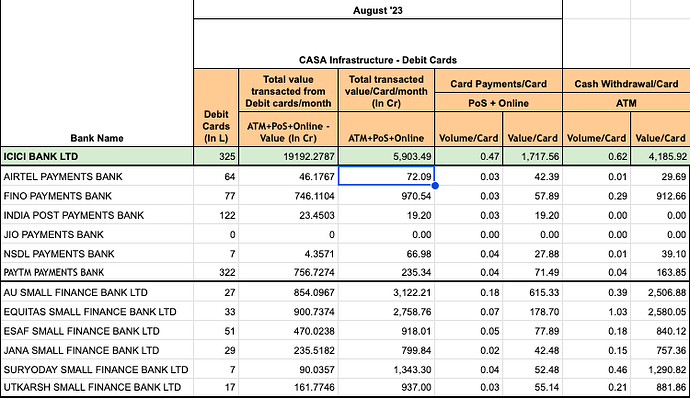

To understand the CASA franchise, I have looked at the debit card transaction figures (In the excel attached) for the last 4.5 years as most CASA customers at the bank have a debit card. Fino has increased its debit card count by 18.5x between June '19 and August '23.

-

Distributing cards is not a big deal, but remember almost all debit cards have been given after an upfront payment - so no lag to recover costs. Also, the total transaction value & volume have both grown by 7x over the same 4 year period. It means CASA customers are indeed using the Fino cards to transact.

-

So, the customers are using the card but are they getting enough value that they will renew? - Well, each card is used 0.3x-0.4x monthly, so 4x-5x in a year for ATM withdrawal + PoS payment. Each transaction is on average worth ~1000.

-

An average CASA customer transacts 4K-5K in a year (See table below) out of his Fino account for a total of 4-5 withdrawals. Assuming similar number of deposits and other administrative needs, an average CASA customer can interact with the bank or its merchant 8-12 times a year. I would consider Fino an important if not primary account for the average CASA customer and worth the annual fee.

-

3. How does the CASA behaviour of the bank’s customers compare with other payments banks and SFBs?

-

Using the RBI data (shown in table above), I have compared the debit card behaviour of Fino debit card customer with its peers and found the utilisation of Fino cards (per card transaction value) is much higher than all the payments bank and many small finance banks.

-

In terms of total transacted value (ATM + PoS + Online), Fino is 3x Paytm Payments Bank despite having only 1/4th number of cards. In fact, Fino does more transactions (by value) than all Payments banks and many SFBs like Suryodaya, ESAF and Utkarsh. So, the debit cards and hence the CASA franchise of Fino is indeed robust in comparison to its peers.

- In terms of volume and value transacted per card via ATM, Fino is again miles ahead of all other payments banks and also significantly ahead of smaller SFBs like ESAF, Jana and Utkarsh.

4. What are the key monitorables that investors need to watch as the traditional metrics for banks are not fully applicable to Fino?

- Per merchant earning

- Spend/Average deposit per CASA customer

- Cross-sell per CASA customer

- Renewal rate for the CASA franchise

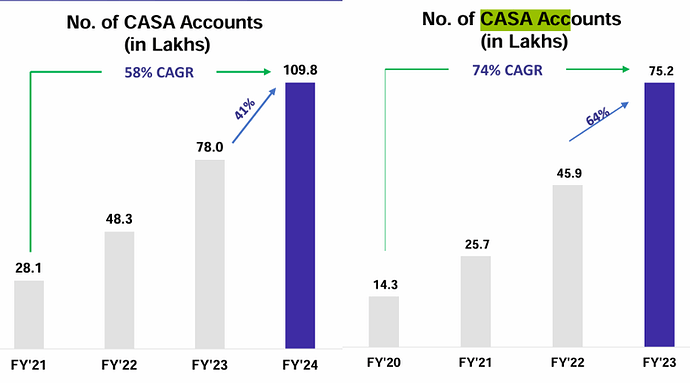

Summary: Fino has been able to scale its merchant network 5x, CASA customer count by 18x and total CASA transaction by 7x over the last 3-4 years. This growth is not just in numbers but has also been value accretive for the shareholders as each CASA customer contributes to the profits from day 1.

-

Since Fino has been able to drive much better engagement with its CASA account than other peers, it may be in a better position to cross-sell loans to its customers. This in turn might drive higher earnings for its merchants causing better competitive advantage.

-

This assumes continued execution and increasing trust and relationship with merchants and customers. Anything that undermines that - regulation changes, macroeconomic issues, trouble with underwriting as the bank turns into SFB, higher reliance on cash etc will remain a source of risk. With a keen eye to the metrics mentioned above, I am optimistic about the performance of the bank.

Requesting members to share their inputs/feedbacks/comments/criticism. Excel sheet with above analysis is here.

Source - ARs, RBI Debit card data, Con-call, Investor presentation

Invested since 6 months, Biased

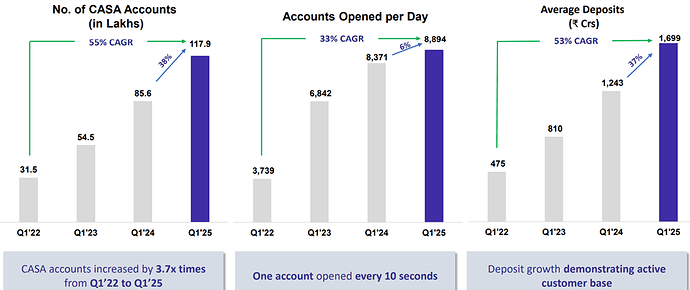

Fino has corrected from its highs of 360 to around 270 rs now and looking attractive now. In a recent interview Link here the management mentioned that they expect the CASA + CMS revenue contribution to grow from 30% currently to 40% in next 12-18 months. And aspire to continue adding 9 lakh casa account every quarter and take the total casa accounts to 2cr from current 91 lakh. In the process of applying for SFB license. May take 2.5 years to finish the process

My KTAs

Higher CASA would lead to good recurring income from renewal.

CASA and CMS being the most profitable businesses, the profit margins would rise as the revenue share from these grows.

While above points are +ves, current tax rate is zero as there are accumulated losses. But once the accumulated losses are surpassed, the tax rates would be normal (I’m considering ~26% but not sure.)

Disc : Invested and biased

From the recent concall of Q2 FY24, the management guided for 20% revenue growth and 50% profit growth rate for next 3 years. I feel that the delta is justified considering the growth would mainly come from my margins businesses i.e. CASA and CMS. Of course there is operating leverage which plays big part.

Like any business high growth rates and (consistent or improving) high ROE is the recipe for return of a stock. I have short calculation of how the ROE may evolve over the years. My calcualtion here

| ROE | calculation | with | 40% | Profit | growth rate |

|---|---|---|---|---|---|

| FY | Fy22 | Fy23 | Fy24 | FY25 | FY26 |

| PAT | 65 | 91 | 127 | 178 | |

| Equity | 480 | 552 | 643 | 770 | 949 |

| Notes: |

- I’ve considered PAT growth of 40% against management guidance of 50%

- ROE = PAT for FY/ average of equity at the end of current FY and previous FY. For eg ROE for FY23 = 65 /0.5(480+552)

- I’v considered no cash out flow in terms of dividend/buybacks

As per my calculation, the ROEs will reach 20% by FY26 and the improvement in ROE may cause rerating in the stock. Other than that there are few other things to consider

- Current ROEs are suppressed by cash and cash equivalents on the balance sheet

- Cash distribution in terms of dividends and buybacks may improve the return ratios. But considering the co is applying for SFB license, I don’t expect much from this

- The profit growth of 40% may or may not be achieved and the rate would go to >25% in coming years from 0 taxes currently

Would appreciate any point for or against my thesis.

Disc: Invested and biased

Thanks

Praveen

Payment banks as a space did not appeal to me from day one due to their limitations. That was verified by the withdrawal of licenses by a few players.

Fino has done exceptionally in terms of business so far, the game change will be when they get the SFB license. Graduation from PB to SFB should enable them to leverage their strength of merchant network.

They should be able to get the license based on their track record.

Is any banefit after RBI decesion on banning to Paytm payment bank…

Out of 11 payments bank licenses issued by RBI, only 6 banks started operations.

If Payment bank license of Paytm I revoked, only 5 would be remaining.

Not much impact on Fino, IMO.

It’s just heartening to see how they’ve made this business profitable (100Cr PAT) and that too in a robust way.

In fact the kind of growth and profitability they’re delivering in CASA and CMS businesses is heartening.

One concern I see is the costs associated with operating as SFB, (technology, man power, etc…)

Another big concern is how market values this Co.

On P/E terms it’s not about expensive.

But on P/B terms, it’s trading at ~4X.

Other than these, I don’t see any major risks currently.

Disc : One of my top positions. Not a reco

They gave 40-45 % guidance in PAT. But delivered 30%. I think their pace of growth coming down.

Disc: 20% of my pf in Fino…

Anyone noticed why is there difference in data points for the same period, am I reading this right.Any other instances seen of the same?

Does anybody know anything about the qualifications of the board members? especially the independent ones.

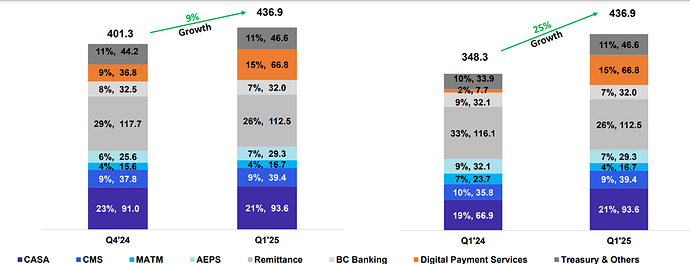

Revenue share as of Q1 25

Fino has been able to build a great liability franchise over the years.

Treasury income has grown 5 % QoQ and 37% YoY aided by deposit growth and a favourable interest environment.

It’s good to see a slowdown in degrowth in some of the legacy/hook products. After a long time, MATM grew from 15.6 crores to 16.7 crores and AEPS grew from 25.6 to 29.3 crores on a QoQ basis. Even BC banking had only a marginal de- growth.

Sequential growth in CASA and CMS continues

Of the INR 66.8 crores in digital revenue, around, INR 64 crores is from the B2B kind of business where they have 19 partners, and Fino provides them online UPI platform for facilitating their business, both on the collections as well as the payment.

In addition to that, there are some MEITY incentives and interchange fees.

It is through partnerships wherein Fino platform facilitates financial transactions online for businesses. This model helps to leverage the platform, which was created over the past 2 years on setting up a simplified digital stack with an in-house UPI switch for the business partners.

The biggest advantage for Fino would be its cost of funds when it eventually gets converted to an SFB. As per the previous concall, they informed that their cost of funds was 2.1 % which is great. They have already converted a cost center(liability side) for most SFBs into a profit center.

Digital expenses have remained high and may not go down any soon. Fino is in the process of migrating to Finacle.

Source: Investor presentation and Concall transcript

You can find that in Annual Report

No, they didn’t mention the qualifications of the board members. that’s the problem.

Business model is good and they have done it right. Going forward would like to understand the following points:

- Their subscription model is bingo, Indian customer paying for a commodity like bank account (full marks to fino). How do they expect to scale it. Secondly, what protects from competition offering this same product at a discounted price.

- once they have the license, which they should get purely because on franchise they have built, how they wish to scale the deposit base.

a) Exisiting base

b) new urban and semi urban base ( - to garner deposit they will have to shell out decent RoIs, then what NIMs they will to play in lending game.

In the remittance and the hook business they have very strong competition from other fintech companies. In the casa business, there is a lot of traditional banks employing BC services and providing saving accounts at 0 fees. For instance, Fino provides BC services to Union bank. If you want to dig deeper from my experience Indian Bank has been trying hard to extend the BC services. So, the competition is already providing the services at discounted prices. Fino have been constantly increasing their reach with more merchants and it is convenience for the customers and clear subscription charges rather than hidden charges like minimum balance charges and folio charges,

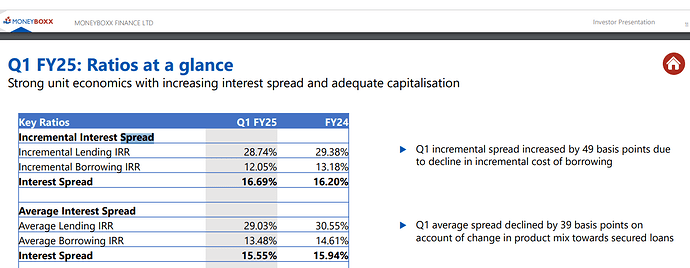

Average deposits is up 37 % yoy and is at 1659 crores. Right now they have to deploy these funds in T- bills and bank deposits. Once they get the SFB license the can lend these funds to the public. Moneyboxx finance could be a pointer at spread.

Indicator of spreads from Moneyboxx Investor presntation

There are few excellent write ups on Moneyboxx in this forum, if you want to dig deeper there.

the cost of funds for Fino was 2.1 % a few quarters back, you can get an idea of NIM from that. As a payment bank they cant take a deposit of more than 2 lakhs, but that would change with SFB licence. They may have to offer a higher rate on fixed deposit but that may still be attractive on an overall revenue basis

- A fintech with a banking license.

- Among the youngest banks, but has a customer base of 1.3 cr.

- The bank operates phygitally (physical + digital). It has more than 18 lakh merchants across the country, who are its real branches.

- Over the last two years, the bank has been focusing on digital initiatives – “Digital D2C’, as they call it. UPI, android and iOS apps etc. While this is routine for every bank, how many FSBs and SFBs have a physical presence in the vast hinterland of the country? Who will hold the hand of this hard-to-reach citizen as he begins his digital banking journey? This is Fino’s real USP.

- The bank charges an “annual subscription” for having a CASA account – the bank is on track to earn Rs. 200 cr. for FY25 on this head.

- Being a payments bank, the bank does not engage in lending. They have, however, applied for an SFB license.

- Their CoF is 2.2% and cost-to-income is less than 26%.

- The promoter, Fino Paytech, has been addressing the financial needs of the unbanked / underbanked for more than 15 years. The parent and the bank have deep domain experience in terms of their target customers and their financial needs. The promo. co. is backed by the ICICI Bank group, BPCL, Blackstone and IFC, among others.

- The management has delivered consistently since listing (late 2021). They have built, rolled out and scaled multiple products specific to the needs of their customers. Their digital payments (UPI payment stack) is a live example. They focus on high margin products and on customer stickiness / “customer ownership” / annuity-type revenue. The management is transparent and attempts to provide detailed answers during quarterly concalls.

- This is a zero debt, profitable and tax paying fintech. Given that H2 is generally better than H1, the company is likely to deliver a PBT in the range of 110 cr. – 125 cr. for FY25.

There are, however, no obvious triggers. Even when the SFB license comes along, it remains to be seen how they will execute on their differentiated, asset-light, liability-first SFB strategy.

Disc: Invested. Views biased.

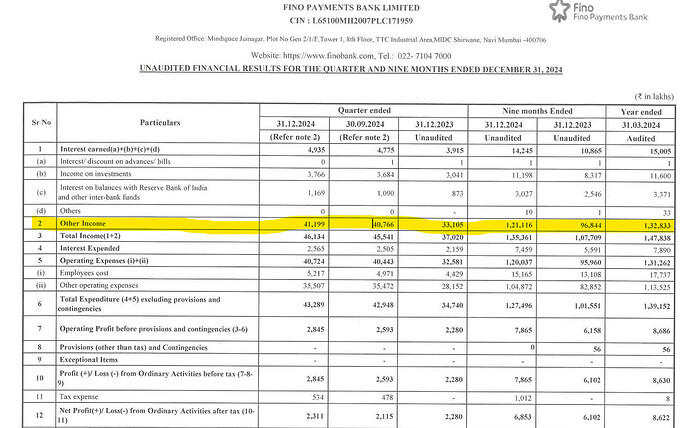

Q3 results - Link

Can someone help to understand why “Other Income” is 90% of income? I thought this will be core operations income, but why does FINO classify it like this?