Does Time Techno - in similar cylinder business?

Not fair to judge given the second generation has come in. Auditors are one of the top 4:- Grant Thorton. Sizing is the key in such companies

AR 21

The Company has a ~150-strong client base in these verticalsegments including Tata Motors, Bajaj Auto, Hyundai,Toyota, BOC India, Praxair, Mahanagar Gas and Adani Gas.

- A key point called our is including CNG in gst could be a game changer and accelerate adoption

above can be achieved via applying a green tax as well

Fromnarticle above- Road transport and highways minister Nitin Gadkari last Monday announced a proposal to impose a green tax on a certain category of vehicles from 1 April 2022. As per the proposal, a green tax could be levied on personal vehicles at the time of renewal of registration certificate after 15 years equivalent to 10-25% of the road tax of a petrol or diesel vehicle depending on the fuel. A similar tax could be levied on transport or commercial vehicles older than eight years at the time of renewal of fitness certificate

Given good natural growth, govt may or may not tinker on taxes but policy push intent and on ground reality (infra and growth) is visible, any booster will help further

One needs to focus on business which remains particularly strong for EKC & not get perturbed by volatility rather take advantage of it .

Opp size remains strong for next few years for EKC tks to boom in CNG auto demand for its cylinders from OEMs, retrofitting kits, cascades for up coming CNG stations in India as the gas pipeline network grows at rapid pace, as can be seen from above good article.

One can also gauge from the tremendous response recent CGD tender evoked as can be seen from enclosed attachment.

TBO17.12.2021 CGD RESPONSE.pdf (590.0 KB)

Even abroad many countries like Egypts are registering new cars only for CNG which is replacing petrol/ diesel cars due to less pollution & cost efficiency.

“India has large domestic reserves of natural gas as compared to crude oil. India has explored about 5 TCM of recoverable reserves, of which less than 0.5% is used as fuel in the current CNG fleet,”

Opp size keeps increasing for CNG vehicles worldwide imlying good utilization for EKC Dubai plant already at 70%.India already running at 90% utilization & capex on. large no of countries hv abundant natural gas reserves & can use it for running vehicles.

We need to focus on underlying business & not be perturbed by price volatality

How much is the threat by EV to CNG vehicles? ,Views Invited.

The total number of CNG-only vehicle registration for 2021 stood at 1,63,696 units as compared to 41,572 units in 2020

Even as electrification catches up in some automotive segments, there has been a significant surge in the sale of CNG (compressed natural gas) vehicles as an alternative to costlier petrol/diesel vehicles in the country.

In 2021, there was almost a four-fold increase in the registration of vehicles powered by CNG. The total number of CNG-only vehicle registration for 2021 stood at 1,63,696 units as compared to 41,572 units in 2020. Also, the total registration of petrol/CNG vehicles grew to 2.36 lakh units from 2.07 lakh units in 2020. Registration of petrol/hybrid vehicles grew to 1.22 lakh units in 2021 from about 84,000 units in 2020, according to official data.

Subscriber Exclusive

Subscriber Exclusive

Portfolio: Getting into the details of Market Rally

Indian indices poised at crucial levels

Portfolio: DIY Screener for banking stocks

The increased price gap between CNG fuel and petrol/diesel and a good increase in the availability of CNG refilling stations across India have driven buyers’ shift towards CNG vehicles.

“Yes, there is a definite shift towards alternative fuel vehicles. In the case of passenger vehicles, we have seen CNG share in sales cross 8 per cent of overall sales and EVs also seeing some traction more so in the recent months. We are seeing more CNG launches by different manufacturers looking at the current gap in retail prices of petrol and diesel,” said Hemal Thakkar, Director, Crisil Research.

Aggressive promotion

In the PV segment, only Maruti and Hyundai have been aggressively promoting CNG vehicles. Maruti, the top player in the sale of CNG models in the PV segment, has seen a big increase in the sale of CNG variants, which accounted for 18 per cent in its volumes during the September 2021 quarter as compared to 11 per cent in the year-ago period.

As it makes economic sense to consider a CNG model vs diesel or petrol variants now, many companies are also jumping into the CNG bandwagon. Tata Motors will shortly announce its big plans for a CNG range of variants in its PV portfolio.

In the commercial vehicle space, CNG penetration has been happening steadily in the small commercial vehicle segment. However, the recent months saw bigger penetration in the higher tonnage categories due to favourable economic reasons. More new CNG models are to hit the markets soon.

“Since BS-VI launch we have seen petrol and CNG vehicles breach 20 per cent of sales in the sub-one tonne category of commercial vehicles in recent months. In the case of ICVs, our latest interactions suggest that CNG has reached almost 50 per cent of overall sales in recent months. In the case of buses, EV penetration has seen a good increase on account of STU tenders and CNG penetration has also remained good with diesel losing share,” said Thakkar.

Pure CNG vehicles will only be available in the commercial vehicles segment. Company fitted petrol plus CNG options are available in passenger vehicles as well as small commercial vehicles.

Petrol cum CNG options give the user some comfort that if the vehicle runs out of CNG then he may still be able to run it on petrol. However, with the increasing penetration of CNG fuel stations, this fear should also abate and we should also see reasonable penetration of only CNG vehicles going forward.

Flex-fuel engines

Meanwhile, the Indian government is now pushing for flex-fuel vehicles for using a high-level blend of ethanol in fuel. Though flex-fuel may have its benefits, it may not be compatible with the present petrol engines and may require some production changes, say industry analysts.

“I believe that it is not going to be easy for the OEMs to come up with flex-fuel engines in such a short time frame. Also, for OMCs (oil marketing companies) it will be difficult to have infrastructure supporting both flex-fuel engines and engines with e5 – e10 ethanol blending. As they also have to make space for EV charging infrastructure. It would be good if there is a long term policy roadmap defined for alternative fuel vehicles including flex-fuel vehicles as this will provide much-required clarity for the development of the ecosystem,” said Thakkar.

Published on January 16, 2022

SHARE

Elevated prices of petrol due to a steep increase in taxes in the recent past is set to increase the adoption of compressed natural gas (CNG)-driven vehicles.

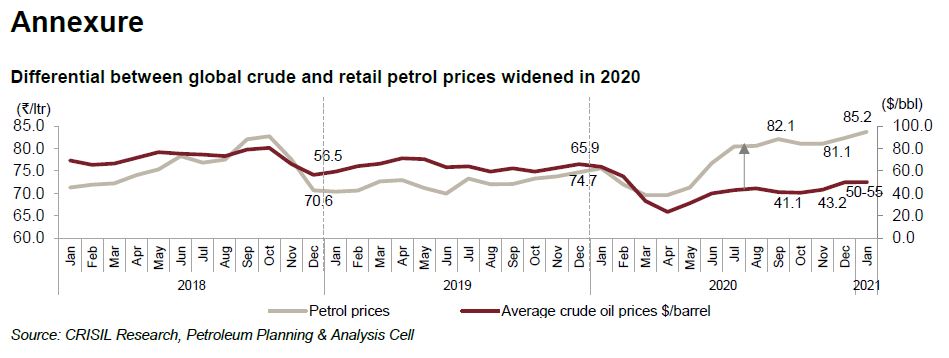

The last time petrol prices had crossed the Rs 80 per litre mark was in October 2018 (see chart 1 in annexure), when Brent crude had surged to $80.5 per barrel. The price has now touched an all-time high of Rs 85.2 per litre in New Delhi even though Brent has slid to ~$55 per barrel (after a roller-coaster 2020 when it surged to $63.6 in January and then plunged to a two-decade low of $23 in April 2020).

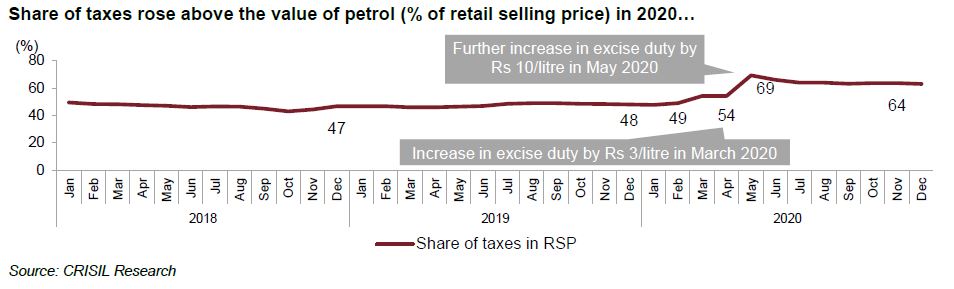

The increase is due to higher excise duty, which rose by Rs 13 to Rs 32.98 per litre in 2020 (see chart 2 in annexure), and value-added tax.

Says Hetal Gandhi, Director, CRISIL Research, “Tax now accounts for over 60% of the retail selling price of petrol, compared with 47% in 2019. Given that the government has to find the money to ramp up public spending – and is also promoting usage of cleaner fuels – it is unlikely that the tax on petrol will come down to previous levels anytime soon.”

In the current fiscal, the government is expected to earn incremental revenue of ~Rs 1.4 lakh crore because of higher excise duty – despite petrol and diesel sales volume likely declining 10-16%.

In calendar 2021, CRISIL Research expects Brent crude to rise ~23% on-year to an average $50-55 per barrel from $42.3 per barrel in 2020, riding on a gradual recovery in economic activity globally. That would mean a ~4% increase over the average closing price of December 2020.

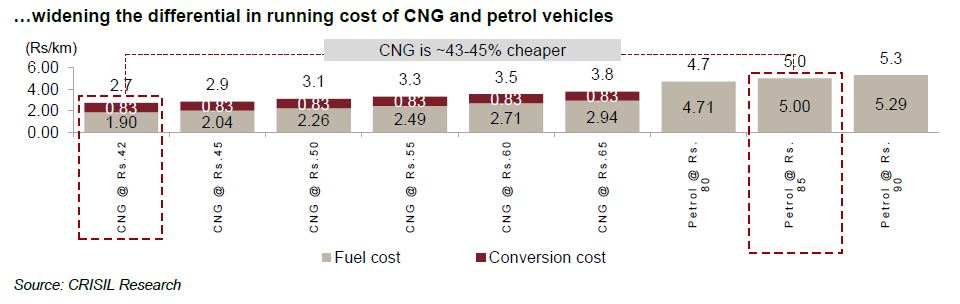

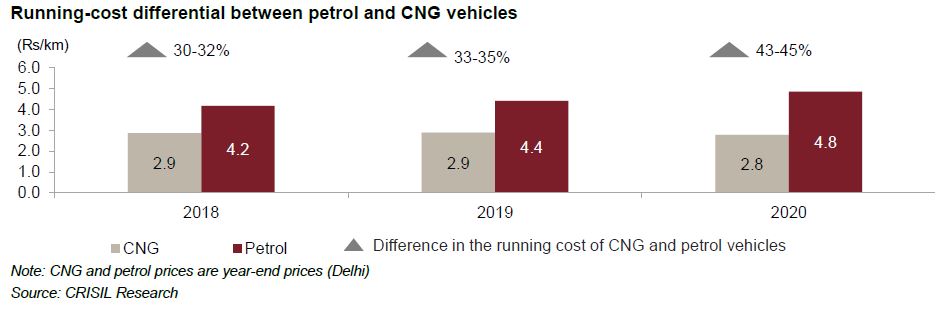

In comparison, domestic gas prices are expected to rise over 20% to $2.5-3.5 per million British thermal unit (mBbtu) in calendar 2021 from $2.45 in 2020. While the percentage increase in domestic gas prices is similar, the differential between petrol and CNG retail prices will remain wide because of higher taxes on the former (see chart 3 in annexure).

Parallely, the government is ramping up city gas distribution (CGD) networks, which would also drive up CNG consumption. Within CGD, the CNG segment – accounting for ~40% of CGD demand – is expected to log a compound annual growth rate of ~25% between fiscals 2021 and 2023.

CNG vehicles1 account for ~5% of the passenger vehicles sold in the country annually. With the implementation of Bharat Stage VI standards, prices of diesel vehicles have risen sharply, pushing most commercial players (such as radio-taxi companies) towards CNG.

The price competitiveness of CNG is evident in consumption volumes, which have logged a CAGR of ~11% over the past three years. About 1.8 lakh CNG cars and passenger vehicles were sold last fiscal versus 1.4 lakh in fiscal 2015.

Says Mayur Patil, Associate Director, CRISIL Research, “CNG was always cheaper than petrol, but the price differential between the two has widened rapidly in the past two years. Today, the cost of running a CNG car is ~44% less than a petrol variant, if you consider the CNG price of Rs ~42.7 per kg in New Delhi.”

What would also ramp up the share of natural gas in India’s energy mix is trunk gas pipelines being laid, and deeper penetration of the CGD network. A total of 136 ‘geographical areas’ have been awarded under Rounds 9 and 10 of CGD, which are expected to cover ~71% of the cumulative population.

While growth in CNG vending outlets has more than doubled to 2,434 between 2015 and 2020, it is still significantly fewer than petrol outlets. The expansion of CGD network and increasing adoption of CNG as a fuel for personal vehicles will ensure this number increases faster than before.

Note 1: Annual registrations of CNG vehicles only, and petrol+CNG vehicles

Subscribe for our press releases

The cost of running a car with a gasoline engine is ₹5 per km, in CNG it works out to be less than ₹2 per km.

Tata have a bullish view on CNG Segment in near future

Btw when did the oxygen cylinder government blacklisting happen? Just saying that one has to be careful in giving automatic exoneration to 2nd gen. ![]() Have to evaluate on their own merit. Always helps to be careful in such cos, discount the CG in our buying price. At same time i don’t believe that one a badass always a badass. Cg Is an evolving picture. We can see relaxo, apl apollo to see how cg concerns have evolved.

Have to evaluate on their own merit. Always helps to be careful in such cos, discount the CG in our buying price. At same time i don’t believe that one a badass always a badass. Cg Is an evolving picture. We can see relaxo, apl apollo to see how cg concerns have evolved.

Is there any evidence of corporate governance improving in ekc ??

Big four imo is to be given 0 credence for corporate governance. Guess who the auditors for satyam were ? One of the big four.

Guess who the yes bank auditors were ? KPMG india.

Disc : tracking, not invested.

Another good interview with shailesh chandra MD TATA Motors PV div extolling the virtues of CNG & increasing opp size for EKC Everest Kanto. EV also to gain but CNG to have the pre dominant shares

Hi Vivek,

A basic question on this, if all auto manufacturer’s future product line has significant amount of CNG component, why would they not manufacture cylinders on their own(similar to Maruti) looking at profitability of EKC and that much cost can be saved or drag down the margins of EKC just like they do with other auto ancillaries, it anyway is not a very difficult product to manufacture technically.

I don’t find trigger for ekc, if a car manufacturer have a fixed set of vendors why they will opt for ekc, making cylinders is not a niche skill, here cost competative ness will be higher left less option for co have a pricing power, also commodity price will drag margin down, also Chinese supply will disrupt as well, just a opinion

Q3 results -

India and US Revenue grew vs previous Quarter; Dubai revenue declined a bit. Profitability came in a bit under pressure during Q3. Decent numbers. Look forward to concall

Hello,

Is there a concall planned by the management? If yes, would you be able to share details?

Regards

Revenue grew by 10% QoQ but the cost of Materials grew by 24% on a consolidated basis. On a standalone basis, revenue grew by 15% and the cost of materials by 23%. Seems like they have been able to pass on more inflation in India.