Margin revival continues, organic sales growth is a bit disappointing and they keep acquiring! I have captured recent call notes below.

FY24Q3

-

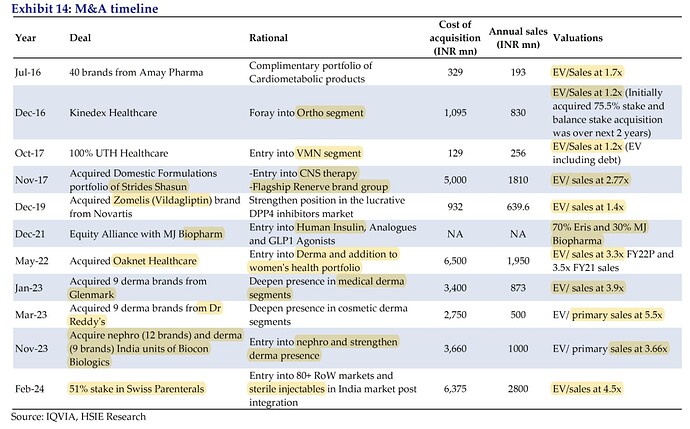

Since FY17: OCF of 2,100 cr., invested 1,900 cr. in inorganic growth + 400 cr. capex + 400 cr. dividend and buyback. 6-year average GM: 80%+, EBITDA margin: 35%, OCF to EBITDA: 75%

-

3 derma acquisitions of 1**,265 cr. in FY23** will contribute 375 cr. sales and 130 cr. EBITDA in FY24. Tail brands are doing badly and main brands are growing well. Commercial production in Gujarat facility has started for derma products which will aid in margins

-

Vision FY29: achieve revenues of 5,000 crores

-

Swiss parenteral (51% for 637.5 cr. + 19% for 237.5 cr. by promoters)

-

Valued at 1250 cr. (12x FY23 EBITDA, 4.5x FY24 sales)

-

FY23 revenue: 280 cr., 37% EBITDA margin and 25% PAT margin

-

Remaining 30% will be held by Naishadh Shah, Director of Swiss Parenterals, who will be in charge of day-to-day operations

-

11 lines of sterile injectables (mostly antibiotics) focused on ROW markets; strong presence in Southern Asia and Africa, and focusing on European markets. Work on distributor led model

-

Will enable Eris to launch Sterile Injectables business in India (hospital focused) along with small volume parenteral market. Target of 100 cr. in first year on the domestic injectables side

-

Differentiation of what goes into Swiss Parenteral vs Eris: Swiss will do large part of hospital business and Eris will do specialty drugs. For example, in Women’s health, there is some amount of biotech which will be done by Eris

-

Will build an OSD business in RoW markets leveraging Eris’s manufacturing facilities and Swiss’ RoW channels and distribution presence

-

1,000 active dossiers across 200 molecules, and pipeline of 1,000+ dossiers in existing molecules and 40+ new molecules

-

2 manufacturing units in Gujarat being run as single shift

-

Unit 1 is for general injectables

-

Unit 2 has dedicated blocks for betalactams, penicillins, cephalosporins and carbapenems

-

Will do 40-60 cr. capex in next 2-years

-

-

R&D: 15 professionals focusing on liposomal, microsphere, oil-based and depot injection

-

-

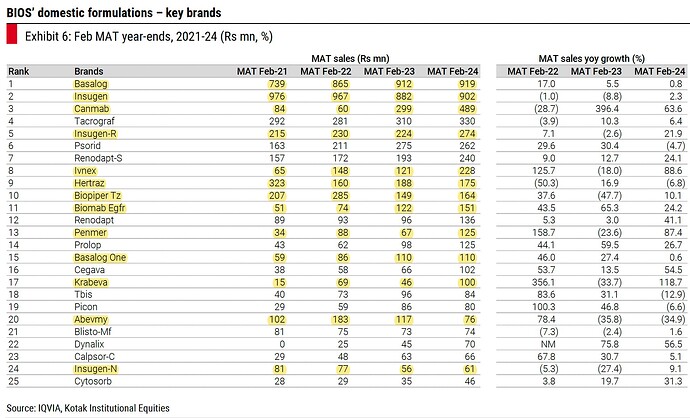

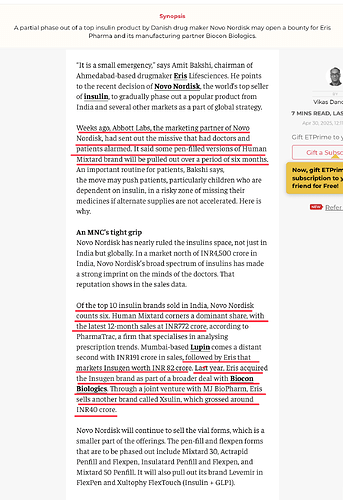

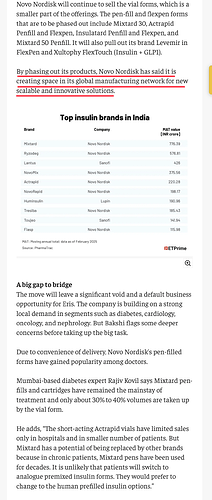

Insulin: 12 cr. sales in Q3FY24 (YPM: 3.5 lakhs). Reached 5 cr. monthly runrate

-

Launches and R&D pipeline

-

Launched Sitagliptin-Gliclazide and Dapagliflozin-Gliclazide in December + Empagliflozin + Linagliptin combination

-

Secured approvals for Liraglutide and Glargine from MJ’s pipeline and these will be launched in Q4

-

Pipeline increased to 26 from 14 in Q2 (17 FDCs + 9 new drugs)

-

-

Looking at standalone performance will no longer make sense as Gujarat facility is part of Eris Therapeutics Ltd

-

Tayo (MAT of 80 cr.; 45% Q3 growth), Gluxit (MAT of 75 cr.; 21% Q3 growth) and Remylin (MAT of 70 cr; 51% Q3 growth) are set to reach 100 cr. annual sales

-

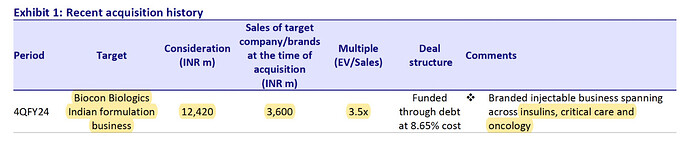

Biocon portfolio doing 7-8 cr. of monthly secondary sales, gross margins will increase from 50s to 70% by Q1FY25

Disclosure: Invested (position size here, no transactions in last-30 days)