AR23 notes

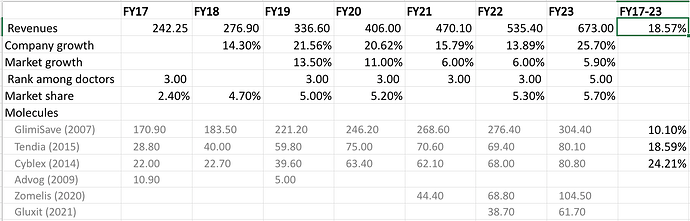

Diabetes

-

Insulin:

o Commercialized 2 products: Human Insulin (Xsulin – Regular and premix as vials and cartridges), Glargine (Xglar)

o Pipeline consists of Liraglutide and other insulin analogs

o Clocked 17 cr. revenue with operating losses of (-20 cr.)

o Expect losses to narrow in FY24 and business to be profitable in FY25

o Promoted through 200-member field team - Glimisave crossed 300 cr. and Zomelis crossed 100 cr.

- Full-service presence across all the oral segments – Sulphonylureas, DPP4 Inhibitors (vildagliptin, sitagliptin) and SGLT 2 Inhibitors (dapagliflozin) – and in injectable Anti-Diabetes therapies

- DPP4 and SGLT2 portfolio have grown at a 50% CAGR over last 3 years

- New launches: Glura (DPP4 Inhibitor), Sidacor

- In covered market of ~14,000 cr., ranks #8 in terms of revenue and #5 as per Rx

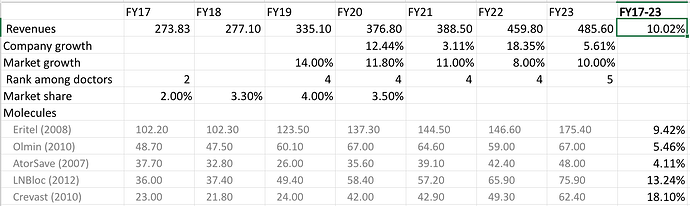

Cardiac

- Eritel grew at 19% and is now 175+ crore mother brand

- New launches: Zayo (relaunched), Bisopharm, Cardexa

- Number of major molecules will lose exclusivity in cardio metabolic segment in next 3-5 years

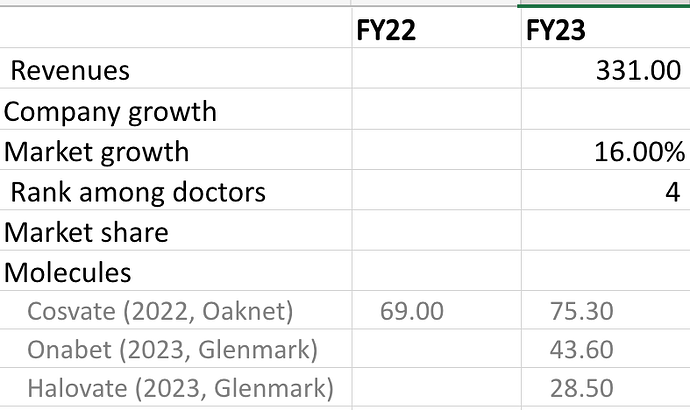

Dermatology

- Spent 1265 cr. spent in 3 acquisitions

- Acquired Oaknet Healthcare for 650 cr.

- Acquired 9 Derma Brands from Glenmark (Medical dermatology) for 340 cr.

- Acquired 9 Derma Brands from Dr. Reddy (Cosmetic Dermatology) for 275 cr.

- Acquisition with an “owner manager” mindset, with willingness to do the hard work to create value

- Oaknet clocked 22% organic growth in FY23 after 3 flat years during FY20-FY22. EBITDA margin expanded from 10% in FY22 to 24% in FY23 and will expand further in FY24

- Ranks #3 in its Dermatology covered marked with a share of 7%

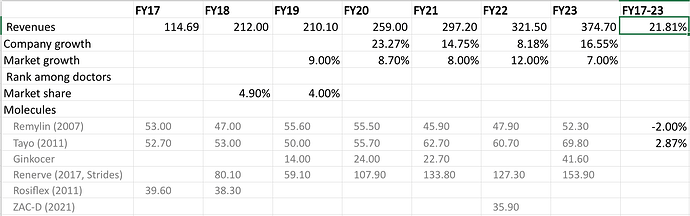

Vitamins, minerals and nutrients

- Excluding impact of ZACD (Covid product), segment grew at 16% in FY23

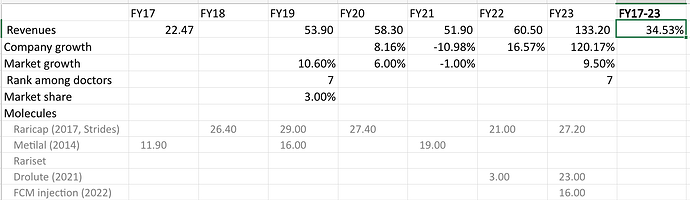

Women’s health

- New launches: Drolute (Dydrogesterone), FCM injection

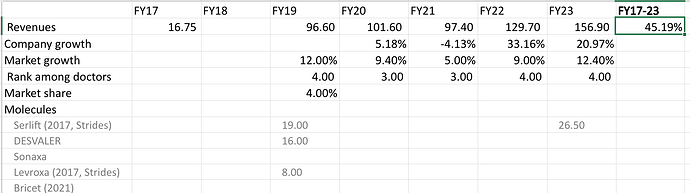

Central nervous system

-

New launches: Nobix, Sonaxa, trivoxetin, HealSenz

Capex and manufacturing

- New manufacturing plant in Gujarat began commercial operations in March 2023 and augments capabilities in oral solids, oral liquids, sterile injectables and creams/ ointments. Its built by WHO GMP standards and has 10x footprint of Guwahati site

- Manufacturing facility at Guwahati contributed 70% of products sold (by value) vs 80% in FY22

- Capex: 208 cr. (vs 53 cr. in FY22). Taken from gross block increase

General

- Top-20 mother brands account for 70% of revenue and clocked 17% growth in FY23

- 15 brands ranked among top-5 in their therapies

- 4 mother brands with revenues of 100+ cr., 6 mother brands with revenues of 70-80 cr. and 5 mother brands with revenues of 50-60 cr.

- Excluding impact of Covid products and “at risk” launches, standalone revenue grew by 15.6%

- Consolidated revenue grew at 25% and 31% excluding impact of covid products and “at risk” launches

- Preservation of consolidated gross margin of ~ 80% is an integral component of growth strategy

- Introduced a reward program to recognize top performers from various departments (sales, marketing, manufacturing, etc.)

- YPM (Yield per Man per Month) in standalone operations (branded formulations business) for FY23 stood at INR 5 lakh per month

- Future growth: In-licensing, exploring newer therapeutic areas and future patent expiries

- Permanent employees: 3’548 (median increase was 8.68%)

- Share price: 550.9 (low), 749.85 (high)

- Shareholders: 46’403

- Expected credit loss provided for: 3.5 cr. (vs 3.5 cr. in FY22)

- Amit Bakshi increased shareholding from 40.28% in FY22 to 40.84% in FY23

- Contingent liability: 28 cr. (vs 24.5 cr. in FY22)

- Auditor remuneration: 1.28 cr. (vs 0.5 cr. in FY22)

- Bankers: Axis, HDFC, SBI, Citi

Industry trends

- With ~55% share in IPM, chronic and sub-chronic therapies grew by 10.6% in FY23, while acute therapy comprising ~45% of IPM, grew by 7.8%

- For Eris, chronic and sub-chronic contributes 87% (vs 55% for IPM)

- NLEM: 7% for Eris (vs 14% for IPM)

Patient initiatives

- Ambulatory Blood Pressure Measurement on Call: 9,000 clinicians have used this service and over 130,000 patients have been screened through ABPM on Call

- 24 hours Ambulatory Electrocardiogram: 68,000+ patients have been screened

- Continuous Glucose Monitoring (CGM): 48,000+ patients have been screened

- Sleep Study on call: 24,000+ patients have been screened

- Montana ANC Associate (detect Hb, PIH and GDM in Fetal Origin of Adult Disease): 200,000+ patients have been screened

Disclosure: Invested (position size here, no transactions in last-30 days)