Industry wide there is drop in CASA as money is moving to TD. Overall deposits growth is very strong for the bank. Over 3000 crore of deposits raised in a quarter is a decent amount for a SFB.

Q2 FY 24:

Notes from Con call

Macro level- Favorable Environment, resilient GDP Growth, all lead indicators are quite healthy (E-way bill, 2w, 3w sales), Upcoming festive season, so very strong demand in all segments.

Last year advances growth in second half very high. So base effect will be there. But, overall loan growth for year expected 25-30%.

New LOS active in 300 branches.

Deposit Mobilization – Retail Focus (Newly lauched-444 product).

Loan Sourcing Channel- Largely in house, we are not dependent on DSA. So, asset quality good.

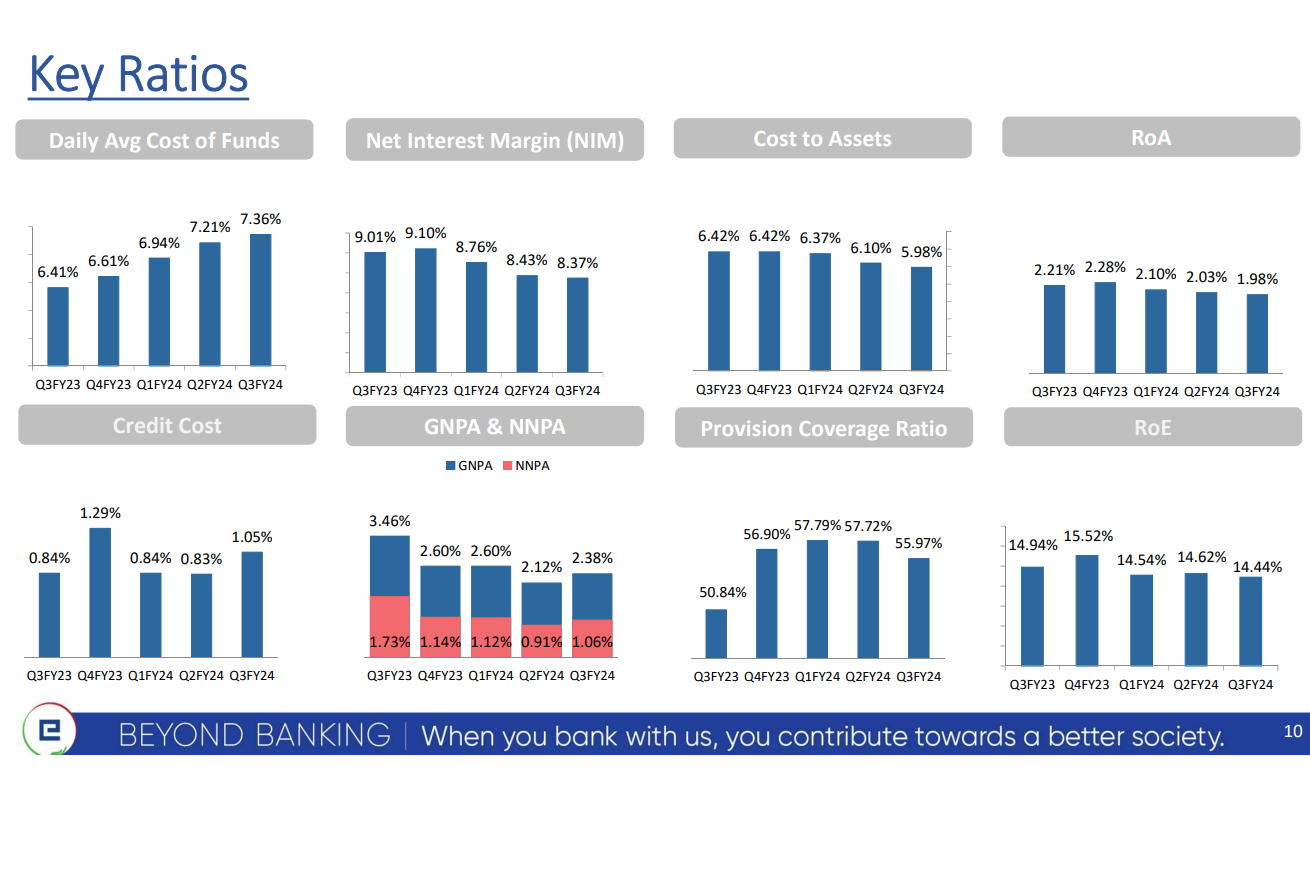

NIM to moderate and remain under earlier guidance.

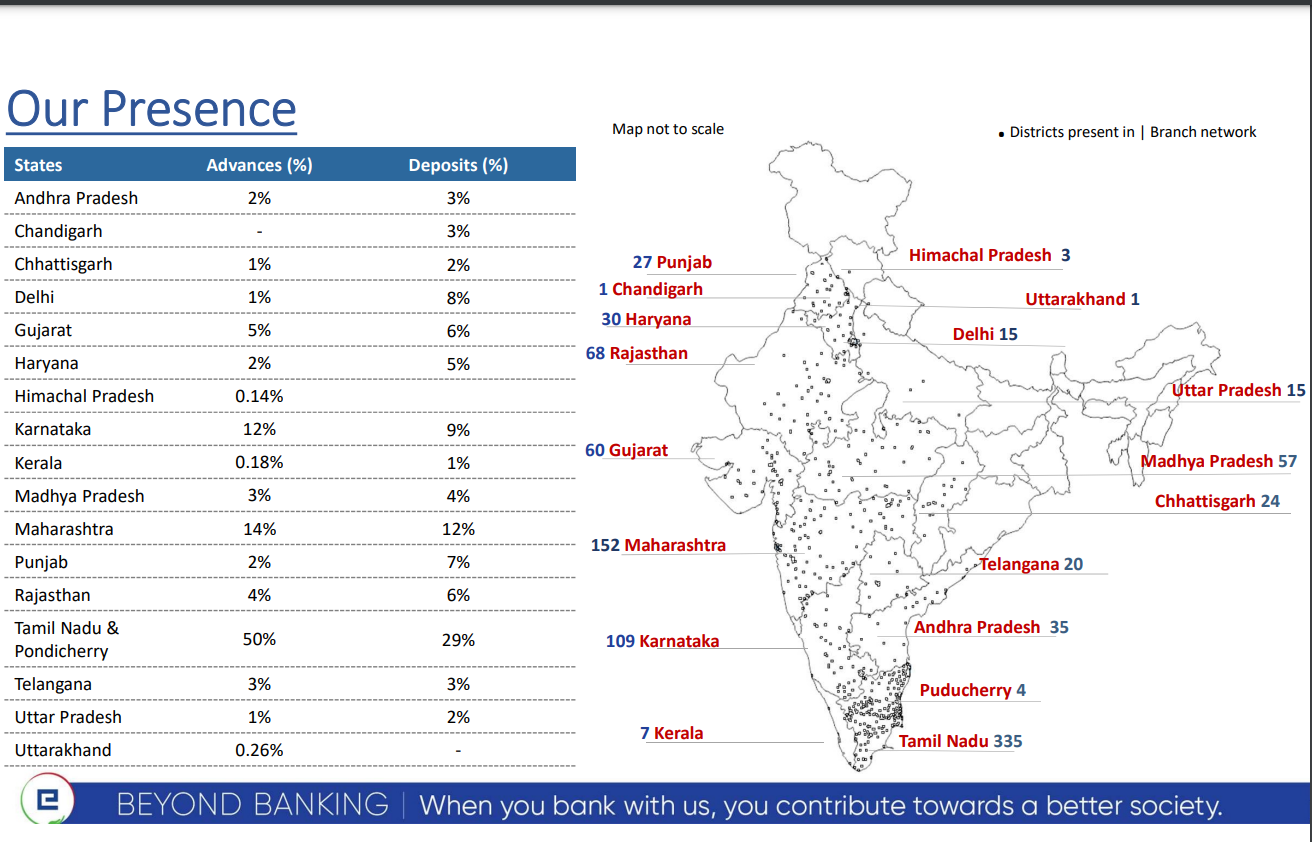

In SBL, focusing on Non-TN. (Telangana, Karnataka, Maharashtra)

Drivers for ROE: We expect the Cost of the funds to move to about 7.5% in the next two Quarter from the current 7.21%. We expect interest cost to go up by 25bps in the second half as older deposits gets repriced.

Benefit of increasing lending rates expected to kick in the next Quarters. Second half will see more disbursements which will increase the fee income.

Credit cycle to remain benign this year.

85% of the book is fixed rate. If we assume the Cost of the funds remains the same for the next 12 months our NIM will expand as our fixed rate books get repriced at higher level as interest rates were raised only in this Q2. So, bottom line will improve.

Opex goes up sharply in the first Quarter because salary hikes are done in this quarter. In Equitas staff costs make up 65% of the Total Opex. So opex, gets reduced in the next 3 Quarters.

In terms of investments, CBS upgrades done, IT upgrade finished, LOS for vehicle finance live now, LOS for retail and home loans started and will complete in next 2 quarters. CRM will go live by 4th quarter. So, no stepping back on any of the investments (Both Tech development and Product Development).

Yield on Disbursements in the latest Quarter is 18.3%. Full benefit of it will come overtime given a largely fixed loan book.

Incremental growth of Deposits compared to loan growth hence Margins decreased despite Spread being constant.

Gross slippage is marginally higher and mostly due to CV. CV collections mostly dull in H1 due to monsoon and will improve drastically in H2.

ROA 2.25% is the long-term guidance. As a business model, sourcing mix, portfolio quality, strong investments in technology we are confident of achieving it.

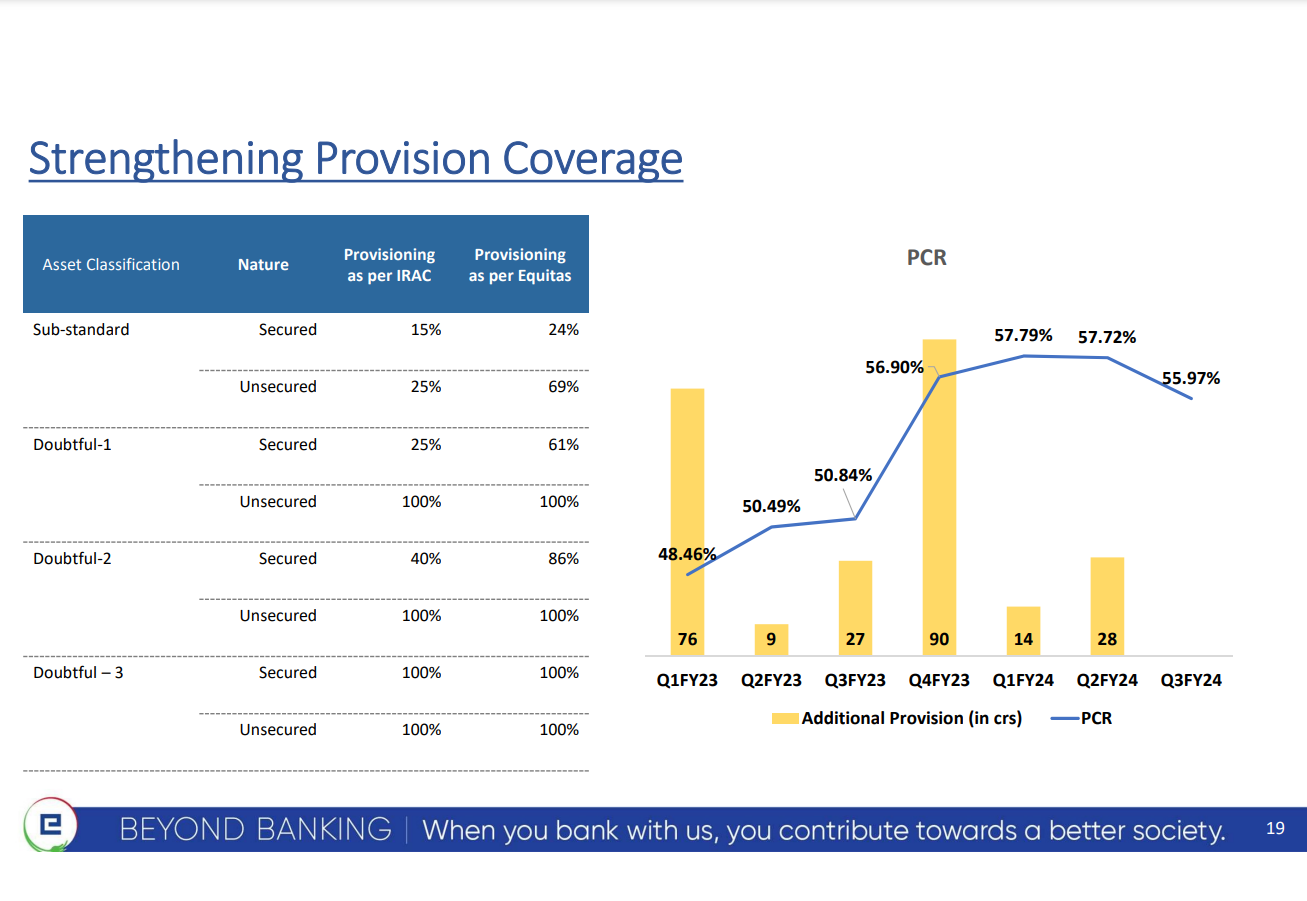

PCR we look at a 2-year time frame to reach 70%.

MSE finance, we had impact due to COVID customers are still not able to come out of it. So, we are waiting for delinquencies to reduce in MSE, so that we can again concentrate in this area. But MSE finance is very small part of the portfolio.

Plans on Branch opening: We have invested strongly in the last 5-7 years. We need to get operating leverage out of it. Hereafter we will add branches but not aggressively. There is huge potential to grow in the existing branches. In the next 2 years, we will not add much branches. However, we will invest in Technology and products to improve efficiency and customer experience. Credit Cards, AD1 this year we are taking on which will drag profitability. Last year Affordable Housing started, this year it will break even and next year will contribute positively.

Disclousre: Invested and Biased

Hello ,

Can anyone please explain the impact of the profit and growth on back of the news that came out day RBI requesting few banks (Including Equitas) to reduce credit to deposit ratio to below 75 % ?

Quick notes on Equitas SFB concall:

- CD Ratio → bringing it down to 85% by March 25; currently ~91%; retail deposits have been increasing, currently more of RD TD as compared to CASA

- Increase in slippages → Attributed to floods in Tamil Nadu, especially impacting vehicle finance and microfinance; historical slippage rate maintained between 3-4%.

- Collection efficiency → Peaks in Q4; anticipates credit cost around 1.25% for the year.

- Vehicle finance → New LOS implemented for vehicle finance across branches; witnessed 30% growth and expects to sustain this momentum.

- Disbursement Yield → Small Business Loan , vehicle finance, micro finance have increased disbursement yield; marginal increase in affordable housing; new CV from 18.28% (March 2023) to 19.56% (December 2023); SBL from 16.33 (March 2023) to 17.16% (December 2023)

- Disbursement Strategy: Management avoids sacrificing NIMs for topline growth; maintains a focus on high-yield products; flat disbursement not solely due to reducing CD ratio.

- Securitisation → SBL 221crs, HF 271crs, VF 897 crs have been securitized; shown as other income

- Guidance → Targets 25% growth over the medium term; aims for 8% NIM for this financial year; RoA of 2.25%+.

- Cost to Income → Major investments directed to Affordable Housing Finance and Personal Loans; no significant branch expansion; CI expected to remain within the same range.

- NIMs → About 85% fixed interest rate book; if interest rates remain stable, NIMs will improve due to rising advances yield; impact of CD ratio coming down on NIMs will be very marginal

Q3 FY24-

Added 7 new branches during Q3FY24 across AP,Delhi,Karnataka and TN.

GNPA and NNPA increase bcz of flood in TN(temporary issue).

Yes, the pressure on CASA will continue to be there.

launch of credit card.

No new branch expansion, earlier expanded branch will become profitable in 2-3 years which increase our revenue.

NIMs will be at 8% in FY24

- And in the beginning of the year, we had mentioned that for this current financial year, we should be looking at around 8.5% NIM for the full year as a whole and also a possible 8.25% exit NIM for the fourth quarter.

So see, if you – last year, we had guided on a credit cost of 1.5%. And we landed at about 1.56%. This year, we feel that our credit costs will be at around 1.25%.

So our nine-month credit cost run rate is 90 basis point-odd. And when we are saying our full year guidance is 1.25%, does it mean that Q4 will be higher in terms of credit cost?

I mean, if you remove some of the Black Swan years, otherwise, historically, our credit cost has always remained in the 1.1% to 1.2%.

Yes, see, we don’t want to sacrifice NIM for the sake of only top line growth. So some of the low-yield products, we have stopped focusing. And we have focused on our high-end products. That is a yes. So the last year, we had the opportunity to do a lot of NBFC funding. And we did get our rates.

And this is the first quarter after last 2, 3 quarters, I think, we have shown growth in SA also. And the increased focus on ASBA as well as trading account, I think we should develop that module. The differentiated solution in current account, for example, virtual account numbers and solution-centric approach, along with TD suite is helping us to grow the CAR account to the current accounts.

One is our AD-I project and the other one is credit card launch. The AD-I project is underway and there’s going to be some amount of investments we need to make both on tech and on people to get us enabled and ready to commence that business. And credit cards, again there’s going to be an investment both on tech and on people before the product will go live.So these are the two products where some investments will come shortly in the future. But otherwise, if you see branch expansion, as we have mentioned in the past also, we have put up a very large number of branches quite early on. And so thankfully, the cost of increasing our network of branches is behind us. So that is not something you should see – for the next at least 2 to 3 years, you won’t see too much of increase in cost because of branch expansion.

That’s one thing. Second thing is that other than these two new products, so credit card and AD-I, we don’t really see any particular new /other new products coming into the system. So there is most of the products that we have already invested and many of the products will become profitable across their loss-making cycles and become profitable. The affordable housing is still at an early stage. But this year, they should break even and the next 2 years, they should be pulling their full weight in the system. So minus credit card and the AD-I, we are all really not looking at any other major product investment.

Next quarter, when we come back, we will give you the data. Yes, we will give you a good amount of idea of the kind of money that we are going to invest in these two and also give you some maybe a ballpark idea in terms of the launch date and also the likely break-even time span. So we’ll give all of that in the next call.

Our slippages have increased slightly for the reason that there have been heavy floods in Tamil Nadu. And primarily, slippages have gone up in vehicle finance and micro finance. But if you look our slippages, they have always been range-bound between 3% to 4%. I think this is we feel that this is normal and 3% to 4% is a range-bound for our business.

l deposit mobilized during the third quarter, about 80% of them came from retail term deposits. The franchise is coming up well. And over the next few years, our strategy is to move to a customer segment approach from a product segment approach, which should help us deepen our offering for families, NRIs and digital-savvy customer segments.

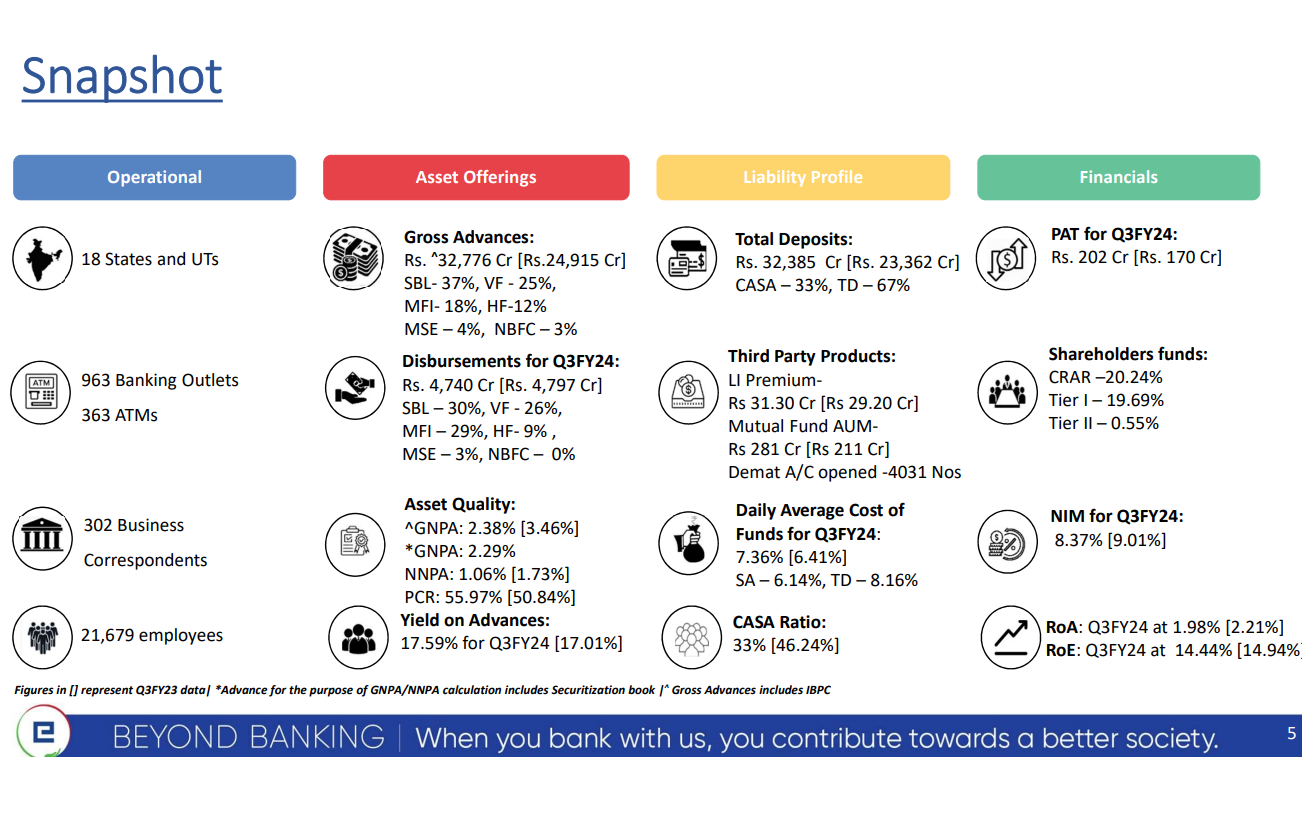

RoA - 1.98 and RoE- 14.44%.

The provision coverage ratio(PCR) remains at 55.97% .(HIGHER THE BETTER)

As of December 22, the composition of disbursements of TN and non-TN were 65% and 35%, whereas as of last month at December end, TN disbursement had come down to 54% and non-TN disbursements have gone up by 46%. Ex-bucket collection efficiency continues to be at 99.5%.(Risk- High concentration in Tamil Nadu).

Screenshot 2024-02-05 120902.png 348.99 KB

Screenshot 2024-02-05 121157.png 375.19 KB

Screenshot 2024-02-05 121253.png 202.41 KB

Screenshot 2024-02-05 121919.png 204.13 KB

The business seen steady growth in the states of AP, CG, Karnataka, and Maharashtra in the non-TN states. The new LoS has been rolled out and is now active in 182 branches across the country. Another 200 branches will go live this quarter

So our continued focus on retail is helping us to penetrate us into investor segment as well as trader segment, so coupled with the fact that you see mutual fund AUM is showing a trajectory growth of 36%, couple of effects, our brokerage account, which we have a 3-in-1 tie-up, is showing very good traction of again a growth of 25%, 26% and, most importantly, ASBA helping us to actually retain SA balances. So expansion from saver to an investor to trader is significantly helping us.

Yes. As we keep saying that we lend to the under-banked or the bottom of the pyramid. So we don’t find much difficulty in increasing the rate. But we also have to keep in mind that there has to be a threshold that there has to be also there. Affordability has to be borne in mind. That is one thing that we have to keep in mind while increasing the rate.

I just want to know that how much of their loan is secured and how much is Unsecured in terms of percentage? and their Small Business loans are secured or unsecured in nature?.

If anyone can answer

If i am not mistaken their Micro finance loan is unsecured in Nature.

80% loan is secured loans.

Check out this article on Equitas SFB (Value research)

Disc: Invested and biased

Q4 Results.

Growth is there , however slippages have also incresed

https://www.bseindia.com/xml-data/corpfiling/AttachLive/6f4374dd-9ba6-4e78-b175-dbdbc68dd17d.pdf

Is Equitas eligible as per standard requirements to convert to Universal bank ? If anyone understands this better and provide your thoughts would be helpful.

Equitas Q4FY24 results:

- Gross Advances increased to 23%

- Deposits increased 43%

- Cost has increased due to higher Interest rate , Hence PAT not increased significantly

- As shown above cost of Fund has consistently increased over the year eating into the profits, If this falls company should start seeing larger profit

FY24Q4 Results not very exciting

High Level Comparsion

Stock is at a decent valuation P/E:14, P/B:2.13 , Holds around 82% secured Loan book

These are the main volatile requirements to meet amongst other,

- having a net profit in the last two financial years; and

- having GNPA and NNPA of less than or equal to 3 percent and 1 percent respectively in the last two financial years.

Source: Reserve Bank of India - Notifications

| Column 1 | Column 2 | Column 3 | Column 4 |

|---|---|---|---|

| GNPA | NNPA | PAT | |

| FY23 | 2.6% | 1.14% | 574 |

| FY24 | 2.52% | 1.12% | 799 |

In my humble, limited knowledge opinion, Equitas will have to keep NNPA below 1% for the next 2 FYs (FY25 and FY26) to be eligible for a universal bank license in FY27.

They should have kept NNPAs below 1% like other SFBs.

It is impossible to know right now whether the next 2 FYs will not have unseen stress events and whether macros will allow them to keep NPAs low. True for all banks.

Equitas has GNPA higher than 3 during FY21 and FY22. So they are not eligible at this moment

FY21/22 dont matter. Latest last 2 FYs are FY23 and 24.

Noob question. Purely from investing perspective, why would upgrading SFB to a full fledged bank make SFB a more attractive investment. I guess it’s a special situation of sorts but what kind?

Sure bank gets access to launch diverse products and services, but the underlying business is still lending. And the asset quality will not change, or diversification will not happen overnight. It would be a gradual process that may actually need more investment. Risk profile is not guaranteed to reduce just because of a universal tag.

What am I missing?

Lower CRR, and PSL requirements, this will help NIMs, COFs. No restrictions on maintaining a smaller lending ticket size.

Will be able to remove “small bank” from the name which the SFBs have been trying to get RBI to remove as a SFB license requirement from the start but RBI never approved. Small has a negative connotation for many customers.

Business update upto 30.06.2024

Disc:Invested

CASA ratio % is declining.That is the main concern here.

I personally don’t think it’s a big issue - CASA ratios are declining across most banks because people prefer to park their money in FDs owing to the highest interest rates we’ve seen in a long time.

Additionally, in the last earnings call, the management referred to their TD base (non CASA deposits) as the “most stable Term Deposit base” with 62% of it being less than 2 crores. Average individual ticket size was said to be in the range of 4.5 to 5 lakhs, which means that there are a large number of depositors, reducing risk. Out of the term deposits with higher ticket sizes, they mentioned that more than 90% of the book was non-callable which should be comforting for them for the next year or so.

Disclosure - Invested & biased