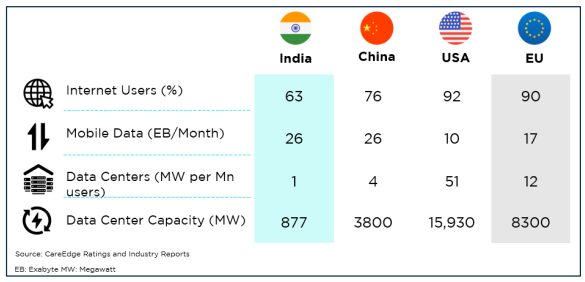

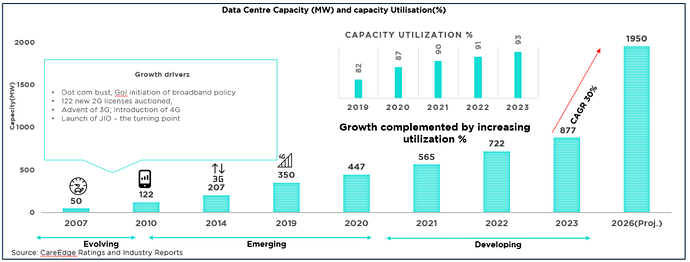

The Indian data center market is poised for growth in the coming years.

I will keep updating this thread as I find companies venturing into this space, with brief info on the company as well as the the specific area.

1. Adani Connex

This is an unlisted company, and is jointly owned by Adani Enterprises and EdgeConnex (50:50). I am expecting the Adani Group to list the business in the near future.

Adani Group has a lot of key advantages when it comes to Data Center business. It is similar to Tata Group having the complete value chain in Electric Vehicle business.

- Complete ownership of large land parcels across the country

- Project management capabilities and resources availability

- End-to-end power value chain (generation, transmission and distribution)

- Fiber connectivity and strong network connectivity

- Renewable Power generation to ensure sustainability

2. Reliance

They have tied up with Brookfield Infrastructure and invested $122 billion for building data centers.

https://www.reuters.com/world/india/indias-reliance-invest-brookfield-infrastructures-data-center-projects-2023-07-24/

3. Tata Power and other Renewable Energy Providers

Many companies will supply Renewable energy to power these data centers. Tata Power already has a contracts with Princeton Digital Group

https://www.tatapowersolar.com/wp-content/uploads/2023/06/26102602/media-19jun23.pdf

4. AurionPro Solutions and other Service IT companies

Multiple small IT companies are also providing services to manage data center operations.

AurionPro is one such company for which value discovery happened this year.

5. Apar Industries (Wire and Cables provider)

Provides CATV cables for high bandwidth requirements

6. Amara Raja Energy And Mobility

This company is a leading manufacturer of Lead Acid batteries which are a key to provide power in a Data Center. India has 150+ data centers, majorly using Lead Acid batteries for supplying power.