Anant Raj: Transforming Real Estate with Cutting-Edge Data Centres

Data Centre- Becoming Investor’s Centre of Attraction

As we dive deeper into the digital age, think of data centers as the powerhouses behind our online obsessions. They’re the secret sauce that keeps your Netflix running and your Amazon orders flying. As more and more people can’t get enough of digital stuff, data centers are evolving faster than a high-speed wi-fi connection. As digital services and infrastructure demand keeps growing, the data center market remains a vital contributor to the global economy in future as well.

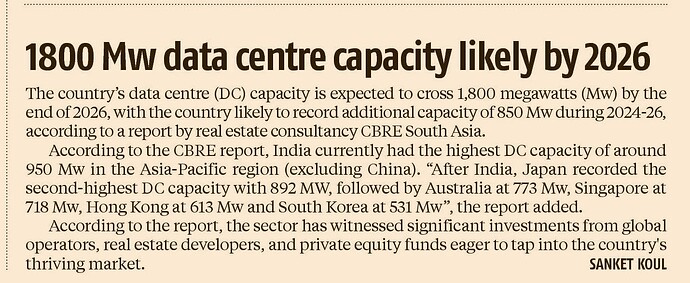

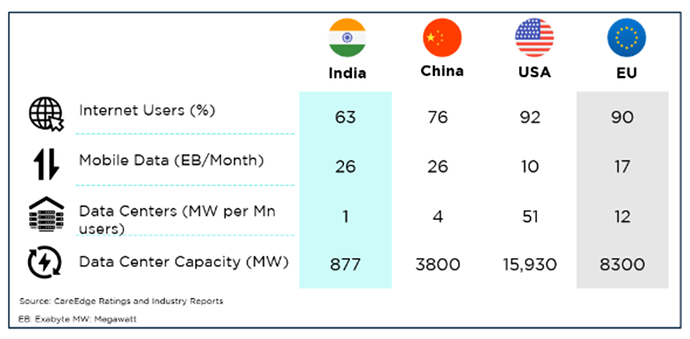

The data center market in India is growing rapidly; by 2026, it is expected to have doubled in capacity to 2,000 MW, growing at a compound annual growth rate of almost 40%. This growth surge is anticipated to draw substantial investments, with an estimated capital expenditure of Rs 50,000 crore over the next three years until 2026, according to CareEdge Ratings.

India’s digital evolution is accelerating as it transitions towards a developed economy, driven by technologies like 5G, IoT, and AI. Data Centre setting up in India offers cost advantages with lower land and labor electricity expenses, making it competitive globally. Government initiatives, such as the Data Center policy and infrastructure status, are further supporting this growth by attracting investments and streamlining regulatory processes. This transformation not only enhances technological capabilities but also positions India as a key player in the global digital landscape.

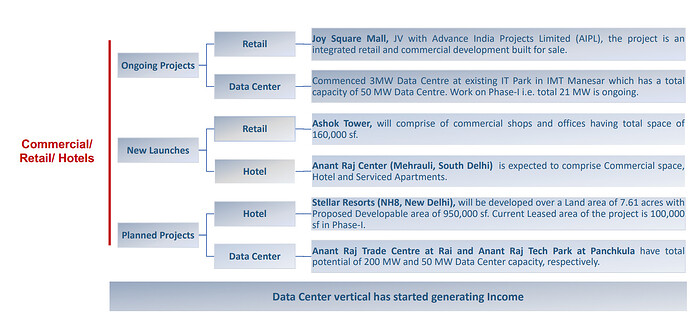

Currently there is one major player, who is attracting the investor’s attention by doing exceptionally well in the industry, Anant Raj Limited. The company is engaging in developing IT parks, hospitality projects, SEZs, office complexes, shopping malls, and residential projects in Delhi, Haryana, Andhra Pradesh, Rajasthan.

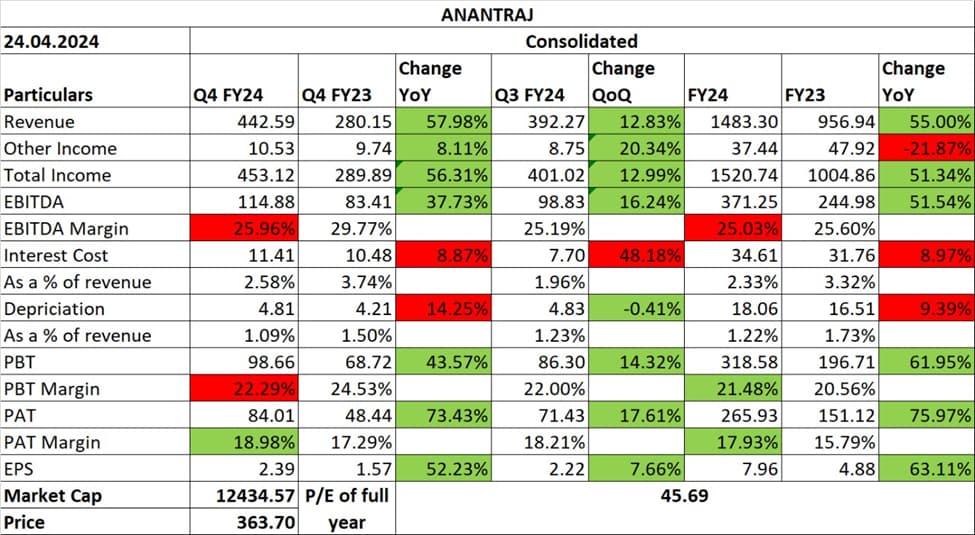

Financial Highlights –

The company’s revenue surge is particularly from its data center operations. With healthy margins of around 18%, Anant Raj demonstrates a strong and profitable business model.

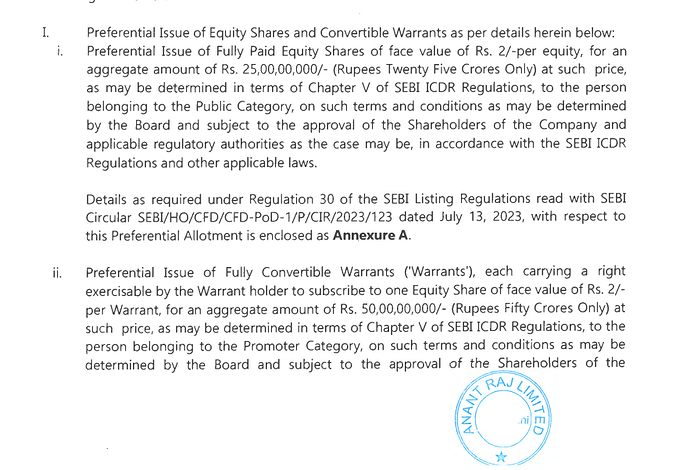

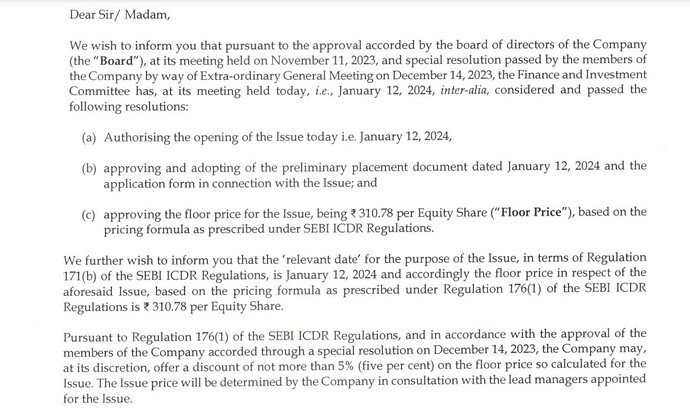

The company launched a QIP of 500 crore in January, 2024. The shares have been issued to Tata Indian Opportunities Fund, Tata Mutual Fund-Tata ELSS Tax Saver Fund, Bofa Securities Europe, Aditya Birla Sun Life Insurance Company, Discovery Global Opportunity (Mauritius), Aditya Birla Sun Life Trustee, Mahindra Manulife Small Cap Fund, and Mahindra Manulife Business Cycle Fund. The Fund will be utilized for further repayment of debt and working capital. After this, the debt of the company will be reduced to negligible level. This will help the company to expedite the development of data centers, launch of new residential projects and expand its rental income substantially.

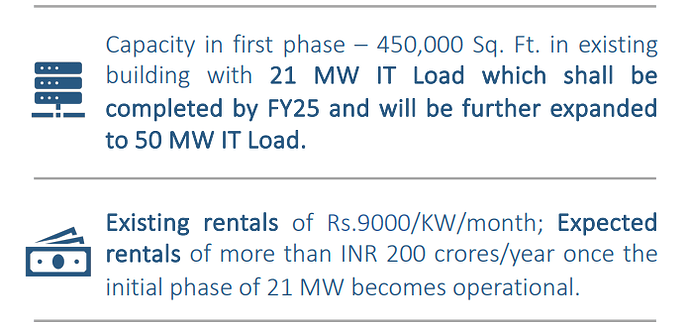

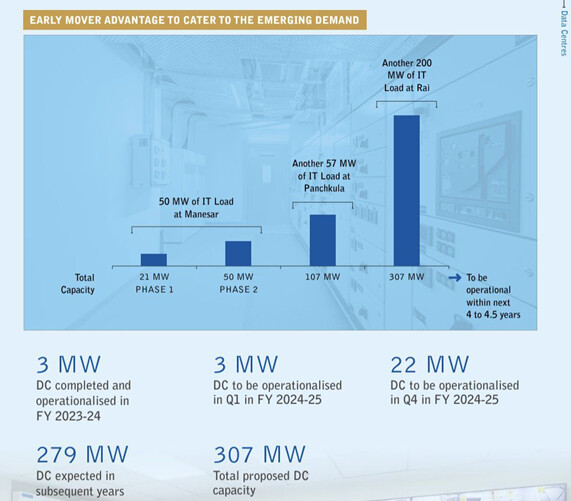

Con-Call Discussion- Management of the company highlighted that they will be net debt free by December 2024. Currently net debt is Rs. 290 Cr. In Quarter 3, Anant Raj Ltd. successfully raised INR 500 crores through a QIP. 75% of the proceeds are allocated to prepay outstanding borrowings, with the remainder accelerating the expansion of their Data Centre at Manesar. Currently, 3MW IT load centre in Manesar is in operation and contributed Rs. 3 cr income during Q4FY24. Management mentioned that 21 MW will be operational by December 2024. At the Punchkula location, an additional 7 MW will be operational with a server. Top of FormBottom of Form

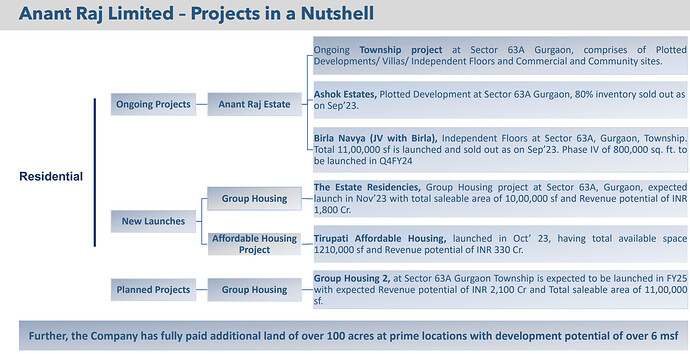

Projects Highlights- Their revenue is generated from Real Estate residential projects and commercial project. In residential projects, total revenue potential generated from different projects like, Sector 63 A sector Gurgaon and group housing project, estimated to be over 15000cr in next 4 to 5 years. Further company has fully paid land of over 100 crore at prime location of Delhi NCR for future projects.

In commercial projects, total revenue estimated to be generated 3.46 crore per month on rental basis including hospitality segment.

In the Asia-Pacific area, India’s data center market is now expanding at the quickest rate. There will be a surge in demand for data center because of increasing data consumption and government backing Digital India Initiative by approving various laws that support and encourage data to be stored locally.

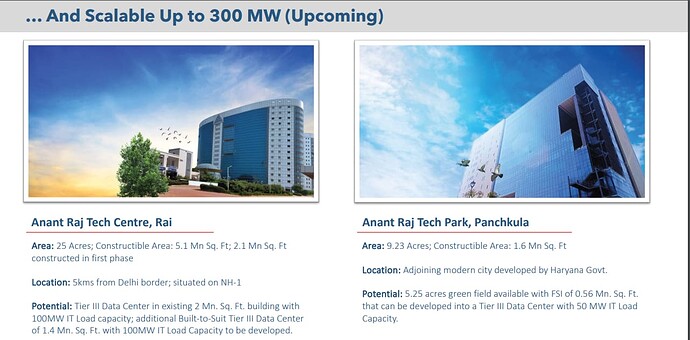

Anant Raj having an early mover advantage, caters to the emerging demand by converting a 5.66 million square feet commercial property into a 157 MW data center, with plans for further expand it to 307 MW in Rai and Panchkula. They anticipate rentals of INR 3,300 crores once fully operational. The company is a Business Partner with RailTel Corporation of India Ltd. for data centers and has a strategic alliance with TCIL in Manesar, collaborating on cloud and colocation services.

Future Planning: We are well-prepared for future endeavours. We aim to harness the robust demand in the real estate sector, anticipating an estimated revenue potential of ` 15,000 Crore from residential sales, integrated development in Sector 63A, Gurugram, over the next 4 to 5 years. Alongside residential projects, we are also planning to enhance township offerings, acquire additional land parcels, and significantly increase data centre capacity to 307 MW IT Load within the same timeframe. Our efforts are concentrated on executing these projects with the distinctive excellence that Anant Raj is known for. Additionally, our vast, fully-paid, freehold land bank of approx. 100 acres in most prominent locations in Delhi and the National Capital Region and is earmarked for diverse projects including residential developments, warehousing, and hospitality, enabling us to seize the market opportunities as they arise. Furthermore, we are focussed on deleveraging our balance sheet to become a net debt free company by December 2024. This target reflects our commitment to financial health and operational efficiency, positioning Anant Raj to leverage opportunities more effectively and ensure sustainable growth in the future.

Going into the Hospitality Segment: Currently, we have ongoing hotel projects situated in prime hospitality and convention districts within the NCR, each spanning approximately 5 to 7.5 acres. These projects are operated by thirdparty entities under long-term leases. Anant Raj Center 2 features a leased area of 1 lakh sq. ft. Plans are underway to significantly expand this area by developing an additional 6 lakh sq. ft., pending approval to increase the Floor Space Index (FSI) from 0.15 to 1.75. Anant Raj Center 1, South Delhi, has an operational leasable area of 70,000 sq. ft., with further expansion in progress. An additional 4.90 lakh sq. ft. is currently under development, made possible by a previously approved increase in the FSI from 0.15 to 1.75, facilitating this substantial expansion, resulting into substantive rise in rental income from these two assets.

Warehousing Segment explored: The surge in e-commerce and the growing need for efficient cold chain networks in the food and bio-pharmaceutical sectors are driving the demand for high-quality warehouses. Moreover, India’s increasing recognition as a global manufacturing hub, coupled with favourable policies, is bolstering the prospects for this sector. With extensive undeveloped land parcels and robust execution capabilities, we are strategically positioned to capitalise on the burgeoning warehousing market. We intend to develop large, tailor-made warehouses through collaborations with international partners and facilitate generation of consistent rental income streams.

Anant Raj is likely a GROWTH STORY in the coming years. The company will capitalize on the Data Center/Real Estate Story. I invested in this stock at Rs. 150. Since then the price has soared above Rs. 400 levels from where the stock had started to drawdown in 2008 due to Real Estate Slowdown. I have been invested in this stock as of today and planning to increase exposure as and when the fundamental confidence increases in the stock.

Hope this Blog helps you get a better view on the stock!!!

HAPPY INVESTING!!!