CMS INFO SYSTEMS

Mcap:4,493 Cr

PE: 18.5

PAT:224 CR FY22

TOPLINE: 1590 Cr

Listing Price:238

CMP: 292

Cash Handled : 11L Crores

Cash, a common perspective is its a dying business. Why digital India. Well there is an interesting data that shows otherwise

THE CIC (Cash on circulation) pre demonetization i.e. before 2016 was around 16L Crores and not i.e. 2022 the CIC id 31L Crores.(Source CMS CONCALL and I’ve crosschecked with RBI Data)

CMS has handled close to around 11L Crores in FY22.(Source Q4 Concall).

Overview of CMS Business segments

Cash Management

Managed Services

Tech Solutions

Cash management : 1. 46% market Share in Cash withdrawal, ATM replenishment, cash evacuation and deposition for BNA/recyclers, day-end reporting, reconciliation and settlement.

2. 36% market Share in Cash pick up and delivery from retail outlets and enabling settlement with retailers’ banks.

3. 26% market Share in Currency movement inter/intra city for Banks.

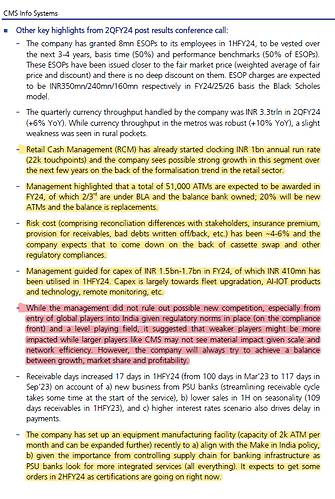

Managed Services: 1.Sales, deployment, and maintenance of ATMs.

2.Brown label ATM Deployment(Capex will be incurred by CMS INFO SYSTEMS) order book of 2000Cr around 70% of this executed the order include 3000 BLA(Brown Label ATM Deployment order from SBI)

3.Managed Services for bank owned ATM networks

4.Management and personalization of cards.

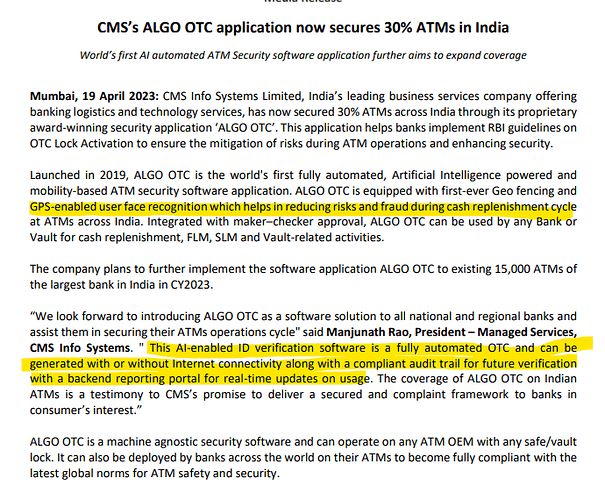

Tech Solutions : 1.Software solutions

2.AI based Remote Monitoring( Remote Monitoring of the ATM’s) Started one year back has successfully completed 10k+ ATM’S order for around 13K+ pending

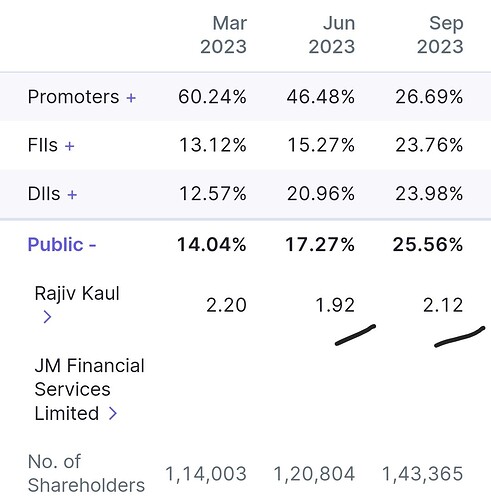

Promoter Group and Management

In 2009 Black stone invested close to 300 Cr into company for 53% Stake in partnership with Rajiv Kaul former Microsoft India MD who currently heads the firm and 37% was held by grover family and around 10% held by Rajiv Kau and management team.

apart from this black stone has infused close to 100Cr Crores in the company .

in 2015 Baring PE Asia Acquired 100% Stake in the company for 2000Cr.

2021 December Came with 1100 Cr IPO Entirely offer for Sale by Baring PE.

Current management

Rajiv Kaul Has been with the firm since 2019 who currently serves as the CEO.

Pankaj Khandelwal CFO, Qualification CA and is with the company since 2006( Was with cms computer systems before demerger).

Manjunath Rao Pare Parmeshwar: President Managed Services Business with the company since 2012.

Anush Raghavan : President Cash Management business, been with the company since 2009.

Industry

ATM Deployment Data by the company DRHP

Approximately 110,000 new ATMs will be cumulatively added, with an additional 198,000

replacement demand; more than half of these will be deployed under the BLA model. 365,000 ATMs are likely

to be installed, driven by pent-up demand and the need to address under-penetration in the SURU regions, as well

as a shift from CAPEX to OPEX-based deals for banks (e.g. BLAs), and with additional upside expected given

the increase in interchange fees. The total ATMs (incremental requirement) is expected to increase from 43,000

in Fiscal Year 2022 to 61,000 in Fiscal Year 2027, predominantly driven by the replacement of ATMs. In order

to address this demand for new and replacement ATMs, banks are likely to prefer a BLA operational model – one

that can reduce CAPEX costs as well as ensure that the demand for the market is met. This is one of the key

drivers for the BLA market which is expected to grow from 86,000 ATMs in Fiscal Year 2021 to 180,000 ATMs

by Fiscal Year 2027.

Benefits The company that can derive from this Managed Services business Which Provides BLA Services( When banks out Source the ATM deployment via BLA model) they managed service segment will benefit out by installing and maintaining these ATM’s if they win the contracts and tech solutions segment will benefit by AI remote monitoring revenue

And cash management will benefit by ATM replenishment service.

Risk: Though the CIS has increased from 16L Crores to 31L crores over 7 years but the ATM value of transactions has been stagnant for the past 7 years i.e. monthly value of transactions has been at 2.5L to 2.75L for the past 7 years.

However the online transactions/POS has increased from 20K Crores per month in 2016 to around 60K Crores per month in 2022.

And from 2011 to 2016 Number of ATM’s in India Has increased from around 85K to 2L+ how ever from 2016 to 2022 the number of ATM’s has been the same of around 2L-2.5L, as per DRHP of the company banks will add 1L more ATM’s in coming 4-5 Years and Banks will replace around 1.8L ATM’s.

Over the last 7 years the number of ATM’S has hardly increased and now its hard to believe that 1L new ATM’s will be added over the next 4-5Years.

And one more thing is Baring Acquired CMS on 2015 a year before demonetization, rest is known to all. Baring acquired CMS for 2000cr they have made 1000 Cr via IPO OFS and the value of their current stake is around 2800cr they made around 1800cr profit over 7 years which is close to 10% CAGR.

Disclosure: Not Invested Trying to understand the future of Hard Cash and the company’s future prospects.