Results look great on a surface level but even greater things are hidden underneath the numbers.

The standalone topline shows 78 Cr which is split under geospatial 43 Cr and Technology solutions 35 Cr. Margins for geospatial segment is 39% and TS is 32%. While this may look outstanding, it is not the right way to look at it in a business like this. H1 FY25 is a somewhat better comparison and even there margins are stellar (Geospatial 24% and TS 41%).

Recently the company has changed its segments where segments which were previously reported under geospatial are now partly clubbed under technology solutions. From one of the earlier calls

These projects (IoT, digital project management systems, inspection work) have a geospatial component but bulk of the value-add is from elsewhere so these are now reported as technology solutions. Technology solutions also of course includes the AllyGrow business which was amalgamated with Ceinsys and so gets reported under standalone (AllyGram JV profits are reported under consol). AllyGrow topline would be around 13 Cr or so per quarter (52 Cr topline from earlier memory). If this is removed from TS, then 22 Cr from TS used to be earlier reported as geospatial. So while it may look like there’s no growth from geospatial YoY, the right numbers to compare are 40 Cr from last yr vs 65 Cr from this year (43 + 22) to compare apples with apples which is ~60% growth.

On a consol basis PAT is relatively muted due to

- Higher employee costs (22 Cr in standalone vs 33 Cr in consol).

- Higher tax outgo - 9 Cr for Q2 when PBT was 21 Cr (15 Cr in H1 FY25 is same as tax for whole of FY24)

The VTS employees + Kelly Yagi + Data center employees in Singapore I think contribute to bulk of the increase in consol along with 5.27 Cr of ESOP expense. VTS and Data center business should contribute to profits going forward so this drag should be lower. If you normalise for these, consol PAT should be almost 18 Cr levels for the quarter

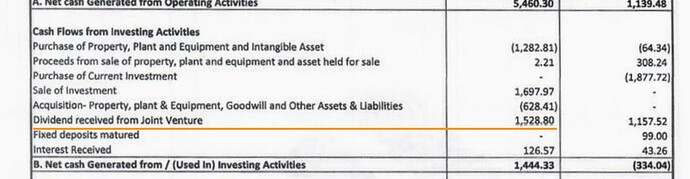

The other thing to note is the healthy cash flow from ops - 57 Cr in consol and 52 Cr in standalone. While the company has had healthy cashflows, it has never even crossed 50 Cr on a whole year basis but has crossed it in just H1 when business is generally H2 heavy.

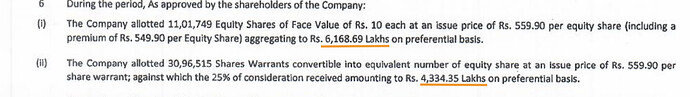

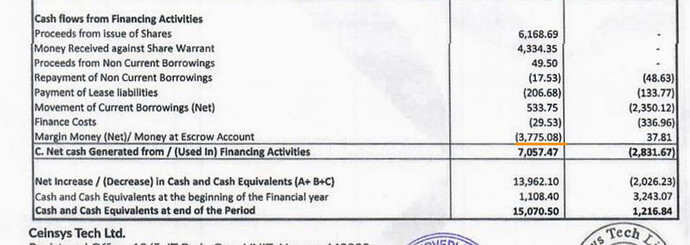

The company has received 62 Cr from equity and 43 Cr from warrants (~130 Cr more will come in when warrants are converted)

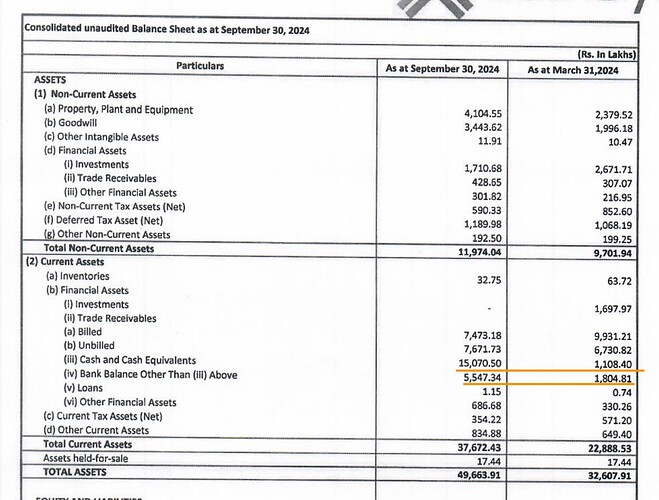

The overall cash levels in the company have gone up from 30 Cr in Mar '24 to 205 Cr in Sep '24.

Now even if you add this 105 Cr from dilution, cash levels are up by 70 Cr from internal accruals!

We know that ~52 Cr is from CFO and looks like bulk of the rest (~15 Cr) has come from dividend from AllyGram

205 Cr cash + another 130 Cr from warrant conversion when it happens puts a very healthy 335 Cr on the balance sheet for acquisitions.

Coming to the acquisition, i noticed an escrow to the tune of 38 Cr. Not sure if this means some acquisition is close to completion.

The last two highlights - the orderbook now stands at 1200 Cr as of Sept '24. There’s L1 of 500 Cr on top of this after this date that we know of - 385 Cr wainganga-nalganga river-linking and 115 Cr IDDP for MMRDA. So overall order book should be around 1700 Cr.

The other things is the working capital days which has trended like this

237 days → 190 days → 108 days

this is nothing short of phenomenal for a B2G facing business. The balance sheet and CFO also confirm this claim by the management as receivables are down YoY despite growth in revenues and healthy CFO of 57 Cr in standalone.

So yes, while the growth is phenomenal, there’s more here when you look deeper that the numbers are telling from order book, working capital, cash flow, scope for margin improvement etc.

Disc: Invested. No recent transactions