The maker of Classic and Gold Flake cigarettes has been given access to Coffee Day’s assets and financial for due diligence, said the people, who asked not to be identified as the discussions are private. ITC could be vying with Coca-Cola Co., which has evaluated India’s biggest cafe chain but hasn’t made a formal offer, said one of the people.

Sell offs worth 40% of debt already made. No further details/news.

Some partnership in the works to convert some outlets into shops instead.

whats the future of CCD ? Inspite of paring the debt, it has lost 90 percent of its value. can someone throw light

How do you know this? They have not released their financials

I only see an upside, a big one. The business was not great, that has been the almost consensus on this forum since IPO. But of course it deserved some de-rated valuation at least.

The loans are being paid off, not fully sure though.

Company is being run with the objective to sell off, so, with a pure focus on share price.

The Japanese retail investment via “ImpactHD” is only a small one of about 100 Cr of equity in the JV and may not be material.

Cafes shutting down is good, they do considerable churn even as normal course of business, it means focus on profitability. The Q1 numbers did not show any decline in top-line even after 14% outlets were shut.

My interpretation of the letter written by Siddhartha was that the suicide was precipitated mainly by the IT actions of Mindtree and CCD shares being made illiquid. Siddhartha made the Mindtree deal possible, by killing himself. (EDIT: the Mindtree deal was already done in March, IT dept was requested to take CCD shares instead as collateral)

I will disregard the terminal para of the letter, seems like random rambling. I do not think anything will come up which makes the borrowings situation worse, for the company or for the family.

We should know by 14 december.

Interim Q1 results: (not audited)

Total Debt = 6k crore in parent (There is additional 3k crore in subsidiaires but from my understanding, assets are more than this. But not sure)

Assets = 2k crore in mindtree, 2.8k crore in tanglin, Sical + Way2wealth = 750 cr, Ittiam+Magnasoft+Resorts+Other coffee subsidiaries = 750 Cr => Total = 6.3k crore

I think the coffee day is nearly free at current valuation. Hence i felt a good chance of upside and bought it. Its a risky investment imo.

Yes, your numbers seem perfect! The calculations in the second last para of this article estimates debt pay offs,

" The group’s debt stood at Rs 7,100 crore in April 2019 but came down to Rs 4,980 crore after the sale of a 20.41 per cent stake in Mindtree to L&T. That debt could further be pared to Rs 3,320 crore as its IT SEZ Global Tech Park is in the process of getting sold to Blackstone Group. That sale is in the final stages and the first payment tranche of Rs 2,000 crore is expected shortly. Within the next one year, the management expects group debt to come down to Rs 1,300 crore. An additional Rs Rs 2,000-3,000 crore debt is with various non-listed companies of the promoter family. "

There is 2000 gap between final loan figure of 1300 and the 3300 now after Mindtree + Global Tech Park deal is explained by Sical worth of Rs 1500 (big IF here) and 500 from remainder tranche of Global Tech Park deal. From last paras of this article.

Sical, big IF of sale and valuation, seems to be resolving.

Anyone attended the AGM? If yes, please share the summary

Summary published in Hindu:

Sounds ok, I do not know why the investigation is taking so long.

Some delay but OK now, hopefully!

@vikas_sinha If Coffee business is sold off to settle debt, what is left with parent company. Such holding structures with residual biz are not accorded decent valuation by market anyways.

Well, they are selling off to save the coffee business. But they will have to get more funds by selling off some part of the coffee business itself, maybe around 50-60% even. Even now it is like a holding company. But I am starting to doubt the intentions of the promoter group now. The investigation report has been delayed a lot. They are not publishing results. Very defensive posture, what are they so scared of? The general lack of disclosure does not seem good for the public share holders.

This is already old info, only 5% remains if you look at BSE page, but all pledges released now. The promoters cannot even release decent info of pledges, exchange had to tell them to reformat the information sent on 24 Dec.

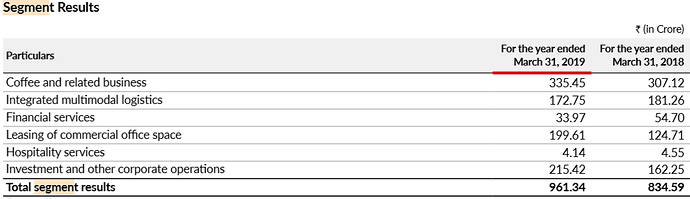

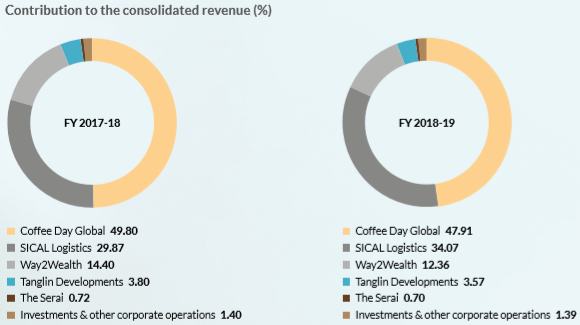

I am confused about the strategy here. The business was chugging along but liquidity issues were troubling, rating was downgraded to “D” in September. They are still trying to get money into the business and might be able to balance the situation so the business will keep running. They are losing large parts to keep only 35% of the business EBIT, that too could be diluted!

Looking at these AR numbers maybe should have sold off the coffee parts and kept some of the others.

Maybe the really good ones were the easiest to sell in the crisis. (Leasing and Investments, and now Logistics). Roughly only 20% of the business value remains perhaps if it survives.

In that case Tata Global is better. Atleast you know you get 50% stake in Starbucks India

The 20% business value is like a worst case estimate, depending entirely on the business dilution (estimate of 40-50% dilution in Coffee Day Global), positives being that the heavy debt will be off the books and the company is definitely showing much better growth than Tata Global. Plus, some other business subsidiaries may also survive in parts. Share is already trading at 1/5th of its usual 200+. Efficient markets.

My bet was no dilution beyond 50% of EBIT earning parts, was collecting around 40 mark but this is too risky with not much gains, should have looked closer, exited now.

I think only thing which is solid to sell is office space housed in probably Tanglin developments subsidiary. Again not sure how much debt they have and how much they can pass thru as dividend to parent.

Sical mcap < 100 cr. So they can just get measly amount for it which is about 50 cr.

Things like Way2wealth and other investments will not get more than book value.

So a substantial part of Coffee Day Global will need to be sold to settle debt.

Listed company is valued at 800 cr at current share price. Assuming it is able to retain 50% of coffee Day Global. Applying 20% holdco discount, values Coffee Day Global at 2000 cr.

I fail to see any value here. But I have done a very superficial analysis and may be completely wrong.