Some updates

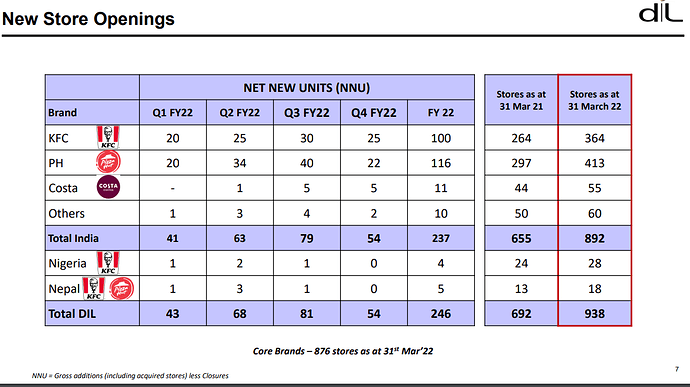

Devyani - We now have a breakout confirmation as of last week’s closing. If results day after tomorrow are good, we should be heading towards 200.

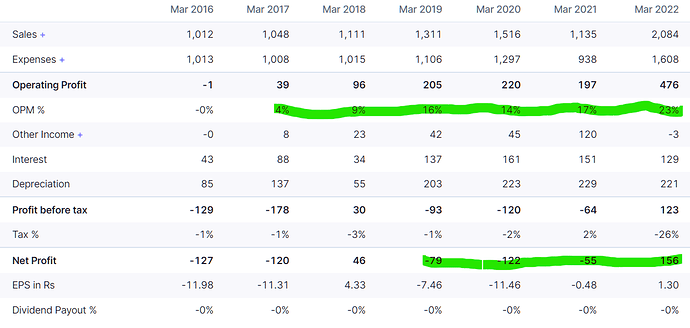

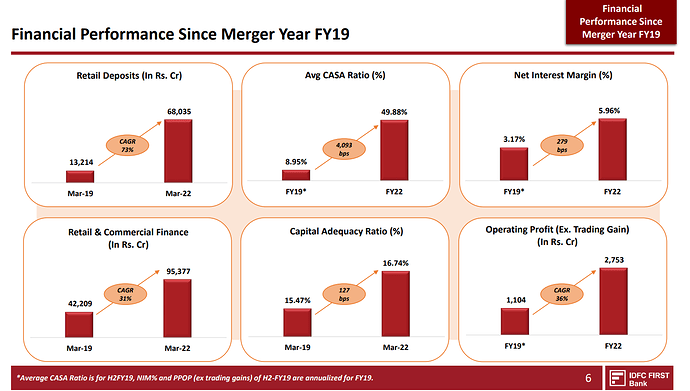

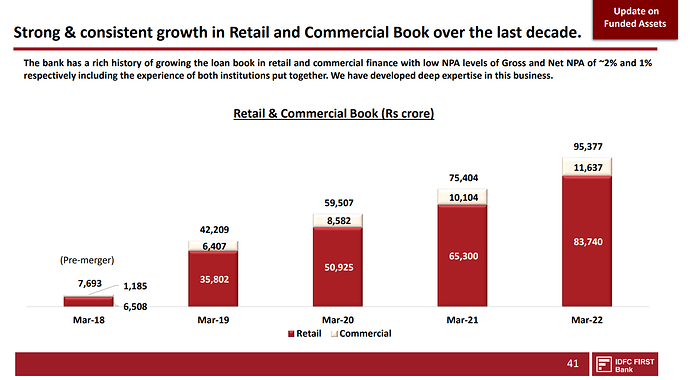

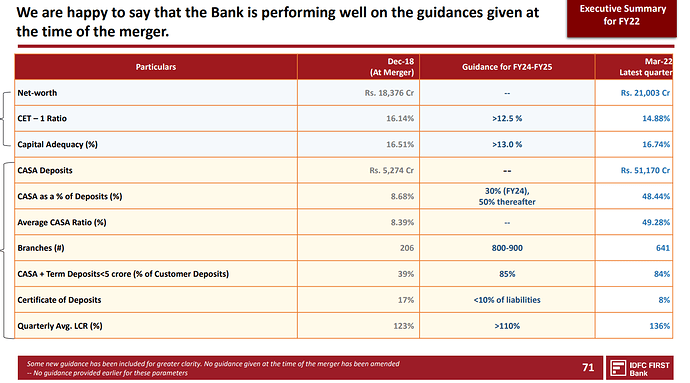

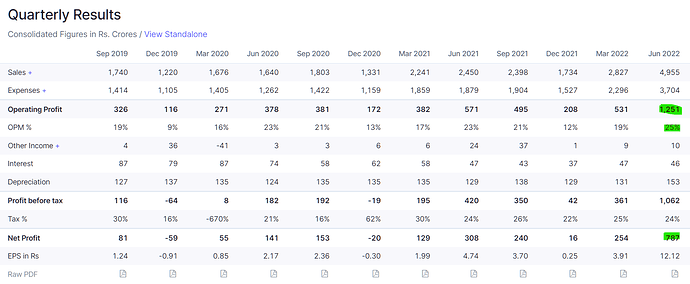

IDFC First Bank - Results were pretty good on all fronts except NIM which should correct itself as the bank reprices. Turnaround continues, provision reduces, loan book grows, RoE improves. As the branches mature, the Cost-to-Income will continue trending down as RoE climbs towards high-teens in the next 2-3 years. I think most people were either too early or bought at slightly excessive valuations - on a scrip with such a high equity base, price doesn’t turnaround swiftly unless confirmation from fundamentals is unambiguous. As of now, every passing quarter is increasing probability and I suspect same may continue for next 2-3 quarters, post which a re-rating may happen.

ITC - Good results with 39% topline growth and 34% bottomline growth YoY. There’s 5% growth in PAT QoQ as well. It still continues to remain cheap and should slowly continue its re-rating.

Varun Bevarages - The numbers are sort of eye-popping. Q1 FY22 PAT of 787 Cr alone is greater than entire FY21 PAT of 694 Cr! This in a business with market cap of 60k Cr.

What’s phenomenal is the volume growth of 97% - 300 million cases over 152 million cases in Q1 FY21. Summer coming early did help and the base quarter as well but this is not 20-30% volume growth but a whopping near doubling of volumes. Post results, the P/E has now dropped from 72 to 46 which makes it good value for a midcap growing at this rate.

New positions

Manyavar, Weekly - Seems like this will be a moving week for the stock after consolidating for 4 months around 1000-1100 levels. On the daily as well, today it has closed at 52 wk high after 3.5 months.

On the fundamentals, I must say I haven’t liked any other listed business this much at first glance. This is a business that is roughly 25 years old, IPO-d earlier this year. It has around 75% gross margins and about 45-50% EBITDA margins which is phenomenal aided by the brand value of Manyavar which probably contributes 80% of topline and probably all the profits, along with some fledgling brands in Mohey, Manthan and Twamev.

I believe this business has longevity and has carved a niche and created a market for itself. Wedding and births are where we tend to spend the most without second-thought, so being able to cater to the need of the former is probably what is aiding the phenomenal gross margins here. Ads spends are around 70 Cr which makes it easier for them to afford Bachchan Sr. and Ranveer Singh (uses him as model as well, along with the ads). They also have good relationship with vendors (intricate artwork and lots of manual labour). This creates an almost impenetrable moat for itself amongst competitors who are mostly small-time in comparison.

I like how they are trying to expand the market as well with upselling the accessories, cross-selling to bride/kids/wedding guests and also creating new markets in celebration wear for festivals like Diwali. The brand positioning as well is very well thought-out. The expansion plans to almost double retail floor space as well augurs well for growth in next 2-3 years as they enter new cities. There’s a good market size in terms of people in marriable age as well in India that helps.

So this ticks almost all the boxes of great margins, expanding market, good moat and a consumer who is bound to switch off rationality while shopping. Valuation though isn’t very good - it is expensive and there’s no denying that. But I am tempted to think it is good value, given the growth opportunities.

Metro Brands, Daily - Has consolidated for 6 months and broken out today with great volumes. The resistance trendline was tested multiple times before this breakout.

The business has some good in-house brands in metro / mochi and also sell other brands, like crocs and clarks. Here again I think the expansion opportunities are huge and the way crocs is taking over Indian market in the last 5 years is really good (reminds me of what VBL is doing with Sting). Valuation is in favour at about 60x P/E given the great growth (good Q1 results as well).

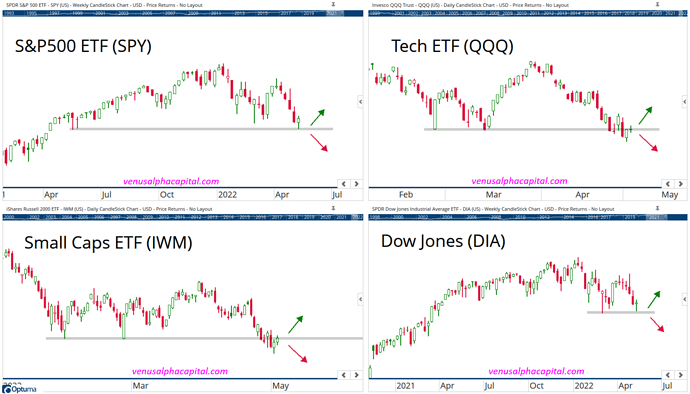

I have continued to buy domestic focused consumption as mentioned in this post here. I am seeing some macro shifts that make me more inclined towards domestic consumption than export focused or chemical / commodity businesses as I was positioned most of last year

Disc: Have positions in VBL around 800. ITC around 270 and IDFC First around 33 levels. Initiated positions in Manyavar around 1100 and Metro brands around 700