Does current numbers include revenue from Allygrow? If not then when can we expect it to happen?

SBI card - Opportunity to enter for mid to long term

SBI Cards and Payment Services Ltd is currently trading near multi year lows. Below is my analysis for the stock based on my limited knowledge and readings.

Why we are at multi year lows?

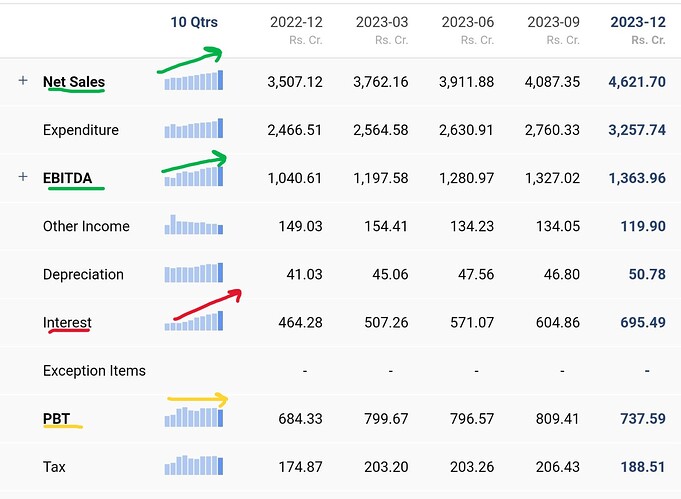

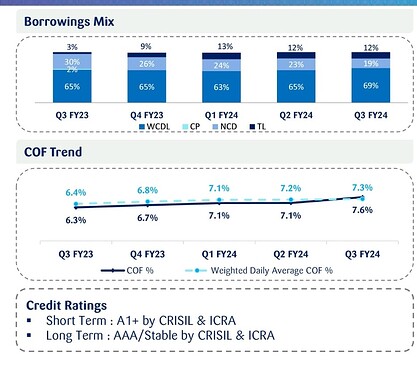

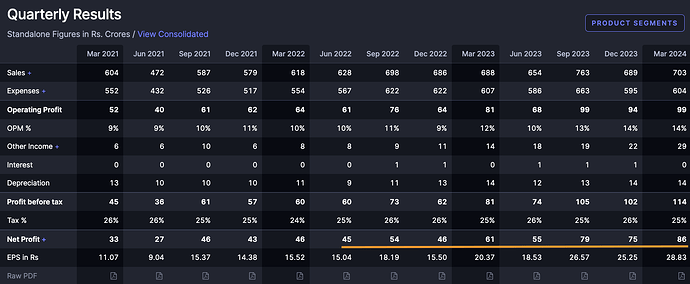

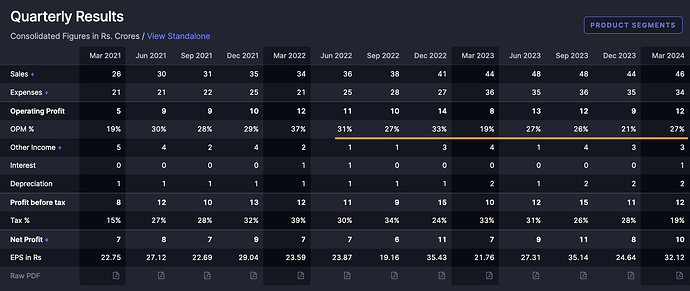

The company is posting record breaking sales every quarter. Despite rising sales and rising EBITDA the interest component is also increasing because we are in higher interest rate cycle. COF = cost of funds.

Narrative bhagwaan chhe -

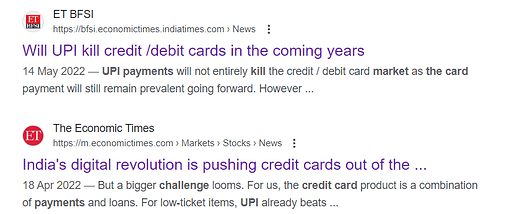

Since last couple of years, there was a broad narrative that UPI and wallet payments are giving slow death to Credit Cards. These kind of narratives impact P/E multiple of industries.

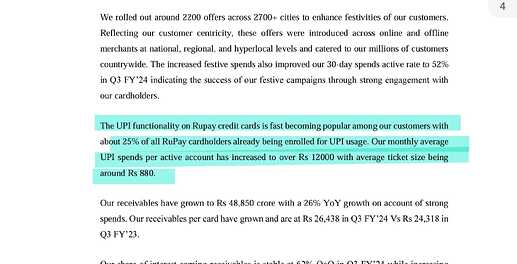

“Aaj tum jisse lad rahe ho, kal wahi tumhare achhe dost honge” Things are changing fast. UPI can now be linked with credit cards (currently only RuPay). This is slowly becoming popular. Excerpt from concall -

He mentioned avg ticket size is 880, small transactions are also being paid thaough credit cards via UPI barcode.

Last week new set of rules came which further cements credit card & UPI partnership -

The National Payments Corporation of India (NPCI) has announced new features for the RuPay Credit Card on the Unified Payments Interface (UPI) platform. The new features announced include EMI facility on the linked credit accounts on UPI app, Credit Account Bill Pavment, Instalment Payment and limit management. The NPCI has asked issuing entities like banks and card issuers to enable these features by May 31, 2024

EMI is a highly profit generating segment for credit card companies.

What about Visa and Mastercard?

It is possible to use your visa/ mastercard for UPI but it is a 2 step process -

All major banks have enabled downloading virtual Rupay cards on phones for free.

Ending note -

With pilling up of US federal debt, the interest rate cycle is bound to turn sooner or later and we will enter lower interest rate regime. The markets are already pricing in interest rate cuts from June. Companies like SBI card thrives on lower cost of funds. I believe the stock is available at cyclical bottom from interest rate point of view. On the other hand, with the exit of Paytm wallet and convergence of UPI & credit cards we are looking at a whole new world of possibilities. The Gen Z likes to pay everything by scanning a QR code and they also like to buy now & pay later. Market share of credit cards is not going to decrease but will rise due to supportive policies which have come up in the last few months. India in itself is a growing economy that means more credit users and more spend per card.

Disclaimer - Holding. Not an expert, not registered with SEBI.

Hii Madhav,

Thank you for such a nice analysis.I was trying to look more on this as a techno Funda bet.As seen from the chart posted by you,Sellers volume are always more than buyer’s. Wouldn’t it be logical to wait more till volume starts increasing on buyer’s side? Whenever the price is falling volume is higher than when the price is increasing.Would appreciate your opinion on this.

Thanks.

I am not very proficient in volume analysis. Also it is in futures segment, so there might another set of volumes that should be analysed.

I find more comfort in buying stocks near support level and wait for action.

Sorry for the late response. I think my expectation is just that - an expectation that I will be very happy to beat. It makes sure that I don’t take dumb risks having very high return expectations. That doesn’t mean that I will cash out on reaching expectations. I will continue to do my best and let luck do its bit. In the past though, I have taken ridiculous cash calls though my exposure to equities was < 50% in early days (in mid '18, Mar '20 and in Oct '21). I somehow don’t find myself willing to do the same these days. Maybe it is my maturing as an investor over this period of time or its something more natural than that.

I think during this period my circumstances have changed considerably as well and the marginal utility of money has reduced by a lot. I have noticed that having a deterministic income - where you are paid by the hour like a consultant or by month, like a salary as an employee messes up with your ability to take probabilistic risks. You start comparing what you gain or lose notionally in an hour or day on volatile days with what you make in a month or year on the job.

The other thing that is deterministic in our lives is expenses - this again is easy for us to compare with drawdown. Maybe a day’s drawdown is the equivalent of a year’s expense and it changes behavior - I think somewhere I have gone over all these hurdles in the past between '18 and '21 and that has molded me into who I am today. My ability to take drawdowns has improved considerably which makes me stay put in the market. I think this only keeps going up with time. I can sort of relate to people talking about taking several 50% drawdowns in their long career. It comes with an ability to stomach volatility due to negiligible marginal utility of money (and also an inability to sell that comes with size) and being answeable to no one but yourself.

Since marginal utility of money is a very personal concept, ability to stomach drawdowns is going to vary a lot in the population. The people who have made it get to appear on TV or write books and so tend to advice on what feels right to them then. On a smaller pf though, they would have churned and been sensitive to drawdowns as us - so I feel staying put vs cashing out is a very personal decision and we shouldn’t go by what anyone else is doing, irrespective of our respect for them.

Since then the pf recovered its past highs and made fresh highs. It very well could have meandered sideways or crashed but the decision to stay put was the right one, given what we knew at that time. I believe for a small portfolio, there will always be opportunities for someone willing to put in the fundamental work keeping technicals aside. Narrowing markets are especially wonderful as you dont have to fight for value to be recognized. We also need to put in considerable fundamental work or we will end up looking at headline indices and be misguided or end up setting up stops that invariably get taken out.

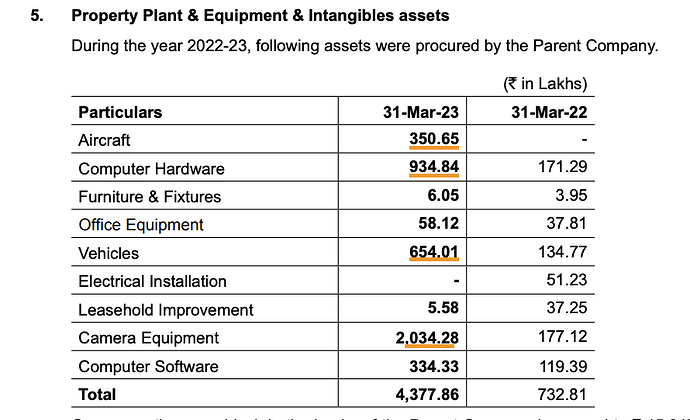

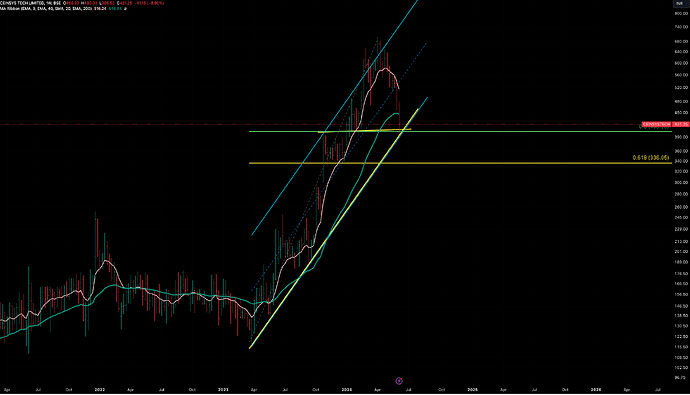

Genesys, Weekly - A breakout from 2+ yr resistance and a re-test that is underway in current week. This is a fundamental pick for me more than technical. Please do check out the geospatial sector thread.

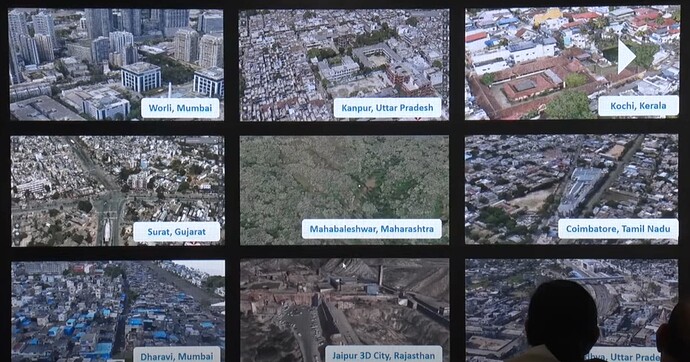

Short thesis is that this sector is still very nascent and growing very fast. The govt. is subsidising map building in these digital twin projects but the digital twin assets reside in Genesys books. The company raised capital from some marquee names and built the equipment required for the project work.

They now have around 57 Cr of intangibles which is the digital twin assets on the books.

These assets can be utilised with other clients across sectors in banking and insurance, power, telecom etc. The company projects for 1000-1500 Cr revenues with a 25-30% margin in 3 yrs. The current order book must be north of 500 Cr going by what the company has won in the last 6 months. As they do more of monetising the data assets, the margins should trend up as this will be more like a product company at that point than a project company it is at this point.

Sharda Motors, Weekly - This slow coach which went nowhere for few months has finally woken up. It continues to remain very cheap with 650 Cr cash on the books. There’s a buyback which is announced. I would expect dividend payout to be healthy as well along with the buyback and they are on the lookout for an acquisition as well. All this alongside growth driven by volumes and value in the exhaust business. While most businesses are busy doing dilutions, here’s one doing buybacks. Considering the cheapness of the stock, this is perfect use of the capital. It deserves to trade much higher

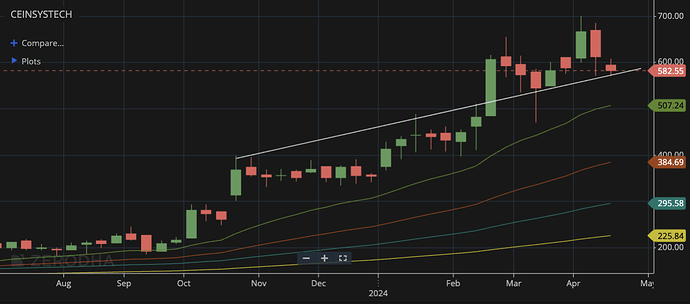

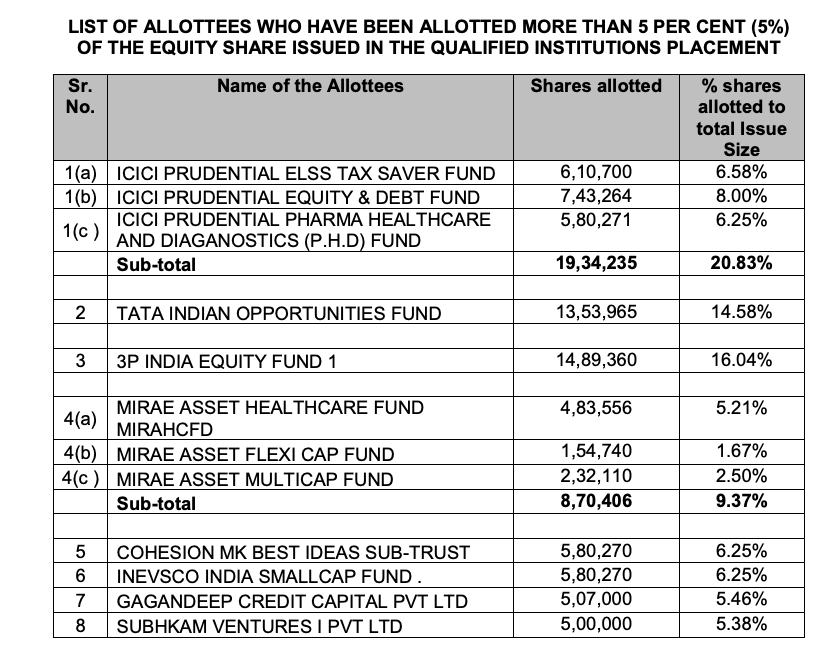

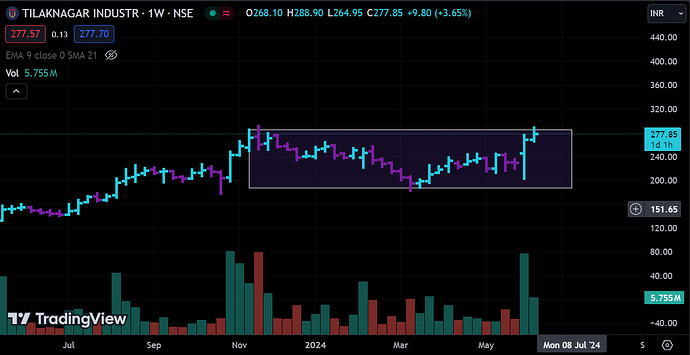

Ceinsys, Weekly - The geospatial sector thread above covers ceinsys as well. Please do have a look. Here too the opportunities are huge as mentioned few times in this thread. Ceinsys has announced a massive QIP+Pref of 240 Cr with promoter participation for ~90 Cr or so at 560/share. This should act as bottom for the share. How the capital will be utilised will drive future value. There are enough and more opportunities in this sector and company has very good order book.

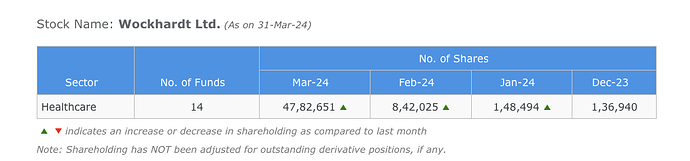

Wockhardt, Weekly - This a medium-term play and is playing out really well so far. Nothing new since last update on the Wockhardt thread except that they have succesfully managed to raise money through QIP - this was a major hurdle to progress in the phase-3 trials for WCK 5222. Very glad that this is now sorted. QIP price of 520 means current levels should hold as it consolidates to take out 620+ levels in the coming weeks

What’s also nice is that marquee investors from Prashant Jain, Madhu Kela, Nimesh Shah’s funds have taken allotment in the QIP.

The institutional holding has now gone up considerably since Dec - both FII and DII, even as retail has shed positions considerably.

Shaily, Weekly - Had taken out previous highs when it was trading above 500 levels. Now it is looking to take out the long-term resistance trendline. Fundamentals discussed few posts above.

Disc: Invested as disclosed before. No recent transactions except in Genesys. Not qualified to advise. Just writing what I do from time to time as clarity for myself as writing helps my thinking

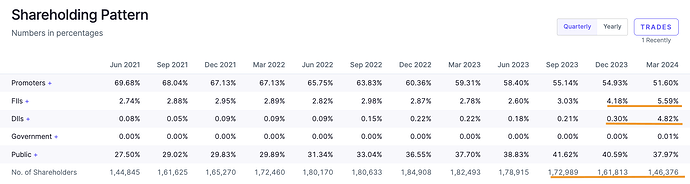

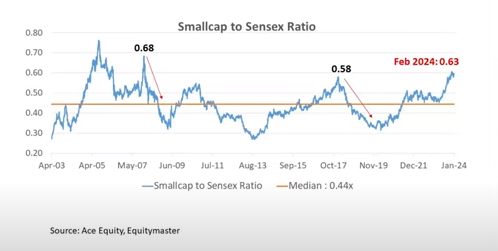

Well, here is little different opinion.

If the chart was published at March end, it might have given more conviction on bearish angle ( a big red candle) . But we got a good recovery in April ( a big green candle) . This shows that there’s still some strength and this also shows the difference between what happened in 2018 vs now ( pink circles). Hence would be bit cautious on taking any view , especially at current levels .

Yes , it is at crucial levels …may be May end candle can give some direction.

We’ve a positive bias as of now due to 4 key reasons :

a) Expected majority government , 3rd time in a row ,a rare event after 3 decades- we’re underestimating the monumental change in Indian politics and policy-making

b) Falling DXY and Brent oil at comfortable levels.

c) Easing QT in US thus more liquidity(Powell said that they would be selling lesser bonds now).

d) Strong domestic economy and expectations of good monsoon.

Yes ,the rally may not be widespread. Some froth from overvalued pockets may go away ( and that is already visible) . It might be stockpickers market here onwards.

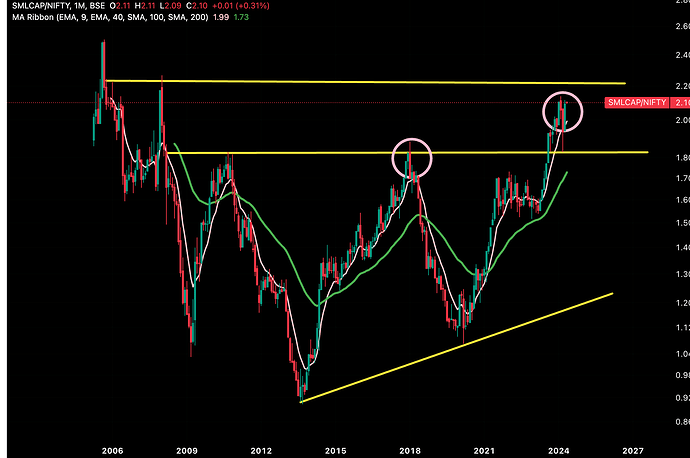

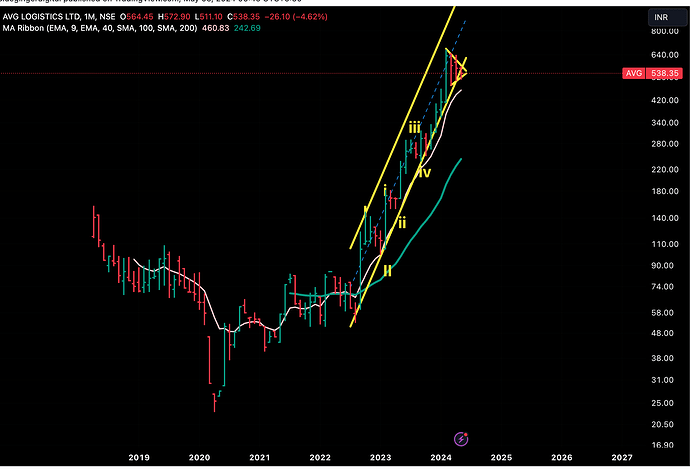

AVG Weekly - Flag formation. After good results in Q3, it went up (forming the pole of the flag) but has been consolidating since then for last 3 months.

The logistics sector hasn’t thrown any big winners in this bull market. AVG has been cheap and has also grown quite well. Unlike other logistics players, AVG is focused primarily on the FMCG sector (60% of revenue) and considers some of the big names as customers

Nestle infact is over 20% of topline and has been a customer since company’s inception in 2010. Nestle has been associated with the promoter since 1991. So long and deep associations offer a lot of comfort. FMCG as a sector is recession proof, so swings in profitability should be relatively lower. Long term contracts also should help in reducing cyclicality in the business.

Other than FMCG, they are also present in the tyres space with the tyre majors like MRF, JK Tyre and Apollo tyres. In pharma, they are involved in cold-chain logistics. They also have a presence in capital goods sector.

The company has 6 leased rail lines - all long haul routes like Chennai - Guwahati, Delhi - Bangalore, Bangalore - Ludhiana etc. - Road transportation costs keep increasing year after year due to diesel prices, toll charges, bribes etc. Rail competes really well with Road and having a 6 year lease on these railway lines provides a big cushion for the company in terms of rising transportation costs. Transporting via rail also seems to give FMCG majors green credentials, so they seem to opt for it.

Under road transportation, the company owns 550+ trucks but operates 1200+ vehicles (rest on lease basis). The company plans to expand in an asset-light fashion and is supporting its drivers to take up ownership of vehicles (“Chalak se Malik” - very small currently at 10-15 vehicles)

Warehousing - the company has grown warehousing at a very brisk pace (2010 - 25k sqft, 2019 - 3.82 lakh sqft, 2021 - 5 lakh sq ft and in 2023 - 7 lakh sg ft). The relationship with FMCG majors allows them to put up warehousing capacity as they consolidate transport and warehousing with one vendor. The newly started Packers and Movers business as well is high margin and expected to grow quite well.

The debt reduction should aid in some financial leverage - there’s mention of 1.5 Cr of monthly EMI reducing to 30 lakh/month - which should add to bottomline by 4 Cr per quarter

Company has recently signed up PepsiCo (for transporting Lays), Leap India, Colgate, Bigbasket and L’oreal recently as customers

Expansion in cold-chain logistics, warehousing and packers n movers - all higher margin businesses, coupled with new signups and growing business with existing clients should grow topline to 700 Cr next year as per guidance. The valuation isn’t very demanding, given the growth and even when compared to peers in the sector. The last two concall transcripts are very good for understanding the business. It doesn’t appear to be a fly-by-night operator. I haven’t done any deep work on scuttlebutt other than reading the transcripts.

Disc: Have positions around 530-550 levels. Not qualified to advise.

@phreakv6 Thanks for detailed analysis on AVG Logistics. One thing I want to know is that as of Sep-23 Balance Sheet, the company is having 139Cr of receivables out of which 50cr is more than 6 months. Why are the receivables so high when the company is doing business for Reputed customers like Nestle and Pepsico?

AVG Chart

The chart does not give so much confidence. We can expect maximum one leg as upside but don’t see huge upside ( on technical analysis basis), It has also broken long term rising trendline (starting from Aug 22)

The stock has become more than 7 X in last one and half years( price was 82 in Sept 22.) and it has become 3 X in last one year ( price was 184 in May 23).

As per our observation ( 7 out of 10 times), stock price tend to take rest after such a run (profit booking, lack of new big -hands etc etc).

We might be proven wrong but we would wait for the last leg to play out ( small one ), or wait for some correction before entering the same.

Disclaimer: This is our view just on the basis of technical charts, no buy-sell recommendation.

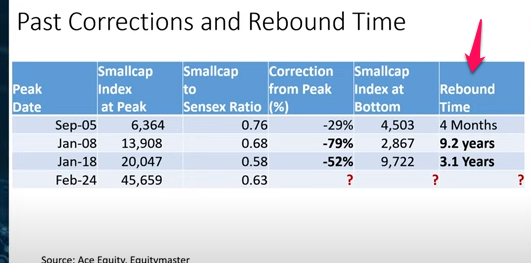

I am not sure how this chart is useful at all unless we expect smallcap index and Sensex to give same returns over long period. If one of the index gives even couple of % higher CAGR over decade+, the ratio will get skewed in favor of that index.

Same applies to S&P 500 vs Gold chart that get’s shown many times. These are typical cases of torturing the data to reveal what you want.

The rebound time is also incorrect since it leaves out dividends. We should be checking Total Returns Indexes. I have Nifty 50, Nifty Next 50 and Nifty Midcap 150 Index TRI data in front of me. Post 2008 January Peak, Nifty TRI took 33 months to cross previous highs. Nifty Next 50 TRI took same 33 months and Midcap 150 TRI took 76 months (it reached 90% of previous peak in same 33 months). Long periods but nothing as long or as dramatic as 9 years.

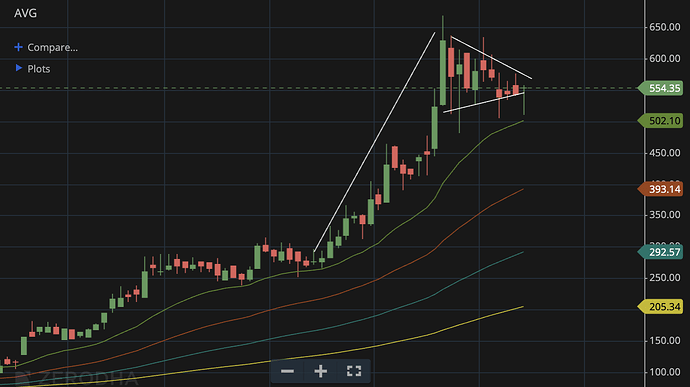

AVG

Last leg has begun ,it seems .

All the results are out, the businesses as well as the elections. I haven’t been writing here much since I haven’t been doing anything. In a year like this activity is a sure fire way to get your capital cut to size in whipsaws.

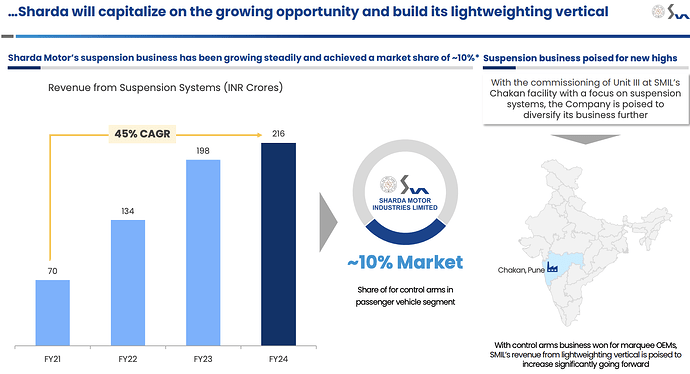

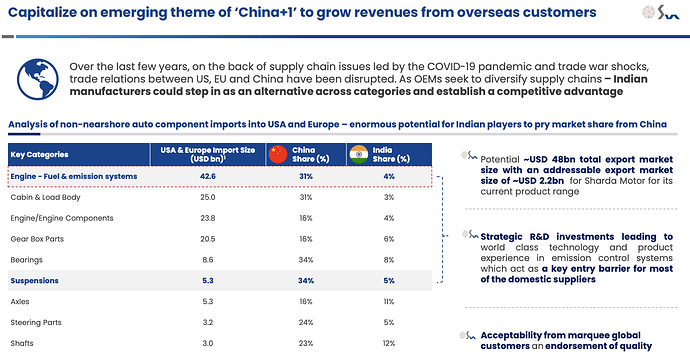

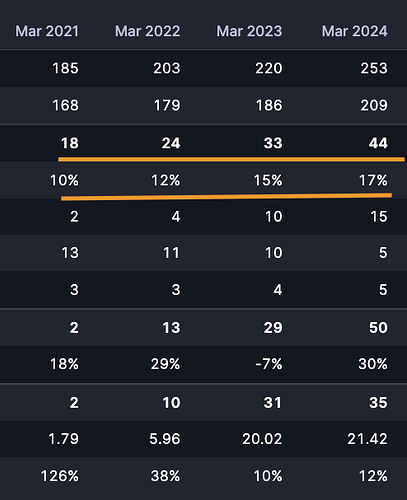

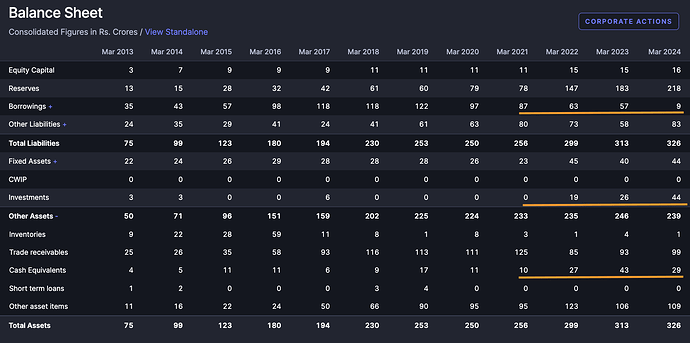

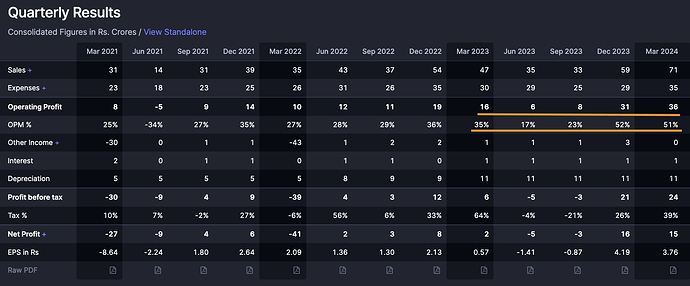

Sharda Motors - Posted great results for the quarter as well as the whole year. Continues to remain cheap, as the price performance is purely being driven as of now through business performance. The BS-VI RDE norms have driven both value and volume going by gross profits as its been in the last two quarters as well.

There’s 45% PAT growth annually too and excellent cash flows. Capital allocation as well is quite good with 220 Cr buyback considering the undervaluation and decent dividend of Rs.28/share (almost 2% div yield). There’s an investment in the suspensions segment of 50 Cr towards growth with still about 500 Cr still left after all this for acquisitions and the company continues to generate cash at a healthy pace. How long can this remain as cheap as it is? One of the earliest to show strength in the pf so maybe with story-driven market coming to a close, maybe fundamental driven stories will do well. Lets see

Few things which I found interesting - the suspensions vertical is already contributing 8% to topline and has been growing quite robustly. The reduction in growth likely due to capacity constraint, the 50 Cr investment planned should help resume growth in this platform-agnostic vertical.

The company seems to be focusing on exports and this slide shows the TAM. With developed nations cutting down on investments in ICE components, there’s good scope for SMIL to get some growth going in exports.

They have made a new CEO hire today as well (Deepak Manchanda with good exp. at Minda, Motherson, Banco etc.) for the global business. There’s definitely a vision for growth in exports as well as looking out for acquisitions in non-ICE segments which if they pull off, should certainly re-rate the stock.

Wockhardt - There’s nothing much new in the results other than some write-offs. 390+ patients signed up for phase-3 trials of WCK-5222. The trial should end in Q4 of FY25 hopefully. The meropenem resistance trials should end by Nov as per the update.

Shaily - Growth continues here in the healthcare division and also the Ikea business. The operating leverage is showing up in the higher margins. I think there’s a lot more to go here. I have captured my thoughts on the healthcare business in the Shaily thread. Though the presentation was sparse this time and no details on the platforms/molecules as promised, the concall was very informative and sheds a lot of light (crux of it captured in my post linked)

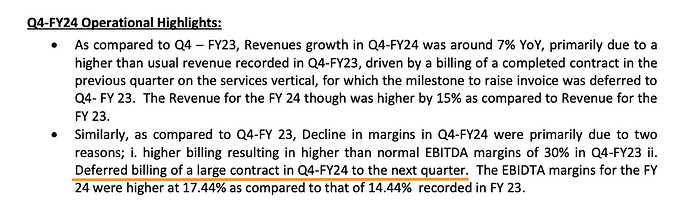

Ceinsys - The results were bad on the margin front. The topline had grown but didn’t translate to profits. The company has mentioned in the past that results aren’t comparable across quarters and should be seen over entire year due to varied nature of projects and execution timelines. There are however lot of positives

There’s healthy growth for full year for last 3 years, along with expansion in margins.

There company has a healthy cash conversion as well and it shows up in good reduction in debt and increase in cash and investments. The order book is healthy as well at 650 Cr.

The CEO they hired 2 years back now owns 9% of the company (4.5% options converted and fresh 4.5% given). They have hired ex-GoAir CEO Kaushik Khona as well to manage India business. The EGM conducted recently mentions an acquisition abroad for which they are raising cash to the tune of 240 Cr. If they are raising the cash as planned at 560/share, and promoter is participating, current levels at 400 are perhaps quite cheap.

Genesys - The numbers have started coming here in last two quarters. If what the management envisions plays out, these could be very early days. If current run rate sustains, we could have 70 Cr PAT which means its trading at around 25x 1 year fwd

Both Ceinsys and Genesys had political risk which played out and has beaten the price down. It also matters non-trivially that both were social media favorities which brings in a lot of short-term players that don’t care much about valuations and were buying them at 650 and 700 and levels. While those were expensive prices, i feel current levels are cheap. I don’t see why there shouldn’t be policy continuity in geospatial sector even with coalition govt. I could be wrong (I don’t understand politics much)

Garware - The numbers here were quite good like it was in Q3. There’s expansion in capacities as well which could mean that they might achieve the 2500 Cr topline guidance in the future. I sold my holdings here though after last quarter runup since the exports data appeared weak but the numbers reported are contrary to that. Maybe there’s a lag here and it might show in Q1? I am not sure and would like to wait and watch.

Smaller positions

Eimco - I continue to hold Eimco which has been performing well and lot of the earnings here is in the future as I shared in the thesis in this thread.

Tarachand - Private capex is picking up and don’t see it being affected meaningfully by the coalition govt. This was purchased at 200-220 levels on a whim without a thesis based just on charts. Not sure if current levels are cheap enough.

AVG - I have misread this completely and should have paid attention to the notes to accounts in past years when they moved from SME to main board. The growth isn’t as stellar as it seems and it isn’t poor either. The management somehow doesn’t inspire confidence as main board requires at least an ability to prepare and present PnL statements well (They included other income in EBITDA for eg. in the presentation). I have exited this position with ~10% loss

Disc: Not qualified to advise. These are thoughts on my portfolio and my decision-making for clarity to myself. No recent transactions other than selling AVG and buying more Genesys at 420-430 levels and Ceinsys around 400 levels (both small incremental purchases - Ceinsys avged up and Genesys avged down)

Ceinsys 424

Stock is trying to bounce back from an important support -trendline, 50% retracment of last leg.

If it contiues this trajectory, then we’re due for a big move in coming months . SL is 396.

Disclaimer: This is our view just on the basis of technical charts, no buy-sell recommendation.

This was indeed the reason. For a company like this, we shouldn’t be comparing quarters but years since they aren’t selling soaps or shampoos but executing large lumpy orders with different revenue recognition modalities by project.

The company came out with first investor presentation yesterday which is quite detailed unlike its ARs. There’s a definite intent here to grow the business and the market cap, with the hiring of high-caliber professional CEO and MDs and giving them hefty options and also hiring Valorem to help investor communications. Disclosures should only get better from here hopefully.

There’s also some very useful information in the PPT like the geospatial segment growth, margins and also segment-wise split-up. The margins in geospatial have gone up substantially in FY24.

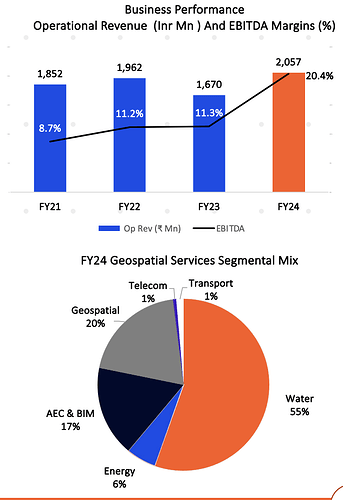

The performance of AllyGrow and AllyGram, their JV with Grammer AG. There’s a severe compression of margins in AllyGrow in FY23 while there’s healthy growth in AllyGram. Not sure if this is due to movement of business from AllyGrow to AllyGram but if its not, then an increase in revenue in FY25 could mean margins coming back in AllyGrow which could be a good kicker on top of geospatial business growth.

The order book position as well is updated. I had mentioned order book was 650 Cr. Looks like it stands at 710 Cr. The deferred large order in Q4 could show up in Q1 or Q2 and hopefully should lead to healthy growth. Overall I don’t see the business performing poorly but on the contrary, could actually be performing quite well.

Taal, Weekly - This is an old position which has been underperforming somewhat. There’s lot of volatility contraction and consolidation within that triangle last 6 months.

There was severe margin contraction in Q3 which led to big selloff post results but the margins are back this quarter back to 27% levels it used to be at.

Disc: Invested in both as disclosed before

Hey!

I had one query? What could be reason for such a big difference in valuation between Genesys & Ceinsys? (comparing the PE & PEG of both companies)

Since Ceinsys is only listed on BSE could that be a reason?

These two are not similar businesses though both are in the geospatial space. Ceinsys is more of a services business and Genesys a product business, although that is simplifying it a lot. Ceinsys also has revenues and profits (JV) from AllyGrow and AllyGram which are in the ER&D and manufacturing domain. Even within the geospatial business, genesys is more of an upstream player that builds geospatial assets, mainly digital twins but also street view maps etc. while ceinsys is a downstream player that very likely uses satellite data from 3rd party sources to implement its projects. There’s nothing superior or inferior about either and both businesses have positives and negatives from their respective business models.

Ceinsys is relatively asset-light or so it seems as of now but over time, as Genesys sweats their assets and find more customers across domains, their growth in revenue will flow directly to the bottomline and the growth will be completely disproportionate - but its yet to happen although there are good signs in the last two quarters. Another thing to note is depreciation which is a real cost to Genesys’ business. Maps at higher level of detail (like LiDAR say) would depreciate faster as building level information in Indian cities will change lot faster than a developed nation. They might adjust for this accordingly in charging their clients lot higher for a higher level of detail. The space has to mature and lot of applications for banking, insurance, real-estate, disaster management, smart cities have to come up and Genesys growth is dependent on that. It is lot more futuristic and so market might value it as such.

On ceinsys valuation, there’s a post in the ceinsys thread which captures what the company’s valuer think its worth. I believe these are futile exercises since it captures what the management thinks are future cash flows and is bound to vary a lot based on whether the management is selling or buying its own equity. In this case, they are “buying” their own equity and thus the biases are bound to project the value lower and correspondingly, the value is at 505, 510 or 560 depending on multiple, DCF and market value method. Now accounting for this bias, it could be valued higher. Also another thing to note in Ceinsys case is the dilution at 560 for acquisition. Although it can be open-ended and done any time in the next 3 years, my thought was that it could happen sooner than later since price, dilution, buyers were all decided and this is not an enabling resolution. They even did a EGM specifically for this.

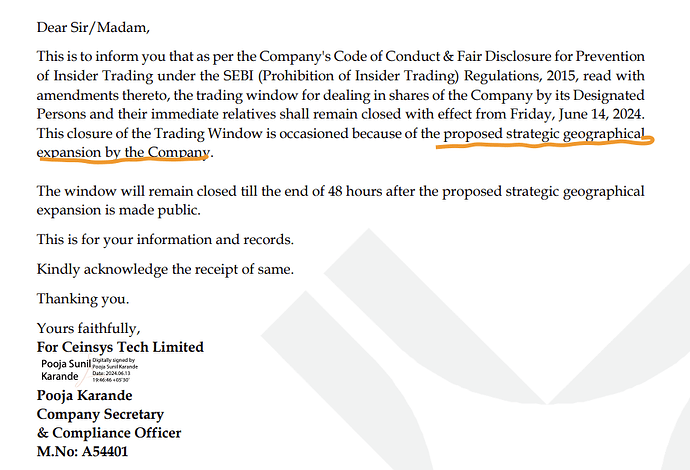

Yesterday’s dispatch from Ceinsys says they are closing the trading window from today until the proposed strategic geographic expansion is made public.

All evidence points to the acquisition target perhaps not being far away. Valuation is not static and an acquisition like this will affect it, depending on what get’s acquired and at what value. When AllyGrow was acquired, Zodius was paid in shares at a value of Rs.160/share or so if am not mistaken and today the value is 3-4x that. If they maintain that track record, 560/share that they are putting in big money at might infact be undervalued but its of course a subjective call.

Disc: Invested in both