The argument that we are not in a bubble in the above video of TV experts is the following two comparisons

Midcaps

Smallcaps

We are substantially lower than Oct '21 (roughly 30% lower), so we are not in bubble, goes the argument (We are merely in euphoria it seems). Lets go back to Oct '21 - back then RBI repo rate was 4% and US 10Y was at 1.5%. I think we can all agree that risk-free rate affects P/E multiple a LOT, especially when it’s closer to 0. We had 8 RBI meets without a cut to the Oc '21 meet (yes, “cut”. We were expecting a “cut”). Inflation hadn’t yet reared its ugly head. Fed was caught napping saying inflation is “transitory”. That’s Oct '21 period in a gist.

Are we going to get to that P/E now when RBI repo rate is 6.5% (fed funds rate now at 5.5%) and there is no sign of a rate cut at least until March '24 and worse still, we may have to tighten rates in a surprise move if crude goes above $100. Sometimes risk can be very visible, but we can still be blind to it because it suits us. Instead of looking at these “avg” numbers, ask yourself what % of stocks you have looked at of-late are trading under 10-year median P/E (for me its probably 1 in 10 at most, or 10%)

Crude has broken out and is at Nov '22 levels. We have had a very benign period in the last 9 months, with Russian oil powering our growth (acquired at a significant discount which kept narrowing until it vanished recently) - this kept our deficit low, currency stable, reserves intact and also we played energy arbitrage really well as lot of European manufacturing moved here - European growth as well depends on crude being low, since they are net importer and discretionary income there can come down dramatically with crude above $100 - so what we can potentially have is a lollapalooza, a vicious cycle of global demand compression - which is not priced in.

Also, my previous post is not a prediction (I am not in the news dispensing business). As a practitioner, we have to stay on top of potential outcomes and their probabilities. I feel

- There is a 25% chance of another 10-30% rally in small caps

- 75% chance of us being close to the top, with maybe another 5-10% to go at most - A top which can be a short/medium term top, depending on how worse macro gets. If crude goes above $100, we can be nearly certain we have made a top.

The reason I think that is purely macro driven

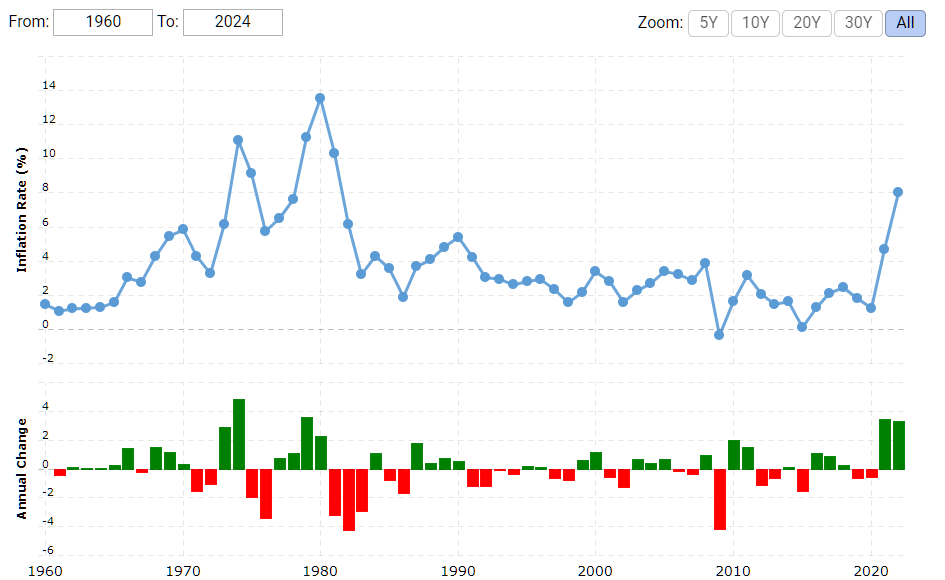

US has not had inflation at these levels for over 40 years

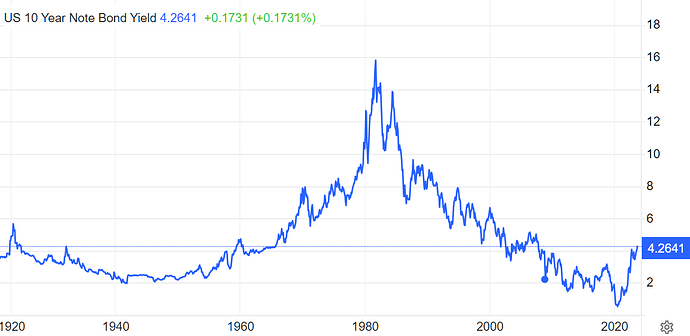

The US 10Y hasnt been at this level in 15 years

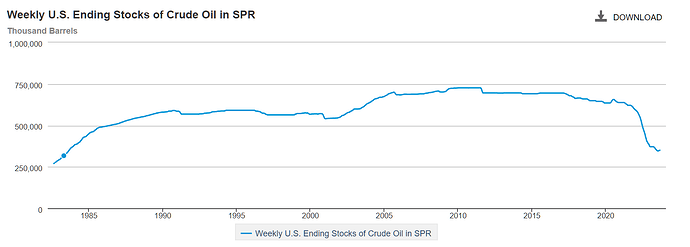

These two are known things and market has pretty much forgotten these since these are worries of '22 (right?). It has gone to the back of our minds mainly because US managed the crude situation last year using its SPR (Special Petroleum Reserves) which it built in the '80s because the OPEC spooked the West causing the inflation in the '70s by cartelising Oil.

The SPR was built specifically for this purpose to counter financial terrorism (through oil). It has helped see through a year or more but now the SPR levels are at levels last seen in '82 (US sold bulk of it to bring down oil from 120+ to 70+ levels)

There isn’t much the West/US can do to defend crude here on (unless it works out some peace negotiation or lifts sanction on Iran or something completely left field - or of course, raise rates further). For an oil importing country like ours, this can be collateral damage.

I am not totally bearish but I think lot of concerning things are happening. The “euphoria” in small/micro/sme is real. In '18, there was neat switch from Micro/small to largecaps. So I am not at all bearish on the Nifty which I think is still only slightly expensive. There’s a good possibility of similar thing happening again but the market participant composition has changed substantially since '18 - so am not sure how well this might work (There was significant herding into HDFC, Asian Paints, Pidilite, DMart etc., the so called quality stocks at 100 P/E)

Extreme caution is warranted in SME space and microcaps - these can turn completely illiquid overnight when tide turns and notional gains can evaporate. Also be wary of all the storification. I haven’t stayed abreast of all the demergers, promoter stake sales, cooked up numbers etc. - but these were very common in several names - if you haven’t yet, do temper your optimism by going through the carnage thread. There’s no need to see through the end of the party when all the single malt is gone and only arrack is left

Disc: Been fully invested since July '22 and it has been a great run. Started reducing exposure to market this week by scaling down NBFCs. I am still ~85% invested and will progressively scale down as performance weakens