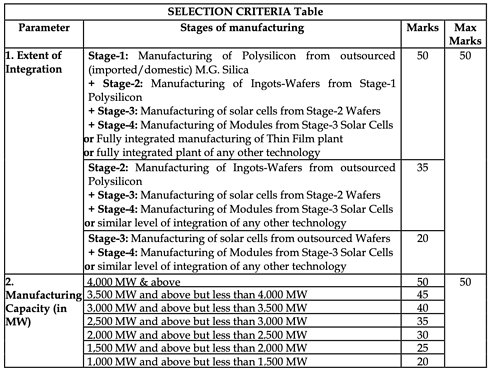

seems PLI scheme is only focused on silicon cell part

Borosil Renewables to ET NOW- over & above the stated capex of doing 4x expansion of current capacities a new facility is being planned from October onward. Don't expect the Chinese to endulge in reckless pricing , demand remains very buoyant

— Ajaya Sharma (@Ajaya_buddy) May 18, 2021

Thanks for sharing, but wasn’t worth the inr 118 I paid for reading it. Q4 Concall is much more informative.

There were also few inaccuracies in the article:

- Current solar glass prices (as mentioned in latest concall) are somewhere between Q3 and Q4 fy21 levels. Article says 1Hfy21 and proceeds with a conservative valuation estimate

- mgmt. expects 500TPD new capacity to be up by July-Aug 2022 (provided in presentation + concall). Article says “late” 2022

- Capex for S4-S5 plants as indicated by mgmt. is 1100cr. Article says 1000cr

Found this article helpful and has lots of good insights. Personally helped me judge the character of management a bit better.

Article fails to mention solar-glass!

Relevant quotes:

Prices for the purified metalloid (silicon) have touched $25.88 a kilogram, from $6.19 less than a year ago

Projects that haven’t signed price agreements with utilities that buy the power might get delayed unless the customer is willing to pay a higher rate for the electricity

Disc: not invested

This article might help in understanding the price rise in Polysilicon. Due to the current semiconductor shortage, there is a clash between Solar PV & Semiconductor Industry which is driving prices crazy.

China is adding huge capacities since last 15 years in Poly-Si and now India wants to grow at the same pace due to similar geographic conditions and ambitious goals of 450+ GW of Renewables addition by 2030.

Thank you for sharing @vikas_sinha.

Apart from what @Investor_Mohit has added here are few other insights.

PV silicon prices are up mainly cause of issues with Xinjiang region in China where majority of the world’s polysilicon is sourced from. Most PV silicon companies in China are housed in this region as electricity is really cheap (Few cents per unit) and silicon/sand requires heating upto 2000 degree Celsius to be refined to 99.99999% purity before it can be used for solar wafer manufacturing.

Now Xinjiang as a region is facing international backlash as there is growing evidence that China is using forced labour in the area for all sorts of manufacturing. The same region grows cotton and that industry too has impacted.

Other short term impacts include rising costs of freight etc. which adds to the overall cost of manufacturing and supply of PV wafers.

In my view, all of this has a short term and limited impact on solar industry. The pace to install hasn’t slowed that to a large degree. Certain developers around the world are still going ahead with installations.

In the grand scheme of things, this is hiccup / short term bump.

No impacts on solar glass industry though.

PS: I realize these conversations are better engaged on a renewables thread, VP doesn’t seem to have one. I will create one today/tomorrow.

Con call: https://www.bseindia.com/xml-data/corpfiling/AttachLive/54372fae-63fb-4c8b-a82e-47552ddd819d.pdf

Anti Dumping Duty on Solar Glass Has Resulted in Monopoly, Shortage, Price Rise - Mercom India

Found this useful to understand the industry sentiment on the anti-dumping duty, and the article also mentions potential entrants into the solar glass industry.

Although the small domestic panel producers are livid for some time now, the authorities are clear in their opinion that the duty is just and is not promoting a monopoly at all.

Thanks for sharing. This is from mid-march when prices were high, things have cooled off somewhat in apr-may as per latest concall.

Though its a complicated issue, there is one clear conclusion that until domestic capacities are ramped up, domestic module manufacturers cannot stop relying on imported solar glass.

The article felt lopsided to me in that it centered on import duties as the major issue. (counterviews invited)…Here are my thoughts:

- It seems like the module makers are more troubled by the fact that some of their competitors are able to source glass at slightly cheaper price (Rs. 466/sqmm vs. Rs. 488/sqmm). Shouldn’t they be more worried about the absolute rise in global solar glass prices since they have a direct impact on costs? What would be their contention, had borosil been selling glass cheaper vs. imports even without duty? This is certainly a possibility in future when they start operating at scale

- There is a also a short term vs. long term industry angle here - without protection, domestic capacities may never ramp up aggressively

- Global hike in freight rates. One module maker harps on this in the article

- Also, solar glass contributes less than ~10% of solar module cost, how can the duty be that significant to the end module cost?

- Not to mention that other module components such as wafers and solar cells have also gone up in prices. Why not talk about them and quantify the prime culprit?

- It will be interesting to see how fast competition enters the domestic market. Longer the delay, Higher the confidence I would have in the “learning curve”/“process-driven efficiencies” that provide some competitive advantage to borosil renew

Disc - Invested

Just to add to above, overall solar module procurement is less than 25% of the total cost to set up a utility scale solar power plant. So while increasing costs does cause some trouble, it doesn’t impact to an extent of making a project unviable.

There are signs across the whole ecosystem that more domestic manufacturing is being added at a rapid pace. ReNew just got 100acre land from Gujarat government to set up a solar wafer manufacturing plant and even through Borosil conference call, they alluded that 13GW of manufacturing capacity is being added domestically this / next year to take total solar manufacturing capacity to 24 GW.

Coal India is setting up 10GW of ingot manufacturing.

3 years from today, no one will be talking about Chinese imports.

Can anyone help me regarding below question?

When a solar module or panel is imported into India, is it pre-fitted with solar glass, or the glass is attached later on after it arrives?

Prefitted. So no opportunity of supplying solar glass to imported modules or imported panels.

I asked that question because by July 31, the safeguard duty on imported modules is expiring, and BCD will be applicable from April 2022, which means for 8 months there can be unrestricted imports of modules. That can be negative for borosil if modules are prefit with glass. Although, local module manufacturers have given application for reinstatement of duty after July 31, but I think it will take time.

http://taiyangnews.info/business/scatec-forays-into-india-in-partnership-with-acme/

Excerpts:-

Norway headquartered energy company Scatec has expanded its international presence by formally announcing its entry into the Indian solar market, in partnership with local solar project developer ACME.

In its statement, Scatec called India a key market for years to come as it grows 15 GW total capacity in operation or under construction by 2025-end, from more than 3.5 GW it has currently

Although increasing material prices and safeguard duties are good for companies like Borosil Renewables in the short term, it could be detrimental to the whole sector in the long run as the projects would get costlier, and hence, unviable.

Solar power investors burnt by rise in raw materials costs | Financial Times (ft.com)

RIL to invest in solar energy, targeting meeting 100 GW requirement of 450 GW plan by PM Modi

Discl : Invested

Suddenly this commodity business doesn’t look so commodity anymore

More production in Solar Chain will move to India from China, it’s inevitable.

To give some context, current PV capacity is 4GW

Reliance’s announcement alone double the PV capacity in India. If you search recent news, you will find many foreign investment and even local players announcing more PV production in India.

While everyone has announced module and PV cell manufacturing, no one has announced solar glass facility, simply cause solar glass requires precision and scale and isn’t as sexy of a business as PV module manufacturing. Any new players that want to enter will take many years to catch up to Borosil’s current + announced capacity.

Unless someone has deep pockets like Reliance, Borosil’s moat is safe.

Move of solar supply chain from China to India will be slow at first then all of a sudden.