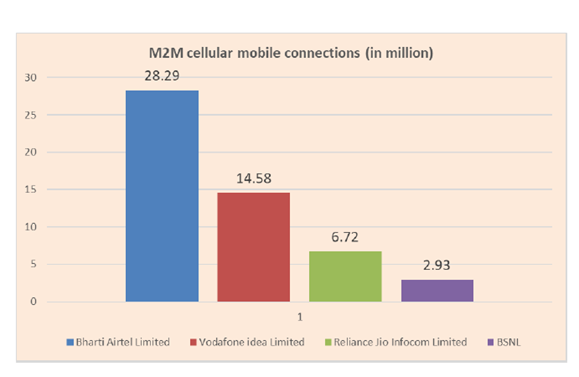

Any thoughts on the impact to Bharti Airtel regarding the news that broke last night. Adani’s entering the telecom spectrum bidding race.

Adani planning to enter telecom spectrum race; to face Jio, Airtel: Report

Any thoughts on the impact to Bharti Airtel regarding the news that broke last night. Adani’s entering the telecom spectrum bidding race.

Adani planning to enter telecom spectrum race; to face Jio, Airtel: Report

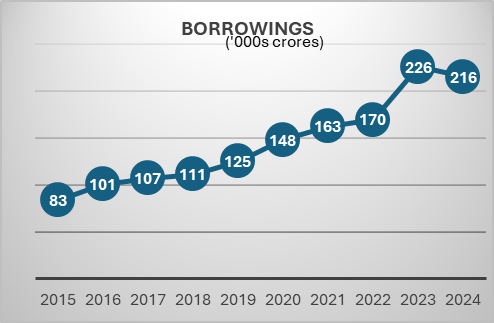

Adani wants to get into every nook and corner of Indian Economy but I don’t think they will be successful here. First of all, their acquisitions, new investments and all have been financed through debt. Not a single investment has any capital infusion, that itself makes it a very risky investment. This puts an unnecessary burden on the entity they are buying or investing in, even before the operations start.

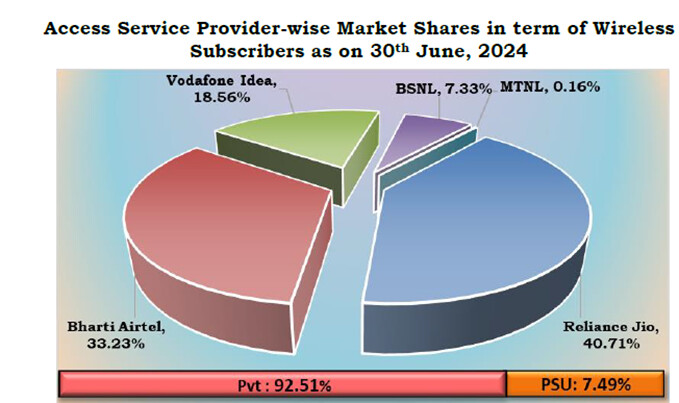

Secondly, it is unlikely that all their investments will turn fruitful. We all know, in any portfolio many stocks do not perform that well and most of the gains come from few select stocks. I think same will happen with Adani’s investments. Now as far as the spectrum auction is concerned, even if they buy the spectrum, what will they use it for? They don’t have a single business that needs this kind of investment and given it’s past history of over paying outrageously for certain investments, just because they have easily available credit, they might over pay for this project too. But I doubt this will affect Bharti in any way.

Bharti survived JIO, AGR dues blow and now is doing better than ever in the telecom space. I have written about this in detail in one of my posts. I’ll put the link here or you can read their recent concall. They are diversifying into so many other growth engines, that harming them in any way would take huge investments.

CLSA has assigned a “buy” rating to Bharti Airtel’s stock, indicating a positive outlook. The rating is based on factors such as the company’s growing post-paid subscriber base and the potential of its 5G services. CLSA has set a target price of ₹1,015 for Bharti Airtel’s stock, suggesting potential upside. The report highlights the positive prospects for the company in the telecom sector, considering its subscriber growth and future expansion into 5G services.

Airtel is focusing on small and medium-sized enterprises (SMEs) and government projects to expand its cloud business. The company aims to tap into the growing demand for cloud services in these sectors. Airtel plans to leverage its extensive network infrastructure and data center capabilities to provide a range of cloud-based solutions to SMEs and government organizations. By targeting these segments, Airtel aims to capitalize on the increasing adoption of cloud technologies and establish itself as a key player in the Indian cloud market.

Bharti + Smart Meters

Smart meter are already SIM enabled so thesis has always been there behind the core thesis

Airtel & Data Center

Indus tower investment augers well for Bharti

Nxtra is a data center play 10% right now. They might look to ipo this in future.

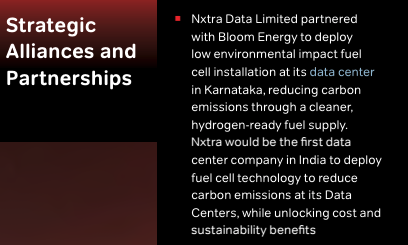

Bloom Energy partnership for Airtel Nxtra (Data Center arm)

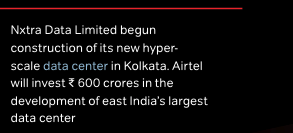

East india largest Data center by Nxtra Airtel

Data center awards for Bharti

Nxtra

#BHARTIARTL: Nxtra by Airtel joins RE100, commits to becoming a 100% renewable energy data center company.

Bharti Airtel - No Data Breach - Airtel

Bharti Airtel fined Rs. 258,000

The telecom giant has been slapped with a penalty by the Department of Telecommunications (DoT) for allegedly violating subscriber verification norms. The fine was imposed based on a CAF audit conducted for May 2024.

These are quite regular. It’s happening more than once almost every month.

Indus Towers will become subsidiary of the company post buyback under the companies act 2013 as shareholding of the company will increase to more than 50 percent of its paid up capital

Disc-holding not buy/sell recom

Airtel Finance launches fixed deposits with up to 9.1% interest On the Airtel Thanks App platform, customers can book and manage fixed deposits directly without opening a new bank account with a minimum investment of ₹1,000

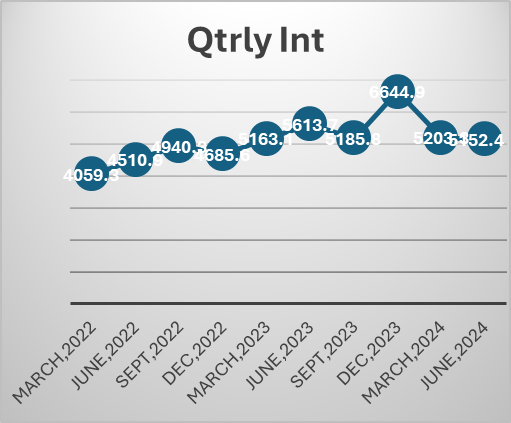

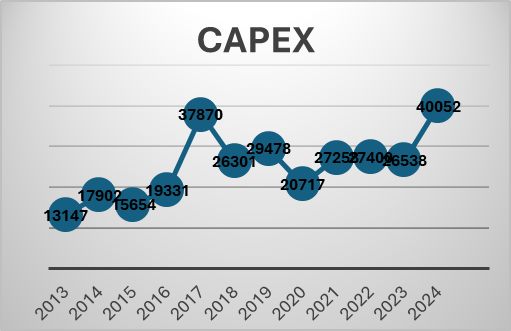

I have been following Airtel for a long time and it seems the company is at an inflection point. Two things that I heard from the few recent concalls that interested me are capex moderation and deleveraging. The company has been through a string of regulatory issues and a period of cutthroat competition.

With the major part of this capex done. The company can now focus on their new age business, cloud, financial services etc. The company’s core business is going to produce a lot of cash which can be used to incubate new business opportunities. Last quarter the company made a cash profit of 16000 crores.

The company has a -ve working capital cycle.

On top of that, Indus towers is looking good with Voda-Idea’s liquidity getting better. With the latest buyback by Indus, the stake of the parent company is 50 %, airtel may not need to infuse any money in here. Bharati Hexacom is listed and is paying dividends. Airtel Africa has also just completed a buyback.

Airtel decided to discontinue Wynk Music due to the lack of a clear monetisation plan as the music streaming market in India offers limited revenue opportunities. Airtel opted to collaborate with Apple in this space. this clearly indicates management’s focus.

The biggest risk to thesis is regulatory. Any issue like the agr crisis could be a gig negative. If you are following Airtel, one will see that they are reporting some fines every week( these fines are very low relative to Airtel’s scale of operations)

This will pave the way for smooth and frequent tarrif increase for data + Voice package as anyway price increase will not effect only voice customers.

All the millennials and zen Z irrespective of social status is already addicted to data and only old age people and features phone users will go for voice only packages.

Airtel is awaiting government approval for satellite telecom!

“In India, we are waiting for, as you know, the spectrum allocation to be done. Both our stations are ready, one in Gujarat and one in Tamil Nadu. The base stations are ready. So as soon as we get permission, we will be launching in India as well,”

This will not work with our 5G phones correct? Can someone confirm?

Results looks incredible, with beat on Revenue and adjusted PAT on the back of industry leading ARPU

Is this worth accumulating in current market scenario? Are Valuation comfortable or seems stretched?

Please share your views…