This is the interview where Mr Rajkumar was dicussed

Q3FY23

- Consolidated revenue at Rs327.8 Cr +41% YoY

- EBITDA at Rs58.1 Cr +79 % YoY

- PAT at Rs30.6 Cr +101 % YoY

9MFY23 - Consolidated revenue at Rs1491.8 Cr + 66% YoY %

- EBITDA Rs306.5 Cr +96% YoY

- PAT at Rs200.6 Cr +202% YoY

Vimal Alawadhi, Managing Director of Best Agrolife Limited, commenting on the performance for the quarter and nine-month ended December 2022 said, “We are glad to share that despite being a lean season BAL successfully managed to remain consistent with its performance in the third quarter of this financial year. While the company has shown growth with a positive outlook across all the business segments durlng this period. We are focused on our global export expansion which wilI start

reflecting in our revenue growth soon. The company plans to introduce new and exclusive patented products like Ronfen and other different segment products which wi I scale up our growth manifolds in the coming years. lt is important to note that BAL recently obtained registration for the indigenous manufacturing of Cyhalofop-butyl and Propaquizafop Technical u/s 9(3) along with several crucial technicals”.

Latest PPT with lots of information

For FY23 Revenues

We gave guidance of 30% growth in FY23 and we should do more than that. So, this year it will go more than 45% as we can see in these three quarters.

For FY24 Revenues

We have not worked on the final plan for the next year, but definitely there is geographical expansion and new product and export segment, so 20-30% bear minimum growth will be there.

On EBITDA margins

We are maintaining more than 20% of EBITDA and the growth will be high because our main focus on the margins and the EBITDA, in the new chemistry and whenever we go for the new chemistry definitely margins will be there, definitely these are new chemistry and market will be there, different segment, different markets. So, we can say this EBITDA will keep more than 20% we will try to keep this margin

Why negative cash flow from operation in 2022, even though PAT shows good growth. The main concern is PAT growth without cash. Has cash got stuck in inventory and trade receivables?

Please throw some light on it.

- Technical: consolidating since feb… long term uptrend… short term downtrend…

- Offers high-quality, innovative, effective crop-protection and food safety solutions

- Offers 70 formulations of various insecticides, herbicides, fungicides and PGRs, some of which have come out of patent in recent past (2021)

- Building strong presence among the farmers by conduction various programmes

- Dec 2022 result was pretty bad…better compared to dec 21 yoy… but since september showed 2x growth yoy compared to 2021 september quarter, this was disappointing

- Received patent for three products out of which two are yet to be launched. Planning to launch these products in the financial year 2024

- Brownfield capex to complete in fy24

- Segment-wise co is working on different kind of one-shot solutions where multiple pest and weeds could be controlled together. So, one such product was launched Q2 which was for sucking pest for cotton and chilly and that product contributed and kept on contributing in Q3 also to a great extent.

- “We are covering not only cotton, chilly, we are covering paddy, which is vast geography in India, we are covering sugarcane also, we are covering corn, we are covering various soya bean also, so different herbicide we are working on, we are in narrow leaf and broad leaf weeds can be controlled together.”

- “inventory levels I believe for the next 12 months will remain at the current levels or little bit laid back, but that due to the reason of more geographical and product expansion what we are having.”

- 2-3 years before others catchup on the current formulations… industry needs rapid r&d

- market size for the company’s patented products is estimated to be over Rs. 2,000 crores, starting from FY25.

- company has received registrations for new products and plans to launch them, targeting a 40% market share.

- company’s margin trajectory is expected to improve over the next 1 to 3 years, driven by export growth and new product launches.

- Pyroxasulfone Registration: The company has already registered the product but has not yet launched it. They obtained the license in January and plan to start sales in September or October of the current year (FY24).

- The company does not have any specific plans regarding increasing promoters’ stake at the moment.

- Backward Integration and Raw Materials: Most of the products, including AI, technical, and formulations, are produced in-house, including the subsidiary. The company’s import dependency on raw materials is decreasing as they are developing intermediates in-house. The target is to minimize import dependency by FY26.

- Formulation Patents: The company’s formulation patents, such as for Ronfen, have a blocked range of percentages within the patent. Other competitors cannot come up with the same formulation outside of the specified range, ensuring the company’s right to win in this regard.

- Antithesis - Environmental Concerns: Critics might argue that the company’s use of large molecules contributes to environmental degradation, pollution, and loss of biodiversity. They may question the sustainability of the company’s agricultural practices and advocate for more environmentally friendly alternatives.

The company aims to achieve 20% agricultural market share target by focusing on various strategies. Firstly, they plan to expand their product portfolio by introducing new and advanced agricultural products. These products will cater to the evolving needs of farmers and help improve crop yield and quality.

Additionally, Best Agro aims to enhance its distribution network by increasing its presence in existing markets and exploring new territories. They intend to establish a strong dealer network and provide better access to their products across different regions.

The company recognizes the importance of digitalization in the agriculture sector and plans to leverage technology to reach out to farmers. They will utilize digital platforms to provide information, training, and support to farmers, helping them make informed decisions and optimize their farming practices.

Best Agro also emphasizes the need for sustainable agriculture and intends to promote eco-friendly practices among farmers. They will focus on developing organic and bio-based products that minimize environmental impact while ensuring optimum productivity.

In conclusion, Best Agro aims to gain a 20% market share by expanding its product range, strengthening its distribution network, embracing digitalization, and promoting sustainable agriculture. These efforts reflect their commitment to providing innovative and environmentally friendly solutions to farmers.

Around 90% of sales are trading sales for Q4 and around 60% of sales are trading sales for FY 22-23 and hence in my opinion the margins are in line with the activity level.

![]() #BESTAGRO - Q4 FY23 Concal - Held Today. I participated.

#BESTAGRO - Q4 FY23 Concal - Held Today. I participated.

Full Link -

![]() First question was asked by me (11.45 min to 17.20 min)

First question was asked by me (11.45 min to 17.20 min)

![]() Co. said → Q4 FY23 was an one-off quarter. Q1 & Q2 will be definitely good.

Co. said → Q4 FY23 was an one-off quarter. Q1 & Q2 will be definitely good.

Is making combinations of molecules such as big differentiator? Cannot a person just buy the different molecules and combine them? Of course the patent stops marketing of such a combination but the end-user is free to make them practically speaking since the composition is of course listed on the product.

Disc: invested

In many cases, generic molecules used in agrochemical products are regulated substances due to their potential risks to human health and the environment. These regulations often require manufacturers to obtain licenses, conduct extensive safety tests, and adhere to specific labeling and packaging requirements. As a result, these generic molecules are typically not available for purchase by individuals for use on farms or in agricultural settings.

Furthermore, mixing agrochemicals without proper knowledge, training, and understanding of the potential risks can be hazardous. Improper mixing or handling of these substances may lead to unintended consequences such as ineffective pest control, crop damage, or harm to humans, animals, or the environment.

I am still unable to understand how a Company whose trading sales is more than 60% of total sales generate higher margins…

Disclosure : Exited due to trading nature of business.

Two red flags

- Management sounds way to optimistic about future. Could be too much of false confidence. Their experience in manufacturing is just 2 years - not enough learning cycle for even the manufacturing aspect of business.

- Company has not been able to convert profit into cash. May be, they are simply doing stock transfer and terming it Sales. Blowing WC is across the year, not just end of year which is a major concern. Likely, headed for a debt trap.

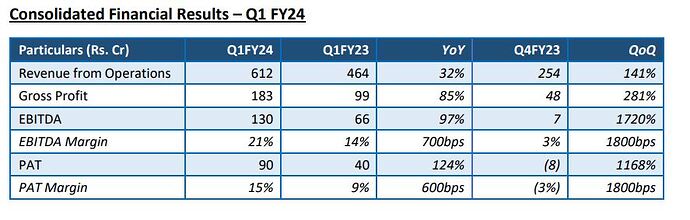

Best Agro results just out, below is the consolidated nos.

I recollect from the last concall, i had added in my notes to look for 600 cr revenue Q1 FY24, the company has declared it as 612.

There are some great points made in this thread, due to my lack of understanding on accounting, I wonder if I can buy more of this stock, esp. points around governance & accounting hygiene. For now, I maintain my 1% allocation on this, as incase there are any misappropriations in company I dont lose much and if they really achieve what they promise, its a rocket from here.

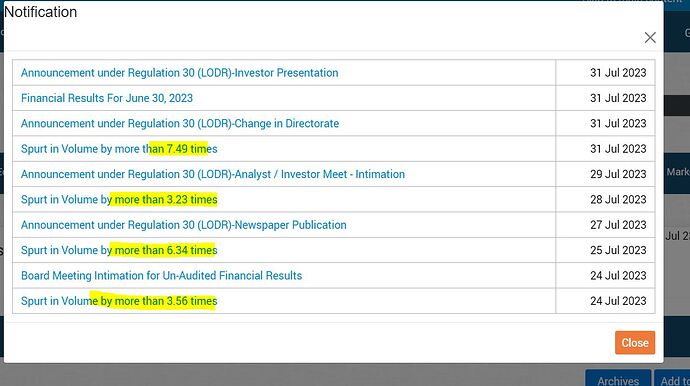

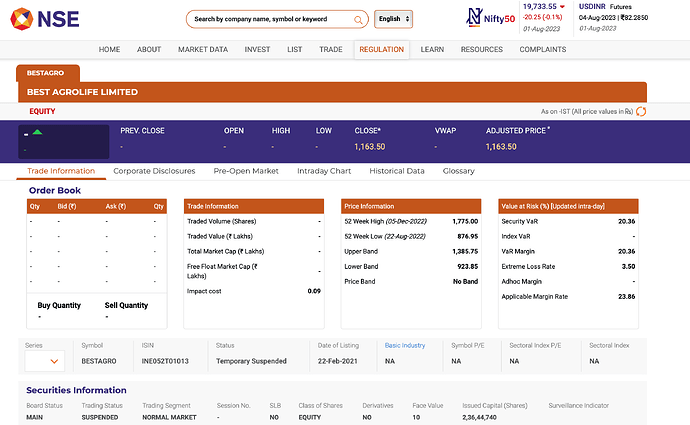

Why was trading suspended in this counter ?

https://www.nseindia.com/get-quotes/equity?symbol=BESTAGRO

Disc: Not invested

BSE hasn’t suspended, but has the below info. could it be this ? too many vol. spurts in short span closer to result + result beating expectations?

the stock is trading today, not sure if the info on NSE is updated

Someone will need to ask this tomorrow in conference call.