mr ghosh sounds optimistic.

interestingly he mentions that for the fist 20 years bandhan had written off only 64 crores.

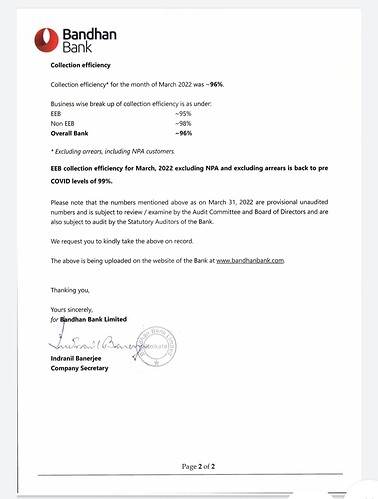

collections even in the worst hit assam seem to be coming back to above 90%, there will be writebacks resulting in increase in book value

i have been holding bandhan throughout the pandemic and have even averaged down

my basic thesis on bandhan has been that if bajaj finance customers who take loans to buy cellphones and appliances (consumption) pay back their dues due to fear of bad credit bureau report

microfinance customers who actually need loans for business would " in the long run" not deliberately default to avoid a bad credit report

ofcourse this has resulted in opportunity cost for me in the past 2 years.

my calculations on how fast bandhan would recover have been wrong

let’s see how the results pan out

Disclaimer :i am invested in bandhan bank, this is not investment advice, please do your due diligence before investing