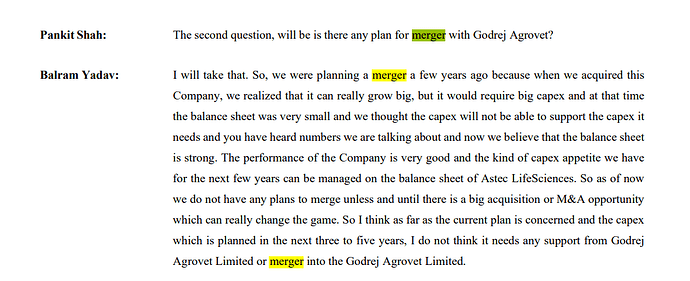

Feb 2024(From godrej agrovet concall)

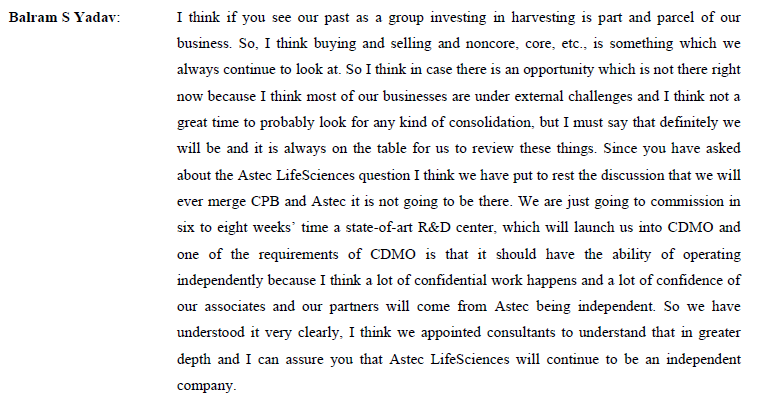

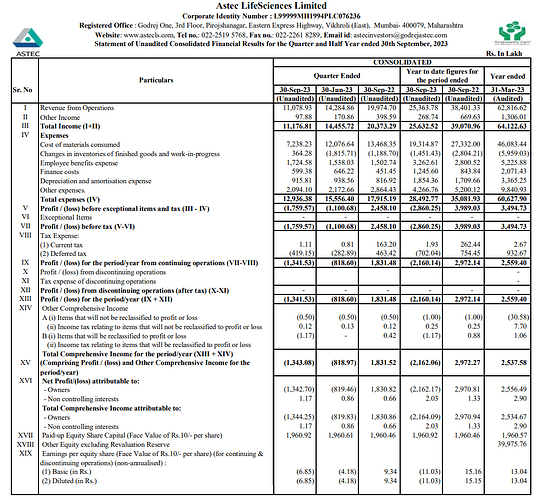

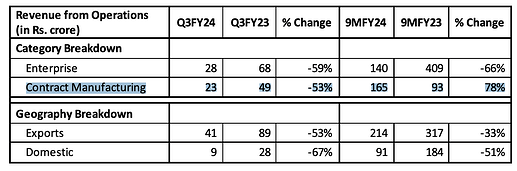

The Enterprise business has been facing extremely challenging external

market conditions which have severely impacted on its top line and margin performance.

Continued destocking in the export markets and excess supply from China resulted in a significant margin erosion of the Enterprise business.

===========================

FUTURE GROWTH TRIGGERS

- R and D centre

=As per Nadir godrej, for Astec, the future looks very bright because of the R&D center.

=From April, since we have put our new R&D center, there have been lot of products which we have

put in pipeline and at very fast pace we are diversifying our existing portfolio from existing Enterprise products and planning to bring in new products as we get into the next financial year.

2…Business strategy

=I think two clear messages. One, keep pushing on the CDMO

side of the business at much faster double digit growth rate, upwards of 40% to 50% and then

diversify from the existing Zole products from where we had significant financial or

performance issues in the last two, three quarters.

=And we have been working at very fast pace on all these two initiatives. Thanks to our R&D center.

Right now, with this adversity in the market, good things that has happened is we had our R&D

center,

A…We are diversifying our Enterprise portfolio and

B…Pressing the growth pedal on the CDMO pipeline.

= And I would not hesitate to say that as we get into Financial Year 2024-25 with the current market situation persist, our CDMO component of the business will overtake the Enterprise business

3…Margin expansion

A…CDMO

CDMO is fetching 5% to 7% higher contributions as compared to the Enterprise business.

B…Enterprise

Sustainibility of margin from enterprise business

=There will be diversification in sustained margin products not too impacted by the volatilities in the market.

=Second thing, we are moving more in the direction of working

on long term contract basis with the customers, even on the Enterprise side of the business with

formalized pricing clauses in build, so that we are able to sustain some level of margins and not too prone to the external volatilities.

C…R and D

And add to that, we are now able to take up a lot of lifecycle

management projects in the R&D which are again adding 4%-5% margins on our product sales.

So, we are very confident that we get back to these gross margins or exceed those gross margins

numbers which you have seen in the business earlier. And it could be as soon as maybe Financial

Year 2024-25 or Financial Year 2025-26.

=So, if you are making 20%-25% on Enterprise, you’ll be looking at (+)30%

at least on CDMO. Getting even as high as 35% to 40%.

4…Capex

We are on track on making those investments.

A…Our herbicide two plant which we had mentioned in the previous call, it is on track for commissioning, and we’ll be commissioning it in the next one to two months.

B…Similarly, a lot of

debottlenecking initiatives for new product launches for diversification from our existing Enterprise portfolio, all those investments will be part of the future growth.

5…CDMO business

=Our story or strategy around CDMO or our guidance to almost grow by 50%-60% every year or even double, looking at the smaller base

from which we started is very much intact and R&D has really given it a push to us.

= CDMO business is moving as per our guidance and targets. In fact, we are very much on mark to hit the numbers and performance on the CDMO.

=So very well on track on CDMO side of the business meeting or exceeding our guidance despite

the challenges from some of the innovator side of the business as well, there have been companies who have been deferring some of the CDMO volumes.

=We would be very few companies in the market wherein we have still held on to those volumes and financial targets. So very much on track on the CDMO side.

=For the CDMO business to

kick off, if everything goes well on the commercial side and the development side, it takes roughly three years to scale up. So, any new products coming into the pipeline, year three is

when you realize the complete optimization and the revenues for those products. So that is what

we are targeting, and I think we have deep confidence to achieve that in the coming years

…Why CDMO down?

=In this quarter, the CDMO business was deferred into the

subsequent quarter. So, it is not a loss in business.

=When it comes to the CDMO business, the quarter and quarter performance typically doesn’t work because you’ll see a lot of times either some of the businesses are pulled into the previous quarters or deferred into the subsequent quarters. So,

quarter-on-quarter it does not give a good gauge on how the business is doing. It is best to look

at it on an annualized basis. That will give you a great view on how the businesses are growing.

6… ENTERPRISE BUSINESS STRATEGY

A… Diversifying from existing zole products which have sustainable margins

=On the existing Enterprise products, since now we have a good R&D

team with us, we have also started broadening our portfolio on the Enterprise side. But as I’ve

mentioned in the previous calls as well, we are taking very strategic bets on very few Enterprise

product which could fetch us sustainable margins and which would have good relationship

profiles with some of the customers we want to work with. So happy to say that at a very fast

pace we have been almost in the last stages of at least bringing in a couple of new products

within the Enterprise segment and the impact of that will be seen in say FY25 and beyond on

that part of the business as well.

=We are diversifying to other products in the same platform or in a different technology platform, so that if in future we go through such market

volatility we have a better play across the Enterprise products to balance our sustained margins.

=Clearly from April, since we have put our new R&D center, there have been lot of products which we have

put in pipeline and at very fast pace we are diversifying our existing portfolio from existing Enterprise products and planning to bring in new products as we get into the next financial year.

B…Utilization of existing asset

=Maybe as we get into next year and the Zole platform still remains subdued from the pricing perspective we will have few of the other

products which could at least give us the utilizations and some level of profitability with utilization of existing asset.

=These products are in the Zole platform or the related, the

technology platforms where we are very well equipped looking at our existing asset profile. So,

they could or could not be in the existing Zole platforms. That is what we are looking at, what

best we can fit in in the existing asset base which we have currently.

7…What if zole products dont perform well in near future also?

=As we get into FY25, our goal is to completely have a plan in

place that if these products do not come back in the pricing or the volume, we still are able to

get to some kind of financial performance which are appreciable.

That is one. And I would say

it should cover broadly all these negative losses from the existing Zole products.

= We are also looking at what products we fit in our existing asset so that we

maximize our return on assets.

=Clearly on the existing Zole products, because of the huge inventories in the market, there has been pressure on utilizing our existing capacities as well to fullest on Enterprise products. So, we are also modifying it appropriately to fit in our new products in a way wherein the CAPEXs could be minimized while the revenues could be at the highest.

=Hence fetching in good double-digit margins for these products.

= So, all those things have been heavily worked on in this lean period of two, three quarters and we are expected to

show good benefits as we get into Financial Year 2024-25 despite volatility or challenging conditions in the market.

======================

WHY SUCH BAD RESULTS?

.Enterprise business- Demand/sipply mismatch

A…Supply problem

=What we are seeing in these products is a correction in the market because

of huge inventory pile ups. According to some analyst reports, or even if you pull up the export

data and see how much of volumes have been pushed in some of these zole products, you will

be surprised to look at those numbers. Those are equivalent to 12 to 18 months of the volumes,

actually, which were floating around in the global market. So that isthe situation. This will come

back. The key part is when. And that is what we all are figuring out. And till we reach that point,

what is happening in the markets, and I mentioned in the last conference call as well, that they

have been destocking complete price erosion in the export markets. Right now, the price erosion

has to some extent abated. It has reached to almost the bottommost level and we are not seeing

price erosion. The real pain is the prices are staying at those abysmally low levels. That is number

one. And the second is because we are still seeing the inventories in the market.

B…Demand problem

There has not

been any meaningful demand coming from the big players. Earlier at times for some of our Zole

products, one order could be 200 to 300 metric tons. Currently an order size is 800 kg to 1 ton.

So, there has been no meaningful demand which is coming from the market. So now we are also

reconfiguring in a way that we liquidate our inventories and then align our production to orders.

So currently on these Enterprise products, most of the companies are moving in that direction

till we achieve a substantial supply demand balance. So, I would say another five, six months or

depends on how China opens up in next two, three weeks. But another couple of quarters at least

to have some kind of visibility on the Enterprise supply demand balance, and then it has to come

back basically.

.

Disc…invested