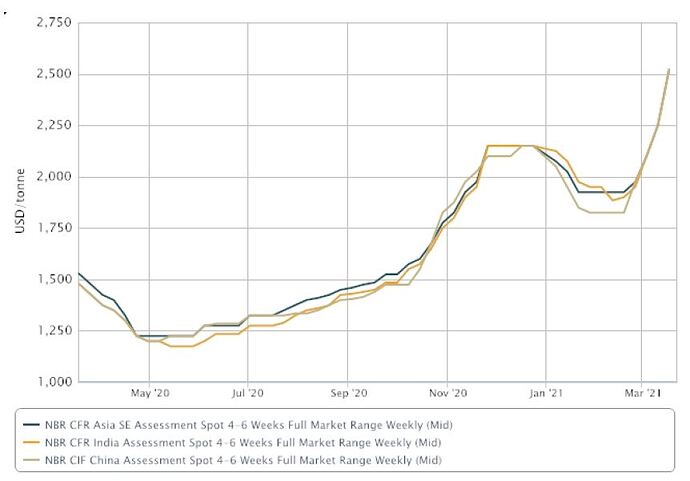

NBR price at multi year highs. Seems like with auto demand back along with agri - next entire fiscal provides high visibility of growth. Along with the stated expansion for XNB Latex 45000 tons (commencing by December 2021) and debottlenecking +15000 tons (commencing in April/May 2021) - profit may more than double in FY23 while FY22 is also expected to be stellar. NBR expansion will be an additional bonus

Can you plot Input prices as well so that we can see the trend of the spread?

Here you go. Amongst the both the split is (BD) 65:35 (ACN). While in total cost both maybe around 90%.

Also, NBR accounts for 30-35% of the business. Realizations have moved up sharply for XNB latex (used for gloves) which is around 10% of business. Realizations for overall product portfolio moving up but these two have moved up faster due to global shortage.

Apcotex Industries AR 2021 notes

- Apcotex is one of the leading producers of Synthetic Rubber (NBR & HSR) and Synthetic Latex (Nitrile, VP latex, XSB & Acrylic latex) in India. The company has one of the broadest range of Emulsion Polymers available in the market today.

- The various grades of Synthetic Rubber find application in products such as Automotive Components, Hoses, Gaskets, Rice Dehusking Rollers, Printing and Industrial Rollers, Friction Materials, Belting and Footwear. Apcotex’s range of Latexes are used for Paper / Paperboard Coating, Carpet Backing, Tyre Cord Dipping, Construction, Gloves-examination, surgical and industrial use etc.

- MR. RAVISHANKAR SHARMA (w.e.f. 1st May 2020) Executive Director He is a Chemical Engineer from Laxminarayan Institute of Technology, Nagpur, passed out in 1988 and PGDBM from Goa Institute of Management, Goa (Executive MBA) in 2009 and has more than 30 years of rich experience in the field of Production, Projects, Specialty Chemicals, operations and Manufacturing

- Manufacturing Capacity

- Taloja PLANT, Maharashtra

(55,000 MT) Synthetic Latex

(7,000 MT) High Styrene Rubber - Valia PLANT, Gujarat

(20,000MT) Nitrile Rubber and Allied Products

- Taloja PLANT, Maharashtra

- Apcotex Industries Limited under the umbrella brand “ApcoBuild” is servicing the construction chemical space in the western region of India so far with a significant presence in Mumbai with large waterproofing contractors and through a network of distributors. Our core strength is in the waterproofing range of products, thanks to our backward integration in manufacturing of high quality range of polymers and coatings along with repair products.

- Nitrile latex for gloves is a new synthetic latex polymer that your company has developed through internal R&D. It was successfully scaled up in FY 2020-21 and is currently only manufactured by your Company in India. The Covid-19 pandemic has accelerated the growth of the gloves industry globally and thus the requirement of Nitrile Latex during the financial year. It is likely to grow at a fast pace for the next few years.

- Sales from the new product range of Nitrile Latex for the Gloves industry has picked-up swiftly during the financial year. The Company aims to make this product range one of the future growth drivers. The Company intends to install new capacities at both Valia and Taloja and is working on obtaining the required approvals.

- In India, around 75% of Nitrile Butadiene Rubber (NBR) is imported, which creates good potential for Indian manufacturers of Nitrile Rubber.

- The Company had registered a Value and Volume sales growth of about 10% over the previous financial year in spite of losing production and sale on account of Covid-19 lockdown during the first quarter of the financial year under review.

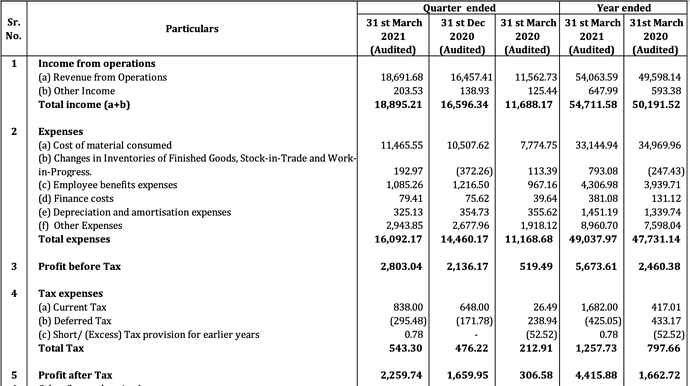

- Profit before tax is up by 131% to Rs. 56.74 Cr. as compared to Rs. 24.60 Cr. during the previous financial year, mainly on account of increase in volume sales, introduction of new products, optimzation of product and customers mix and commissioning of cost savings projects. During financial year 2020-21, Operating EBITDA went up by 100% to Rs. 71.54 Cr. from Rs. 35.83 Cr. during the previous financial year.

- The Co-gen Power Plant commissioned during the last week of March 2020, has helped to reduce the cost of production and this along with other projects have also helped to improve margins during the financial year

- During the financial year 2020-21, your company continued to face competition from overseas suppliers due to dumping of products like NBR at a low price. The Company has approached the relevant authorities for imposition of antidumping duty on NBR.

- Company faced intense competition from overseas suppliers especially for NBR. Some of them supplied material at a very low price in the country, which forced the Company to reduce the pricing and therefore margins during some months of the financial year.

- Major risks arise from a few key raw materials like Styrene, Acrylonitrile and Butadiene, amongst others, that are used in several of our products. There is an availability risk associated with all these products. Styrene and Acrylonitrile are not manufactured in the country and have to be imported.

- The HSR market has shrunk over a period of time and more or less stagnant over the last couple of years which may result into under utilization of the HSR production capacity. The Company has incresed export of HSR in overseas market and is also exploring the alternative use of the production facility for other products.

- Financials

- Gross margins improved from 30% to 37% yoy.

- Cash and Financial investments of Rs. 90 cr.

- The Company exported its products worth Rs. 92.64 Cr. during the financial year, approximately 17% of the total revenue. Increased by 50%.

- Power cost reduced from 25 cr to 23 cr in FY21 despite increase in turnover by 10%. Power cost decreased from 5% to 4% in FY21.

- R&D expense of Rs. 3.49 cr compared to Rs. 4.09 in FY20.

Apcotex NBR Duty Rejection Finmin July 2021.pdf (156.3 KB)

Finance ministry has rejected the NBR duty recommended by DGTR

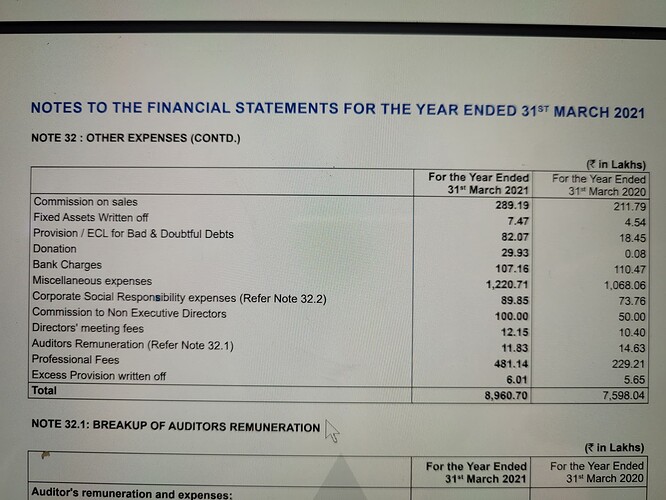

The company has miscellaneous expenses of 12.2 Crores(PY 10 crores). Has the management talked about what these expenses are?

Disc: invested

They have made repairs and maintenance spends towards making their reactors fungible. This should benefit them going forward and has removed some cyclicality out of the business.

But why hasn’t that been disclosed separately, and classified as misc? I find that strange.

He had mentioned it in the concall.

Not sure if this is relevant but sharing some notes from scuttlebutt. Our family has a business in rubber and we are a customer of Apcotex. They are making nitrile latex which is a substitute for natural latex because some people are allergic to natural latex. They are the only company in India manufacturing this. There is a 10% import duty on the product. Though, we also import some quantity and do not buy entirely from Apcotex because their quality is slightly inferior. Their plant is very old and they are setting up some new capacity which will commence production in July. The ownership has changed hands multiple times and currently it is being run by Asian Paints promoters. It was earlier part of Apar Industries but it was hived off and sold by Apar because it was a loss-making division.

Disc- no holdings

Happy to answer any questions from customer angle if anyone has

Malhar, you are correct in your channel checks that company makes nitrile latex and is the only company in India doing the same. By converting some existing capacity, they are making nitrile latex in Taloja plant. Now they are working on an expansion, which has already been announced, which will become operational in FY23.

As far as product quality is concerned, they have Topgloves (World’s largest gloves manufacturer) as their customer. So I believe quality must be of international standard.

As far as Apar plant is concerned, that plant was purchased by Apcotex in FY16 from a US based company. That US company had purchased that from a French company and that French company had purchased that plant from Apar in 2009. This plant is in Valia. They make NBR rubber there and not nitrile latex. I agree with you that when Apcotex purchased this plant, it was a loss making one. In last 4 years they have made efforts to improve the quality and reduce cost. To the best of my understanding, this plant is now profitable.

Discl - invested.

Only Valia plant owenership has been changed.

Apcotex promoter was previously director of asian paints

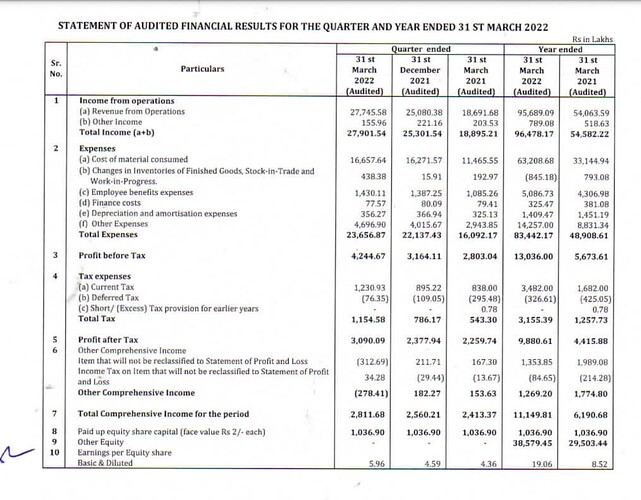

Investor presentation Q4 2022

=Operational Performance:

• Across all financial parameters the Company has reached historical highs in Q4-FY22

• Quarterly Volumes grew 24% YoY with balanced growth across all industries, geographies, and product groups

• Export contribution grew to 20% of overall Revenue

Projects:

=Projects

• Work on new expansion projects is running on schedule and expected to be completed in Q3-FY23

Disc…invested

The management mentioned to track their performance on ebita per ton basis as the revenue might look inflated based on high oil prices . Will it be right to assume that once oil prices fall the revenue will see a slight decline , but the margin profile will remain the same ![]()

Studying the stock not invested.

Once Oil prices fall, will lead to inventory losses. Currently virtuous cycle of inventory gains happening. These margins might not be Sustainable in a downturn

Good results, but no immediate upside triggers I think, until the new capacities are ready and ramped up. That is still around 12 months away. Until then downside risks remain with lower prices and demand slowdown due to global macro factors.

They said the capacity will be ramped up from Q3 onwards.?