Concall Summary (source:capital market)

Ebidta margin generally have been under pressure in Dec 18 and in Mar 19 quarter due to inventory adjustments. High inventory of raw materials on one hand, falling raw material prices on other hand and slowdown in automotive segment, issues with domestic carpet industry due to removal of export incentives etc were some of the challenges seen in H2 FY 19.

Large impact in margins in Mar 19 quarter due to higher inventory of raw material. Margins should improve going forward as such high cost inventories are no more.

Construction side and NBR side demand remained strong and stronger volumes were seen throughout the year. NRB segment margins were lower due to raw material issues and slowdown in auto industry affecting some product mix. Other user industry segments performed on expected line.

Carpet would be around 10% of total revenues. Roughly around 35% of sales is towards auto including tyres.

In FY 19, the company incurred a capex of around Rs 50 crore and remaining Rs 40 crore will be spent in FY 20. This includes power plant commissioning by June 19. The capex will increase latex capacity by around 20%. Efficiency and maintenance costs capex also is included in the capex of Rs 90 crore.

Exports account for around 13% of total FY 19 sales. The export customer who got fire in his premises has still not started off-takes from the company. Expects the export off takes from this customer from H2 FY 20 onwards. This customer account for around 4% of total exports. Excluding the customer, exports have grown at around 20%. Exports should continue to grow at around 15-18% going forward as well.

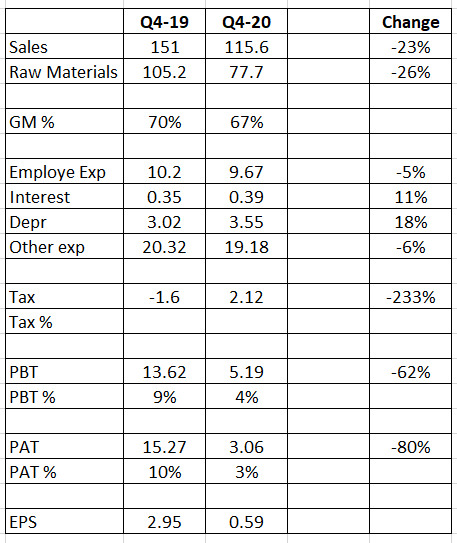

Tax rates normally are around 30-31%. There is deferred tax credit which was fully utilized in the quarter and hence overall tax was at lower rate.

By mid of FY 20, the company has plans to invest around Rs 250 crore for increasing capacity of latex by 40000 tons and NRB by around 25000 tons. This will take around 18 months time from the start of the project and can generate more than Rs 500 crore of additional turnover. NBR is a high margin product.

Debtors are well under control.

The margins should improve. The endeavour is to reach to around 13.5-14% in next 24 months and to take it forward from there.

NBR would account for around 35% of total sales, Synthetic Latex would contribute around 50% of total revenues and Synthetic Rubber would be around 15% for FY 19. Exports mostly are from sale of Latex.