Company Details:

Annapurna Swadisht Limited is a manufacturer of snacks and food products, namely, Fryums, cakes, candy, namkeen, chips, and Gohona Bori. Company was incorporated in the year 2015, and over the years, it is being able to establish itself as a brand name in the Eastern India. They have a unique price point of Rs. 5 which makes them the dominant player in Rural Areas.

Annapurna Swadisht Limited sells 12 Lakh+ packets of products daily. The company is one of the largest FMCG players in Eastern India in fast growing segments in Fryums, Cakes, Candies, Namkeen, and Potato Chips.

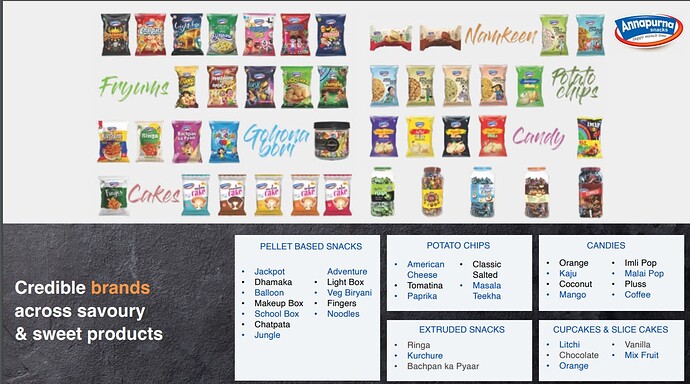

Company’s products are marketed under own brand names Jackpot, Chatpata Moon, Balloon, Finger, Rambo, Makeup Box, Dhamaka, Phoochka, Jungle Adventures, Ringa, Bachpan Ka Pyaar, Kurchure, Cream Filled Cake Vanilla, Cream Filled Cake Litchi, among others.

They have been certified by Food Safety and Standards Authority of India (FSSAI) for the quality management systems.

Products and Distribution:

- Currently they have 38 SKUs across 6 product lines

- 300 plus distributors in West Bengal, Bihar, Odisha, Jharkhand and Assam

- 80 plus Super stockists in key markets (5 states mentioned above)

- 5,00,000 plus retail touchpoints across 200+ towns & 70,000+ villages

Manufacturing Capacity:

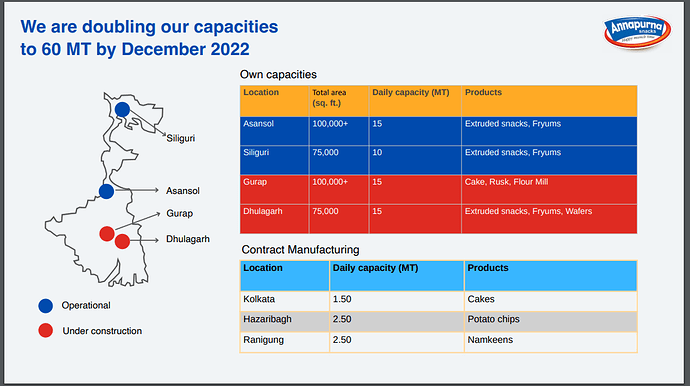

Currently they have 2 Manufacturing Units in West Bengal. Capacities are built in proximity

to markets of consumption to reduce freight costs.

(1) in Asansol with a constructed area of approx. 50,142 sq. ft. and

(2) in Siliguri with a constructed area of approx. 35,000 sq.

Daily production capacity of Asansol unit is 15 MT of Fryums and daily production capacity of manufacturing unit at Siliguri is 10 MT of Fryums. (Total 25 MT of capacity)

Currently, both facilities are operating at ~100% utilization as on June 30, 2022.

Capacity expansion plans:

They are more than doubling their capacities to 60 MT by December 2022. They are adding two more manufacturing units in West Bengal (Gurap and Dhulagarh). They are aiming to secure backward integration in Gurap unit with flour mill.

Currently total Capex of approx. INR 21 crore+ is underway for above (Funding mainly from funds raised in IPO).

Financials:

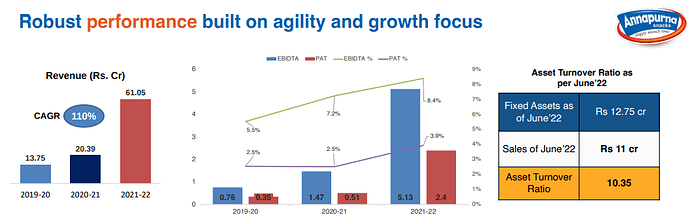

Annapurna Swadisht Ltd has been growing rapidly in last 3 years on lower base. They have grown from topline of 13.75cr in 2019-20 to 61.05cr in 2021-22.

Furthermore, they have clocked 29cr revenue in Q1 of 2022-23 and looks to maintain similar growth trajectory.

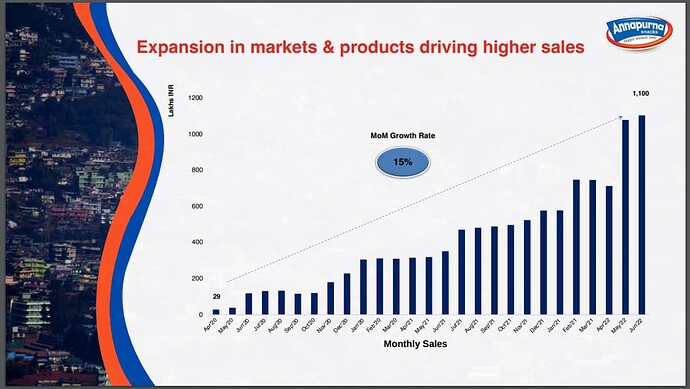

They have grown 15% MoM from April 2020 till June 2022, which is nothing short of an incredible growth journey!

Geographical Revenue Breakup (2021-22)

West Bengal – 68.5%

Bihar – 7.6%

Jharkhand – 22%

Odisha – 0.9%

Assam – 0.7%

Investment Thesis:

*They are in highly growing Indian Snacks Market:

The snacks industry of India is the most promising and booming segment of the FMCG category. There is a rise in demand for snacks in India; it is driving the companies to grow and operate in this segment lucratively. According to Renub Research latest report, the India Snacks

Market is expected to reach US$ 23.36 Billion by 2026.

The packed snacks such as instant and ready-to-cook snacking food items act as the primary growth drivers for the snacks industry in India. The consumption of package snacks is growing in India due to hygienic factors, easy availability, numerous choices, and a rise in its citizens’ personal disposable income. Study suggests that the Indian Snacks Market size is expected to grow with a double-digit CAGR of 13.24% from 2020 to 2026.

*They are adding new flavours and products to nearly double their SKUs to 50 by December 2022. They are also aiming at expanding presence across price points to mitigate any potential customer concentration risk.

*Annapurna Swadisht Ltd is growing at a phenomenal rate and plans to grow similarly in future (atleast for next couple of years with enhanced capacity). Management is expecting to close the current financial year (2022-23) at around 180-200cr of revenue (which is 3x of their 2022 revenue of 60cr).

*OPM has been increased from 5.5% in 2020 to around 8% in 2022. With scale, expect OPM to further improve.

*With current capacity of 25MT, they can clock up to 15cr per month (as per management). With 60MT capacity (most likely to be from Jan 2023), they can clock up to 30-35cr per month and around 360-420cr per annum. If they can penetrate other eastern states as they have with West Bengal, they can grow very well for next 2-3 years atleast with current enhanced capacity.

Risks:

*This is a microcap company which was recently listed and is only listed in NSE SME board. Investing in a SME stock without due diligence can erode your capital quickly.

*At current market price, company is trading at 2.2 Market cap to Sales (considering same runrate of Q1 2023) and P/E of around 50, which is not cheap by any means. (We could argue that an FMCG company growing at such rate could command such valuations).

*Geographical concentration risk: 68.5% of the revenue was from West Bengal. Need to keep this in mind. (Though management is trying to penetrate Bihar, Jharkhand, Odisha and Assam)

Disclaimer: Invested 1 lot. This is not an investment advise. Please do your own diligence before taking buy/sell decision.

If anyone else is tracking the company, please provide your valuable inputs.