Industry

Before we dive into the specifics of angel, a few words on the industry itself. Participants need to place orders on exchanges (stock, commodity etc). These happen through intermediaries called brokers. Brokers provide the UI/UX to the end participant to execute their trades. Traditionally, brokers have made money through 2 couple of major sources:

- Brokerage: In the olden days, brokers used to have “packs” (say X trades in Y days for Z rupees) and also provide custom plans to their clients with a focus on driving volume. This got disrupted with the advent of discount brokers like Zerodha (nice interview where one can hear from the horse’s mouth directly: The Success Story Of Zerodha's SMART Business Journey ft. Nithin Kamath | The Ranveer Show 68 - YouTube). Most brokerage houses now offer flat brokerage for some segments and 0 brokerage for others. The idea is, people who trade more, pay. People who are in it for buying and holding, anyway do not contribute volumes, let’s make that free (from brokerage PoV, there might still be other charges). This is why when you buy that PI Industries stock for the next 5 years (delivery trade), you don’t pay brokerage for it. Flat brokerage is the idea that each trade costs the same and so larger trades do not cost more. Earlier, brokerages would charge 0.1% of the trade as brokerage. So a 1cr trade would cost Rs 10,000! Now, it costs Rs 20.

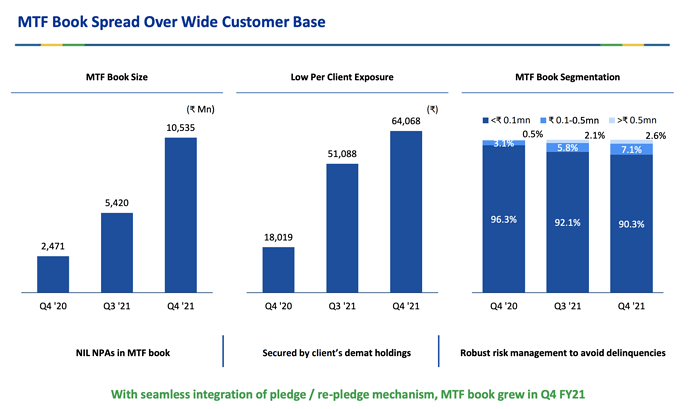

- Margin funding: When one wants to execute a trade, there is a concept of leverage. If I as a trader bring my capital of 1 lakh rupees, I can ask the brokerage to lend me money (leverage) and use the larger capital to amplify the effects of my trade, making more money. This is known as margin funding for the brokerage. Since the brokerage can square off your positions by the end of the day, this business is very low risk for the brokerage (unlike traditional lenders who can have NPAs). Brokerages charge interest for the margin lending (like any lender does) and that becomes the profit for the broker.

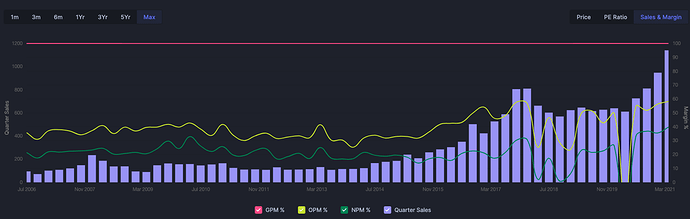

The broking industry revenues are tightly coupled with the performance of the stock market. Every bull run causes greed to explode in the hearts of people causing new client additions to soar through the roof. Bear markets have the opposite effect. Dejected traders and investors realize their shortcomings and end up quitting the market. This makes broking a largely cyclical industry with periods of upswings (bull markets), periods of no growth (sideways movement in the market) and periods of degrowth (bear markets). Have a look at the revenues of motilal oswal financial services over the years:

One can clearly see the 2014-2018 bull market, 2018-2020 bear market and the new bull market.

Due to this cyclicality brokers are eager to diversify into new sources of revenues. The major one which good brokerages are able to build is a distribution platform which enables them to distribute financial products like loans, insurance, mutual funds. ICICI securities gets ~25% revenue from this stream. This is less cyclical than the brkoing biz. There are multiple things to be excited about in this industry, but won’t make 1st post longer by adding everything here.

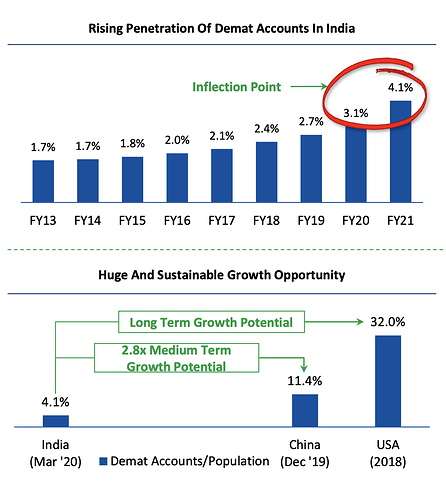

Just 1 image to excite the reader about the huge under penetration of equity in India and thus the market opportunity. Narrative is similar to under penetration in other industries like mutual funds, equity ownership.

Angel’s Business

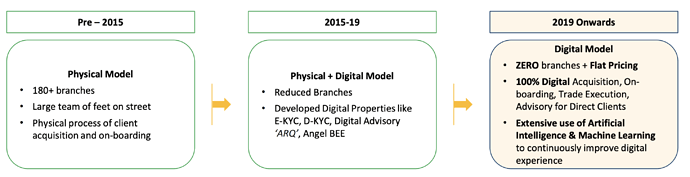

Up until 2018-2019 or so, Angel used to be a full broker with many branches, physical order placing and such like. They realized that this model does not scale and also had high operating costs and thus decided to transition to becoming a fully digital broker with no physical presence.

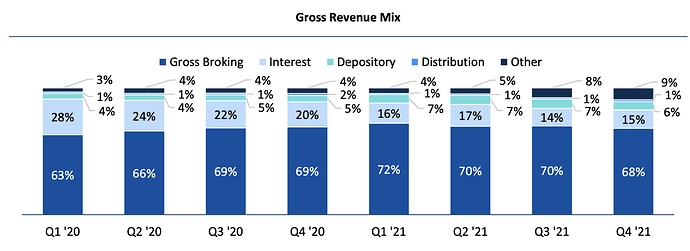

As a broker, angel earns majority of its revenue from broking. The “interest” we see in the chart below is the margin funding book which is also growing nicely.

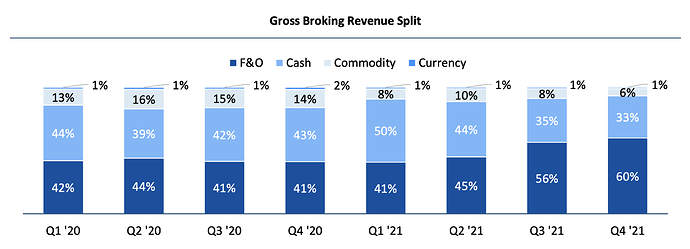

Broking revenue if further subdivided into F&O, cash segment, commodity segment and currency segments. One would see Cash segment contributions going down due to recent interesting rules by SEBI (Sebi new margin rules: Daily cash turnover plunges 29%; F&O stable - BusinessToday) which while ensuring client protection also forced many traders to migrate from cash segment to F&O segment.

Word of caution: margin funding book is very volatile and hence growth trends cannot be extrapolated from 3 quarters. As an example, angel’s margin funding book was 1,000 cr in 2018 peak, and is 1500 cr right now.

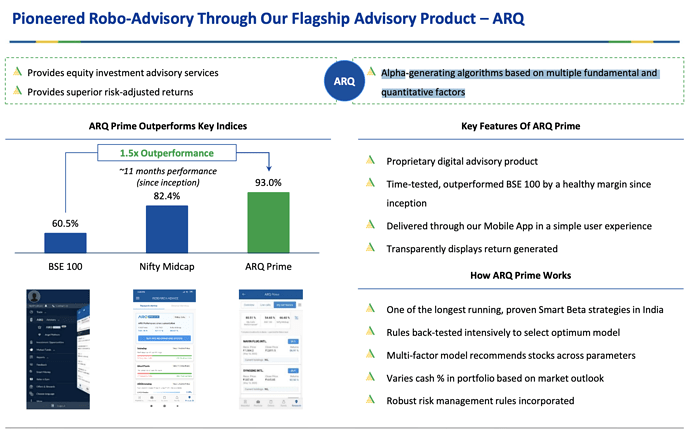

Angel also have a couple of products which they are proud of. First is the ARK engine which consists of Alpha-generating algorithms based on multiple fundamental and quantitative factors (i would think of this as a quant smart-beta investing strategy). They also claim that they were the first brokerage to develop such a smart beta algorithmic strategy in-house (difficult to verify for me).

The other product is Angel Bee App (separate from angel broking) which is their take on financial products distribution. As we could see in a previous image, distribution is only 1% of the topline for angel. Angel Bee is supposed to grow this. However, they recently changed strategy. Now planning to develop a superapp through which cross-selling would become easier. Same app would enable users to trade and invest in MF buy insurance etc.

Another interesting trend we see play out across the industry and definitely for angel is that they want to become a tech platform which enables other apps to integrate seamlessly, increasing value added for the clients.

Angel’s Growth

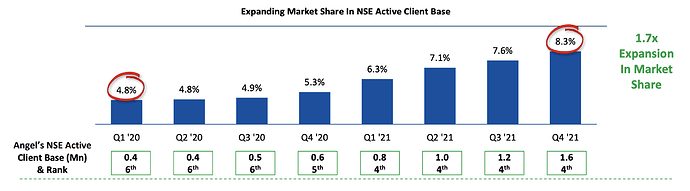

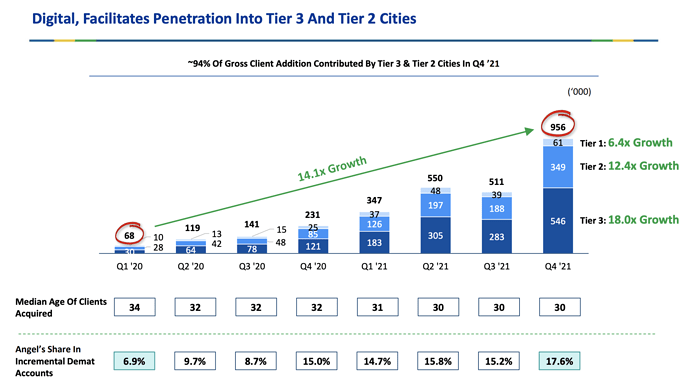

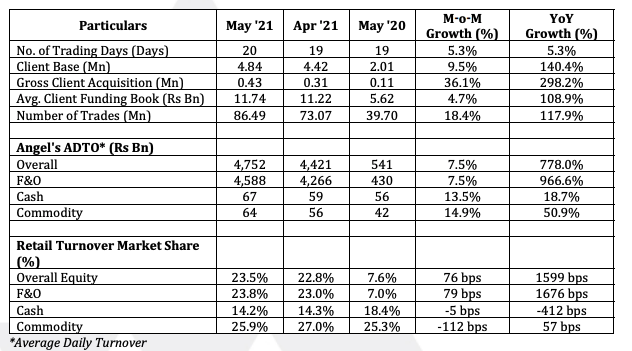

Angel has been consistently gaining market share and scale, which we can see in the images below.

Client Acquisition

Angel’s market share for active NSE clients has grown roughly 1.7x in 2 years.

Angel is adding new clients rapidly. A lot of them are coming from tier 2 and tier 3 cities. Do take a special look at Angel’s share in incremental demat clients which has risen from 6.9% to 17.6%.

Client Activity

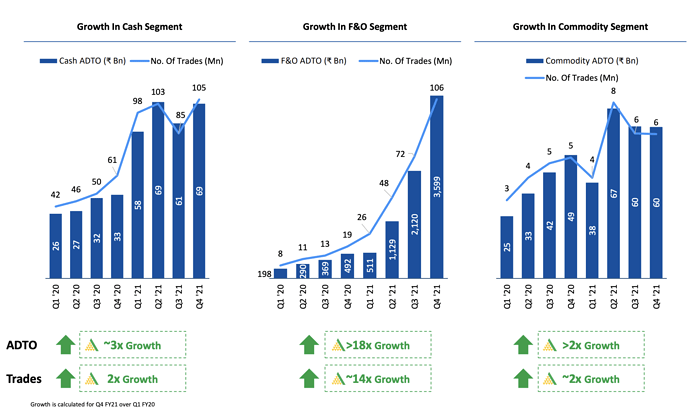

A second lever for growth has been the bull market. One can clearly see the large increase in number of trades happening and ADTO (Average daily turnover, a measure of trading volume). Remember, cash segment has been impacted by SEBI rules and thus F&O growth is extraordinary.

Angel’s Profitability

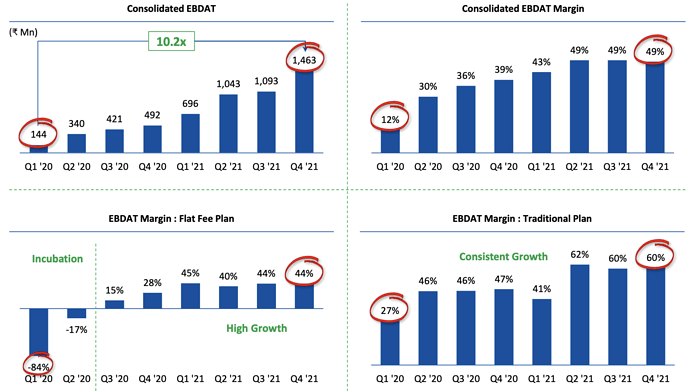

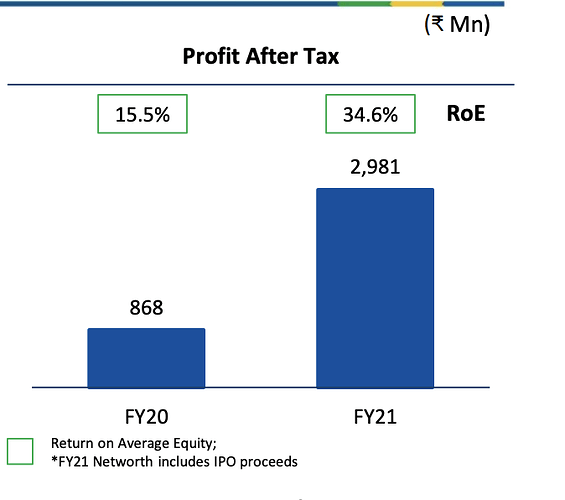

Broking, specially digital business is a very high ROCE business. This is because costs are very minimal (maintain a sub-linearly scaling computer network, employee pack) and client acquisition costs (consists of digital markettting: showing ads on Google and FB or TV. this is the key lever management can control in order to balance between profitability and growth). This is visible in the numbers as well.

The good thing about this industry and business is that there are multiple levers for operating leverage. As they add more clients, the relatively fixed costs get amortized over a larger revenue base leading to not just high but improving unit economics. Second, when management can execute any cross-sell that is at almost 0 cost. So any incremental distribution revenues flow directly to bottomline.

What Excites me about Angel

A lot of what I am going to talk about comes from reading all their concalls and their DRHP. Angel has some triggers lined up which excite me about the business.

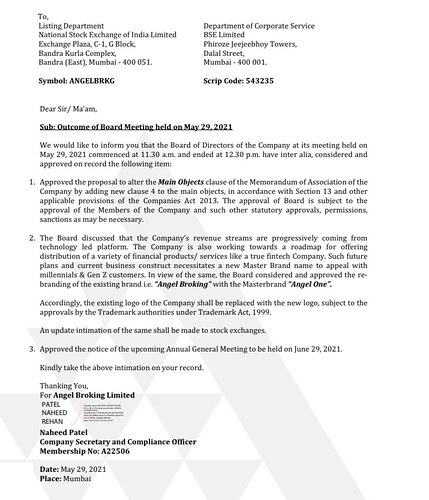

- AMC entry: In the Q4FY21 concall, they announced their intention of getting into the AMC business in the next 1-2 years. This by itself is a big enough trigger and primary reason for the rerating we have seen recently. What i was more fascinated by was their vision for what this AMC biz would look like. Instead of setting up a traditional AMC, they want to focus on a more tech-enabled and algorithmic kind of AMC. ETFs, Smart-beta products, Quant strategies. They realize that trends which have happened in the west are likely to repeat in India and thus preparing early enables them to stay ahead of the curve.

- New CEO hire: The reason I believe that they would be able to do this is their recent CEO hire. Their ex-ceo died (God rest his soul) and they hired the new CEO, Narayan who is an absolute tech giant and is the ex-CTO of ola and ex-head of engineering at Uber. Has worked at Google too (got good feedback internally). His leadership could transform angel from a broking house to a true fintech. While listening to angel concall, it was the first time I heard an indian CEO talk about 4 9s reliability being a top level goal. (the angel broking app has 3 9s reliability and wants to take it up to 4 9s reliability). CEO is also talking about how they want to scale the system to be robust in the face of 10x more traffic.

- Angel’s client acquisition strategy: is to reinvest their increased profitability into client acquisition. Instead of letting their profitability increase due to operating leverage, they would reinvest all of that incremental margins into higher client acquisition by doing higher spends on digital ads. This strategy is clearly working which we see in angel’s faster than industry growth. Also, 38-29% of angel’s total client base is active, compared to industry average of 32%. This means they aren’t just acquiring dud customers, the customers are active.

- Distribution revenues: are only 1% of the topline. ICICI securities has 25% of topline as distribution revenues. Not that angel would find it easy to scale this up to 25% but management has a clear focus on increasing revenues from cross-selling and distribution of products. All of this is very low cost for the business and this would provide significant operating leverage, flowing directly into the bottomline. Angel’s strategy of maintaining profitability would thus allow them to acquire better (more active) clients and also grow faster than industry.

- Industry tailwinds 1: A word on why I am excited about the broking industry as a whole as well. There is severe under penetration of equity in India which makes demat account growth a long term secular trend with short terms cycles (bull/bear markets) in the middle. Although cyclical, if we carefully look at MOSFS revenue graph I has posted, we realize that the revenues do not go down very dramatically in down years (20% down from 2018 peak post 2018). Reason investors lose money is because they buy the company at unreasonable valuations right before a market crash (MOSFS was at 34 pe before 2018 crash. Business went down, valuations crashed and the twin engines of growth became twin engines of degrowth).

- Industry Tailwinds 2: In addition broking industry has a mega-trend which has started but not at all played out which is margin funding. Total margin funding book for the Indian brokerage industry is < 1B$ currently See client funding link. This same industry is 100B$ in China and 800B$ in USA. Will the same trend play out in India? I think there is a possibility that it will. Specially with the new SEBI norms on regularising margin funding norms, we should see more structure emerge in this part of the industry.

- Angel’s client base: Consensus estimates are for an economic revival in India. This would enable larger tradable incomes for angel’s tier 2/3 clients enabling higher growth for their margin funding business.

Valuations

This is the most difficult part of the story for me because multiple parts of investment thesis are uncertain. When would AMC be setup? What would its profitability be? When would the next stock market crash happen? For this reason I am refraining from doing any absolute valuation analysis and rather choosing to post a comparison of various peers. Do keep in mind that each company is unique and could have high or low valuations for the right reasons.

Risks

This is the most important part of the analysis.

- Entire broking industry is cyclical and thus angel is not immune. Any large/prolonged bear market can cause angel’s business metrics to invert from growth to degrowth causing the double engines of value destruction to kick in: derating and business degrowth.

- Angel might not get an AMC license. (I personally place low probability on this event).

- Angel’s bet on smart-beta and ETFs might be a trend which doesn’t playout in India in which case it would be a bad capital allocation decision.

- Angel’s clients mostly and incrementally come from tier 2 and tier 3 cities. Prolonged economic distress either due to covid or otherwise can cause their ability to trade to suffer.

Disc: Invested. Latest position size here.