Ajanta Pharma Q2 highlights -

- Segment wise growth in India vs IPM -

Ajanta Pharma vs IPM -

Opthal - (-) 1 pc vs (-) 1 pc

Cardio - 10 pc vs 13 pc ( underperformance )

Derma - (-) 2 pc vs 4 pc ( underperformance )

Pain Management - 8 pc vs 1 pc ( outperformance )

Overall - 4 pc vs 5 pc ( underperformance )

Last 4 yr growth Ajanta vs IPM -

FY 17 - 16 pc vs 9 pc

FY 18 - 6 pc vs 6 pc

FY 19 - 16 pc vs 11 pc

FY 20 - 13 pc vs 11 pc

HY 21 - 4 pc vs 5 pc

- Q2 India sales - 202 cr- flat YoY

Cardio - 44 pc

Opthal - 29 pc

Derma - 20 pc

Pain Management - 7 pc

- Segment wise ranking of Ajanta Pharma -

Opthal - 2nd

Derma - 14th

Cardio - 16th

Pain management - 39 th

Overall - 31st

- Global Business -

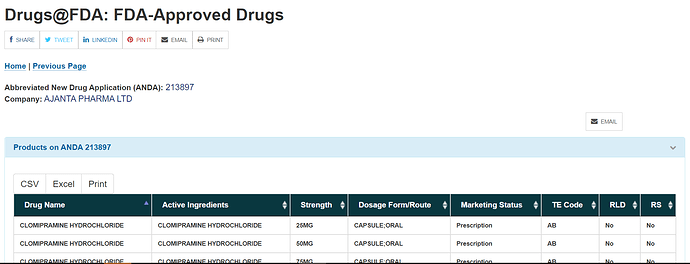

US business - 33 products on shelf, 37 final approvals, 19 under approval, focus on sound execution for customer delight

US sales at 154 cr vs 111 cr

Africa branded sales - 112 cr vs 82 cr

Asia sales - 180 cr vs 181 cr

Africa institutional sales - 51 cr vs 72 cr

Overall exports - 499 cr vs 447 cr

- India + Export sales - 701 cr vs 650 cr

India sales - down 1 pc

Export sales - up 12 pc

Overall - up 8 pc

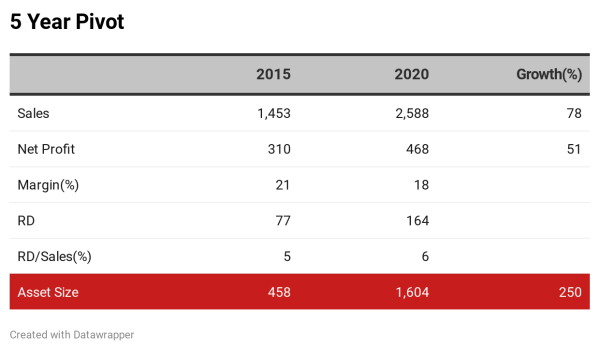

R&D expenses at 29 cr vs 40 cr YoY at 4 pc of sales

Last 5 yr R&D spending trend ( as pc of sales ) -

6 pc, 8 pc, 9 pc, 9 pc, 6 pc

- Manufacturing facilities -

Formulations -

3 facilities in Aurangabad

1 facility in Dahej

1 facility in Guwahati ( Opthal bloc - to commence production in Q4 )

1 facility in Pithampur ( newly comissioned )

1 facility in Mauritius

APIs -

1 facility in Walunj ( captive consumption )

- Financial highlights -

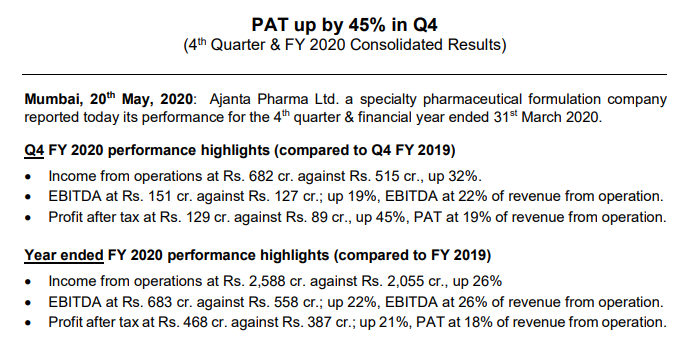

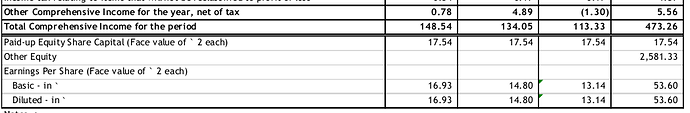

Total sales - 716 cr vs 643 cr, up 11 pc

EBITDA - 274 cr vs 178 pc, up 54 pc, margins at 38 vs 28 pc

PAT - 170 cr vs 116 cr, up 46 pc

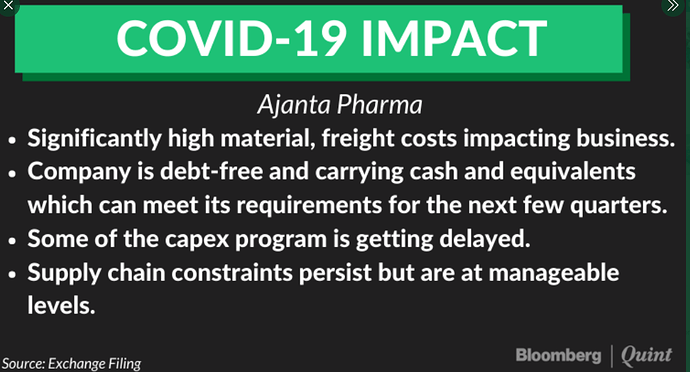

EBITDA expansion due - lower cost of RW as a percentage of sales, lower other expenses as a percentage of sales, lower R&D costs

Disc : invested