I was going through older annual reports and thought of collating some of my notes here:

Annual Report 2010:

Turning science into caring, We advance leading edge science and technologies that hold the potential for significant improvement to health and practical health care.

Our mission in India: To be an admired organization and a leader in our core therapy areas by shaping the continuum of care be amongst the 3 fastest growing companies through 2015

Prominent brands: Brufen, Cremaffin and Digene are some of the heritage brands which have become household names in India. Epilex, Ganaton, Prothiaden, Sevorane, Survanta, Thyronorm and Zolfresh are among the other prominent market leading brands

Annual Report 2011:

Abbott, a global broad-based healthcare giant, enjoys a diversified presence in the discovery, development, manufacturing and marketing of innovative pharmaceutical, diagnostic, nutritional and hospital products.

We achieved a major milestone of merging two sterling companies, Abbott India Limited and Solvay Pharma India Limited, into one cohesive and integrated business. Thyronorm: Now No. 1 in Thyroid therapy area. Amongst Top 50 brands

of IPM. Heptral: One of the best product launches amongst MNCs in 2011 and

the best ever launch for Abbott India. Cremaffin: Crossed the milestone of Rs 100 Crores. The Company significantly outperformed the market, and its nearest rivals, in the core therapy areas in which it operates. As per IMS MAT Dec 2011, the market in which the Company participates grew by 16% versus the Company’s growth at 25%.

Annual Report 2012:

Headquartered in Mumbai, Abbott India Limited, a publicly listed company and a

subsidiary of Abbott Laboratories, enjoys strong brand equity in multiple therapeutic

categories such as Women’s Health, Gastroenterology, Neurology, Thyroid, Diabetes

& Urology, Pain Management, Vitamins, Anti-Infectives & other therapy areas. Abbott India is one of India’s fastest growing pharmaceutical companies. Abbott India’s success is driven by a combination of a highly competent and motivated commercial team, R&D backed products, aided by strong alliances and partnerships with our suppliers and vendors. Abbott India employs over 2,600 people and reaches customers through a network of 35 distribution points, catering to over 4,500 stockists and 150,000 retail outlets.

Digene continues to be # 1 prescribed Antacid with over 5.5 million prescriptions annually. Approximately 29,000 doctors prescribe Digene every month.

I am happy to report that your Company had another record year in 2012. Sales increased by 11.6% and Profit After Tax by 20.2% over prior year. This is a significant achievement considering the slower growth in the Indian Pharmaceutical Market at 11.1% vs.14.9% in the previous year.

We are currently in the process of completely overhauling our new product launch processes to double the number of new launches per year. These are being developed with a view to be early to launch new products and increase the success of new launches.

Annual Report 2013-14:

As you may be aware, implementation of the Drugs Prices Control Order (DPCO) 2013 had a significant impact on some of our major brands like Thyronorm, Obimet, Epilex. These brands faced new price limits which have directly impacted our profitability.

To cater to diverse and different health needs, we have a comprehensive range of products developed with leading scientific research and innovation that includes all stages of life and encapsulates most therapeutic areas.

As a connecting-link with patients, it is the doctors who are our key customers. We support them with research data and scientific information with cutting edge insights. These enable them to provide their patients more effective and useful health solutions.

In the Indian Pharmaceutical business which is dominated by a sea of generic formulations and me-too products, strong brands are equated with trust, faith and consistency. Our broad stable of more than 50 brands ensure strong relationships not only with doctors and healthcare professionals but also with patients and their care givers.

Annual Report 2015:

Our success, in large measure, has resulted from our focus and effective implementation of a three-pronged strategy - innovation in brand building; strong talent acquisition and people development; and flawless execution. Consumer Care division is a new focus area for the Company. Thyronorm, the market leader with 52.6% market share, continued its strong growth, growing at 41.2%* during the year This division grew by 19.4%*

during the year. Digene, the flagship brand of the division, was repositioned during the year as a more consumer focused brand.

Annual Report 2016:

Our solutions—across the spectrum of care and for all stages of life—help people live their best lives through better health.

At Abbott India, we always believe in outdoing ourselves. We grew our

Sales by 15.3% and Profit After Tax by 13.4%. Our PEOPLE give us the ability to execute our strategies. Our high-science PRODUCTS help generations of Indians lead better, healthier lives. Together, these deliver a PERFORMANCE that outpaces the market, our goals and your expectations.

Our strong portfolio of over 110 brands continues

to lead the Indian Pharmaceutical Market (IPM).

This year, 6 of our brands* were featured among the top 100 brands in the IPM, while 6 brands individually crossed Sales of Rs. 100 Crores.

We are not only attracting talent from the pharma sector but have a healthy mix of differentiated non-pharma talent from leading companies and top universities across the world to enable cross-pollination of ideas from across industries and sectors.

Annual Report 2017

At Abbott India, the key trigger to our business performance is that we offer quality, affordable medicines. We have an endless drive to bring meaningful innovation - in both the medicines and the services that go along with them - to help people live healthier fuller lives. We give people a reason to choose our medicines and this model has led to consistent and exceptional growth.

Annual Report 2018

We continued to take on the mantle of launching market shaping initiatives in collaboration with cross-industry players and technology partners, even when we encountered challenging circumstances on a few fronts.

We are here to help people lead fuller, healthier lives. And in this mission, it is imperative for us to gain patient insights. We also leverage technology to connect and engage with various stakeholders. Notable initiatives include Thyroweight, the country’s largest Thyroid Awareness program.

As we set our eye on the future, rapid inroads into sub-therapies, accelerated new product launches, innovative marketing and deployment of digital tools, steady deepening of relationships with the doctor, pharmacist, patient trio, continued strengthening and expansion of our brand portfolio, and the collective living of a shared vision by an over 3,300 strong employee pool, will continue to be the central levers of our growth momentum. Gutfit: A comprehensive program was

created, which enrolled high-risk patients and provided them with virtual counseling, wearable devices for tracking health metrics and customised diet plans.

Annual Report 2019

This is a landmark year. On August 22, 2019, your Company completes 75 years of its remarkable existence. On behalf of the entire Board, I would like to express my sincere gratitude to all of you – our dear shareholders, employees and business partners, for your constant support through the decades and for being part of our path-breaking journey. Your trust has been inspirational and instrumental in shaping our success over all these years. The future holds enormous promise.

We want to make room for “now” and “next” therapies, thereby addressing today’s demands while moving towards tomorrow’s challenges. We aim to accelerate our established brands through technical innovations that will add breadth and depth to our reach and scope as we serve patients, doctors, pharmacists and caregivers. We know that digital platforms will achieve maximum impact and dispersal in a market like India.

I just started reading about it a few weeks back. Amazed to know so many of their brands are No 1 like in hypothyroidsm (Thyronorm), Vertigo (Vertin) (My wife is an ENT doctor, she says most of the doctors prescribe Vertin only) and esp their marketing strategy to propogate awareness amongst public on Thyroid issues etc. is extremely good and as more and more diagnostics happen, it will automatically increase such companies sales. Abbott is also consciously moving away from third party manufacturing to their own plant in Goa which should improve their margins. Every year Abbott India is planning to introduce 8-9 products.

Some useful data I picked from different reports and sources

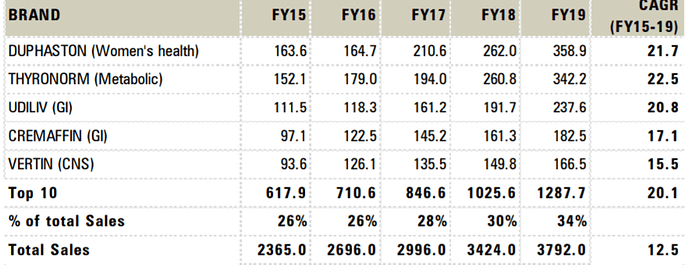

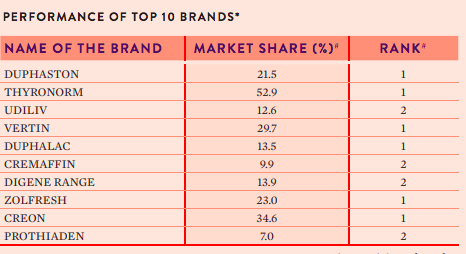

Brand-wise contribution to topline

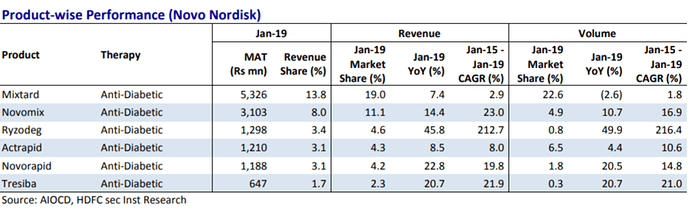

Group-wise contribution

Thyronorm pretty much makes up the complete metabolic group (10% of topline)

Dyphaston makes up complete women’s health (10% of topline)

Udiliv & Cremaffin make up about 50% of GI segment (25% of topline)

Vaccines though having grown fast appear to have hit stagnancy

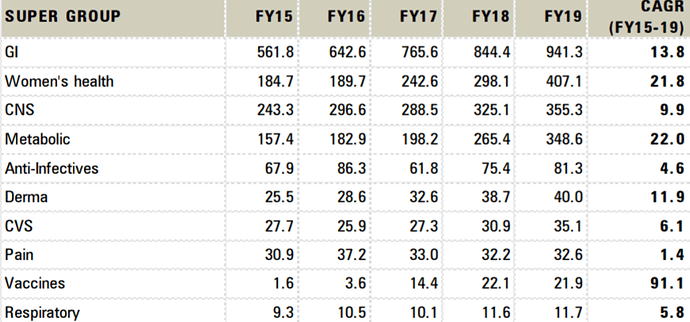

This was the brand-wise contribution I found in another report from last year which sort of matches the above.

All the data appear to be from AIOCD.

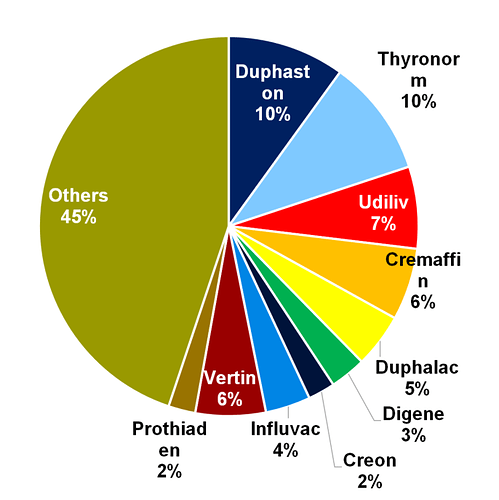

Also importantly, a bulk of the profits (about Rs.1400 Cr of topline) come from Novo Nordisk’s diabetes portfolio which Abbot India distributes (probably low margin)

This could be a stable contribution going by the collaborations between Novo Nordisk and Abbot globally in Diabetes in terms of integration of Novo Nordisk’s insulin pens with Freestyle Libre system (glucose monitoring without a prick).

Sources:

http://content.icicidirect.com/mailimages/IDirect_Abbott_CoUpdate_Aug19.pdf

First up, a disclosure - Invested for self and other customer portfolios I manage, so may be biased in my views.

Abbott India caught my attention late last year due to the following reasons -

-

I have stayed away from export oriented formulation companies since it would have needed me to understand pricing, regulatory dynamics and channel dynamics across different geos. Abbott India however looked like a simple domestic play with market leading brands and pedigree that is beyond question

-

Very healthy growth rates and a steady state growth rate of 12%+ over the long term looked doable in the 1.2 lakh Cr domestic formulations business. Gross margin improvement over the years can be seen due to improved product portfolio, really a surprise when I saw no royalty being paid out to the parent

-

Minimal R&D spends means minimal balance sheet risk and low risk of accounting jugglery. Effectively this then becomes an FMCG like play where you get someone else to make the product (most manufacturing is outsourced to 40 vendors) while you own the sales & distribution push to pharmacists (under well known brands) and medical professionals. Also most of the products are directed towards chronic illnesses where customer lifetime value justifies the customer acquisition costs. You spend on ASP, give incentives to the channel and influencers to get long term customers on board - very sweet deal

-

NLEM in the Indian context is a risk but hardly 15% of the portfolio comes under that, other than the insulin products which Abbott India co markets for Novo Nordisk (this is a distribution agreement at hardly 5-6% margin) most other products won’t come under NLEM anytime soon. Also Abbott India distanced itself from other MNC’s and is more aligned with the goals of the Indian regulator, you can see news articles on this which means India is serious enough a market for the parent though it is not a large segment as such

Long story short you have a 35%+ ROCE, asset light business which has minimal balance risk, has clean financials, owns a branded play in a growing Indian Pharma market which is massively under penetrated. All this at a TTM PE of 35 when average consumer businesses are trading at 45+ PE, I kept raking my brains as to how Abbott India was not a consumer play once you adjust for the minor regulatory angle.

I’d rather buy Abbott India at 35 PE rather than buy a well known consumer play at 50 PE. Looks like the market came around to my view much sooner than I anticipated, else this would have been a much larger position for me

However from CMP my expectations of IRR aren’t > 15% p.a., I am now asking myself why I would want to buy Abbott India at 40 PE (adjusted for tax rate change) rather than a Marico at almost the same valuation which does not have the regulatory risk or the sister company/parent company risk.Both are different businesses no doubt but the quality and valuation are comparable right now.

Run up of this stock from Aug 2019 to now is tremendous. Not sure whether it can sustain since the P/E at the current EPS has touched 56. Most analysts has kind of estimated the FY 21 EPS should be in the range of 300, still i feel the run up is too quick to my comfort. The 2nd quarter results may set the tone for the year end growth.

Very detailed presentation by HDFC Sec. Thank you

Hi

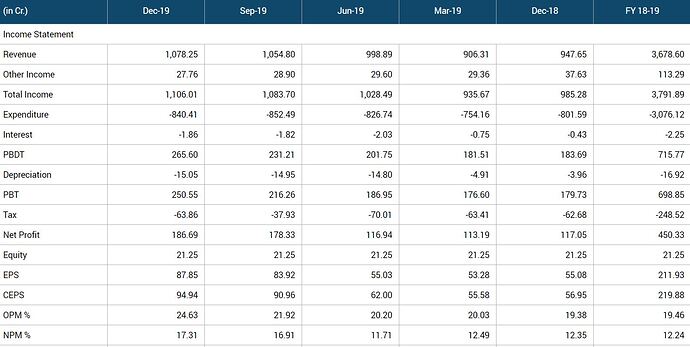

Decent results by Abbott. Thanks to FM the bottom line shoots up. Margin contracts by few bps. Revenue sees an 8% bump YoY.

Valuations seem to be not coming off though.

Rgds

Disc: Have a minor position. No transaction in last 30 days.

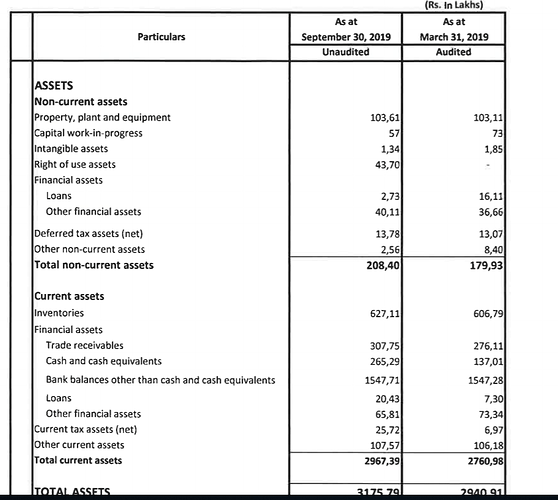

Abbott is sitting on a cash of 1700 cr. on a balance sheet size of 2800 cr.

They could be looking at buying brands?

Huge CAPEX for next 3-4 years?

Buyback - Dividends?

Anyone can provide any reasons with conviction for the above?

Including cash equivalents, it is almost Rs 1812 cr . they earned interest income of Rs 60 on the deposits till date this year. Surely there should be better way of investing this huge cash pile.

Have been maintaining quite a large amount throughout the last 3-4 years .

Hello All ,

This is my first post with respect to Stock discussion Topic.

Abbott has always intrigued me, and i am trying to understand what makes Abbott the CASH MINTING MACHINE it is.

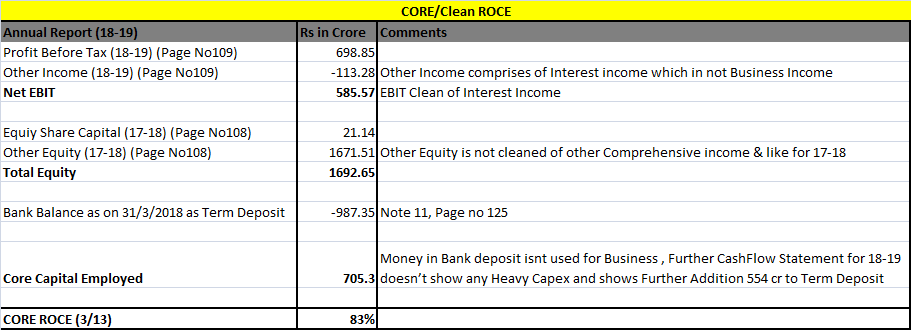

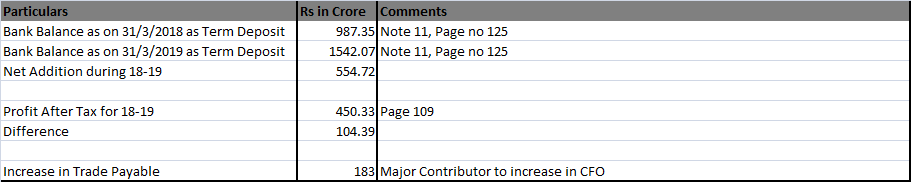

Topics like Products Leadership, Sales Growth and Consistent Operating Profit margin are well covered in this thread, i want to add another perspective from Cash Position (which should be taken with heavy dose of Salt)

The Calculation is rough and primary glance and not based on deep diving

The Core ROCE is 83% and should be higher for current FY !!!

Can we infer that Abbott India is being Financed by Creditor’s and whole of PAT is free of any requirement of being Invested back in Business ?

Few Obervation:

Cash forms 52% of Asset side of Balance Sheet and 77% if Net Assets/Owner’s Equity.

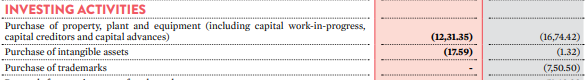

Require’s little reinvestment of Cash = 12 Cr in FY 18-19 and 24 Cr in 2017-2018

The Stock has Embedded Term Deposit of 725 RS (based on 31/03/2019 figures) which seems to be increasing by the day .

Overall The (Liquid) Balance Sheet and High ROCE and Sales Growth and Consistent Operating Profit Margin and Profit being Converted in to Cash makes investor’s Dream Financial Statement.

Please correct me if any of my interpretation/understanding/calculation is wrong/illogical/doesnt make sense. The Calculation are rough and Back of Envelope kind.

Disc: Abbott form >20% of my Portfolio and havent added in last 3 months

Thanks

Harsh

Both Pfizer and Abbott have unlisted entities in India. How can we be sure that new products would be launched through listed Indian entity? Any basis to take call on this?

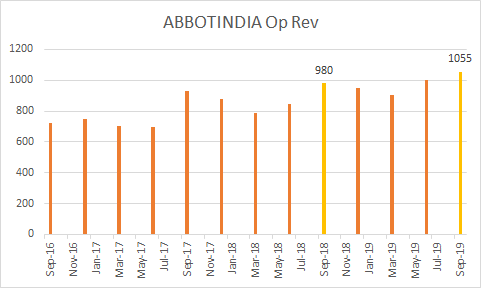

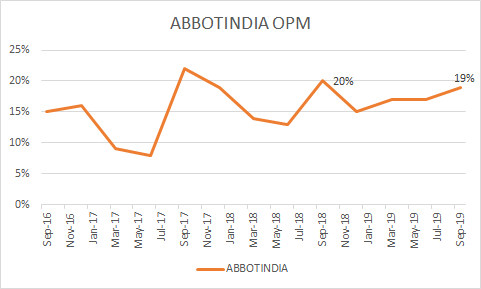

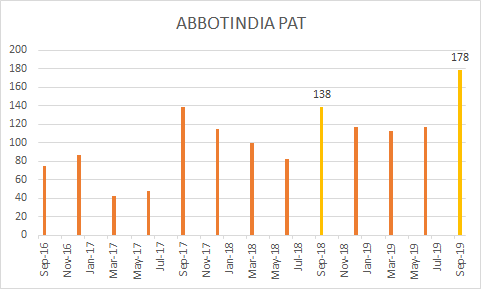

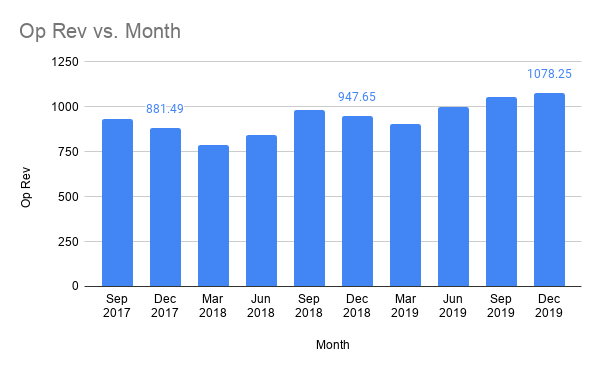

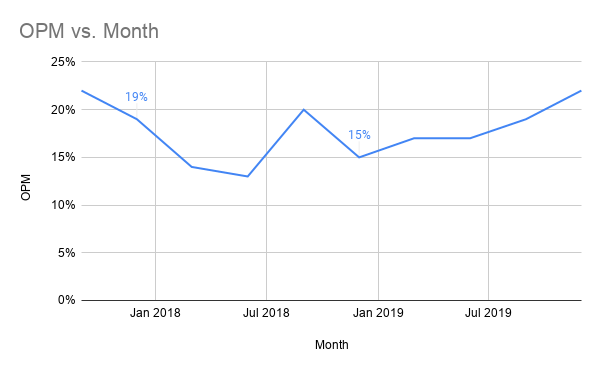

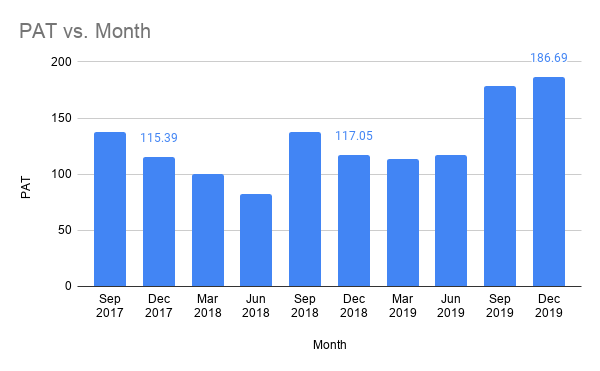

Q3 result:

Hi

Quite decent results by Abbott.

- Over 13% increase in operating revenue YoY.

- Highest operating margin at 22% in the last 10 quarters

- I think the best quarter ever so far in terms of PAT and also the highest PAT margin in the last 10 quarters.

The stock is trading at roughly around the highest PE ratio in its lifetime. Quite a bit of stretch. Imho its in the class of FMCG stocks on valuation yardsticks for the moment.

Let us see how things pan out.

Regards

Disc: Hold a small position. No transactions in last 30 days.

What else we can ask for, the results have been extraordinarily good. QoQ the financials has improved. Expecting similar results from Sanofi India too.

Source: BSE India

I’ll not be surprised if they launch it in India via their unlisted arm.

It will definitely be via unlisted arm. All diagnostics is via that arm

475B4CCF-8773-4D62-B854-70647E3C023E-092331.pdf (139.4 KB)

Abbott India clarifies that the statement made in Moneycontrol stating that "At the moment Abbott’s testing will be confined to the US, but given the urgency of the situation, it could be a matter of weeks before it is available in other countries including India” is factually incorrect